Identity, Fraud & Compliance Solutionsfor Enterprises in MEA

stop fraud before it starts and achieve regulatory compliance.

Our digital identity partners

Comprehensive features across identity

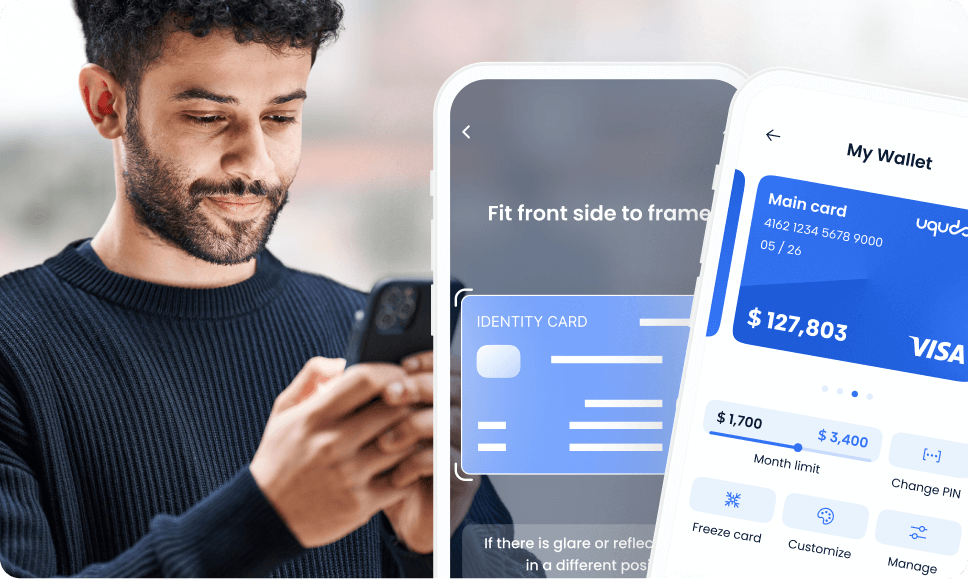

AI Document Scanning

Extract data from Thousands of document types in milliseconds with 99.5% accuracy, enabling frictionless onboarding while preventing document fraud at scale

Multilingual OCR

Process Arabic, Kurdish, and Latin scripts to accurately capture regional identity documents without manual intervention or data entry errors

NFC Chip Reading

Validate 156+ passport types and national ID cards across 22 countries using cryptographic verification that's virtually impossible to forge

National Citizen Registry

Verify individuals directly against government databases in key MEA countries for the highest level of identity assurance possible

Facial Recognition

Ensure genuine customer presence with biometrics detecting presentation attacks, image injection, and deepfakes

Quality Detection

Assess image quality (lighting, focus, obstruction) to ensure reliable verification while providing clear feedback to users

Company Registry Lookup

Access information on 300+ million companies globally through tiered data approach delivering exactly what you need

Automated Document Processing

Validate business documents with AI-powered scanning that extracts and verifies critical information in milliseconds

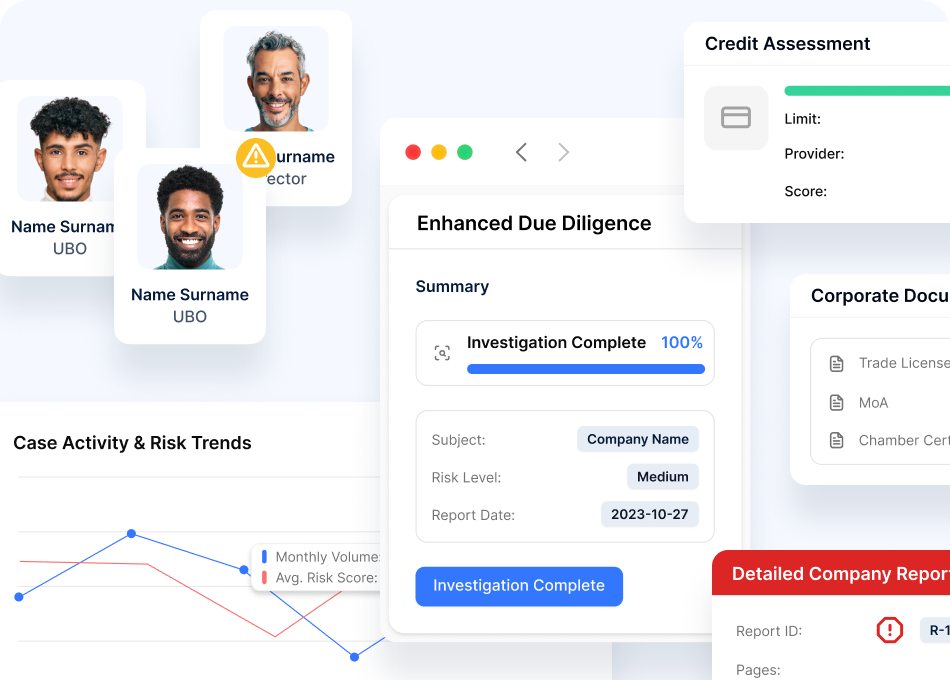

Director/Shareholder Verification

Verify business principals through automated identity verification integrated with KYC capabilities

Trade License Verification

Validate trade licenses and business registrations with automated OCR and verification

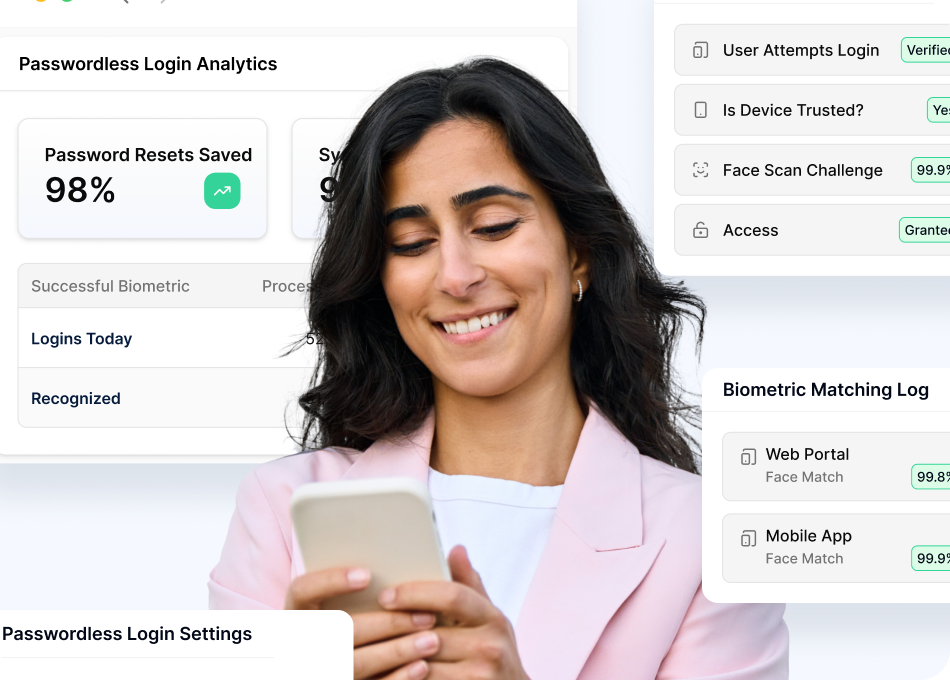

Passwordless Login

Replace passwords with facial recognition to enhance security

Transaction Authorization

Secure high-value operations with biometric verification that prevents unauthorized access while maintaining seamless UX

Account Recovery

Transform password reset into simple biometric verification for instant, secure account restoration

Multi-Factor Authentication

Deploy FIDO2-compliant MFA combining biometrics with device recognition for phishing-resistant security

Continuous Authentication

Verify user identity throughout the session using passive behavioral and contextual signals

1:N Face Search

Prevent multi-accounting, promo abuse, and fraud rings by matching each user against your entire customer database

Repeat Document Detection

Flag when the same document is used for multiple account attempts stopping bad actors before they succeed

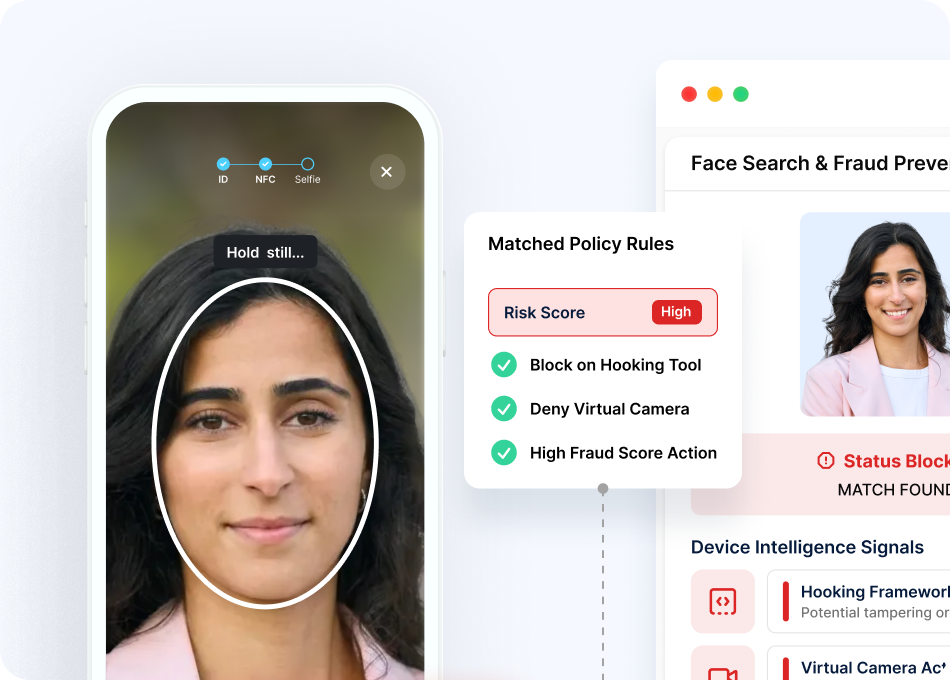

Deepfake Detection

Identify AI-generated or manipulated videos through advanced analysis that distinguishes real humans from synthetic media

Presentation Attack Detection

Prevent photo/video replays, masks, and other presentation attacks through multi-factor liveness analysis

Behavioral Biometrics

Analyze typing patterns, interaction rhythms, and navigation behavior to detect account takeovers and bot activity

Velocity Checks

Monitor account creation rates, transaction frequencies, and other velocity metrics to identify abuse patterns

Bot Detection

Identify automated attacks through interaction pattern analysis, device fingerprinting, and behavioral signals

Account Takeover Prevention

Detect suspicious access attempts through device, location, behavior, and biometric anomalies

Anomaly Detection

Flag unusual patterns in customer behavior, transactions, or account activity for investigation

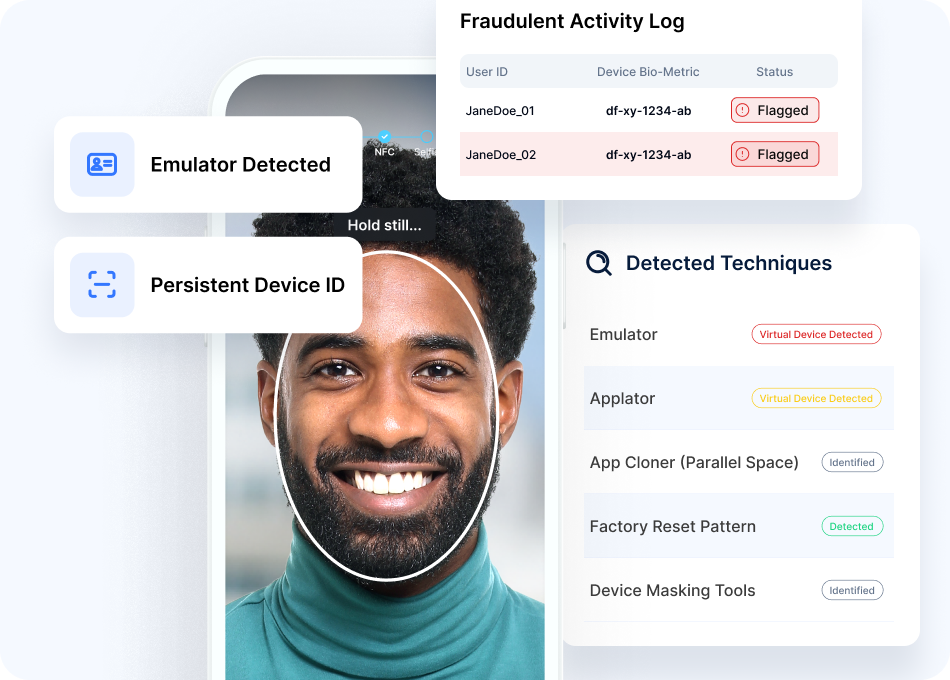

Persistent Device Identification

Persistently identify devices across sessions, reinstalls, factory resets, and OS changes, beyond spoofable IDs like UUIDs and IDFAs with >99.9% accuracy.

App Cloner Detection

Detect app cloners (e.g., Parallel Space, Dual Space) that generate multiple profiles from one device, preventing multi-account fraud and promo abuse at scale.

Emulator Detection

Detect apps running on emulators instead of physical devices, blocking large-scale bot attacks and fraud farms creating thousands of fake accounts.

Device Masking Detection

Expose device identity masking via spoofing tools, modified ROMs, or virtualization, uncovering fraudsters behind fake device profiles.

Jailbreak/Root Detection

Flag rooted or jailbroken devices that disable security controls, preventing privilege escalation and security bypass attacks.

Hooking Detection

Detect hooking tools (e.g., Frida, Xposed) and app tampering used to manipulate verification, inject fake biometrics, or bypass security controls.

GPS Spoofing Detection

Detect GPS spoofing and location manipulation, protecting geo-fencing, location-based services, and compliance checks.

VPN/Proxy Detection

Detect VPN, proxy, or Tor usage that masks true location or network, flagging jurisdiction evasion and regulatory risks.

Suspicious Factory Reset Detection

Flag devices with abnormal factory reset patterns often associated with credential laundering, account cycling, and identity fraud operations

Device Trust Scoring

Real-time risk scoring using 30+ configurable device signals, delivering actionable trust scores with customizable thresholds by use case.

Geolocation Analysis

Assess risk based on device location, IP address, network characteristics, and location history patterns

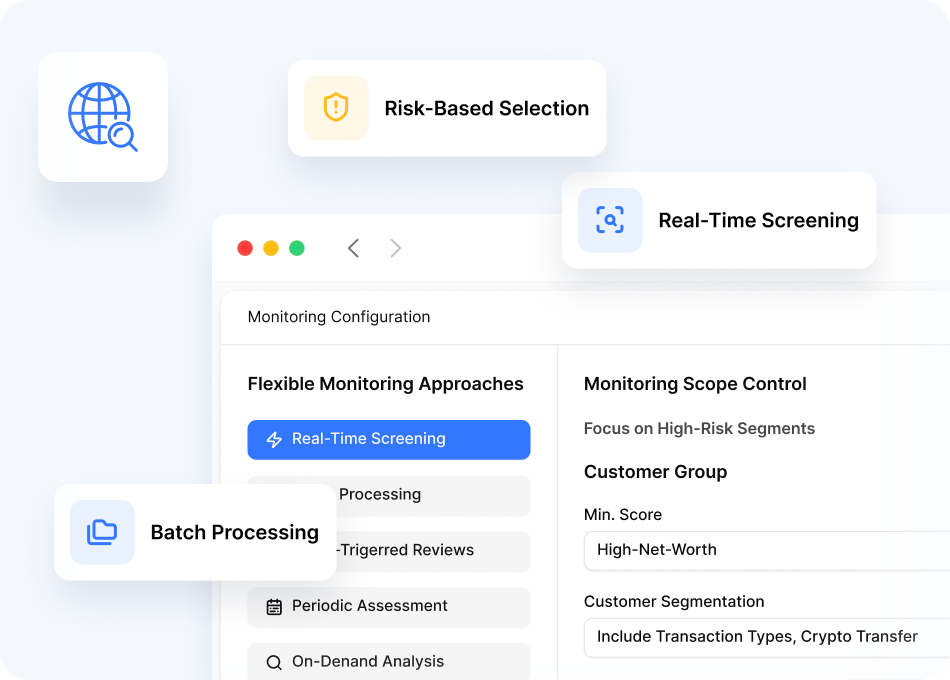

Continuous Monitoring

Maintain ongoing compliance with automated rescreening that alerts you to changes in customer risk profiles in real-time

Risk Scoring

Assign dynamic risk scores based on screening results, customer profile, and behavioral patterns

Alert Management

Prioritize and investigate AML alerts through purpose-built workflows that streamline compliance operations

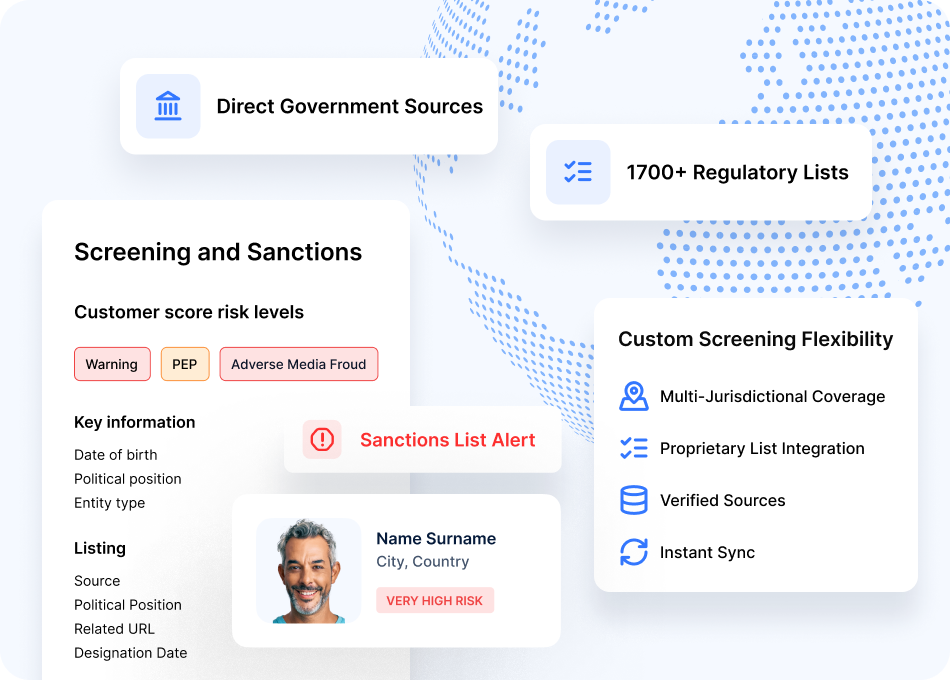

Sanctions Screening

Screen against 1,700+ global sanctions lists with fuzzy name matching to identify sanctioned individuals and entities

PEP Screening

Detect political exposure with access to 1.7+ million PEPs continuously updated by global research analysts

Adverse Media Screening

Protect your brand with advanced monitoring across 3B+ articles from 120,000+ verified global sources.

Entity Resolution

Accurately match entities despite name variations, transliterations, and aliases using advanced fuzzy matching algorithms

Global Watchlist Coverage

Screen against comprehensive databases including OFAC, UN, EU, INTERPOL, and regional watchlists

Real-Time Transaction Analysis

Monitor transactions as they occur to detect and prevent fraud before processing completes

Pattern Recognition

Identify suspicious transaction patterns including structuring, round-tripping, and unusual behaviors

No-Code Rule Builder

Create and deploy sophisticated monitoring rules without technical expertise using intuitive visual interface

Case Management

Investigate alerts efficiently with a consolidated view of customer history, relationships, and suspicious activities

SAR/STR Reporting

Automate the generation of Suspicious Activity Reports and Suspicious Transaction Reports for regulatory filing

Velocity & Threshold Monitoring

Track transaction frequencies, amounts, and patterns against configurable thresholds

Cross-Border Transaction Analysis

Apply enhanced scrutiny to international transfers with jurisdiction-specific rules

Anomaly Detection Models

Leverage machine learning to identify deviations from normal customer behavior patterns

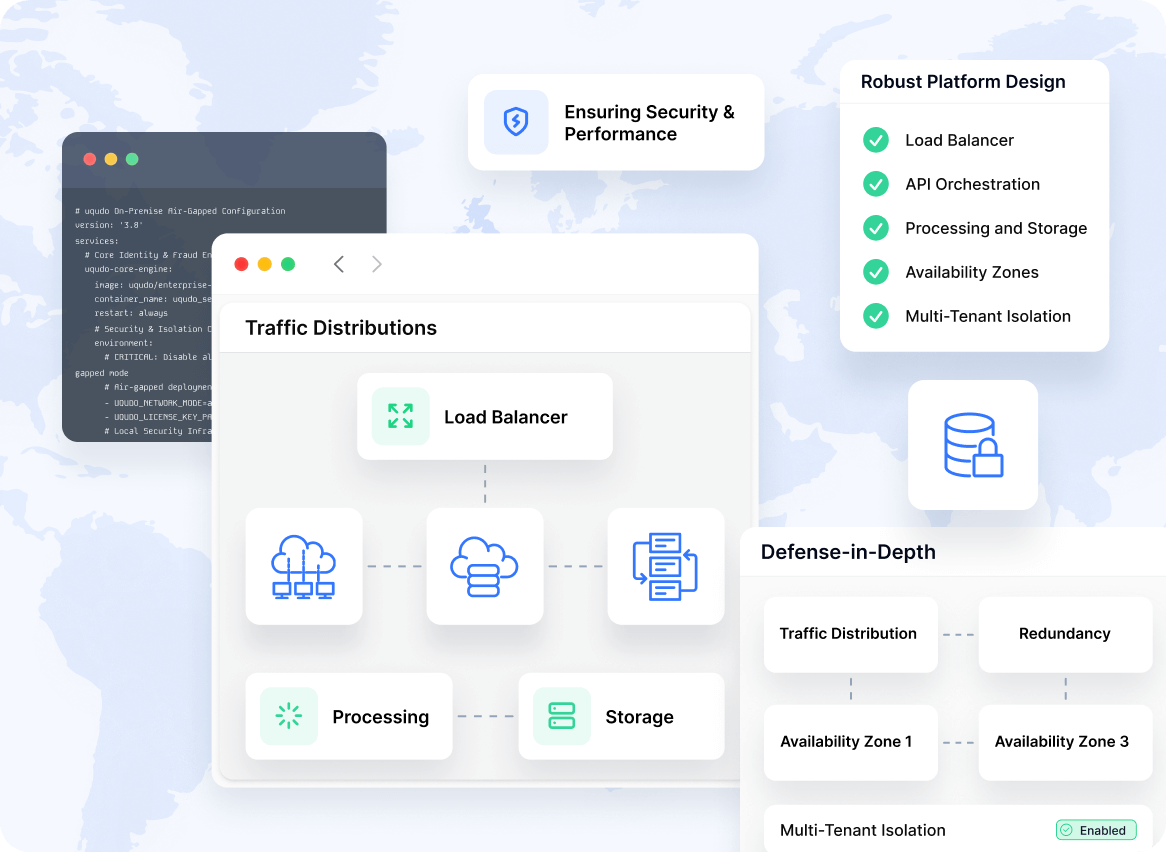

Deploy your way.

Meet MENA data residency requirements

Stay up-to-date with the world of identity

Subscribe to get the latest identity artcles, guides and videos, straight to your email.

We’re committed to your privacy uqudo uses the information you provide to contact you about our content, products, and services. You may unsubscribe from these at any time. For more information, check out our privacy policy.