KYB

Digital KYB services to verify business identities

Super-charge your KYB (Know Your Business) compliance with advanced company verification and screening service for risk-free B2B relationships.

See it in action:

Why choose us?

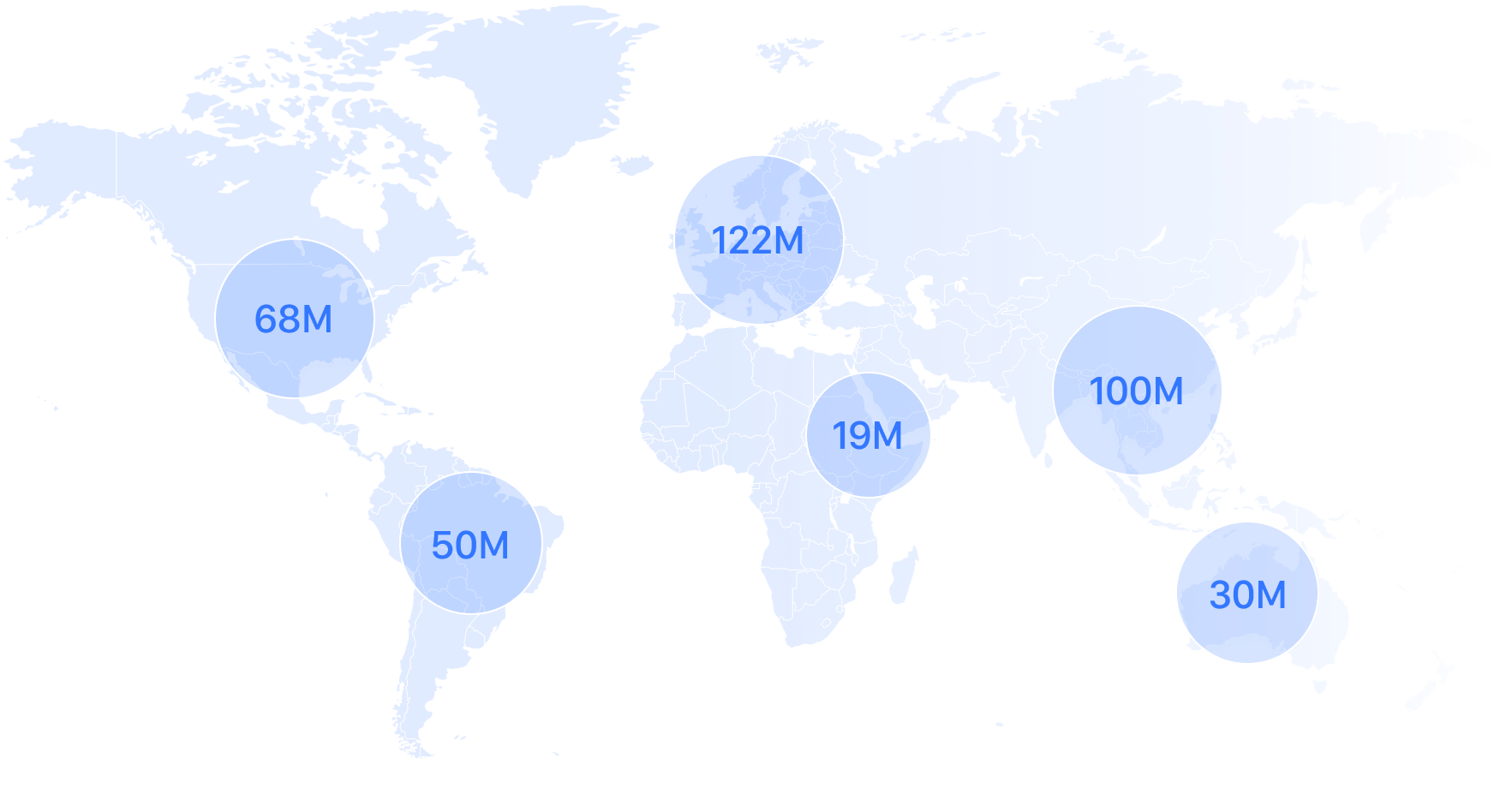

Verify businesses by accessing the world’s largest company database with our global coverage service.

Leverage our algorithm to identify the most cost-efficient route to the data you need from our broad partner network.

As leading KYB solution providers, we can screen the ultimate owners of the business using the world’s largest risk database.

How it works

Our four-pillar approach to comprehensive

KYB (Know Your Business) screening and verification.

Read

Read and extract identity data from company documents or trade licenses.

Authenticate

Check business authenticity via global databases.

Identify UBOs

Identify the Ultimate

Beneficial Owners of the company.

Verify & Screen UBOs

KYC owners and screen for AML and sanctions.

KYB Features

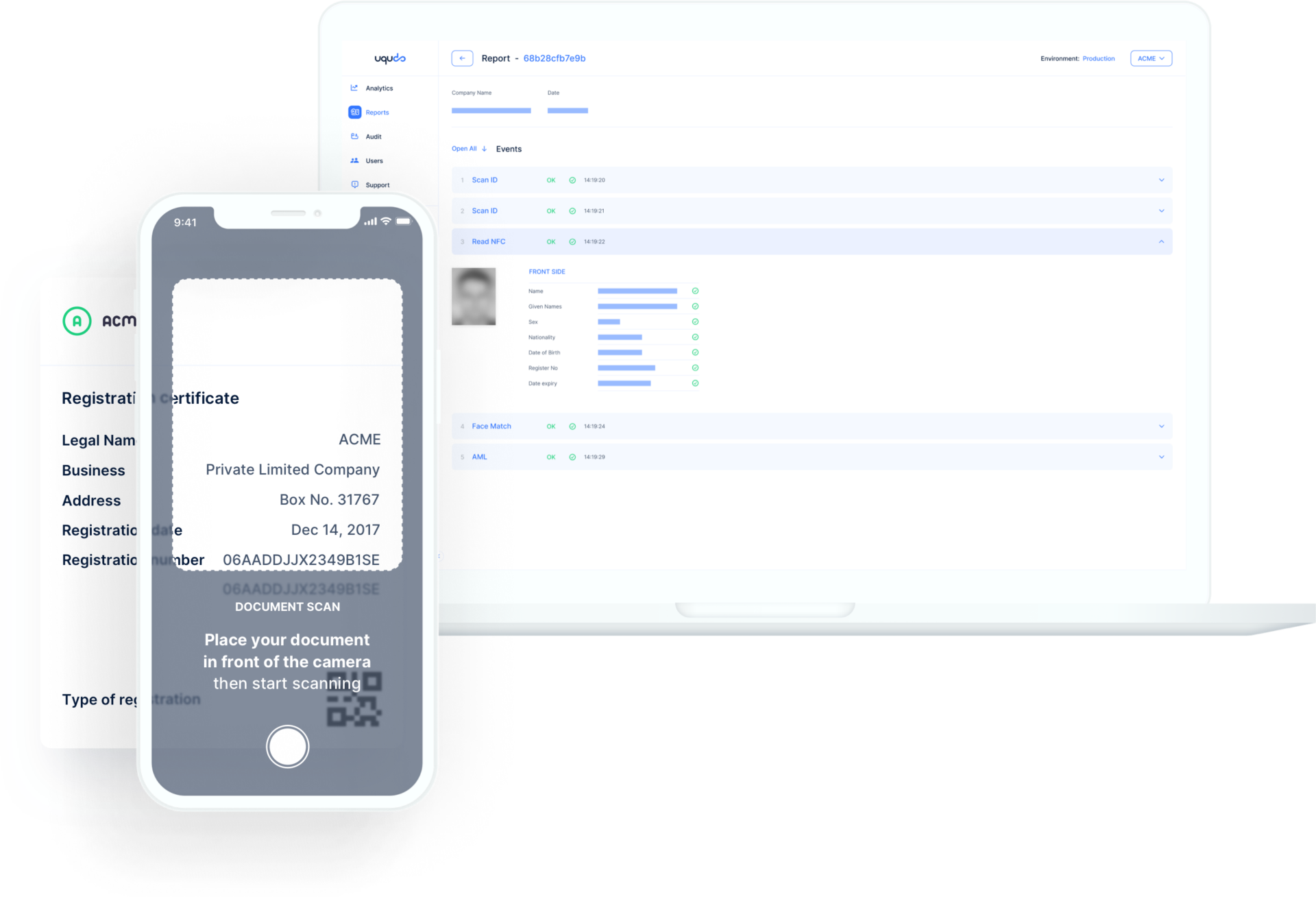

AI Document Scanning Solutions

Use our comprehensive AI scanning process to read company documents and trade licenses to extract critical data relating to company ownership in milliseconds, and build a seamless KYB process.

Business document verification services

Use uqudo’s Know Your Business verification service to check for business authenticity with access to over 400 million companies and verify company documents from over 195 countries in the blink of an eye.

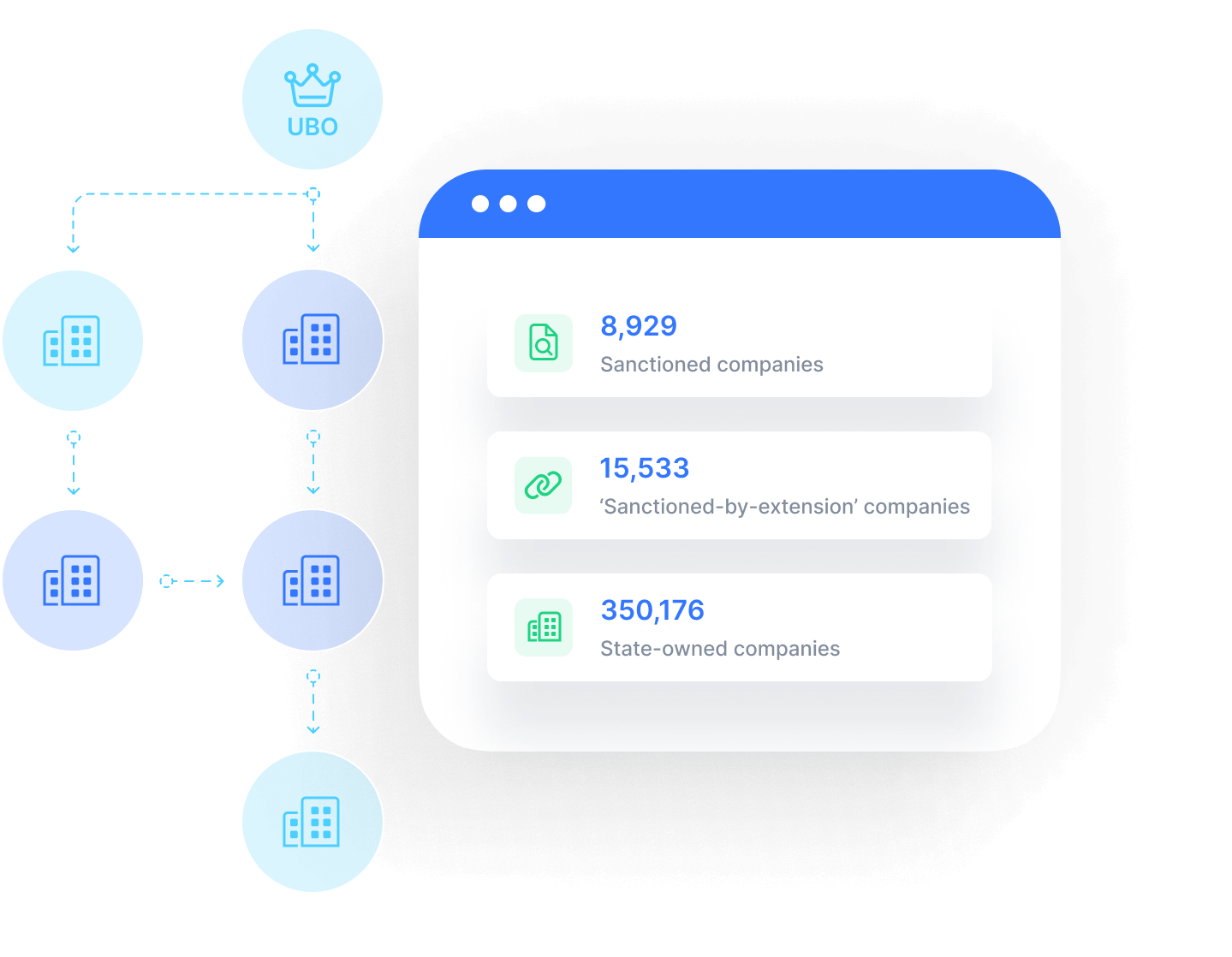

Professional business screening

As a leading KYB solution provider, uqudo can identify, verify, and screen Ultimate Beneficial Owners (UBOs) to establish business risk profiles and automatically monitor changes in beneficial ownership.

Secure, frictionless, & fully compliant digital onboarding. Integrated seamlessly within your app.

Latest KYB updates

What is KYB? Why is it necessary for your business?

Chandrika Mahapatra

KYC Content Specialist uqudo

Why is authentication important for your company?

Chandrika Mahapatra

KYC Content Specialist uqudo

Our clients

Easily integrate  with your tech stack.

with your tech stack.

Use our simple and secure Web SDK, Mobile SDK, or RESTful API to seamlessly integrate identity capabilities into your operations.

See documentationAn award-winning team

uqudo is proud to be recognised by some of the world’s most distinguished organisations.

Here’s what people say about us

-

Abdulmajeed Alsukhan

CEO & Co-Founder Tamara

uqudo, with its user-friendly interface, efficient processes, and responsive team, aligns seamlessly with our dedication to delivering fast, easy, and cost-effective customer authentication experiences. This collaboration fortifies our focus on putting our users first and upholding the highest standards of privacy and security.

-

Xu Chi

VP Ecosystem Cloud Middle East Huawei

Partnering with uqudo will enable Huawei Cloud to offer customers cutting-edge identity verification, contributing to the goal of building a more secure and inclusive digital world.

-

Joseph Dallago

CEO Rain Crypto

We are thrilled to partner with uqudo to leverage their innovative and secure identity technology into our customer’s onboarding process. By prioritising security and user-friendliness, we aim to make the benefits and opportunities provided by cryptocurrencies more accessible to individuals in the region.

-

Maqbool Al Wahaibi

CEO Oman Data Park

Oman Data Park is committed to providing our customers with the latest and most advanced technology solutions. Our partnership with uqudo will help us to further enhance our services and deliver fraud-proof digital identity solutions to our customers in Oman.

-

Jude Dike

CEO Get Equity

After our research, we found uqudo to be by far the best AML provider and we are confident that they will help us push our business forward as we grow.

-

Mehdi Fichtali

Founder & CEO FinaMaze

What made us choose Uqudo as our digital identity partner is their clear and fast integration process and the constant availability and efficiency of their support team. The client ID verification and video selfie is user-friendly and convenient making our onboarding process quasi-instant.

We price based on successful onboarding.

Say goodbye to request-based fees, repeat charges, and spiralling customer acquisition costs.

FAQ

What is KYB?

Know Your Business (KYB) refers to the controls that a company must implement to ensure its clients are not engaged in criminal activity. It is the process of due diligence that should be undertaken before dealing with any organisation.

What is the difference between KYC and KYB?

KYC (Know Your Customer) refers to verifying the identity of an individual, whereas KYB (Know Your Business) analyses and verifies the identity of companies.

Why is KYB necessary?

KYB helps companies obtain essential information about their potential clients, in order to protect their interests while dealing with other businesses. It also ensures that organisations are not indirectly associated with fraudulent activities.

The main advantages of a comprehensive KYB Screening procedure are:

- Helps evaluate the business authenticities of companies, and identify changes in transactional behavior, which sometimes indicate fraud.

- Identifies the Ultimate Beneficial Owner (UBO) and evaluates their risk profiles.

- Screening key stakeholders prevents the occurrence of financial fraud and makes companies trustworthy.

Who are UBOs?

A UBO (Ultimate Beneficial Owner) is the ultimate business owner of an organisation. A UBO can be classified as someone

- who owns more than 25% of the company’s shares.

- who controls more than 25% of the voting rights.

- who is a beneficiary of at least 25% of the organisation’s capital.

- who is a shareholder, including those with bearer shares that can be transferred anonymously.

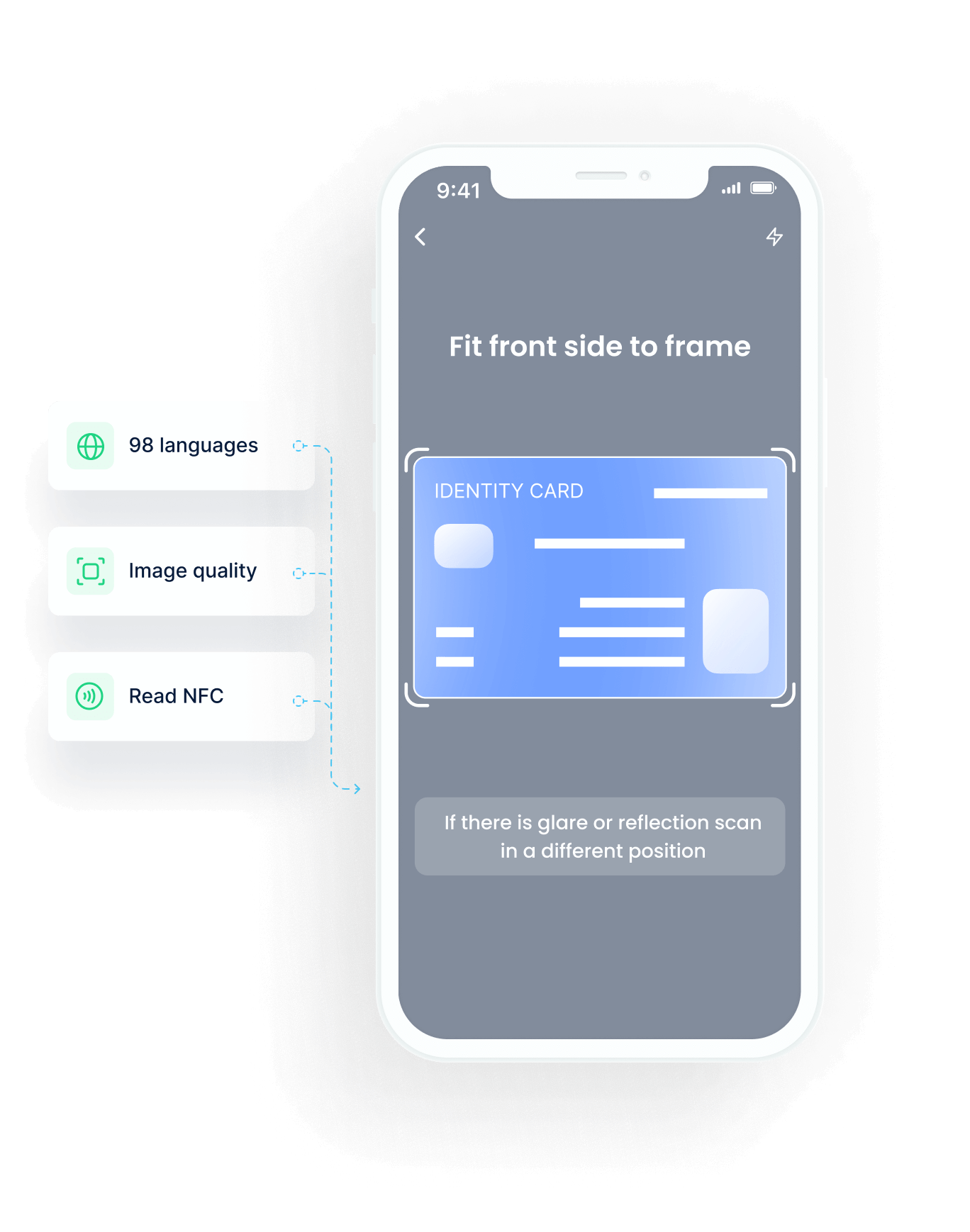

Can uqudo verify KYB documents in languages other than English?

Yes, uqudo’s KYB coverage includes more than 98 languages, including Arabic, English, Afrikaans and many more.

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-advertisement | 1 year | Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. These cookies track visitors across websites and collect information to provide customized ads. |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Please wait while you are redirected to the right page...

with your tech stack.

with your tech stack.