Transaction Monitoring

Stay Ahead of Fraudulent Transactions and Meet Compliance Standards

Ensure real-time, data-driven monitoring of transactions with uqudo’s Transaction Monitoring. Gain a 360-degree view of customer behaviour, detect anomalies instantly, and prevent financial crime with a seamless, AI-powered solution.

Why choose us?

Connect KYC and transaction monitoring for a unified view of customer risk.

Detect suspicious activities in real time, minimizing reliance on manual reviews.

Use machine learning to detect anomalies and uncover hidden customer risks.

Ensure continuous customer due diligence and compliance with global AML regulations.

Deploy seamlessly over your existing infrastructure—no rebuild needed.

How it works

Leverage AI and real-time data analytics for proactive transaction monitoring.

Data Integration

uqudo Transaction Monitoring merges transaction data, KYC data, and external intelligence into a unified profile.

Behaviour Monitoring

The system continuously analyzes transactions against expected patterns.

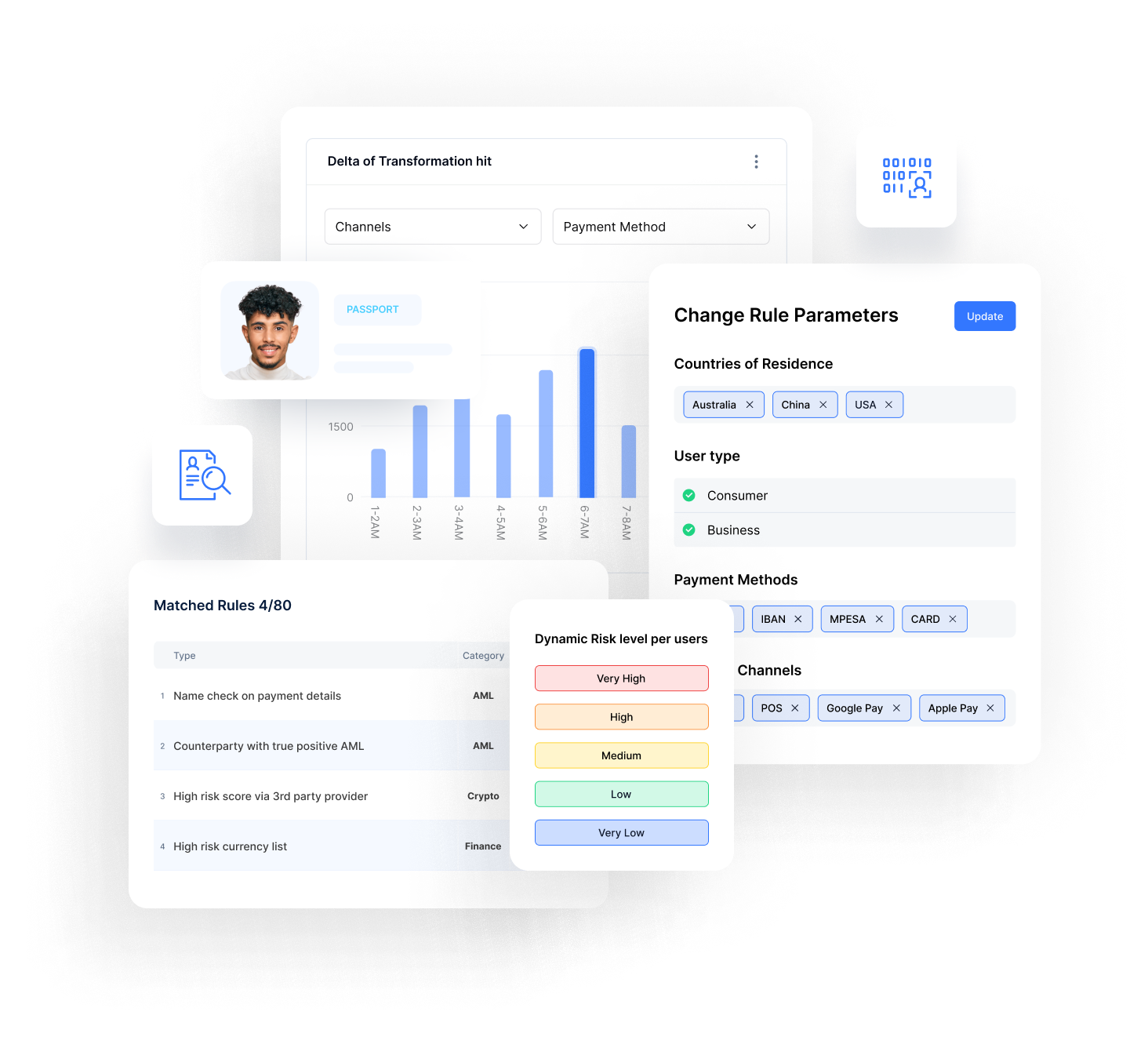

AI & Rule-Based Alerts

The system uses predefined rules and machine learning to detect suspicious activities in real time.

Automated Reviews

Trigger client risk reviews based on anomalies rather than periodic manual checks.

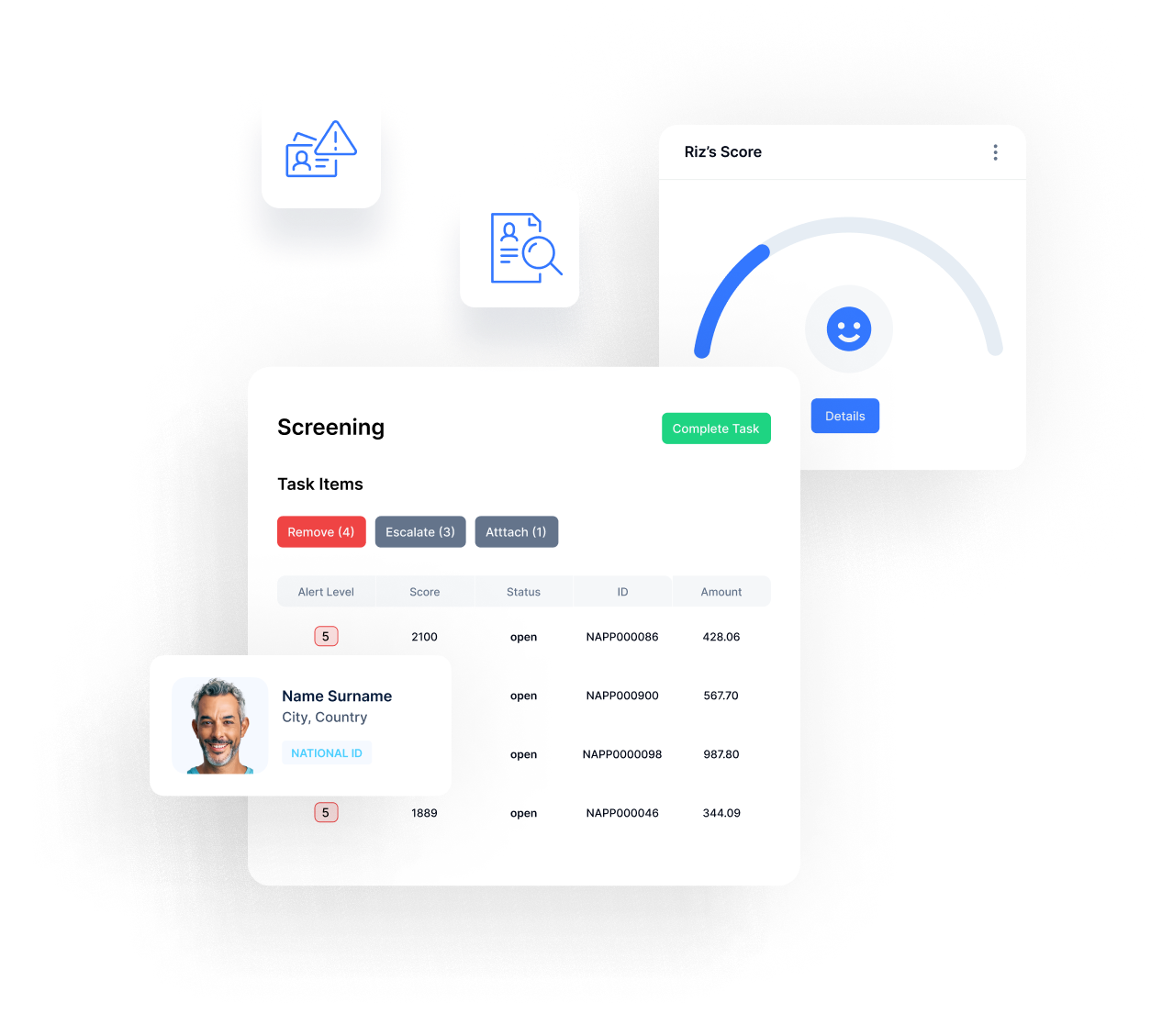

Investigation & Escalation

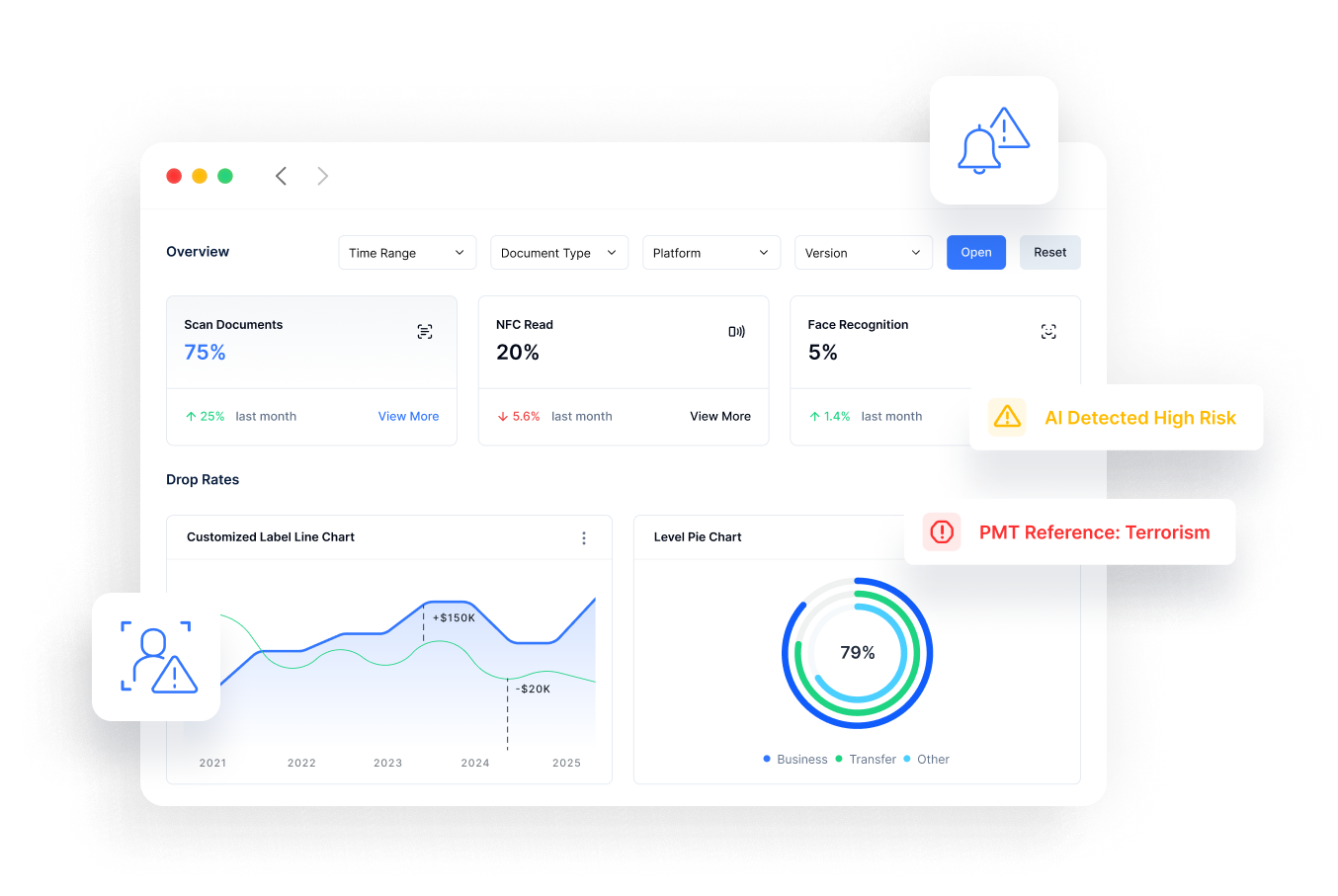

Alerts are sent to compliance teams with intuitive dashboards for efficient analysis.

Robust Transaction Tracking Capabilities

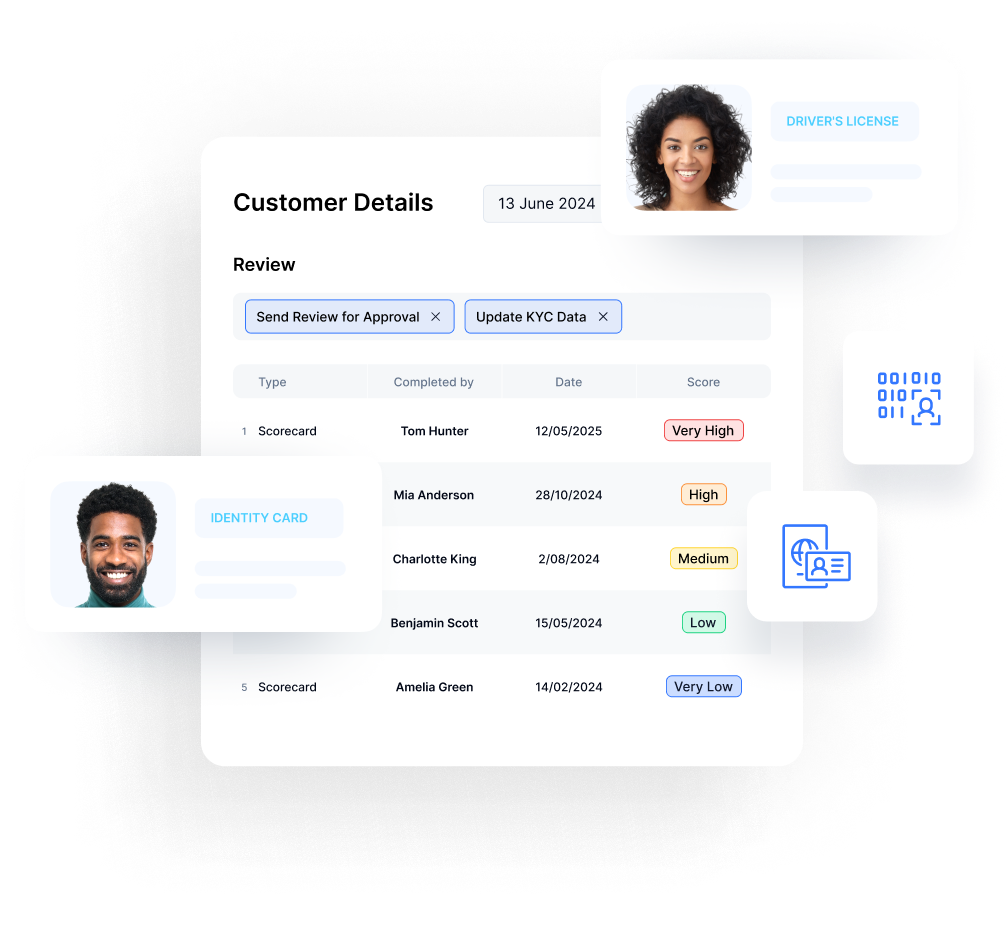

Unified Customer View

Gain a single view of customer activity across multiple systems, ensuring compliance with global AML regulations through continuous monitoring.

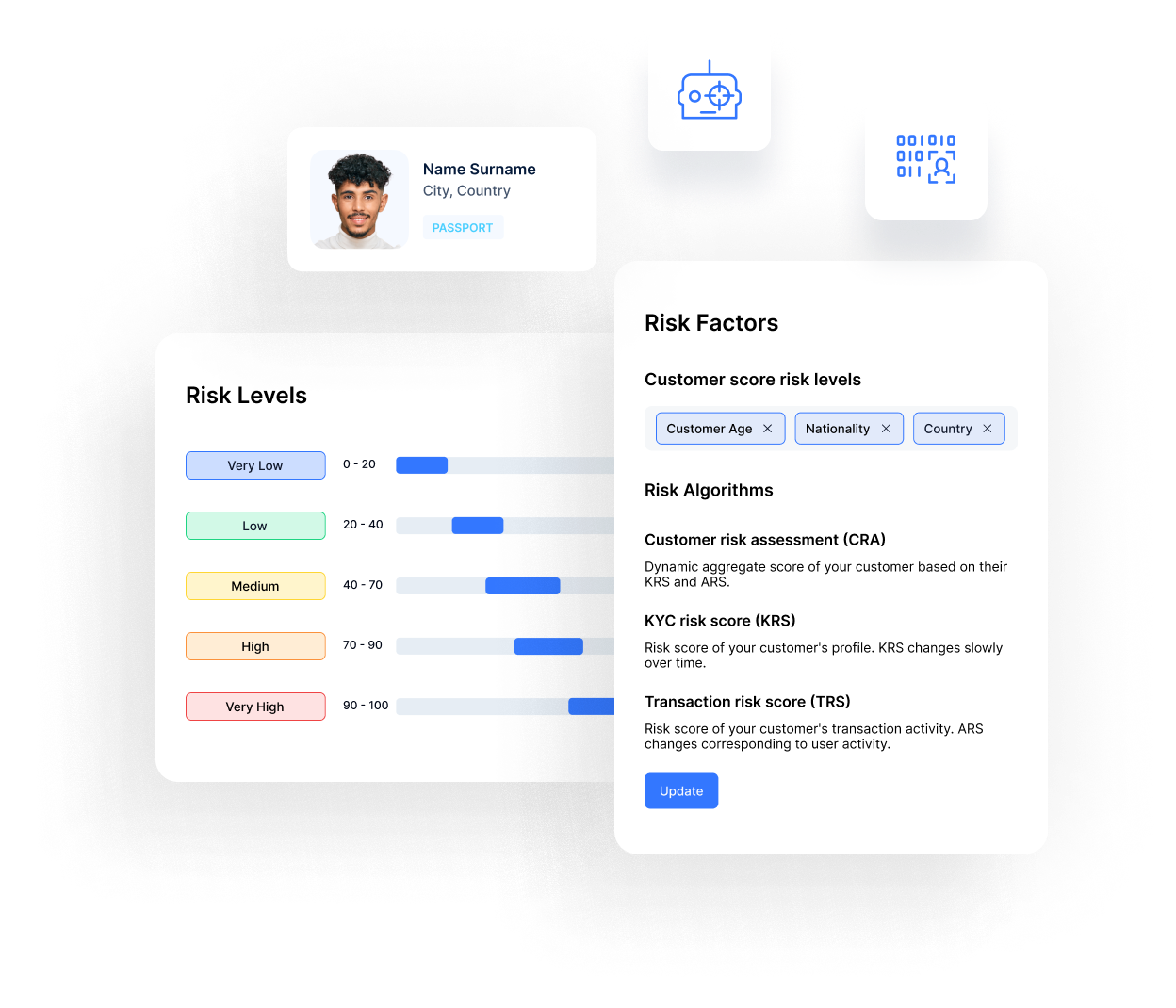

Real-Time Risk Detection

Detect suspicious activity in real time and replace periodic KYC reviews with dynamic, behaviour-based customer due diligence.

AI-Powered Anomaly Detection

Identify unusual customer behaviours using AI and machine learning while minimizing false positives for more efficient investigations.

Intelligent Workflow & Reporting

Automate alert handling, streamline compliance workflows, and analyze customer behaviour with real-time visual dashboards for faster decision-making.

Harness the Power of Advanced Transaction Monitoring

Proactive Risk Management

Detect and respond to suspicious activity in real-time rather than reactively.

Regulatory Compliance

Ensure adherence to ongoing monitoring and customer due diligence requirements.

Operational Efficiency

Reduce manual effort and increase automation in financial crime detection.

Smarter Alert Precision

Leverage machine learning to minimize false positives and focus on genuine threats.

Future-Proof Compliance

Adapt to evolving AML threats and regulations with an AI-driven approach.

Secure, frictionless, & fully compliant digital onboarding. Integrated seamlessly within your app.

Latest Transaction Monitoring updates

How Transaction Monitoring Enhances Compliance and Risk Management

Vlad Simakov

Solution Architect uqudo

Why Are Anti-Money Laundering Services Essential for Your Business Growth?

Rohan Joseph

Sales Manager uqudo

UAE’s 2024-27 AML Strategy: How uqudo supports Fraud Prevention

Chandrika Mahapatra

KYC Content Specialist uqudo

Our clients

Easily integrate  with your tech stack.

with your tech stack.

Use our simple and secure Web SDK, Mobile SDK, or RESTful API to seamlessly integrate identity capabilities into your operations.

See documentationAn award-winning team

uqudo is proud to be recognised by some of the world’s most distinguished organisations.

Here’s what people say about us

-

Abdulmajeed Alsukhan

CEO & Co-Founder Tamara

uqudo, with its user-friendly interface, efficient processes, and responsive team, aligns seamlessly with our dedication to delivering fast, easy, and cost-effective customer authentication experiences. This collaboration fortifies our focus on putting our users first and upholding the highest standards of privacy and security.

-

Xu Chi

VP Ecosystem Cloud Middle East Huawei

Partnering with uqudo will enable Huawei Cloud to offer customers cutting-edge identity verification, contributing to the goal of building a more secure and inclusive digital world.

-

Joseph Dallago

CEO Rain Crypto

We are thrilled to partner with uqudo to leverage their innovative and secure identity technology into our customer’s onboarding process. By prioritising security and user-friendliness, we aim to make the benefits and opportunities provided by cryptocurrencies more accessible to individuals in the region.

-

Maqbool Al Wahaibi

CEO Oman Data Park

Oman Data Park is committed to providing our customers with the latest and most advanced technology solutions. Our partnership with uqudo will help us to further enhance our services and deliver fraud-proof digital identity solutions to our customers in Oman.

-

Jude Dike

CEO Get Equity

After our research, we found uqudo to be by far the best AML provider and we are confident that they will help us push our business forward as we grow.

-

Mehdi Fichtali

Founder & CEO FinaMaze

What made us choose Uqudo as our digital identity partner is their clear and fast integration process and the constant availability and efficiency of their support team. The client ID verification and video selfie is user-friendly and convenient making our onboarding process quasi-instant.

We price based on successful onboarding.

Say goodbye to request-based fees, repeat charges, and spiralling customer acquisition costs.

FAQ

How does the system detect suspicious activity?

The system uses machine learning and rule-based logic to analyze transaction patterns and identify anomalies in real time.

Is the solution compatible with existing infrastructure?

Yes, the platform can be integrated with existing systems without the need for major changes.

How does it support compliance requirements?

The system ensures continuous customer due diligence and helps organizations meet global AML regulations.

What type of alerts are generated?

The system generates AI-based alerts for suspicious activity and routes them to compliance teams via intuitive dashboards.

What sets uqudo apart from other providers?

uqudo combines KYC and transaction data for a unified risk view, offers seamless integration, and provides real-time AI-driven monitoring with minimal false positives.

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-advertisement | 1 year | Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. These cookies track visitors across websites and collect information to provide customized ads. |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Please wait while you are redirected to the right page...

with your tech stack.

with your tech stack.