Trusted Digital Identity Solutions in Rwanda

MEA’s leading identity platform delivering secure, frictionless verification for Rwanda’s digital economy

Transform Identity Verification for Rwanda’s Progressive Digital Economy

Empowering Rwanda’s Digital Identity Landscape

Rwanda has established itself as a technology leader in East Africa, with ambitious digital transformation initiatives through the SMART Rwanda Master Plan and Vision 2050. As financial inclusion expands and digital services proliferate, robust identity verification has become essential for businesses operating in Rwanda’s forward-looking digital ecosystem.

Solving key challenges

-

Regulatory Compliance

Meeting the requirements established by the National Bank of Rwanda (BNR) and Financial Investigation Unit (FIU)

-

Document Authenticity

Verifying the authenticity of Rwandan identity documents including national ID cards and passports with precision

-

Multi-Language Support

Supporting English, French, and Kinyarwanda character recognition with high accuracy

-

Mobile-First Security

Balancing high security standards with frictionless user experiences in a sophisticated market

uqudo’s Rwanda-Focused Solution

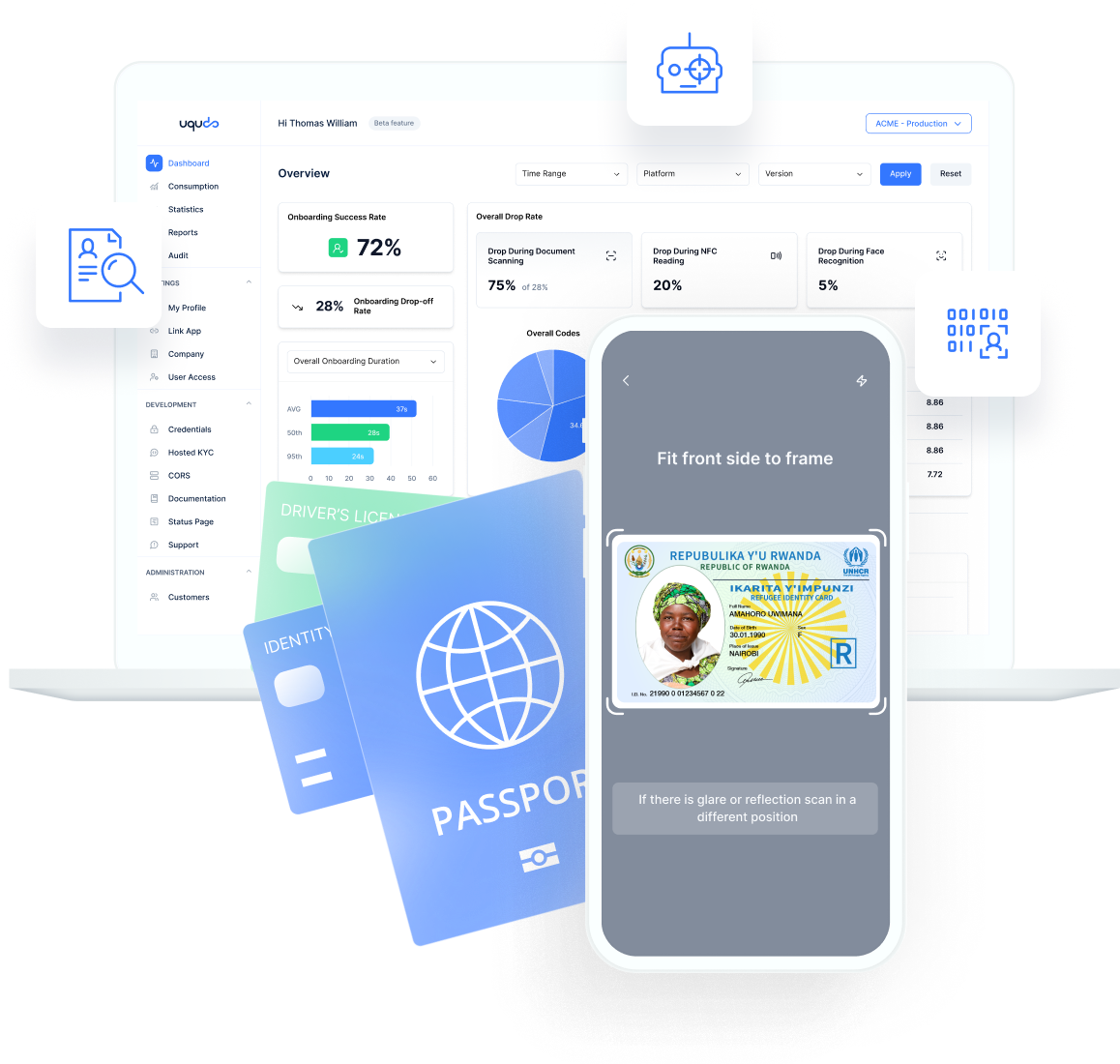

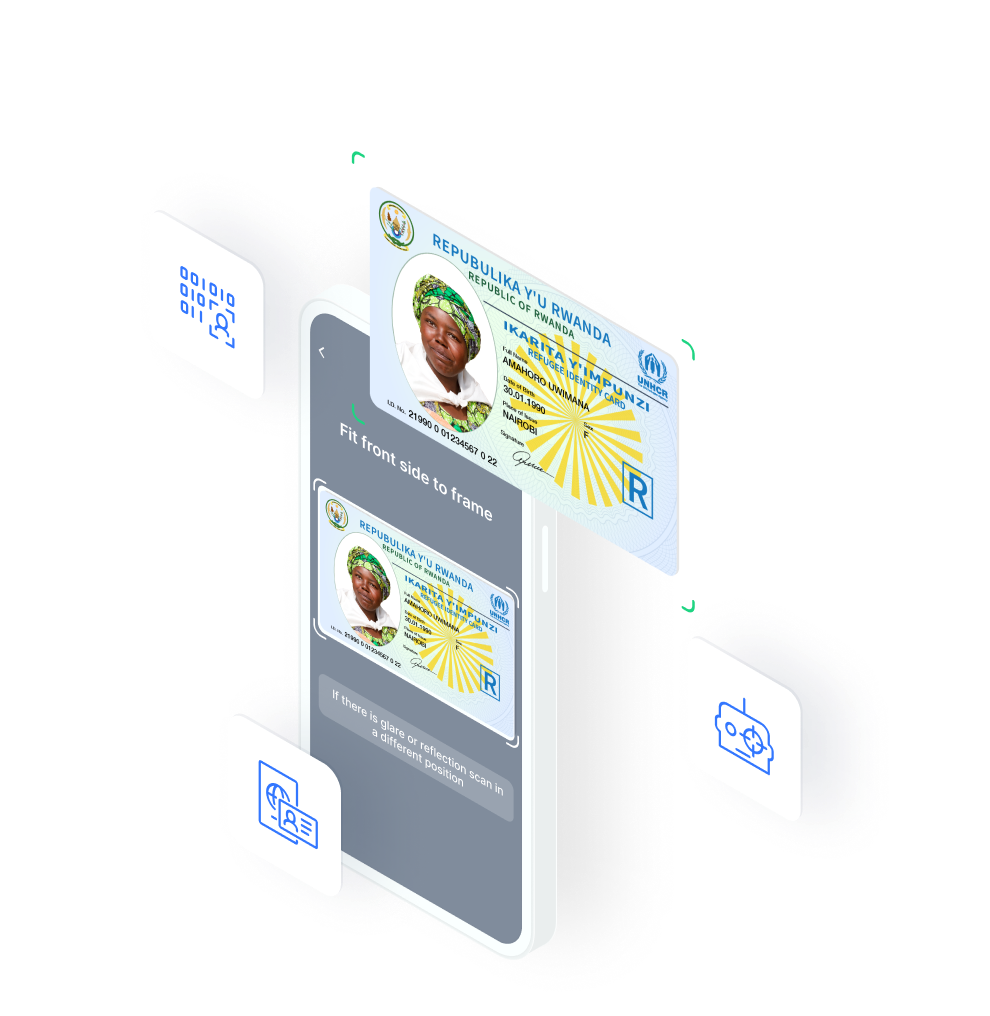

uqudo delivers a comprehensive digital identity platform optimized for Rwanda’s unique needs, supporting local identity documents with advanced verification technologies including NFC chip reading and National Citizen Registry verification that help businesses achieve regulatory compliance while creating seamless user experiences.

Verify Rwandan Identity Documents with Precision

The Rwandan National Identity Card, issued by the National Identification Agency (NIDA), is fully supported by uqudo’s advanced verification technology with multiple validation layers.

uqudo verifies Rwandan passports issued by the Directorate General of Immigration and Emigration, extracting and validating all critical personal information through multiple verification layers.

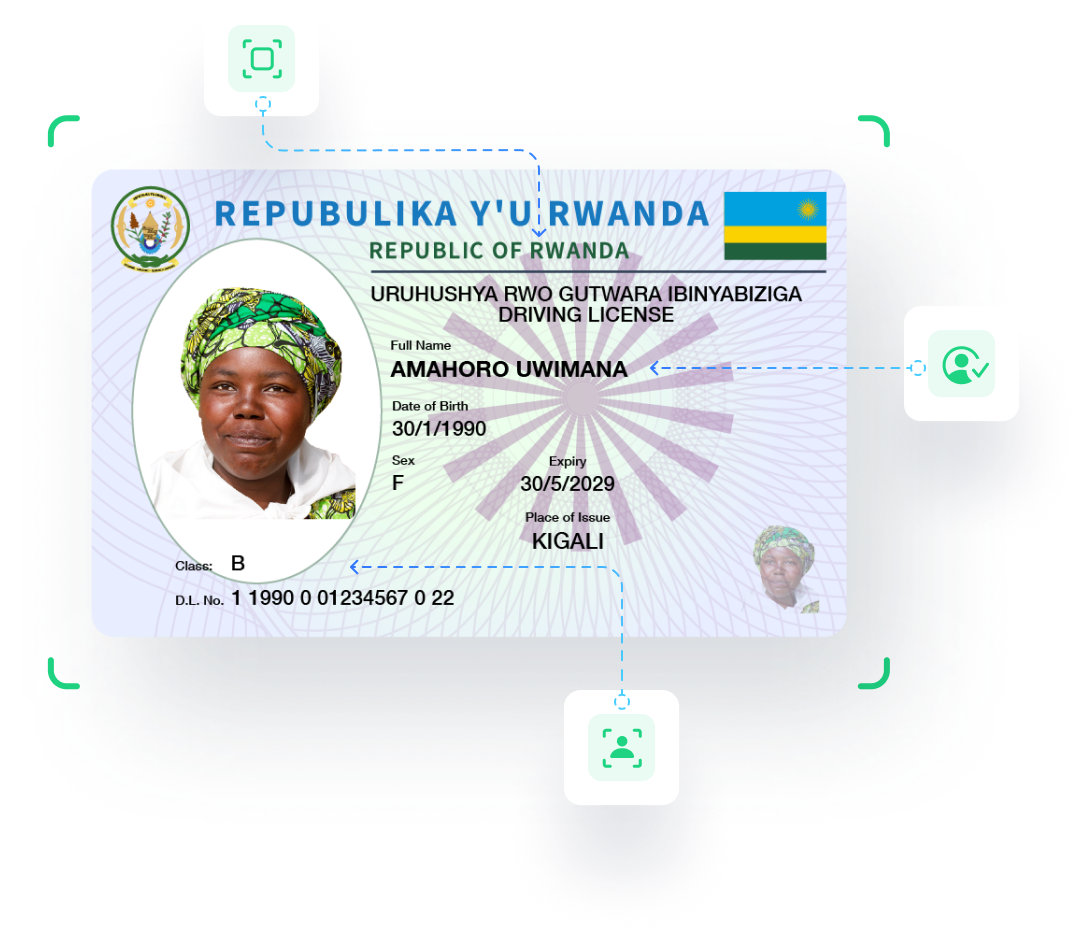

As a leading ID verification solutions provider, uqudo supports comprehensive verification of driving licenses issued by the Rwanda National Police.

- National Identity Card

- Passport

- Driving License

AI Document Scanning

-

Quality Detection

-

Advanced Tampering Detection

-

Superior OCR Capabilities

National Citizen Registry Verification

-

Government Database Verification

-

Enhanced Verification Certainty

-

Real-time Authentication

AI Document Scanning

-

Millisecond Processing

-

MRZ Validation

-

Comprehensive Tampering Detection

NFC Chip Reading & Verification

-

Enhanced Security

-

Data Verification

-

Stronger Assurance

AI Document Scanning

-

Precision Document Isolation

-

Quality Assessment

-

Tampering Detection

-

Enhanced Data Extraction

Experience Advanced Document Verification for Rwandan Identity Documents

See how uqudo verifies Rwandan ID cards, passports, and driving licenses with millisecond processing, NFC reading, and government database verification.

Navigate Rwanda’s Evolving Compliance Requirements

- Regulators

- Data Protection

- Data Residency

- Data Subject Consent

- AML / CFT

Regulatory Authority

• National Bank of Rwanda (BNR)

• Rwanda Utilities Regulatory Authority (RURA)

• Rwanda Information Society Authority (RISA)

• National Cyber Security Authority (NCSA)

Key Legislation

- Law N° 058/2021 of 13/10/2021 Relating to the Protection of Personal Data and Privacy

Regulatory Authority

• National Cyber Security Authority (NCSA)

Key Legislation

• Regulation No. 01/R/DFSI-CB/RURA/022 on Digital Financial Services

• Law N° 058/2021 of 13/10/2021

Regulatory Authority

• Rwanda Utilities Regulatory Authority (RURA)

• National Bank of Rwanda (BNR)

Key Legislation

• Law N° 058/2021 of 13/10/2021 Relating to the Protection of Personal Data and Privacy

Regulatory Authority

• National Cyber Security Authority (NCSA)

Key Legislation

• Law N° 75/2019 of 29/01/2020 on Prevention and Punishment of Money Laundering, Terrorism Financing and Proliferation Financing

• Regulation N° 32/2012 on AML/CFT

Regulatory Authority

• National Bank of Rwanda (BNR)

• Financial Intelligence Center (FIC)

Deploy Identity solutions that meet your specific requirements

Flexible Implementation to meet local requirements

-

Private Cloud Hosting

-

In-Country Hosting

-

On-Premise Deployment

Security and Compliance

-

Strong Encryption

-

Local Compliance

-

Security Audits

Build Trust Across

the Customer Lifecycle

Complete KYC Solutions

Complete Rwandan identity verification with NFC, government database integration, and biometric authentication.

KYB (Know Your Business)

Automate Rwandan business verification with comprehensive company data, ownership structure mapping, and document validation that streamlines due diligence while enhancing risk assessment accuracy.

AML Screening solutions

Screen against global sanctions, identify politically exposed persons, and monitor adverse media with continuous screening that helps clients identify emerging risks across Rwanda’s business landscape.

Advanced Authentication

Secure user accounts with biometric login, transaction authorization, and multi-factor authentication that prevents fraud while delivering seamless experiences across digital touchpoints.

Transaction Monitoring

Detect suspicious patterns with real-time analysis, configurable rules, and AI-assisted insights that streamline alert investigation and strengthen fraud prevention capabilities.

Professional Services

Deploy identity expertise through solution design, integration support, and ongoing optimization delivered by specialists who understand Rwanda’s unique verification challenges and regulatory landscape.

Leverage Purpose-Built Technology for Qatar's Unique Requirements

Government Database Integration

Direct access to Rwanda’s National Citizen Registry for the highest level of identity verification assurance, providing real-time validation against official records.

NFC Verification Excellence

Provide enhanced identity assurance with NFC chip reading for Rwandan passports, extracting secured data for superior verification certainty.

Advanced Biometrics

Prevent identity fraud with face recognition technology optimized for diverse populations, multi-layered spoofing protection, and passive liveness detection that delivers security without compromising user experience.

Seamless Integration

Deploy verification through lightweight SDKs (8MB), flexible APIs, and no-code solutions that enable rapid integration with existing systems and accelerate time-to-market for identity features.

AI-Powered Security

Detect sophisticated fraud with five-pillar tampering detection, event analytics, source validation, and advanced verification that provides unparalleled protection against document manipulation.

Offline Capabilities

Maintain verification functionality even with intermittent connectivity, addressing the unique infrastructure challenges in rural regions.

Frequently Asked Questions

What Rwandan identity documents does uqudo support?

uqudo supports comprehensive verification of Rwandan National ID cards, passports, and driving licenses with AI document scanning technology. Additionally, we offer NFC reading for Rwandan passports and National Citizen Registry verification for ID cards.

Does uqudo have direct access to Rwanda's National Citizen Registry?

Yes, uqudo has integrated with Rwanda’s National Citizen Registry maintained by the National Identification Agency (NIDA), allowing for real-time verification of identity information against official government records.

How does uqudo ensure the authenticity of Rwandan identity documents?

uqudo employs advanced AI document scanning with MRZ code verification for passports, NFC chip reading for passports, government database verification for ID cards, and our five-pillar tampering detection system to ensure document authenticity.

What deployment options are available for Rwandan businesses?

uqudo offers flexible deployment including SaaS cloud solutions, in-country hosting options to address data residency requirements, and on-premise deployment for specific security needs.

How does uqudo support data residency requirements in Rwanda?

uqudo provides in-country hosting that meets data residency requirements in Rwanda, helping clients comply with Law N° 058/2021 on the Protection of Personal Data and Privacy and financial sector regulations on data localization.

What integration options does uqudo offer for Rwandan businesses?

uqudo provides multiple integration paths including lightweight mobile SDKs (8MB), web SDKs, comprehensive APIs, and no-code solutions to suit different technical requirements.

How does uqudo help with Rwanda's data protection requirements?

uqudo’s flexible solution helps clients navigate Rwanda’s regulatory landscape including Law N° 058/2021 on the Protection of Personal Data and Privacy, providing features that support compliance with data subject consent requirements and privacy best practices.

Can uqudo help with National Bank of Rwanda's KYC/AML requirements?

Yes, uqudo works with financial institutions to help them achieve compliance with National Bank of Rwanda regulations on KYC/AML, including Law N° 75/2019 on Prevention and Punishment of Money Laundering and related instructions.

How does uqudo address telecom subscriber verification requirements?

uqudo provides solutions that help telecom providers address subscriber verification requirements outlined by the Rwanda Utilities Regulatory Authority (RURA), supporting SIM registration compliance.

What are the main identity fraud challenges in Rwanda?

Common challenges include document tampering, synthetic identity fraud, and account takeover attempts. Rwanda’s rapid digital transformation has created opportunities but also new fraud vectors that require advanced detection capabilities.

How does uqudo address document tampering specific to Rwandan IDs?

uqudo’s five-pillar tampering detection system is tuned for Rwandan documents, including source detection, ID photo integrity checks, consistency verification, and event analytics to identify both physical and digital tampering.

What are the best practices for identity verification in Rwanda's financial sector?

Best practices include implementing multi-layered verification (document + government database + biometric verification), continuous monitoring, and robust OCR for accurate data extraction while maintaining a frictionless user experience that supports National Bank of Rwanda guidelines.

Manual to Automated: Understanding the Changing Landscape of KYB

Tom Green

COO uqudo

AML Compliance: Navigating the Challenges of Cryptocurrency and Digital Payments

Tom Green

COO uqudo

Unveiling the Role of AI Document Scanning in Ensuring Fraud Protection

Tom Green

COO uqudo

Our clients

Easily integrate  with your tech stack.

with your tech stack.

Use our simple and secure Web SDK, Mobile SDK, or RESTful API to seamlessly integrate identity capabilities into your operations.

See documentationAn award-winning team

uqudo is proud to be recognised by some of the world’s most distinguished organisations.

with your tech stack.

with your tech stack.