Real-time KYC & AML Solution for Uganda

Utilise uqudo’s advanced Know Your Customer services to verify your users’ identity in seconds.

How our digital identity solution works

Scan Document

Read the document and extract identity data.

Facial Recognition

Check the person on camera is real and matches the document.

Validating Data

Verify the individual via government databases.

Screening

Check customers are worthy of doing business with AML & sanctions screening.

Authentication

Enable passwordless login for returning users and strengthen authentication with biometrics.

KYC for Uganda in under 10 seconds

Validate your customer’s identity with uqudo’s innovative eKYC process, digital identity verification and AML solutions in Uganda, which can be easily integrated into your onboarding platform. Keep fraudsters out and drive your conversions sky-high!

Stay compliant with our KYC & Screening solutions

In accordance with the guidelines of FATF, OFAC & ESAAMLG for

Uganda identity documents we verify

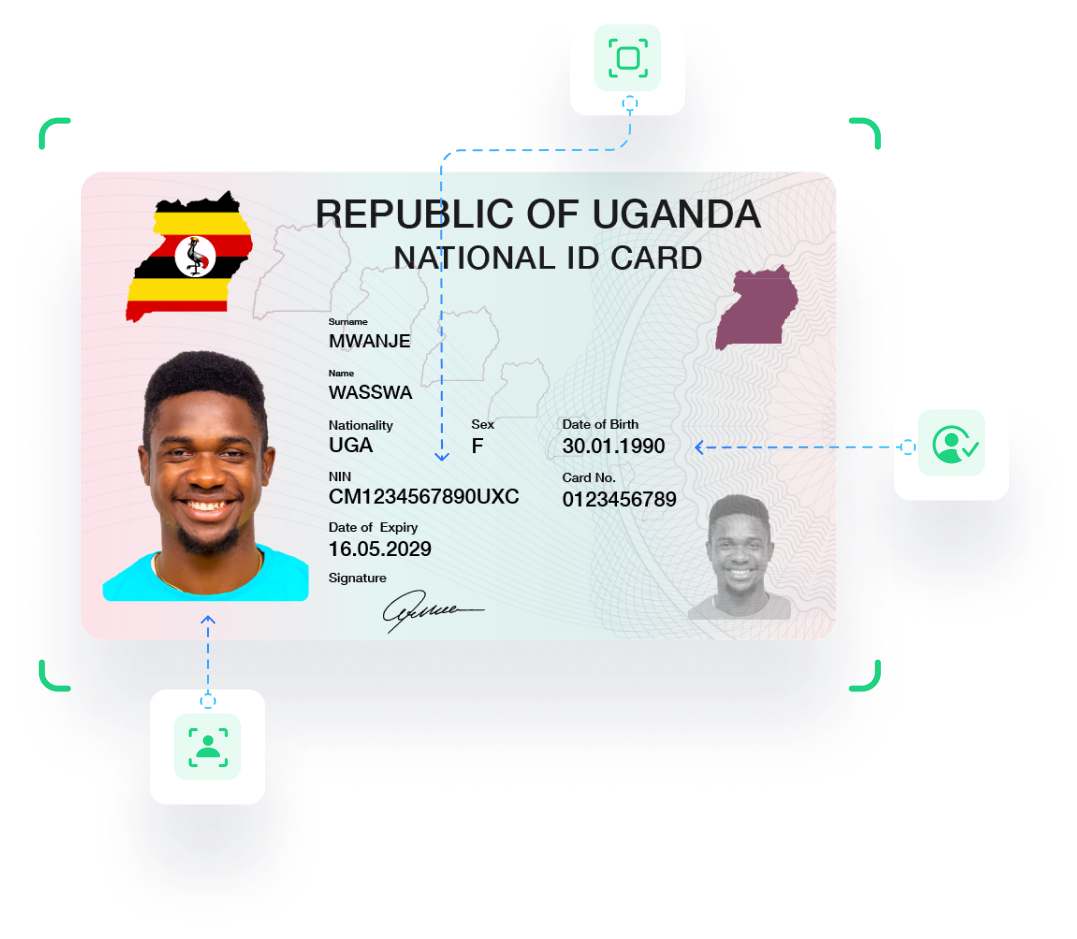

National ID Card

National ID Card

As digital ID verification service providers, we verify the National Identity Card in Uganda issued by the National Identification and Registration Authority (NIRA).

AI Document Scanning

- Isolating the document from the image and evaluating the quality based on glare and blur.

- Detecting document tampering or forgery.

- Validating hologram print.

- Extracting data via OCR.

Verify via NCR

- Verification of extracted data using existing databases

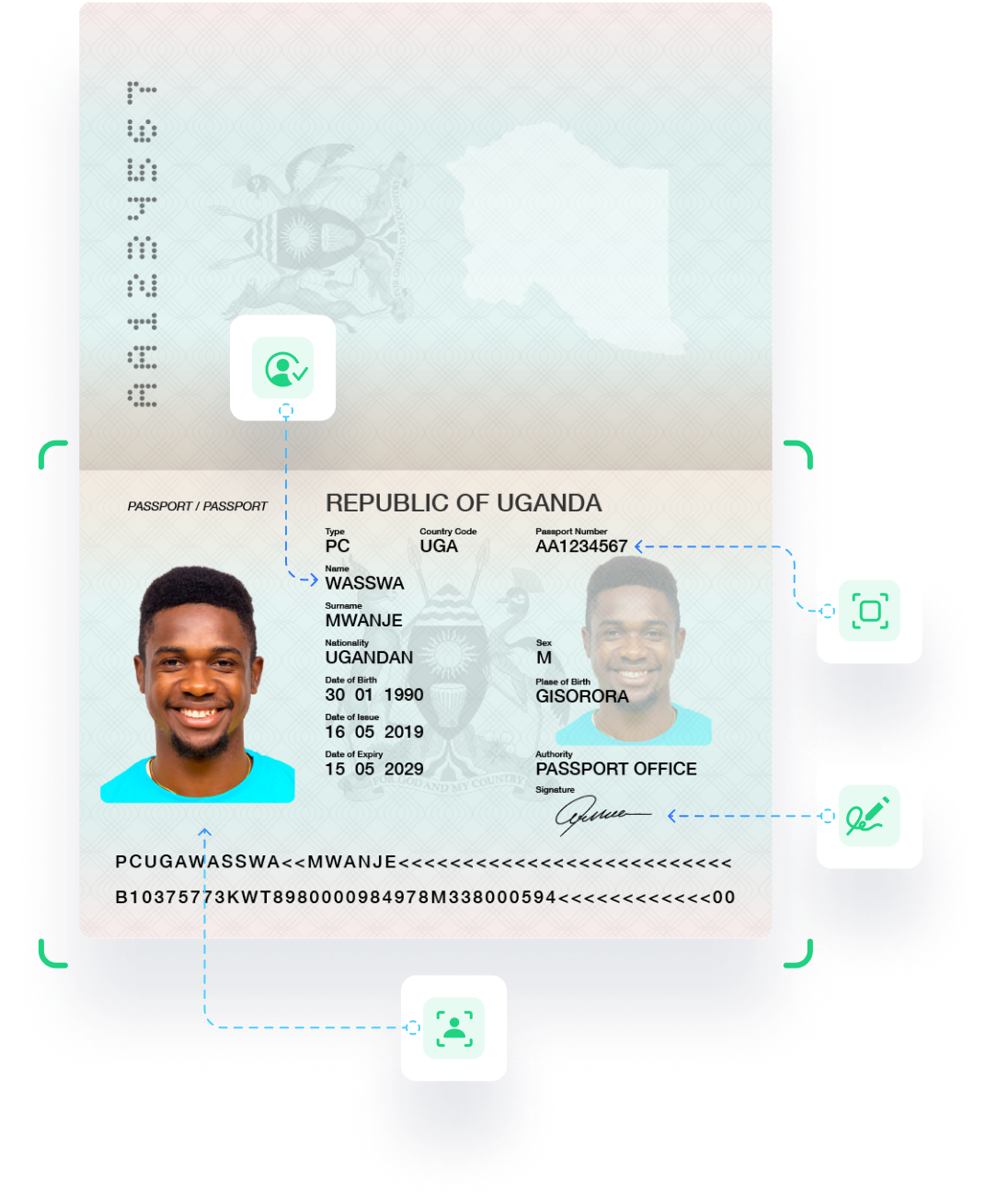

Passport

Passport

uqudo verifies Ugandan passports issued by the Directorate of Citizenship and Immigration Control for KYC in Uganda, which includes verification of users’ name, date of birth and telephone number, along with Enhanced Due Diligence.

AI Document Scanning

- Isolating the document from the image and evaluating the quality based on glare and blur.

- Detecting document tampering or forgery.

- Checking format’s accuracy.

- Checking the data with the MRZ code & hologram.

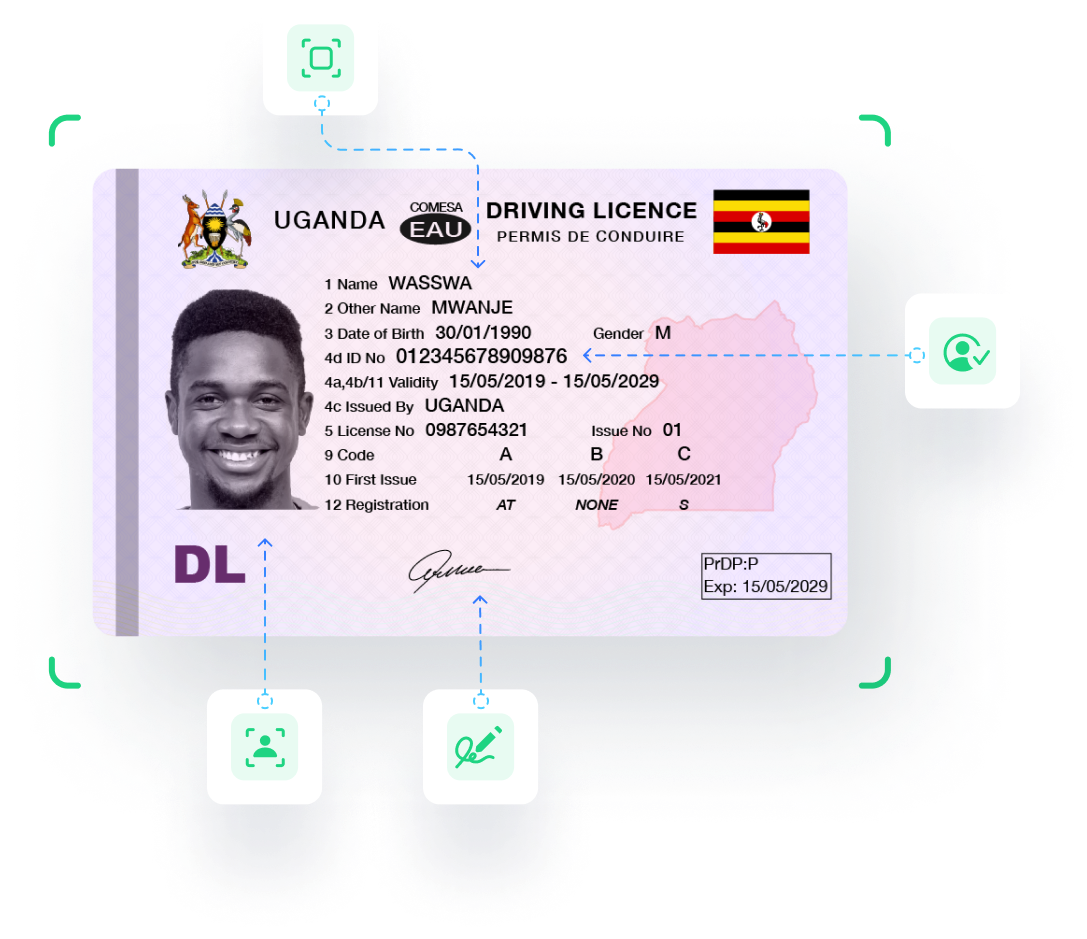

Driving license

Driving license

As a leading identity verification company, uqudo verifies the driving licenses issued by the Uganda Driver Licensing System in Uganda by,

AI Document Scanning

- Isolating the document from the digital image and aligning it properly.

- Evaluating the quality of the image based on glare and blur.

- Detecting document tampering or forgery.

- Validating hologram print.

- Extracting data via OCR.

Pushing boundaries in the identity space in MEA and beyond

Licenses sold

EMEA Document Scanning Coverage

Global Passport NFC Reading

Awards & Recognitions

Full stack identity solution: KYC, Enhanced Due Diligence, AML Screening & Biometric Authentication

A fully customizable onboarding journey embedded in your app or website

An award-winning team

uqudo is proud to be recognised by some of the world’s most distinguished organisations.

Easily integrate  with your tech stack.

with your tech stack.

Use our simple and secure Web SDK, Mobile SDK, or RESTful API to seamlessly integrate identity capabilities into your operations.

See documentationWe price based on successful onboarding.

Say goodbye to request-based fees, repeat charges, and spiralling customer acquisition costs.

with your tech stack.

with your tech stack.