Document Verification

Verify document authenticity from government repositories.

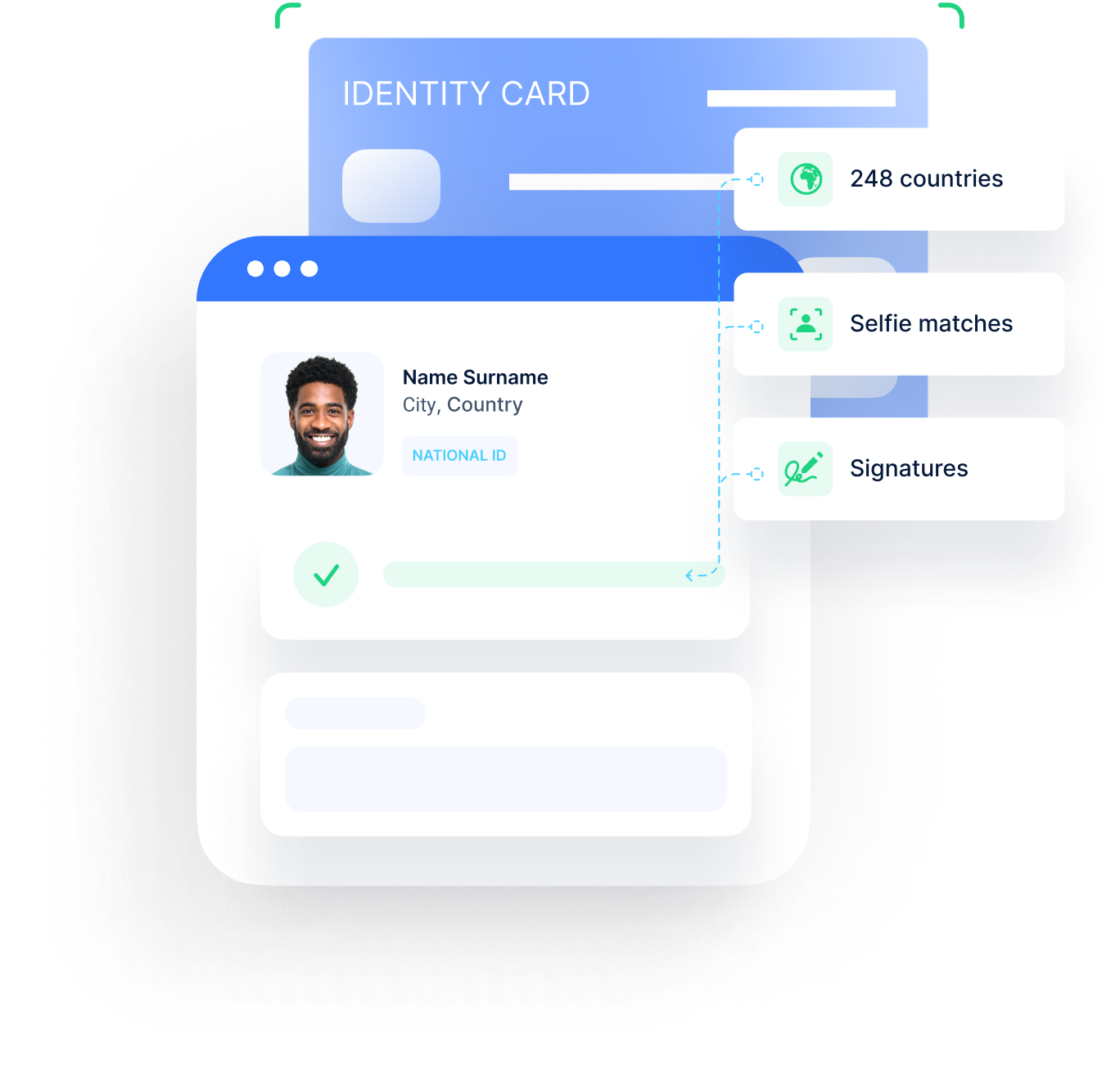

Analyse and verify identity documents across 248 countries and territories in seconds with unparalleled accuracy.

See it in action:

Why choose us?

Greater coverage

Access identity documents across 248 countries and territories to verify identity.

Eliminate fraud

Use digital signatures to remove the occurrence of fake or tampered IDs.

Precise data extraction

Use AI to extract data from identity documents in milliseconds.

Real-time verification

Automate document verification and enhance customer experience.

How it works?

Step 1

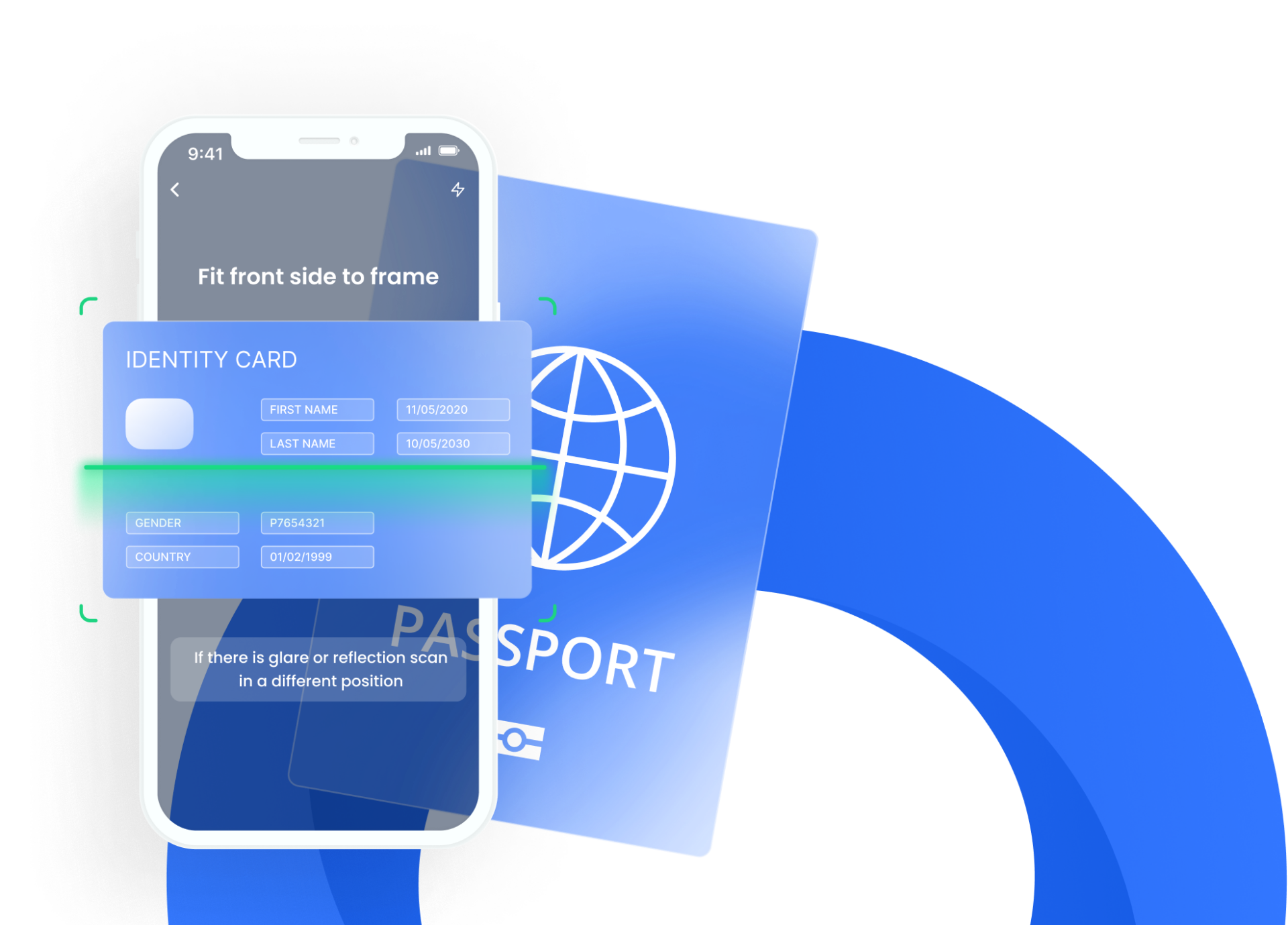

Capture images from identity documents like National IDs, Passports, Driving Licenses and Company related documents.

Step 2

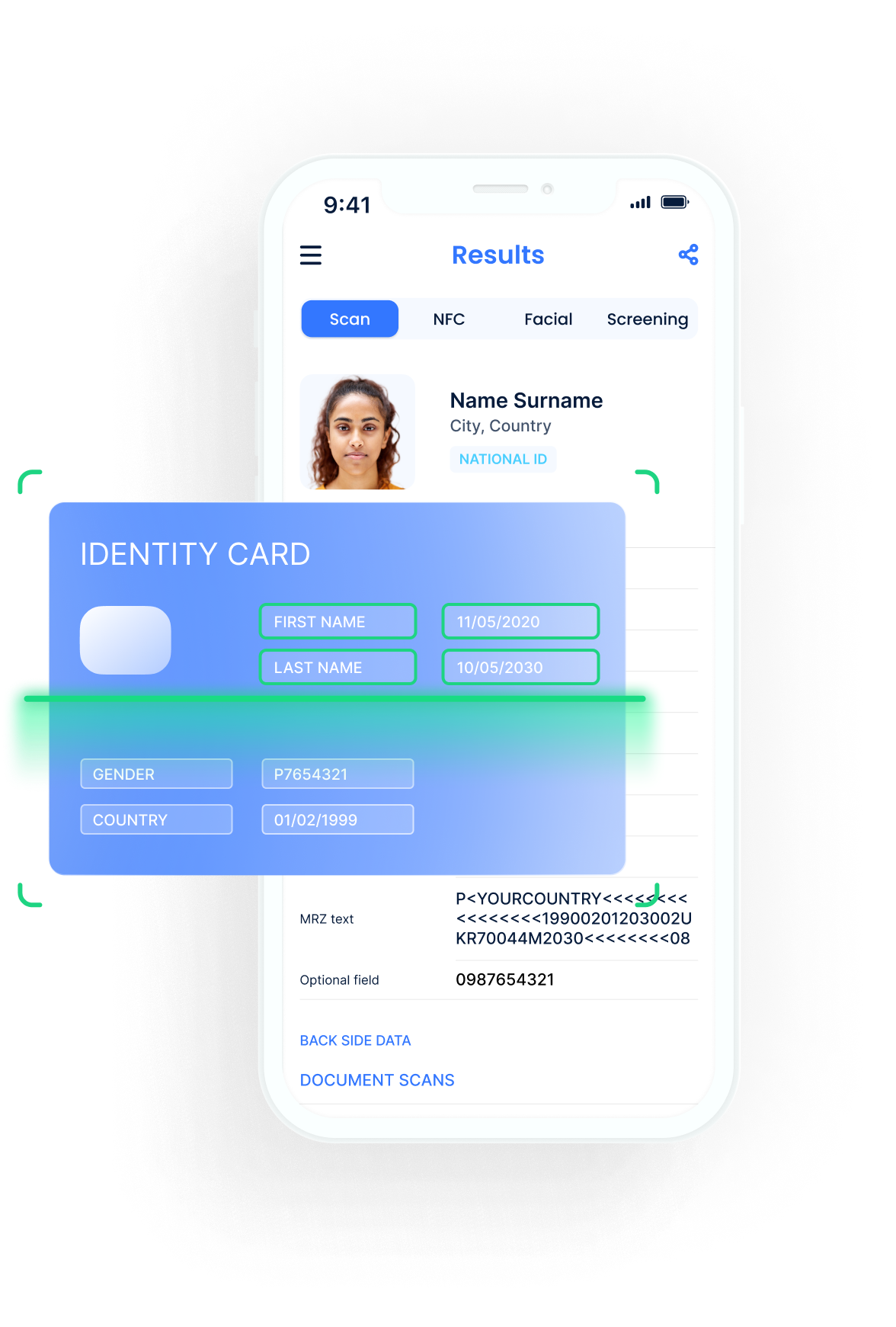

Extract data from images using AI technology in milliseconds with unparalleled accuracy.

Step 3

Access the database to verify if the document matches the individual and is real.

Document Verification Features

Image Capture

- The user clicks an image of the required ID document.

- If the captured image appears misaligned, our APIs trigger a recapture.

- This allows users to complete the entire process in a single try, reducing errors.

Data Extraction

- Data from the captured document image is extracted using software, not requiring manual typing by your users.

- OCR software extracts the required information, automating all data entry.

Data Verification

- The extracted data is then verified against identity documents from 248 countries and territories.

- Documents are also checked using government repositories to validate identity.

Secure, frictionless, & fully compliant digital onboarding. Integrated seamlessly within your app.

Latest KYC updates

4 reasons why is KYC broken and how you can achieve better compliance

Chandrika Mahapatra

Content Writer uqudo

What is KYC? Overview, Uses, Components and Process

Chandrika Mahapatra

KYC Content Specialist uqudo

8 ways OCR enhances digital identity

Chandrika Mahapatra

KYC Content Specialist uqudo

Our clients

Easily integrate  with your tech stack.

with your tech stack.

Use our simple and secure Web SDK, Mobile SDK, or RESTful API to seamlessly integrate identity capabilities into your operations.

See documentationAn award-winning team

uqudo is proud to be recognised by some of the world’s most distinguished organisations.

We price based on successful onboarding.

Say goodbye to request-based fees, repeat charges, and spiralling customer acquisition costs.

FAQ

What is KYC?

Know Your Customer (KYC) is an identity verification process that authenticates the real identity of customers during onboarding.

What is Enhanced Due Diligence?

EDD goes beyond CDD and looks to establish a higher level of identity assurance with additional verification steps such as verifying the customer’s address.

How do you perform KYC?

Three key steps are involved in our identity process; first, we read the document and extract identity data; next, we check the person on camera is real and matches the document; finally, we verify document authenticity via government databases or using the digital signatures on the document.

What are the requirements for KYC?

KYC document requirements vary according to a region’s jurisdiction but generally include

- A government-issued ID card

- Passport

- Driving License

- Voter’s ID

- Birth certificates

Why is KYC required?

KYC helps financial institutions verify the identity of customers and prevents companies from being used in illegal financial activities. KYC also helps firms understand their customer’s financial behaviour, aiding in a better user experience.

What is eKYC?

eKYC or Digital KYC refers to a remote, paperless KYC process, that can be completed digitally. The steps involved in eKYC are:

- AI document scanning

- Biometric face recognition

- Digital document verification

How long does KYC verification take?

uqudo’s identity verification can be completed in less than 10 seconds.

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-advertisement | 1 year | Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. These cookies track visitors across websites and collect information to provide customized ads. |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Please wait while you are redirected to the right page...

with your tech stack.

with your tech stack.