Table Of Contents

What is KYC?

Know your Customer or Know your Client (KYC) is a standard process of verifying a client’s identity while building a business relationship, in accordance with the legal requirements. KYC verification helps banks and other financial institutions have detailed information about their clients, their risk profiles, and their financial positions. A stringent KYC in banking-related matters protects organizations from money laundering, financial fraud, identity theft, terrorism financing, and other financial crimes.

An efficient KYC procedure is vital for compliance and risk management programs, making KYC an important part of any onboarding process. The verification of KYC while dealing with customers is a legal obligation under the Anti Money Laundering (AML) framework, which banks and financial institutions have to follow.

KYC process is that of a risk-based approach, where the greater the risk a customer poses, the more information the bank or financial institution would like to collect. This risk-based approach helps clients understand the financial activity of their customers along with their business operations and characteristics and detect deviations to identify a potential fraud at its early stages. The risk-based approach involves implementing various guidelines including transaction monitoring for risk assessments.

The importance of strictly implemented KYC process steps is important for organizations in every industry, but it has a major impact on financial institutions, banks, and their related industries like insurance, telecommunications, trade, and cryptocurrency. KYC can be done online or in person, but with the world getting more digital day by day, it is very important that KYC can be done accurately in a remote manner and this is why having a long-term KYC partner is crucial for companies today. Digital KYC also helps in checking for KYC updates long after a client has been onboarded.

Where is KYC used?

When a new client is onboarded, it is necessary to learn about their financial situation, and this is where KYC comes in place. The main objective of this is to prevent banks and financial institutions to be used, without their knowledge, in illegal money laundering activities and financial crimes. All businesses that deal with money need to have an effective KYC procedure for customer identity verification in place, and these industries include:

- Fintech

- Cryptocurrency and Blockchain

- Financial Institutions and Banks

- Insurance

- Telecommunications

- Real estate

- Audit and accountancy

Along with this, every business that deals with financial matters and organizations that work with government institutions require Customer Due Diligence (CDD), which is a key aspect of KYC.

Components of KYC

While implementing the KYC process steps, a clear definition of the entire procedure has to be determined, which is should be consistent for every customer, despite their risk profiles. These processes have to be documented thoroughly to ensure a proper audit trail is maintained.

- Customer Identification: The first essential element of KYC, a customer can be a person/entity on whose behalf an account is created or anyone who is connected to the financial transactions being done. It refers to identifying and verifying a customer’s identity through various documents, data, or information. Customer identification is done by verifying the name, date of birth, and address of the customer through documents like passports and national identities, which are hard to forfeit.

- Customer Due Diligence (CDD): Customer Due Diligence is the process of collecting and evaluating the financial information of customers in order to assess their risk potential. The most important aspect of the KYC procedure, CDD helps in analyzing the customer risks in compliance with the country’s legislation. Financial institutions do CDD in order to guard against fraudulent activities and assist law enforcement. Different levels of CDD are applied to customers (Simplified Due Diligence and Enhanced Due Diligence), based on their risk profiles.

- Constant Monitoring: Continuous monitoring of the account activity of customers in order to identify any suspicious activity helps prevent money laundering and terrorism financing.

What are the documents required for KYC?

KYC documents vary according to local jurisdiction and the exact KYC requirements for banks, but majorly include a government-issued identity document that validates the individual’s identity along with address proof. Some examples of documents that can be used for KYC are:

- Passport

- Driving license

- Financial documents (statements, references)

How does KYC work?

KYC checks are not only performed at the onboarding of a new client, but it is an ongoing process that occurs during the entire span of the client-customer relationship. Since the major aim of KYC is to identify changes in customer transactional behaviour on a real-time basis, periodic KYC checks are necessary. The main steps involved in KYC checks include:

- ID verification: The first step of KYC is to verify the individual’s identity. This is done generally by verifying a government-issued ID document (eg. Passport) to ensure the individual’s documents are not forged.

- Facial recognition: To ensure that the person whose documents are being verified is not using someone else’s identity, a liveness check of the individual has to be done along with facial recognition.

- Screening: The information next has to be verified with the existing database to ensure the background check is accurate.

Types of KYC

There are different types of KYC which vary according to a banking system or a financial institution’s requirements. The main aim of all these types of KYC methods is to have a procedure that is feasible and cost-effective for that firm.

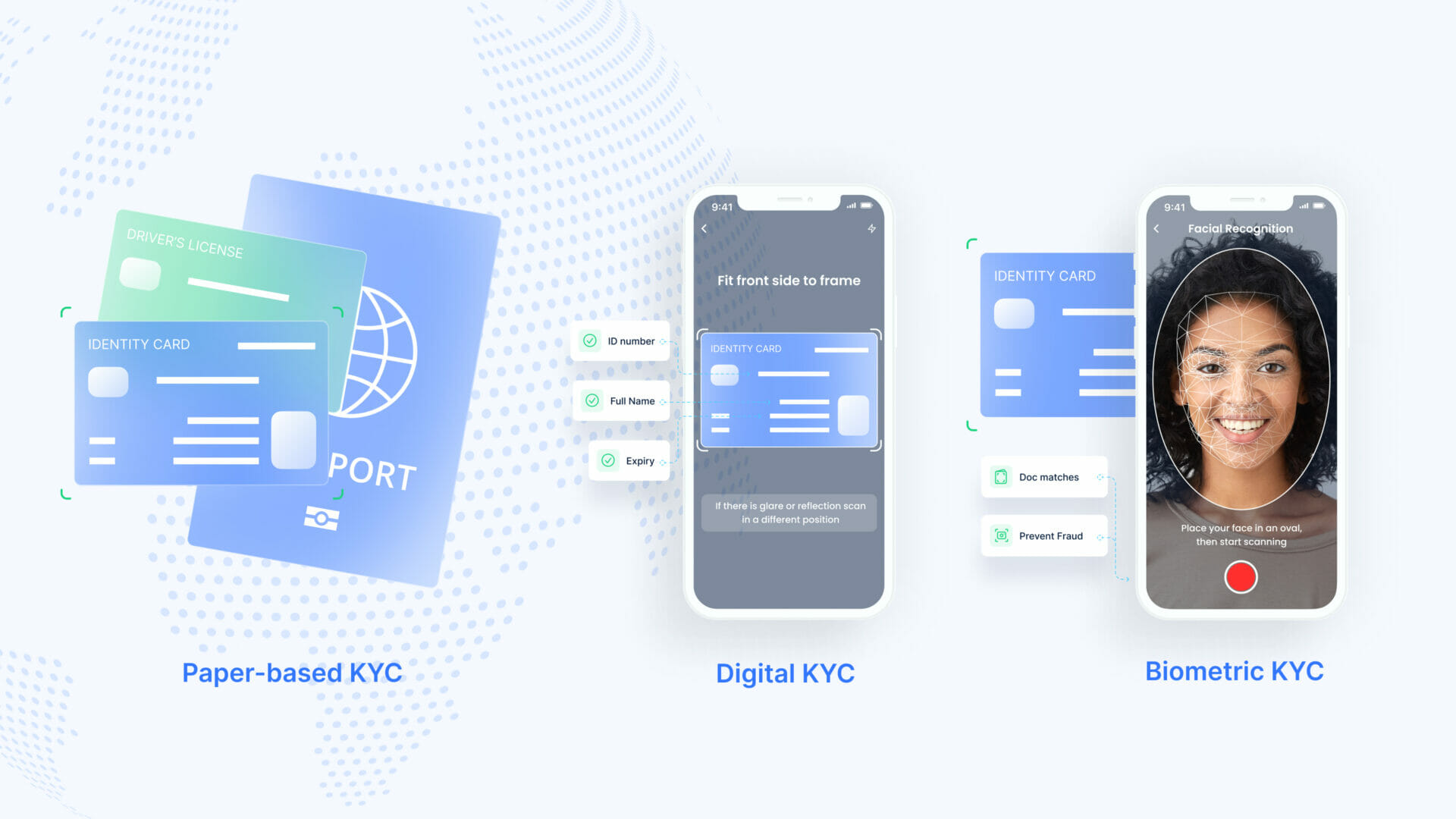

- Paper-based KYC: The most common KYC procedure right now, in paper-based KYC customers provide a physical copy of their verification documents which are then verified by the financial organization. Since any financial body can conduct paper-based KYC, this is sometimes preferred over an online method.

- Digital KYC: This online method of KYC verification is becoming increasingly popular due to its ease of use and efficiency. In this, the documents of the individual are verified digitally and a live picture of the customer is taken to verify the identity.

- Biometric KYC: Biometric refers to physiological characteristics like fingerprints, facial features, iris patterns, etc used for verifying an individual’s identity. In biometric KYC, a selfie or video of the customer is compared to the photo on an ID. Biometrics are then used for validating the identity of the customer.

Why is digital KYC the way to go?

KYC uses a large amount of critical data that can be misused if gotten into the wrong hands. Financial institutions that handle sensitive data benefit tremendously from a digital platform due to its ease of use and reduced costs. With the COVID-19 pandemic propelling people to a more digitized world, customers are likely to continue preferring the digital mode of transaction. A few advantages of digital KYC are:

- Confidentiality of data: One of the biggest advantages of having a digital KYC system is the encryption of data in a manner that cannot be seen by a third party.

- Real-time data verification: KYC providers tend to have access to numerous databases which enable them to validate and verify data on a real-time basis. This in turn increases the accuracy of data, reducing manual intervention.

- Cost-efficient and eco-friendly: With the KYC process being fully automated by the use of AI and machine learning, the costs for utilizing the process are lower in comparison to offline methods of identity verification.

What is AML and how does it vary from KYC?

Anti Money Laundering refers to all the rules and regulations in place to prevent the disguise of illicit funds as legal income. Ranging from small tax evasion to public corruption and terrorist financing, the expansion of the financial industry has increased the occurrences of money laundering activities. According to the United Nations, approximately 2% to 5% of the global GDP, which values at $ 800 billion to $ 2 trillion is laundered every year.

KYC, which is the process of identifying and verifying a customer’s identity, essentially falls under the broad umbrella of AML procedure. KYC in banking systems is a part of the compliance procedure for Anti Money Laundering. Banks and other financial institutions develop their own KYC requirements, whereas AML is the jurisdiction of the legal authorities of a region. This means that the KYC procedures of an organization should be compliant with the AML regulations.

Why KYC is essential? What are its benefits and advantages?

KYC is a part of the Anti Money Laundering’s legal requirement to establish a customer’s identity and evaluate their risk profiles. It is essential for banks and financial institutions to comply with the KYC regulations, which include Customer Identification and Customer Due Diligence. KYC providers obtain data from various sources which help accurately assess a customer’s identity, which generally would have been a tedious and expensive task for financial institutions. Prior to a digitized method of identity verification, banking systems, and other financial institutions were completely dependent on manual background checks, which often were inaccurate and prone to potential fraud.

KYC also helps clients thoroughly understand the risk profiles and past financial behavior of customers, making the onboarding process of new customers more efficient. Due to a constant ongoing process of database updates, it is easy for KYC providers to find out any change in the risk profile of customers quickly, which in turn helps in preventing potential financial crimes.

KYC is essential for financial institutions because it prevents:

- Money laundering: Disguising financial assets for illegal transactions poses a huge risk for the fintech industry. Since KYC uses a risk-based approach to prevent money laundering, having a systemized KYC process protects organizations.

- Identity theft: Banks and financial institutions need to identify customers through a verified procedure, and accurate KYC prevents identity thefts and other frauds that can occur due to a stolen identity.

- Financial fraud: KYC involves constant monitoring of the customer’s transactional activity, any suspicious fraudulent activity can be easily identified and prevented.

Key to a successful KYC

The main aim of a successful KYC procedure is to minimize the possibility of money laundering and other financial fraud. Some best practices to ensure effective KYC are:

- Compliance with the region’s AML laws: Different countries nowadays have different AML laws in place to counteract money laundering and terrorism financing. By creating an effective checklist that adheres to all the legal AML regulations, banks and financial institutions can protect themselves from fines and penalties in case of customer fraud.

- Ongoing data checks: With customer data prone to some changes frequently, it is necessary that an effective system to check this updated data periodically is in place. It is necessary to perform these checks in lieu of the risk potential of the customer. While ongoing KYC updates are essential, it is necessary to ensure that the user experience in spite of these data checks remains positive.

- Identify fraudsters: With the growth of the digitized world, the ease of doing online fraud is very high. Be it acquiring personal information online or even phishing for information from various sources to falsifying biometric and liveness checks with various tools, fraudsters can sometimes pass customer identification checks and pose as different individuals. It is thus imperative that KYC providers have a proper procedure in place which can prevent these online frauds.

How does uqudo facilitate your KYC process?

At uqudo, we offer an AI-powered trusted Identity as a Service. Being the region’s finest KYC service providers, we enable the seamless incorporation of essential onboarding functions whilst aiming to eradicate identity fraud by providing the addition of an identity layer. With every country having specific KYC, AML, and CDD requirements, uqudo has an evolving identity management system that can be customized according to the client’s requirements.

Our KYC process involves the following steps:

- Scanning the ID document: Customers use a mobile app that includes the uqudo SDK to scan their ID document (e.g. Passport) using the camera of their phone. The SDK supports both one-sided ID documents such as passports and two-sided ID documents such as a local ID or driving license. During the scanning, our AI-based module auto-detects and extracts the data including the MRZ, QR Codes, and the face image. It also provides an image of the ID document itself.

- Reading the NFC Chip: Over 150 Passports globally and a large majority of National IDs contain NFC chips. These chips contain more data than can be optically seen and our solution is designed to be able to read these chips. The data is digitally signed and includes a face image. The backend of the uqudo SDK can validate the certificates to ensure the data read is genuine. Using digital signatures ensures the government has issued the captured data. Through this process, fake IDs and documents are completely eliminated.3.

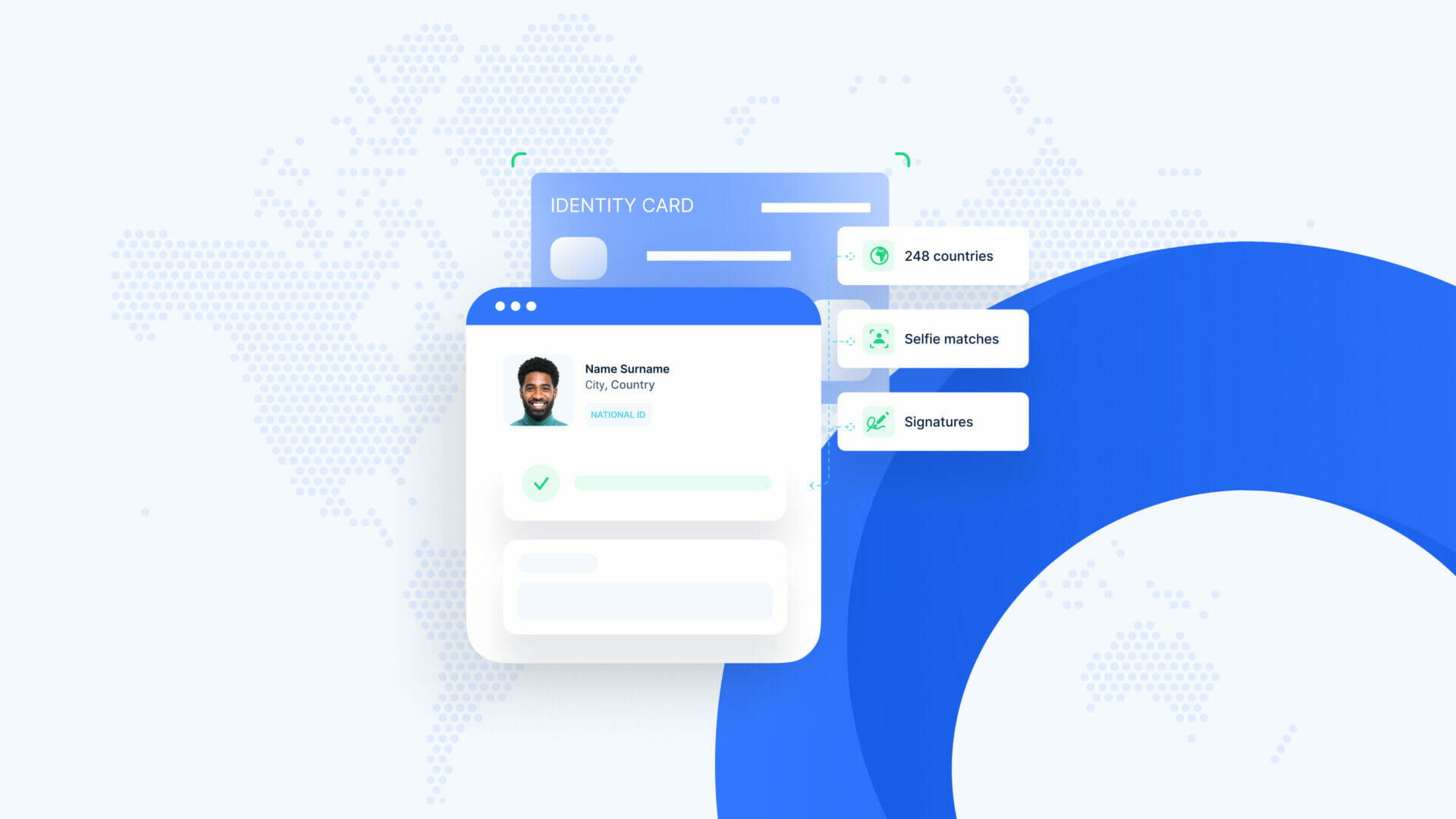

- Document Verification: Identity documents across 248 countries can be verified in real time, with unparalleled accuracy. The selfie taken by the customer is verified to see if it matches the document. Our government database repository enables the verification model to identify if an individual is real.

- Performing biometric recognition: After reading the ID document data, the app performs facial recognition to ensure the owner of the ID document is performing the onboarding. Facial recognition only requires a phone with a selfie camera. The process also includes liveness detection. It ensures the selfie captures a real person, not a photo or video in front of the camera.

- Screening: The uqudo platform allows integration with external databases and services to enable background checks of identities. This includes databases provided by government or commercial organisations including but not limited to:

- Interpol for lost or stolen passports

- International Sanction lists

- National Security Databases

- KYC/AML Databases (Sanction Lists, PEPs, etc.)

With every organization having specific requirements for KYC, uqudo’s platform with its ease of accessibility, and customization can meet the demands of your KYC procedure, making your transaction processes simpler.

How uqudo’s KYC can work for your organization?

The increasing digital fraud activities have made following KYC guidelines an essential component in the financial industry. For greater protection against money laundering and other financial crimes, regulatory bodies have made their anti-AML laws stringent.

With every organization having specific requirements for KYC, uqudo’s platform with its ease of accessibility and customization can meet the demands of your KYC procedure, making your transaction processes simpler. For more details, get in touch with us.