KYC+

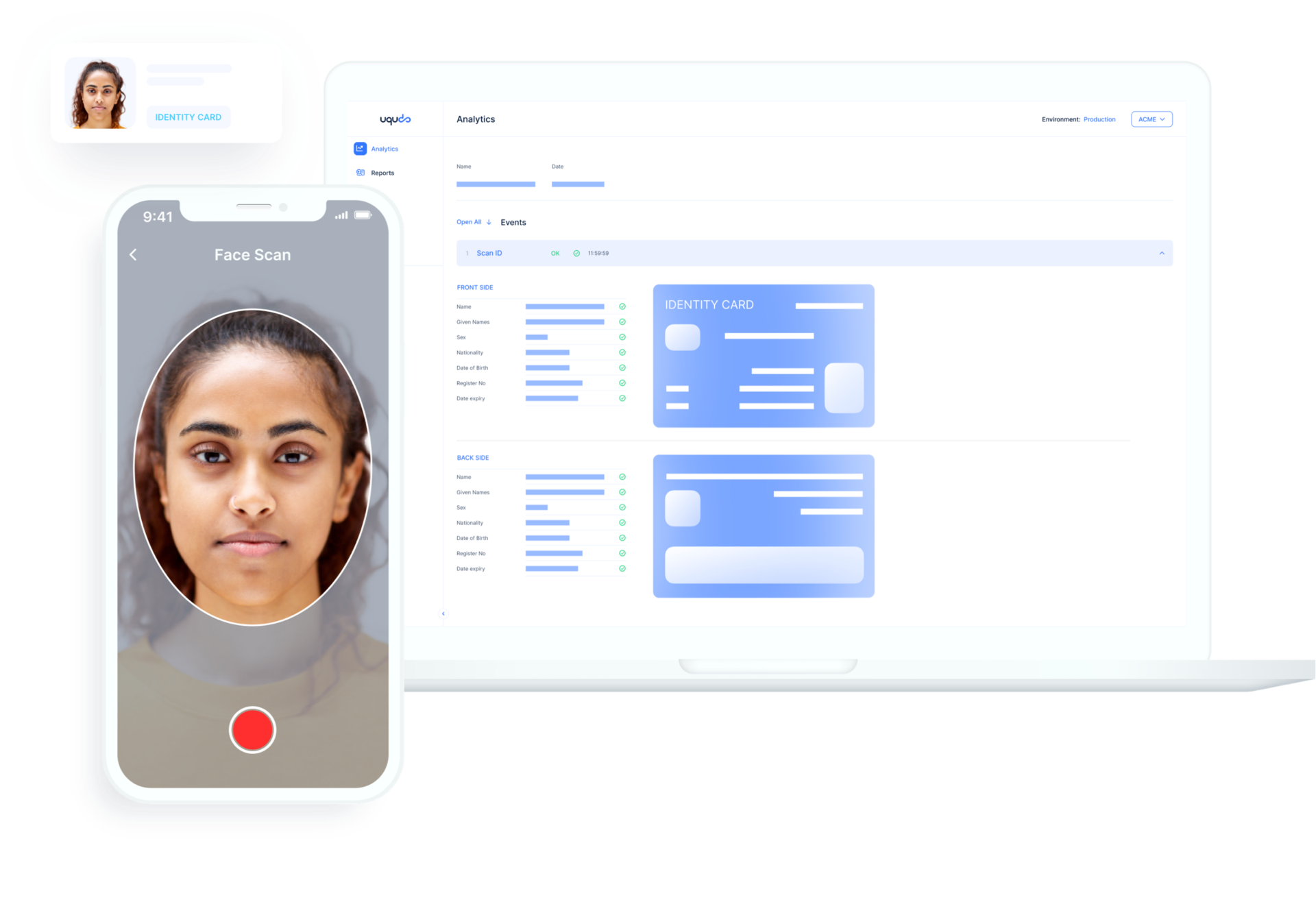

Seamless digital KYC verification for efficient user onboarding

Drive conversions sky-high and enjoy peace of mind with a speedy and compliant onboarding experience that keeps fraudsters out and ensures that only real people are approved.

See it in action:

Why choose us?

Stay compliant

Meet KYC (Know Your Customer) & AML regulation requirements with a robust onboarding and user verification system.

Frictionless & Formless

Integrate uqudo’s Digital KYC services seamlessly into your company’s onboarding experience.

Fast verification

As a leading KYC solution provider, uqudo can verify passports and ID documents in under 10 seconds.

Reduce costs

Save time and money by reducing manual KYC (Know Your Customer) processing and company admin work.

How it works

Step 1

Read the document and extract identity data.

Step 2

Check the person on camera is real and matches the document.

Step 3

Verify the individual via government databases or NFC chip.

Step 4

Go a level deeper with

enhanced due diligence.

KYC+ Features

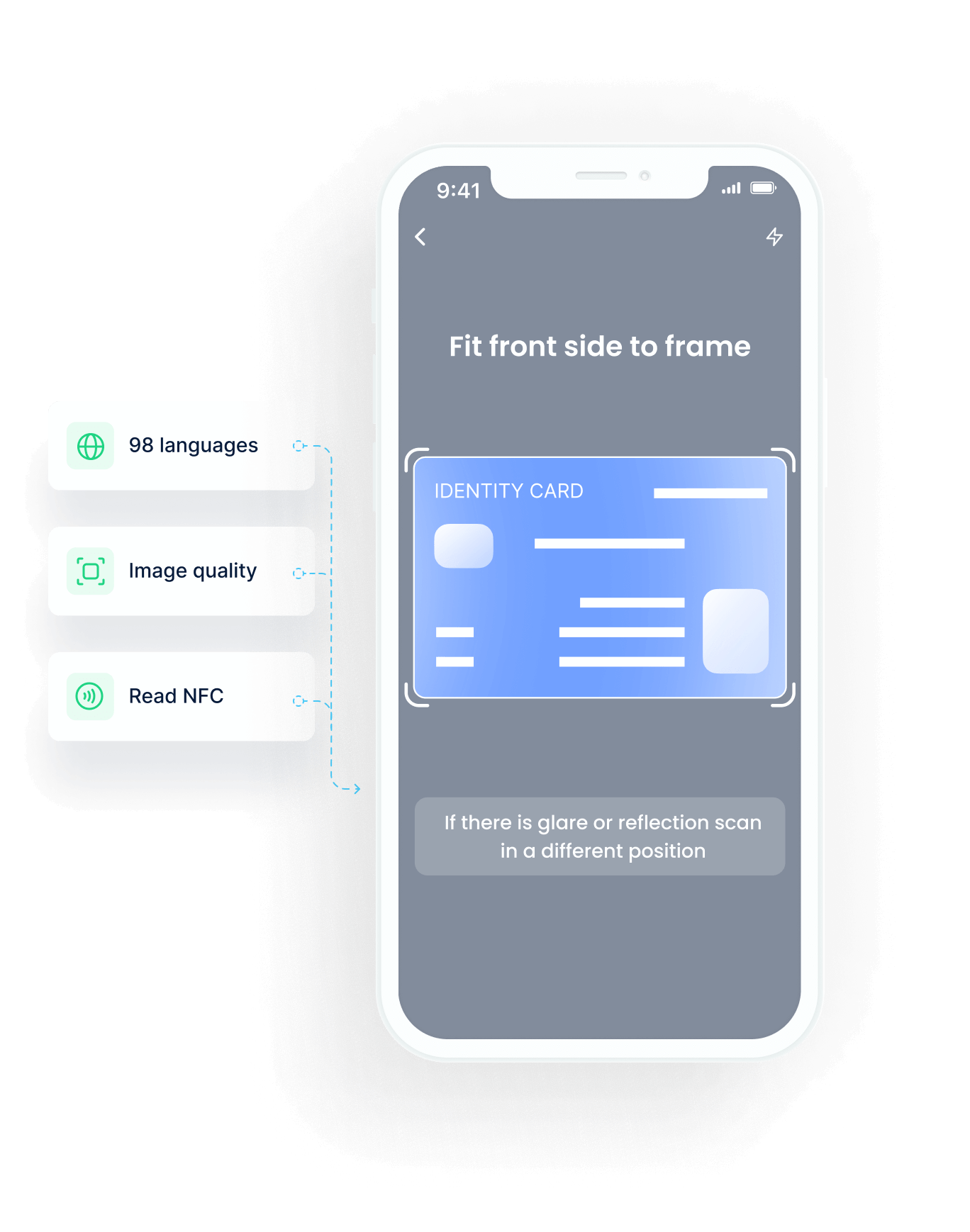

AI document scanning services

Reduce your KYC (Know your customer) workload and speed up onboarding with uqudo’s AI-powered document scanning solution.

- Read and extract identity data from documents across 248 countries and territories and 98 languages within milliseconds with unparalleled accuracy.

- Detect image quality based on glare, blur, photo clarity, and more.

- Better than human tampering detection to identify forged documents.

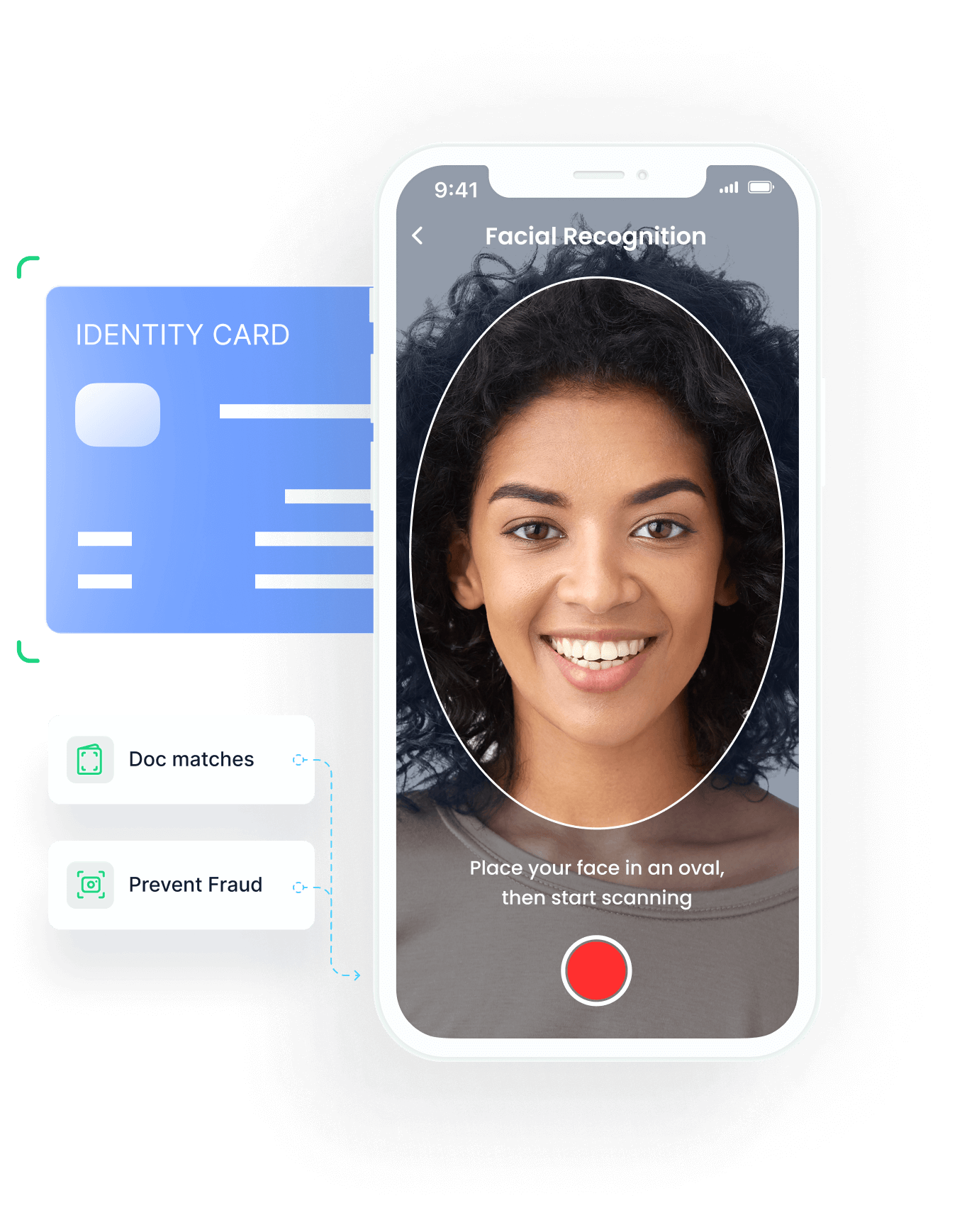

Biometric face recognition solution

Protect against stolen identities and impersonation during the KYC (Know Your Customer) verification process while delivering a superior user experience with our liveness-based biometric facial recognition services.

- Verify that a user’s document matches the person’s face on camera with a selfie.

- Prevent bad actors using photos, videos, or masks from gaining unauthorised access by ensuring a real person is present.

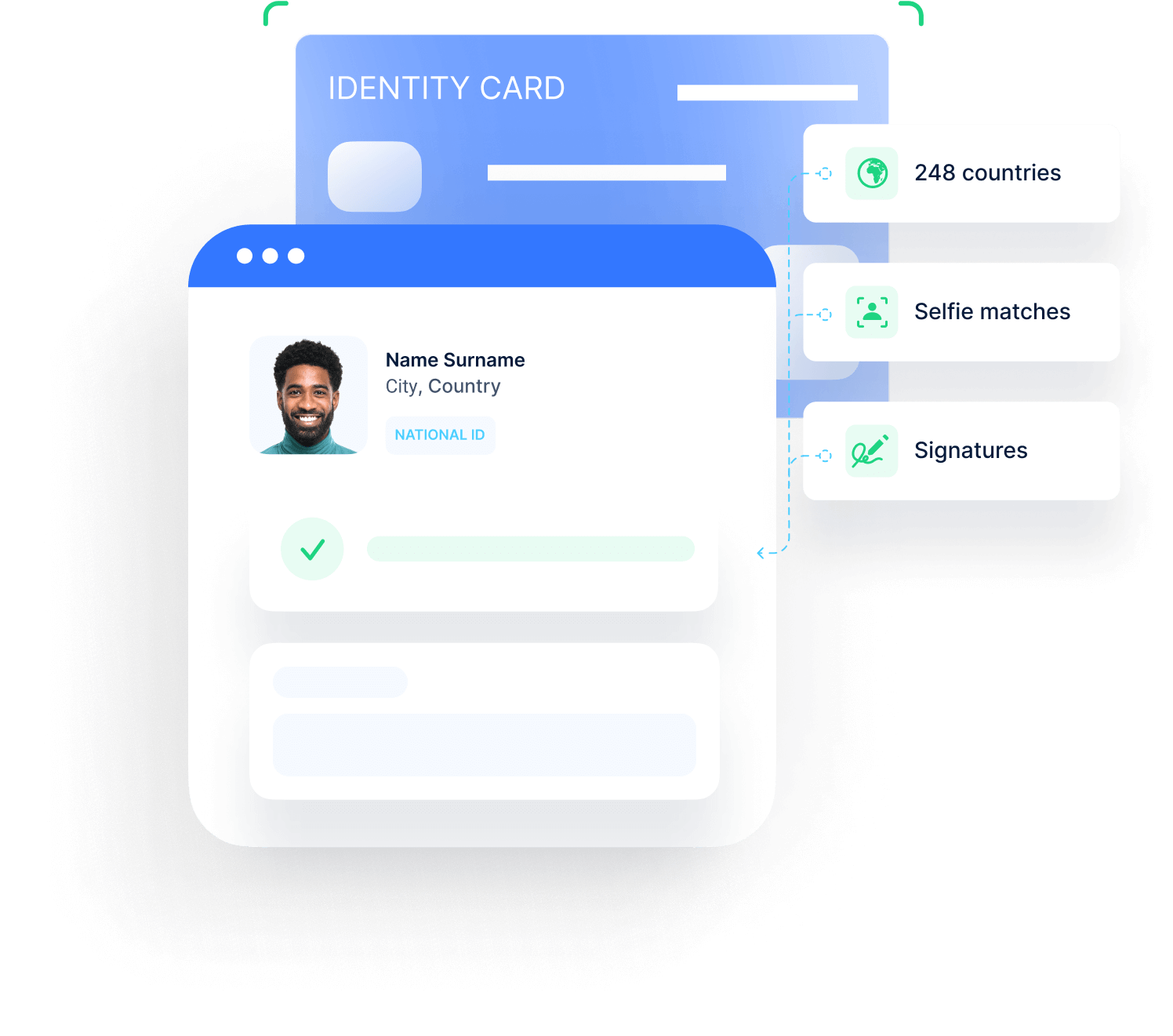

Digital document verification

As the best-in-class digital KYC solution provider, uqudo can analyse and verify document authenticity in real-time and with unparalleled accuracy.

- Verify identity documents across 248 countries within milliseconds.

- Ensure the person in the selfie matches the document and stay compliant with local regulations.

- Eliminate fake or tampered IDs by 100% using digital signatures.

- Access government repositories to identify if an individual is real.

Enhanced Due Diligence

Bank account verification

Quickly match account details like sort code and account number for lightning-fast validation and fraud risk elimination process.

Credit check

Access global credit risk

insights that leverage

real-time bank data.

Duplicate detection

Protect against fraud by ensuring each person has only one unique profile across your entire user base.

Address verification

Validate addresses in seconds with access to global address registers.

Secure, frictionless, & fully compliant digital onboarding. Integrated seamlessly within your app.

Latest KYC updates

4 reasons why is KYC broken and how you can achieve better compliance

Chandrika Mahapatra

KYC Content Specialist uqudo

What is KYC? Overview, Uses, Components and Process

Chandrika Mahapatra

KYC Content Specialist uqudo

Our clients

Easily integrate  with your tech stack.

with your tech stack.

Use our simple and secure Web SDK, Mobile SDK, or RESTful API to seamlessly integrate identity capabilities into your operations.

See documentationAn award-winning team

uqudo is proud to be recognised by some of the world’s most distinguished organisations.

Here’s what people say about us

-

Jude Dike

CEO Get Equity

After our research, we found uqudo to be by far the best AML provider and we are confident that they will help us push our business forward as we grow.

-

Lacina Koné

CEO/Director General Smart Africa

Digital ID, data governance and cross borders e-payments are critical to advance the digital transformation we want for Africa. Therefore, welcoming uqudo to the alliance is clearly aligned with our ambitions. Their expertise and experience will be a great asset to our organisation.

-

Paksy Plackis-Cheng

Chief Strategy Officer Staex

Authentication and authorization are mission-critical components. Staex provides a dynamic lightweight network layer for new digital collaborators such as public-private engagements while uqudo offers proven digital identity technology. The combined solution safeguards our lives and actions in the digital world.

-

Rob Haslam

Strategic Advisor TECH5

From a strategic point of view for TECH5, uqudo is a great partner for the integration of both companies’ offerings to create unparalleled digital KYC and National Identity programs in the Middle East, Africa, and other regions. In addition, we appreciate access to uqudo’s expertise as a full-service provider in the space of digital onboarding and authentication.

-

Ewan MacLeod

Chief Transformation Officer Sohar International

I’ve seen the uqudo platform working first hand and it’s extraordinarily compelling, especially if you are looking for an incredibly seamless onboarding/ID verification process.

-

Mehdi Fichtali

Founder & CEO FinaMaze

What made us choose Uqudo as our digital identity partner is their clear and fast integration process and the constant availability and efficiency of their support team. The client ID verification and video selfie is user-friendly and convenient making our onboarding process quasi-instant.

-

Oliver Obitayo

Board Advisor uqudo

It is an honor and great fun, working with a company like uqudo! I‘m fascinated not just by their great talent and tech & market expertise … but especially by their passion. For their products, their customers and the restless willingness to go beyond. All this resulted already in impressive successes – looking forward to working with the team, to truly ‘own’ the region and grow beyond.

We price based on successful onboarding.

Say goodbye to request-based fees, repeat charges, and spiralling customer acquisition costs.

FAQ

What is KYC?

Know Your Customer (KYC) is an identity verification process that authenticates the real identity of customers during onboarding.

What is Enhanced Due Diligence?

Enhanced Due Diligence (EDD) goes beyond Customer Due Diligence (CDD) and looks to establish a higher level of identity assurance with additional verification steps such as verifying the customer’s address.

How do you perform KYC?

Three key steps are involved in our identity process; first, we read the document and extract identity data; next, we check the person on camera is real and matches the document; finally, we verify document authenticity via government databases or using the digital signatures on the document.

What are the requirements for KYC?

KYC document requirements vary according to a region’s jurisdiction but generally include

- A government-issued ID card

- Passport

- Driving License

- Voter’s ID

- Birth certificates

Why is KYC required?

KYC helps financial institutions verify the identity of customers and prevents companies from being used in illegal financial activities. KYC also helps firms understand their customer’s financial behaviour, aiding in a better user experience.

What is eKYC?

eKYC or Digital KYC refers to a remote, paperless KYC process, that can be completed digitally. The steps involved in eKYC are:

- AI document scanning

- Biometric face recognition

- Digital document verification

How long does KYC verification take?

uqudo’s identity verification can be completed in less than 10 seconds.

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-advertisement | 1 year | Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. These cookies track visitors across websites and collect information to provide customized ads. |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

with your tech stack.

with your tech stack.