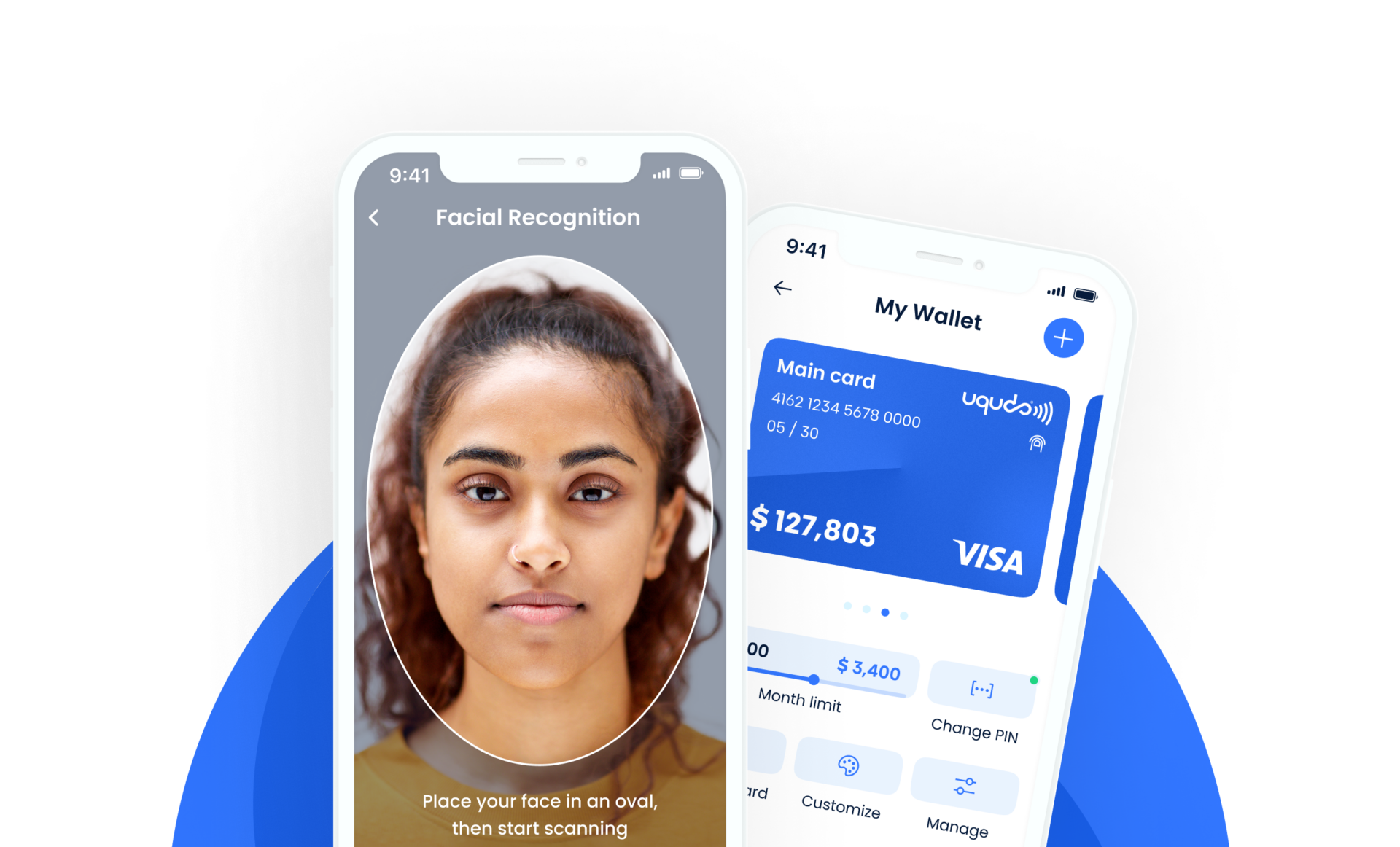

Transaction Authorisation

Authorise payments

using biometric sign-ins

and selfies

Validate transactions with biometrics to prevent unauthorised payments and identity theft.

See it in action:

Why choose us?

Eliminate unauthorised transactions

Validate transactions to ensure that your users are protected.

Improve compliance and security

Read and scan documents containing personal information with data security.

Enhance user experience

Let your customers upload documents in record time, enhancing UX.

Save time and reduce costs

Save time and money by reducing manual processing and admin work.

How it works?

Step 1

The user initiates a transaction via the platform.

Step 2

Once a payment request is made, the server sends an authentication request.

Step 3

User authenticates with the biometric identity provided during sign-up.

Step 4

The server checks if the biometric is a match and then acknowledges the transaction.

More on transaction authorisation?

Widespread payment fraud has made it necessary for financial services to implement a strict mode of authentication. Along with numerous biometric authentication methods for a user to access their payment accounts, financial institutions now require customers to authenticate themselves while initiating transactions. This helps firms establish the identity of those initiating payments and reduce the risk of fraudulent transactions.

A few methods of transaction authentication are:

- OTPs (One-Time Passwords): These refer to codes sent to a user via text, email or phone calls.

- Biometrics: Transactions can be authenticated using the user’s fingerprint, facial or retinal recognition.

- Authentication apps: This includes authenticating transactions with unique security codes that regularly changes.

Transaction monitoring helps companies keep track of transactions, and easily access information in case of fraudulent fund transfers. This in turn protects firms from becoming platforms for money laundering and terrorist financing activities. Even though transaction authentication is not mandated by regulatory bodies, verifying payments protects a firm’s overall reputation while building customer confidence.

Secure, frictionless, & fully compliant digital onboarding. Integrated seamlessly within your app.

Latest Authentication updates

Why is authentication important for your company?

Chandrika Mahapatra

KYC Content Specialist uqudo

How facial recognition is changing digital identity?

Chandrika Mahapatra

KYC Content Specialist uqudo

8 ways OCR enhances digital identity

Chandrika Mahapatra

KYC Content Specialist uqudo

Our clients

Easily integrate  with your tech stack.

with your tech stack.

Use our simple and secure Web SDK, Mobile SDK, or RESTful API to seamlessly integrate identity capabilities into your operations.

See documentationAn award-winning team

uqudo is proud to be recognised by some of the world’s most distinguished organisations.

Here’s what people say about us

-

Abdulmajeed Alsukhan

CEO & Co-Founder Tamara

uqudo, with its user-friendly interface, efficient processes, and responsive team, aligns seamlessly with our dedication to delivering fast, easy, and cost-effective customer authentication experiences. This collaboration fortifies our focus on putting our users first and upholding the highest standards of privacy and security.

-

Xu Chi

VP Ecosystem Cloud Middle East Huawei

Partnering with uqudo will enable Huawei Cloud to offer customers cutting-edge identity verification, contributing to the goal of building a more secure and inclusive digital world.

-

Joseph Dallago

CEO Rain Crypto

We are thrilled to partner with uqudo to leverage their innovative and secure identity technology into our customer’s onboarding process. By prioritising security and user-friendliness, we aim to make the benefits and opportunities provided by cryptocurrencies more accessible to individuals in the region.

-

Maqbool Al Wahaibi

CEO Oman Data Park

Oman Data Park is committed to providing our customers with the latest and most advanced technology solutions. Our partnership with uqudo will help us to further enhance our services and deliver fraud-proof digital identity solutions to our customers in Oman.

-

Jude Dike

CEO Get Equity

After our research, we found uqudo to be by far the best AML provider and we are confident that they will help us push our business forward as we grow.

-

Mehdi Fichtali

Founder & CEO FinaMaze

What made us choose Uqudo as our digital identity partner is their clear and fast integration process and the constant availability and efficiency of their support team. The client ID verification and video selfie is user-friendly and convenient making our onboarding process quasi-instant.

We price based on successful onboarding.

Say goodbye to request-based fees, repeat charges, and spiralling customer acquisition costs.

FAQ

What is Biometric Authentication?

Every individual is unique and through the use of biometrics, we can use aspects of uniqueness to authenticate a person’s identity. Everything from the face, fingerprint, palm, and voice can be used to verify a person is who they say they are. Given most ID documents are photo IDs, the face is the most common and popular way to authenticate with biometrics.

How can biometric authentication help my company?

Biometric authentication provides the opportunity for passwordless logins for your users. Logging in with the face is both faster and more secure. Strong authentication refers to the set of specifications laid out by FIDO. These specifications mean authentication is intrinsically stringent enough to ensure the security of the system it protects.

Is facial recognition safe?

Biometric face authentication uses unique facial patterns to identify people, making it highly efficient. Since our platform doesn’t store data, all biometric information is encrypted and secure.

What all biometric authentication methods can be used?

uqudo lets your customers use the following biometrics for authentication:

- Face

- Fingerprint

- Voice

- Iris

- Palm

How does 2FA work?

Our two-factor authentication (2FA) uses facial biometrics as the second factor to provide a non-invasive second layer of authentication, to keep your customer data secure.

Which documents do you support?

uqudo’s AI Document Scanning can read and extract identity data from 98% of commonly used identity documents in EMEA. Check out our Coverage & Capabilities for a full breakdown of supported documents filtered by geography.

Which documents can you verify?

We are able to read all passports with an NFC chip and verify passports in 86 countries. In addition to this, we are able to verify identity cards in a total of 11 countries currently. For a full list of the documents that we are able to verify visit our Coverage & Capabilities page.

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-advertisement | 1 year | Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. These cookies track visitors across websites and collect information to provide customized ads. |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Please wait while you are redirected to the right page...

with your tech stack.

with your tech stack.