What is OCR?

Remember that image you had taken of a contract for future reference, and wanted to store it in a text format? OCR (Optical Character Recognition) is the technology that converts text images into a machine-readable format. An OCR software extracts data from images, scanned documents and pdfs and repurposes them into machine-readable text.

Often referred to as text recognition, OCR uses a combination of hardware like an optical scanner with advanced processing software like Artificial Intelligence (AI) which reads the images and converts them to text. Even different handwriting styles can be converted into written text using Intelligent Character Recognition (ICR).

The earlier versions of OCR could process only printed documents, but with advancements in technology, OCR today can recognise both printed and handwritten text, that too in various languages.

Before the advent of the OCR technology, printed texts had to be manually retyped for digital formatting and this was not only time-consuming but was prone to inaccuracies and typing errors. In the early 2000s, OCR was available in a cloud computing environment, but nowadays OCR can be done using a smartphone’s camera.

OCR in today’s world is used widely for data entry from printed data records including bank statements, passport documents, legal filings, receipts, invoices etc since digitised text can be stored more efficiently. This data can then be easily analysed to streamline operations and enhance productivity.

The OCR market size is expected to reach $27 million by 2030, with a CAGR of 10.3% from 2022 to 2030, the industry is expected to have greater application in different industries combined with AI and deep learning.

How does OCR work?

OCR is used to obtain data from image documents, and the general process varies according to the OCR software developer, but it does have a few general steps. First, the document is scanned using a physical scanner (generally a smartphone nowadays). An important point here is that the document has to be aligned properly so that the scan is efficient.

The next step is a preprocessing stage in which the software cleans up the text elements of the document so that any imperfections are removed, letting only plain text remain. After this, the characters of the text have to be identified. This is done by isolating each individual character by breaking them down to their constituent elements of curves and corners.

Once the characters have been identified, each isolated character has to be recognised by the OCR software. Since this is the trickiest step, this is the one which differentiates various OCR programs. Some softwares compare the pixels of an individual character to the ones stored in their database, identifying the closest match. But since this won’t work for handwritten characters, these involve a more complicated OCR program.

Advanced OCR technologies recognise characters from their individual patterns, and some even use contextual clues to identify the characters. After the character recognition, some OCR softwares use internal dictionaries to verify and reduce errors. Then, a fully digitalised text is formed which then can be used for any purpose.

How is OCR helping businesses today?

The OCR technology is widely used in different industries where a need to convert paper documents into a digital format, which not only is free from human error but also is easy to store and secure.

1. OCR in banking

The banking industry is one of the largest sectors that use OCR technology in its operations. From analysing bank statements to evaluating customer transactional behaviour, OCR plays a large role in reducing typing errors in the banking system. Banks generally use OCR to scan cheques and store their data in their records. While this has been a common practice for typed cheques, an advanced OCR technology also helps banks record handwritten cheques in a digital format. This in turn helps in reducing turnaround time for banks and financial institutions.

2. OCR in insurance

The insurance industry has to record and process a large number of documents on a day-to-day basis. Before the advent of OCR in the insurance industry, insurance providers had to rely heavily on manual documentation of insurance documents, which made the entire process more time-consuming and prone to errors. Since automated data can be processed much faster and with greater accuracy, OCR has made data analysis and customer service more efficient for insurance providers.

3. OCR in the government sector

Another important sector that has wide uses of the OCR technology is the government. OCR in this case is used to scan and record identity cards, license forms, tax reports and various other government-related documents. Since OCR reduces the occurrence of human error, this helps the public sector keep track of various documentation. An important benefit here would be that using a digitised method helps in keeping all sensitive documents secure from criminals, and this can be added to the OCR technology.

Other than these sectors, industries which deal with a large number of documents on a regular basis like real estate, legal, payroll and healthcare industries benefit largely from using OCR as their method of scanning and storing documents.

Working alongside Artificial Intelligence (AI), OCR is a method that is playing a very important role in digitalising data culture. Since AI helps the OCR technology to identify errors, a combination of these two enables the recognition software to identify and comprehend information more efficiently.

How is OCR benefiting the identity industry?

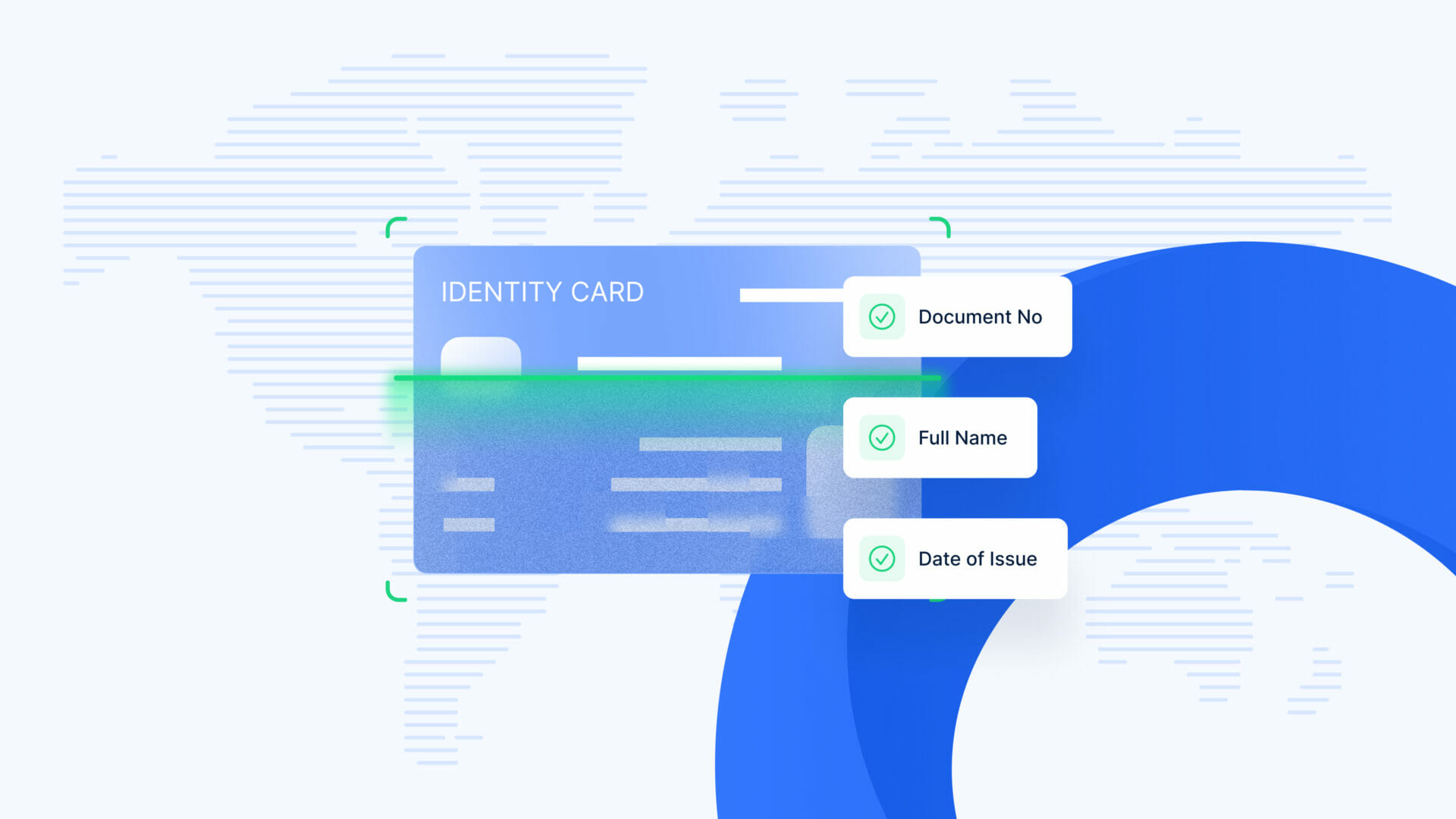

Verification of identity documents plays an important role in every industry, and having a digital method of reading and storing data has made a huge impact on the world of identity. From data extraction to the actual process of identity verification, OCR plays a vital role in making all these tasks much easier and faster.

For example, the first step in any digital KYC (Know your Customer) process is the scanning of the individual’s identity card. OCR is in fact the technology that is used here. The OCR software scans the document and then stores it in a digital format in the system, and this document can be used for further validation against the verification source.

Since the identity industry has to deal with a large number of verification documents regularly, OCR makes obtaining and storing information much more efficient, thus enhancing customer experience. When an AI-based OCR technology is used, it helps identify characters from identity documents even in poor lighting conditions.

An important benefit of using OCR in the identity industry is that with the growth of OCR technology, the software can easily identify numerous alphabets like Latin, Chinese, Cyrillic, Arabic and many others. This in turn saves time and reduces manual costs. More on the benefits of OCR in the next section.

What are the advantages of using OCR?

Using a digital method of reading data has numerous advantages from greater efficiency to a reduction in costs. An important advantage of using OCR is the greater customer satisfaction due to the lesser amount of tasks they have to perform while submitting information, and also how quickly OCR reads and processes data. A few advantages are given below in detail.

1. Greater accuracy

The biggest advantage of using a digitalised method of data entry is the higher accuracy of documented information. When typed manually, information has a greater occurrence of errors and inaccuracies, which makes it necessary to retype everything. But while using OCR, these human errors are reduced, and this helps in the faster processing of information.

2. Automates workflow

The digital identity industry requires regular verification of documents. With OCR, users can simply scan documents and request verification, and this reduces the need for human intervention. This automation helps in making the entire verification process possible in seconds.

3. Reduction in costs

Manually reading and then typing data in a digital format requires a large amount of manpower, and this does not include information that has been fed inaccurately. Using OCR technology helps in reducing the overall costs of using an actual person to digitise data, along with the printing and storing of documents. Since errors are also lesser while using an optical recognition system, it also reduces the cost of extracting data multiple times.

4. Optimizes time requirements

An important benefit of digitalised data is the amount of time it saves that else would have been used for manual data collection, verification and then final processing. Using an optical recognition system, companies can process their documents much quicker.

5. Security of data

Wouldn’t a piece of information stored online (protected by passwords or something similar) be more secure than a piece of paper stored in a place where anyone could get their hands on them? High data security is another important factor that drives banks and other financial institutions to use OCR for document scanning.

6. Greater storage space

Similar to the fact that digitised information has greater data security, it also reduces the storage space that would have else been used to store large amounts of paper documents. OCR thus helps in reducing the cost of maintaining paper documents.

7. Ease of data accessibility

An important feature of all digital data, OCR makes it possible for banks and other industries to search for the required data quickly. Imagine you are looking for a file of a customer that had done their verification a few years back in your company’s document storage room. Wouldn’t simply typing the said person’s information on your computer saved you a lot of energy and effort than searching through the entire storage room?

This is why data stored on an online platform is more accessible and time-saving.

8. Editability of documents

When a document is scanned, sometimes organizations need to add some more information on the same. Optical Character Recognition technology makes this easy because of the ability to store scanned documents in any text format.

How does OCR stand in the near future?

With the increase in usage of technology in our day-to-day lives, a fully digital world (paperless) is just around the corner. A quick method of digitalising documents that can also be editable is necessary in the new digital workplace environment. When used alongside AI and machine learning, OCR not only can recognise characters but can also be used for accumulating knowledge and identifying all possible characters.

The OCR which was first introduced in the 1980s was simply something that could recognise characters. New generation OCR techniques can identify characters and also analyse if the text makes sense.

Though reading and identifying characters is the most important aspect of the OCR technology, researchers today are working on making the technology more ‘intelligent’, where it can not only identify characters but also perform data analysis and understand what those texts actually mean.

The future OCR technology is also predicted to be more efficient, with greater ability to identify different fonts and handwriting and also assess the information on an image. Transferring data between incompatible technologies is another future scope of the OCR technology.

Combining machine learning and AI with OCR can help processing large amounts of data thus helping in automating business processes in the future. This would also help software identify images on its own, and even provide descriptive texts automatically.

How is uqudo uplifting your identity verification process through our OCR technology?

uqudo’s well-powered OCR software plays an important role in our digital identity verification service. The software first scans your document and captures the text from non-editable document formats like pdf, images and even paper documents. As leading OCR verification service providers, uqudo remove all requirements of a manual data entry, making your digital verification procedure more efficient and faster.

Our optical character recognition service module supports real-time optical capturing and verification. It includes optical character recognition (OCR) to read the attributes of a document including the Machine Readable Zone (MRZ)

Our KYC and Screening procedures require extensive documents which need to be verified but using OCR this is done in seconds, where customers have to manually enter minimal data.

With access to documents from over 248+ countries, our system can easily read and extract data from more than 98 languages in seconds, with unparalleled accuracy.

For more information or to schedule a call with us, get in touch with our identity expert team.