AML Monitoring & Ongoing Compliance

Continuous Protection Beyond Initial Screening

Uqudo’s real-time AML Monitoring solution delivers ongoing vigilance against emerging compliance risks, ensuring that your organization maintains regulatory alignment long after initial customer verification.

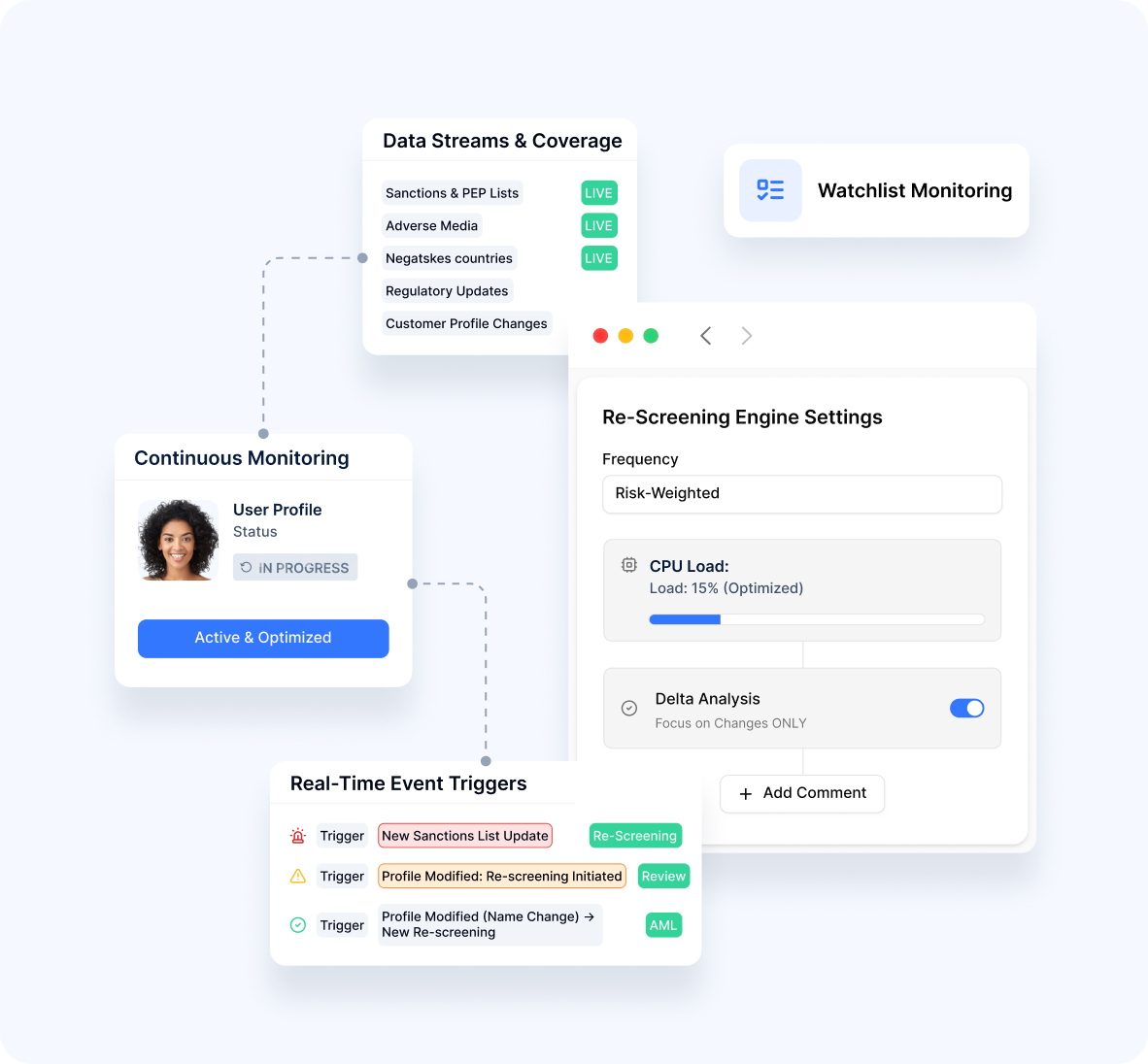

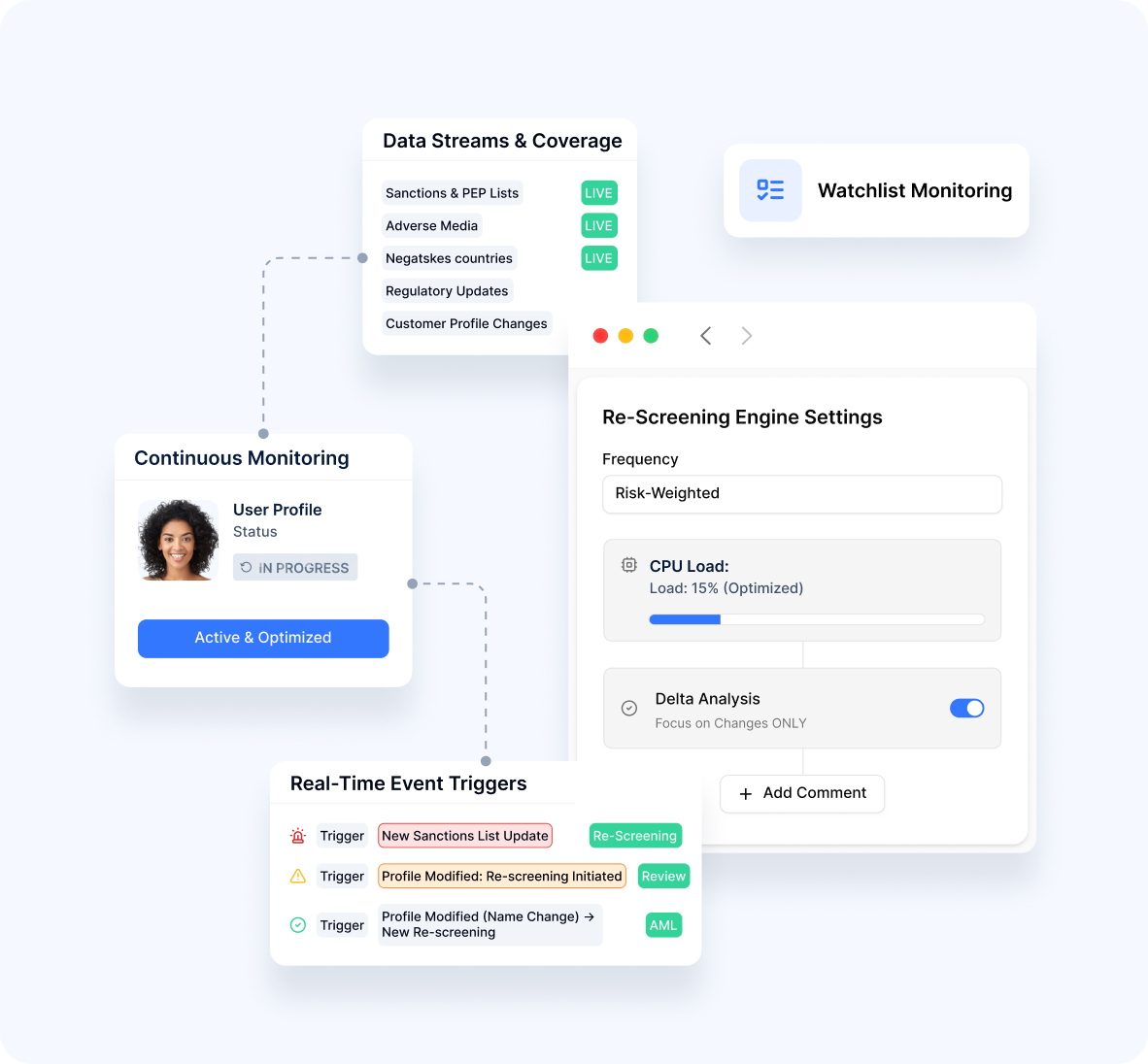

Continuous Screening Approach

Intelligent Monitoring Technology

Our platform provides comprehensive oversight with smart automation

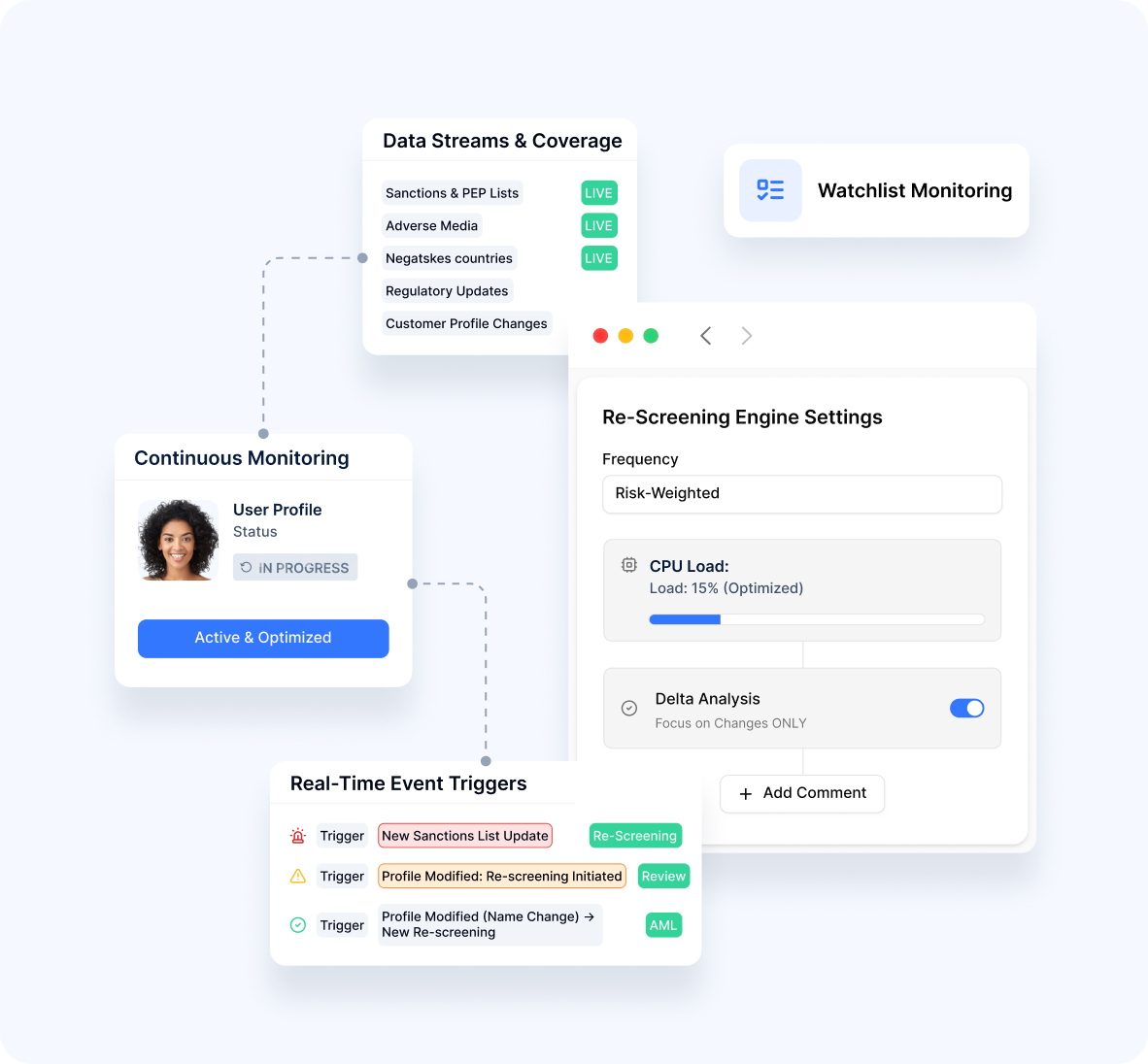

Multi-Faceted Monitoring

- Watchlist Monitoring Continuous checking against changing sanctions lists

- PEP Status Tracking Identification of newly designated politically exposed persons

- Adverse Media Surveillance Ongoing scanning for negative news appearances

- Regulatory Update Alignment Adaptation to changing compliance requirements

- Customer Profile Monitoring Detection of significant changes in customer data

Intelligent Re-screening Engine

- Smart Scheduling Risk-based determination of screening frequency

- Delta Analysis Focus on changes since the previous screening

- Resource Optimization Efficient processing designed for large portfolios

- Confidence Maintenance Ensuring consistent match quality over time

- History-Aware Processing Consideration of previous screening results

Event-Triggered Screening

- List Update Triggers Immediate re-screening when watchlists change

- Profile Change Verification New screening when customer data is modified

- Transaction-Based Review Risk-aligned verification for significant activities

- Periodic Assessment Scheduled re-verification based on risk profiles

- Manual Initiation On-demand screening for specific compliance needs

Monitoring Implementation Models

Flexible Deployment Scenarios

Our platform supports various approaches to ongoing verification

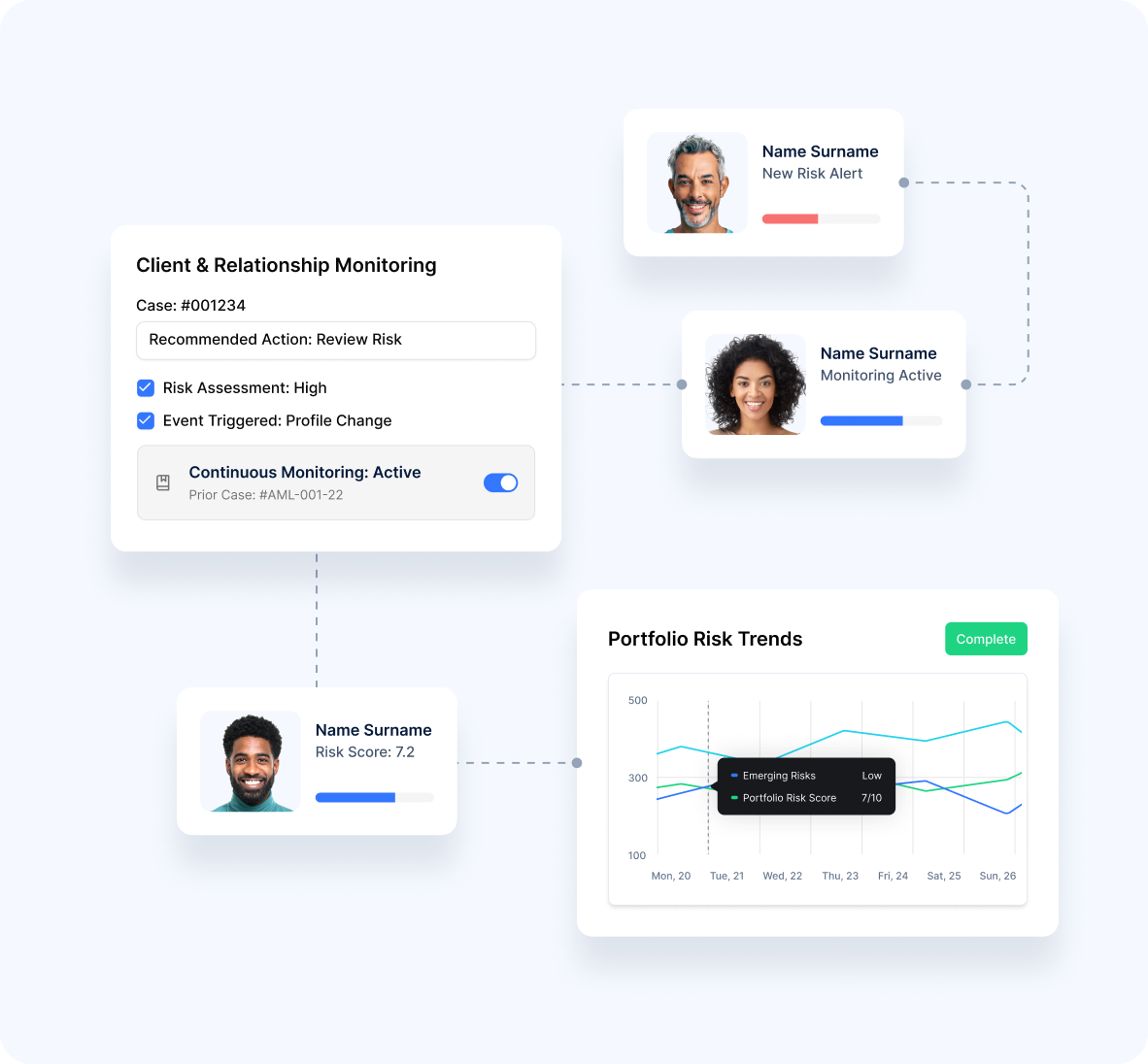

Scenario 1: Customer & Beneficiary Management

- Continuous monitoring of existing customer bases

- Verification of payment beneficiaries

- Streamlined onboarding for trusted relationship networks

- Scalable processing for large customer portfolios

- Immediate notification of emerging risks

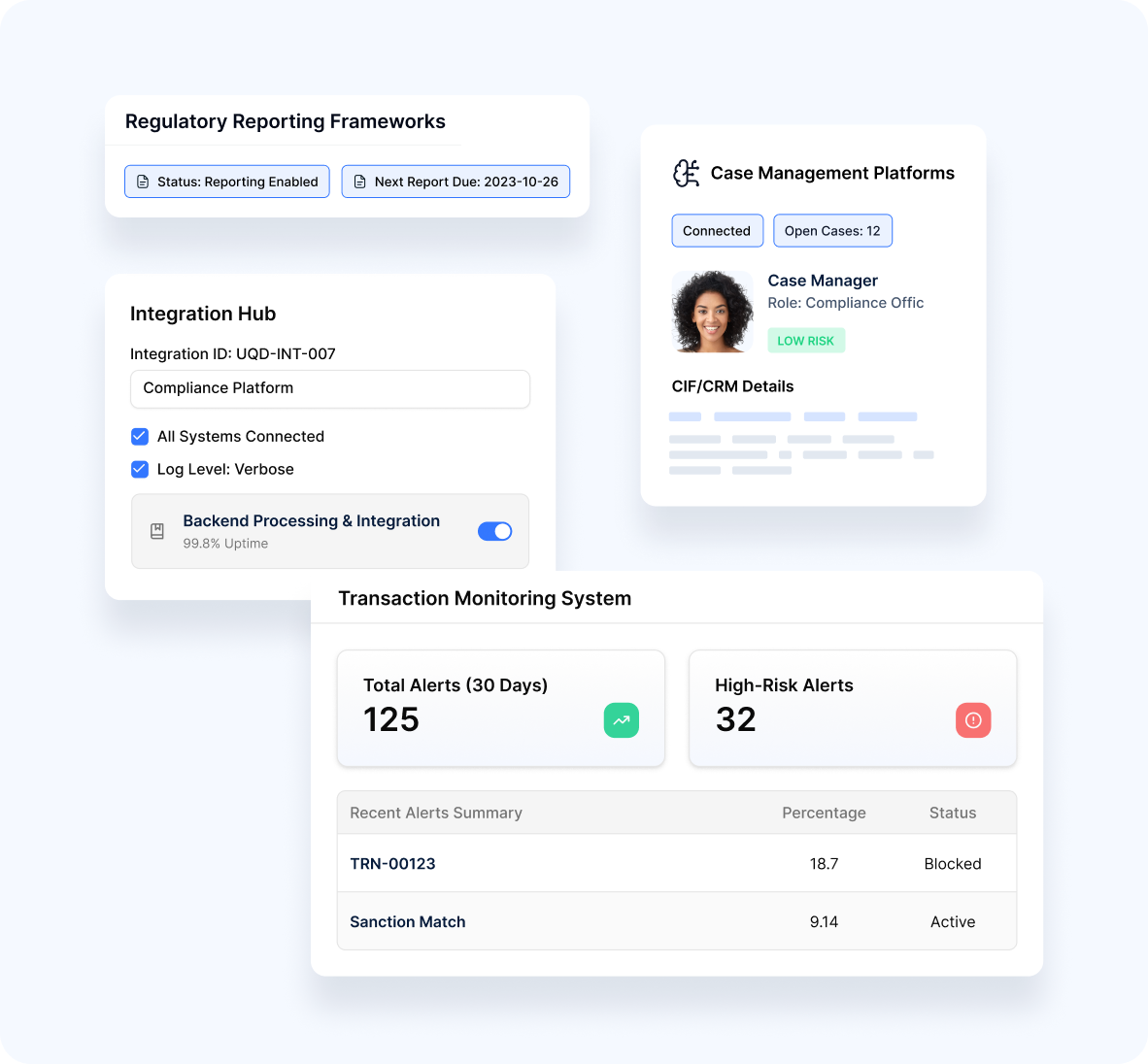

Scenario 2: Backend Processing & Integration

- Seamless connection with transaction monitoring systems

- Integration with customer information files

- Interoperability with case management platforms

- Connection to regulatory reporting frameworks

- Support for multi-system compliance architectures

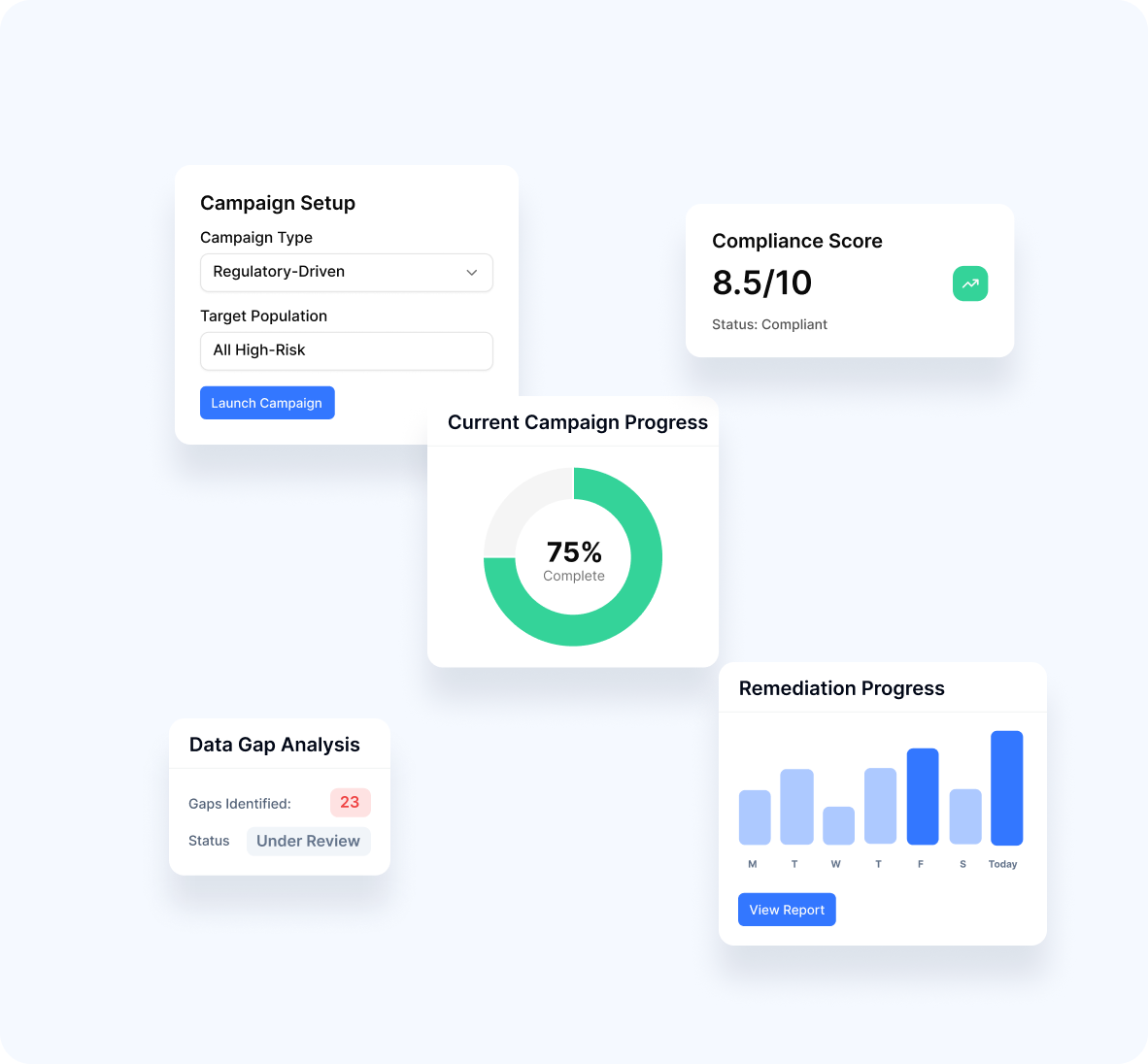

Scenario 3: Re-screening & Remediation Campaigns

- Point-in-time verification of the entire customer base

- Risk-based customer remediation initiatives

- Regulatory-driven re-verification programs

- Merger and acquisition customer integration

- Historical compliance gap remediation

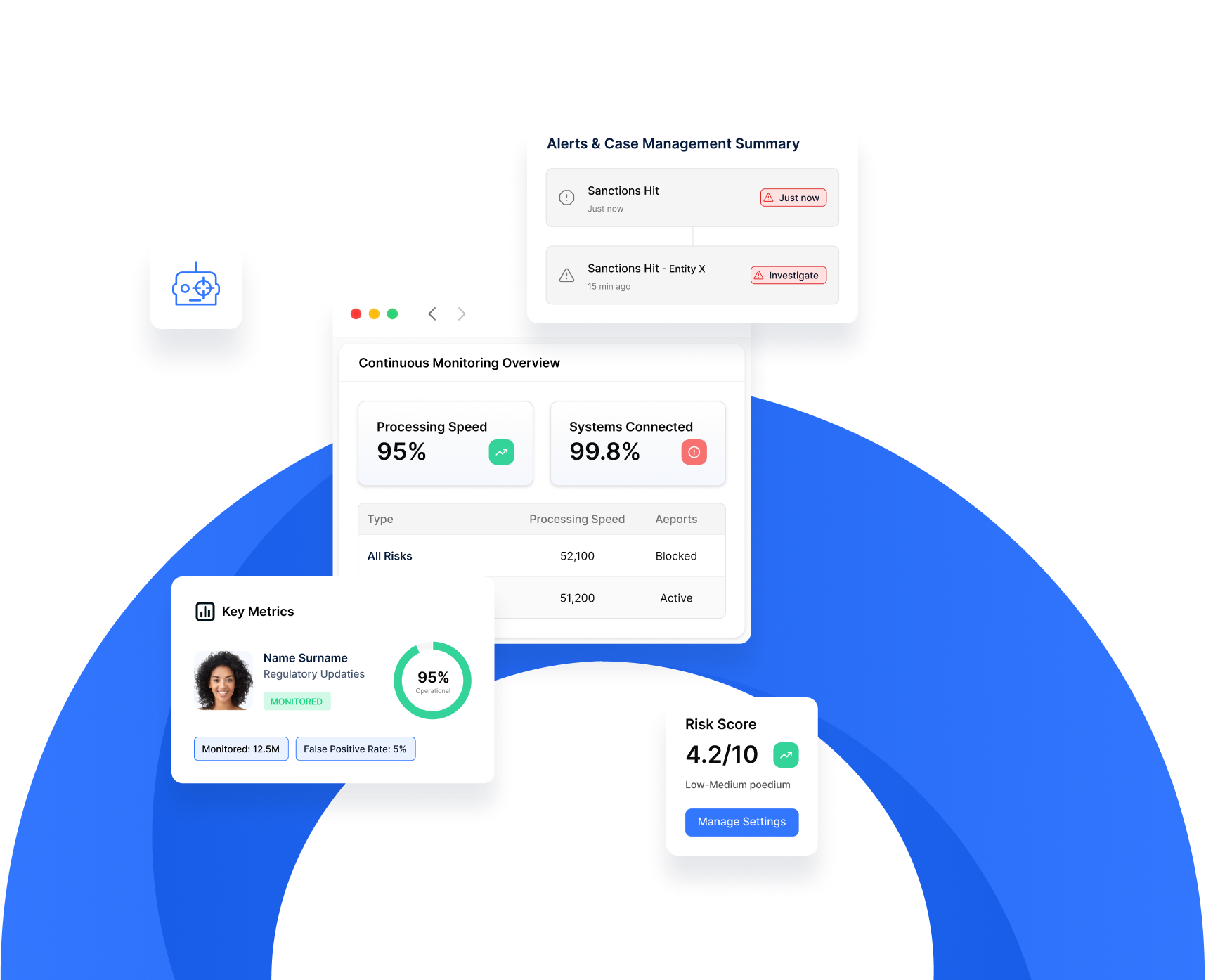

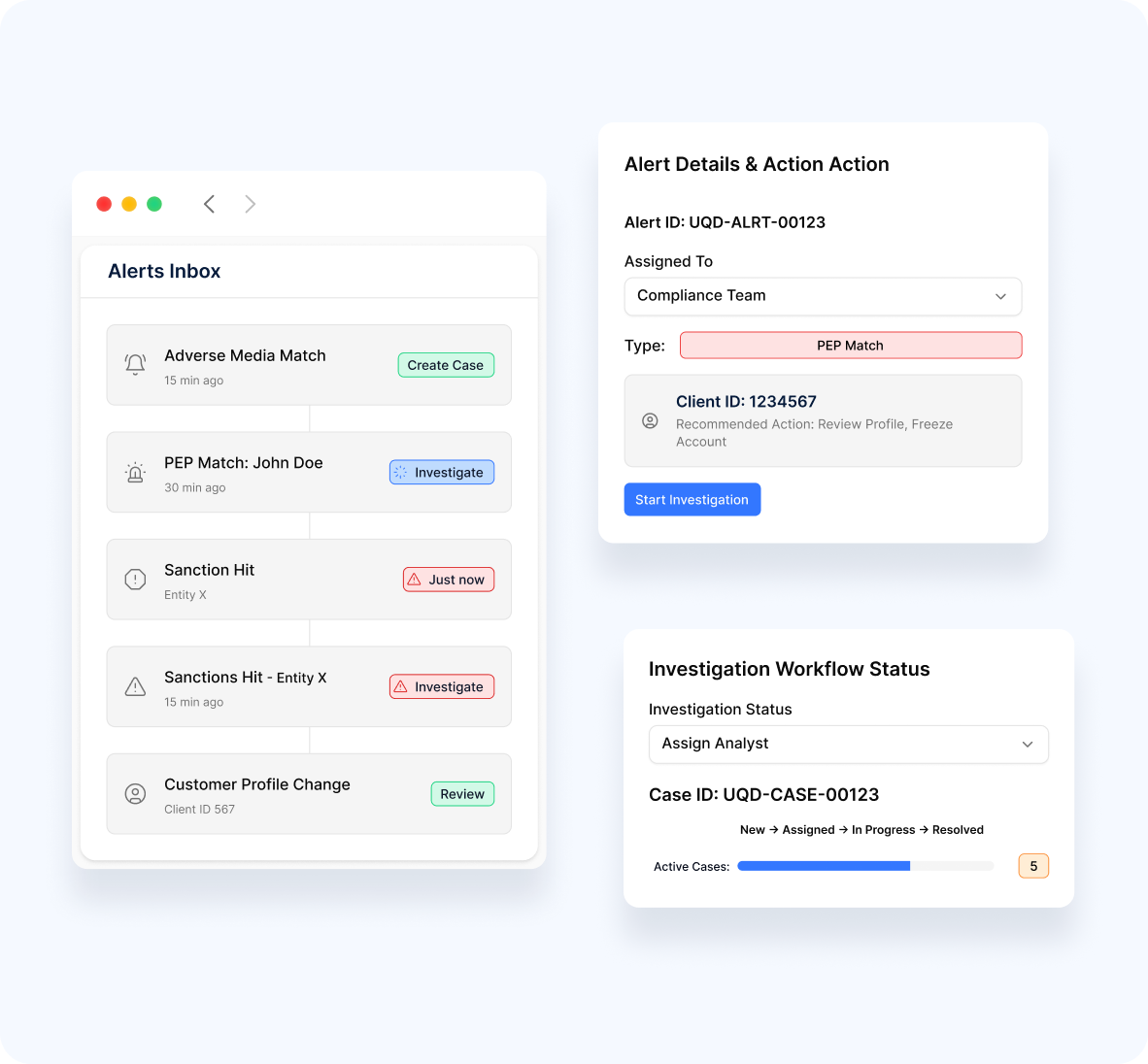

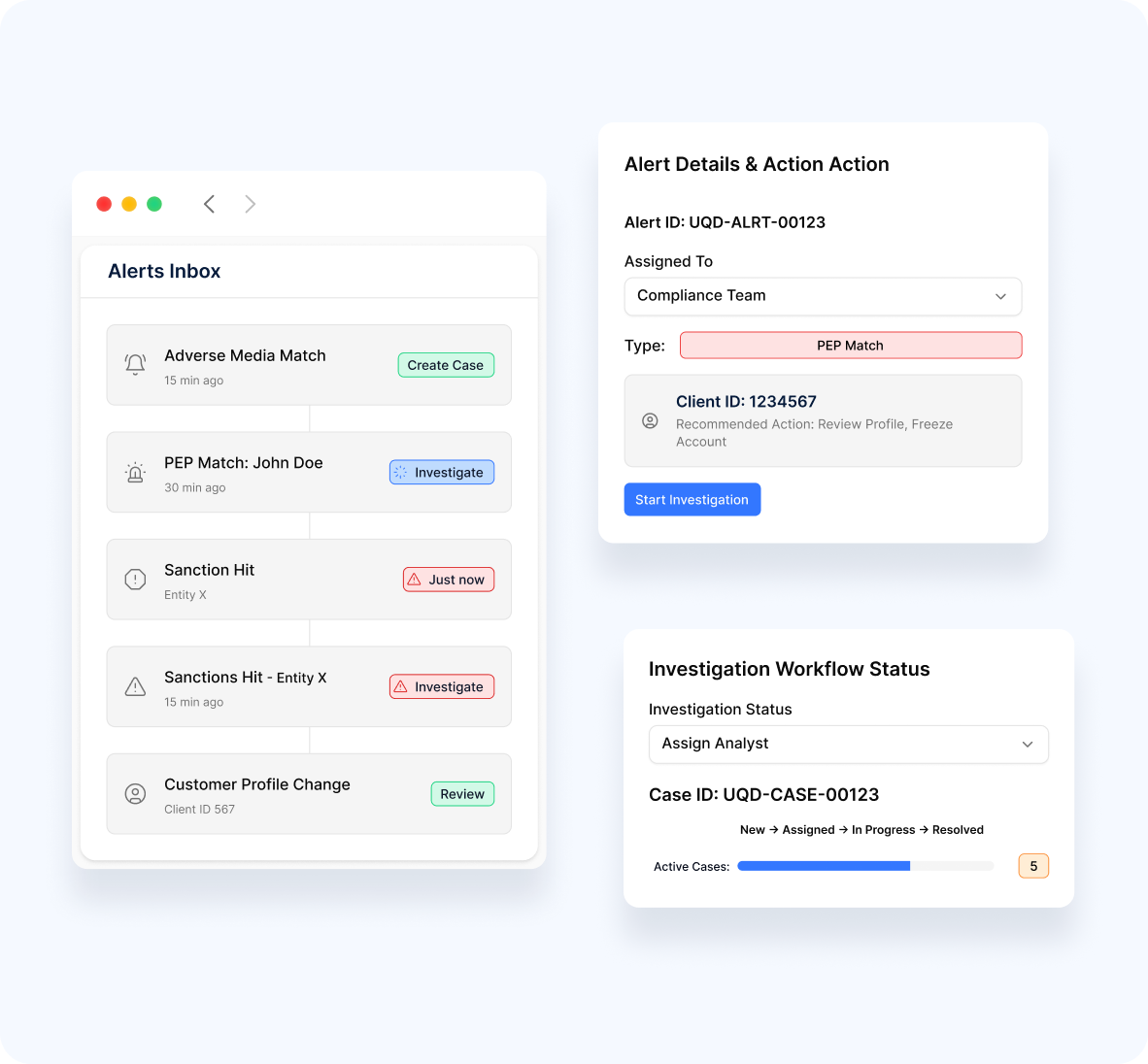

Alert & Compliance Management

Real-Time Response and Documentation

Comprehensive tools for immediate action and regulatory defense

Real-Time Alert Management

- Real-Time AlertingInstant notification of new compliance concerns

- Multi-Channel DeliveryAlerts via portal, email, API, and system integration

- Alert PrioritizationRisk-based classification of notification urgency

- Contextual InformationComprehensive details supporting quick assessment

- Action GuidanceRecommended next steps based on alert type

Streamlined Investigation Workflow

- Case CreationAutomatic generation of investigation records

- Assignment RoutingIntelligent distribution to appropriate team members

- Investigation ToolsComprehensive resources for efficient review

- Resolution TrackingMonitoring of case progress and outcomes

- Audit DocumentationComplete record of all monitoring activities

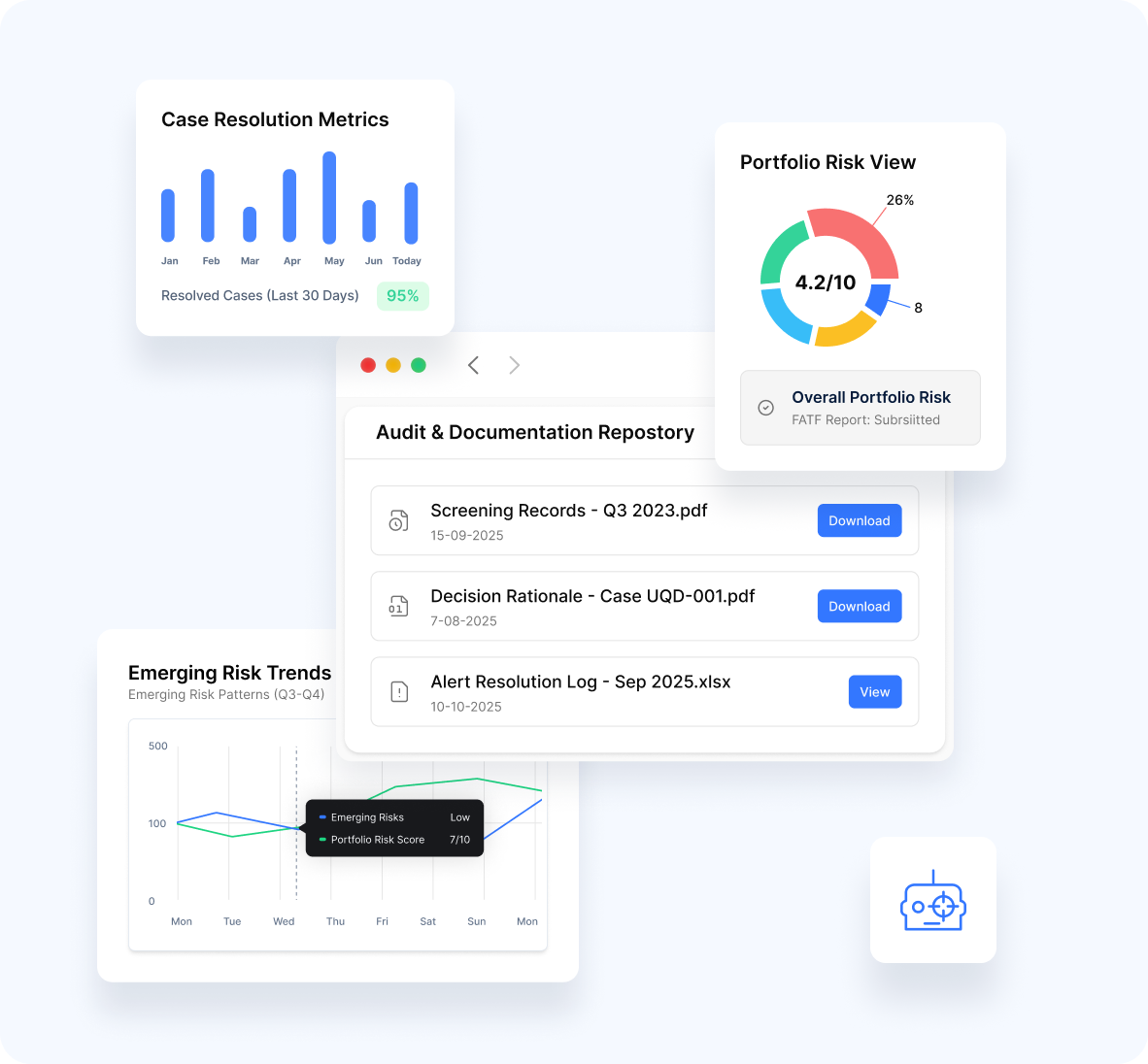

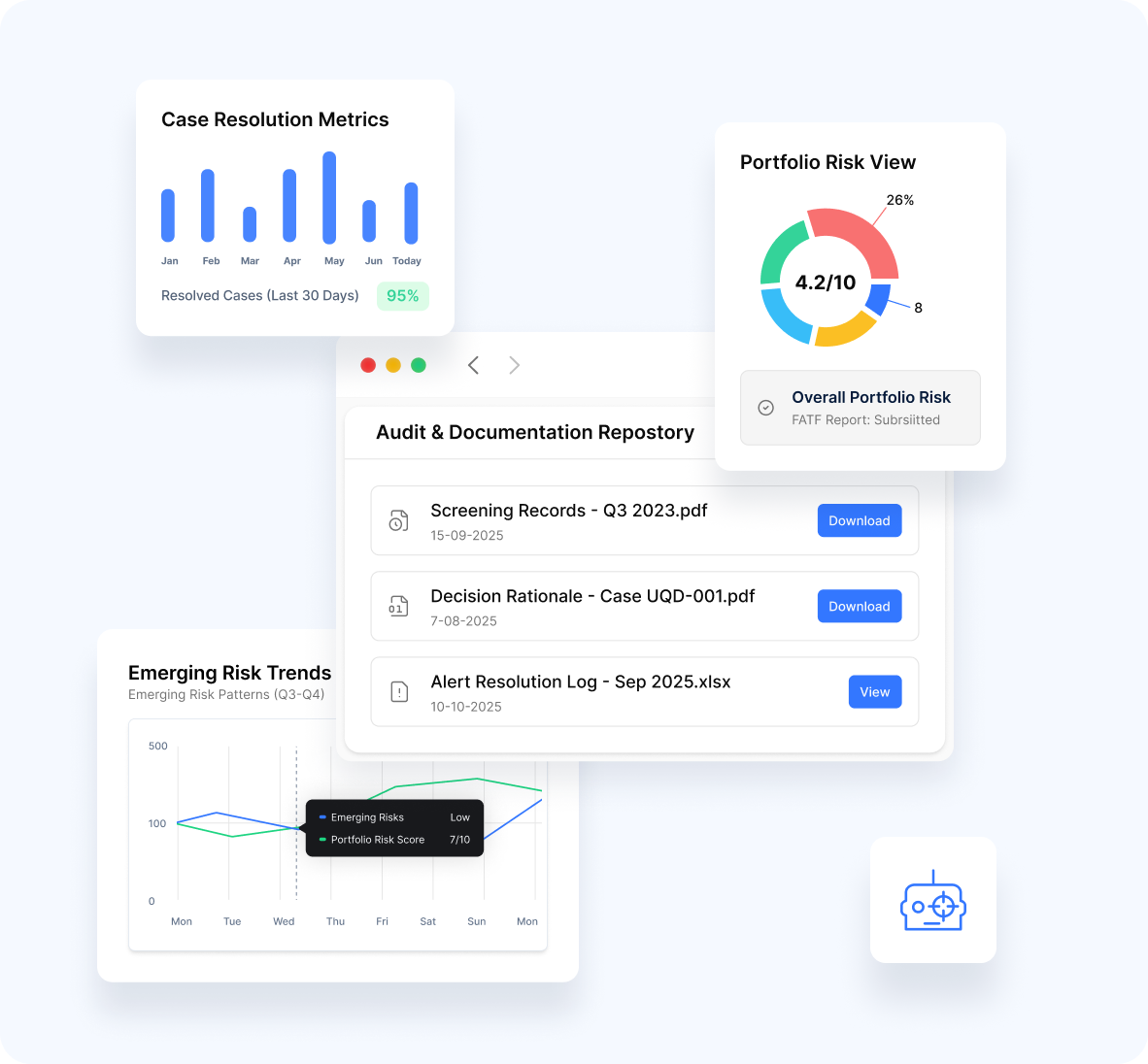

Compliance Dashboard & Documentation

- Portfolio Risk ViewOverall assessment of monitored entity risk

- Alert Status TrackingReal-time view of outstanding compliance concerns

- Resolution MetricsPerformance indicators for alert handling

- Regulatory Reporting StatusTracking of required compliance filings

- Trend AnalysisIdentification of emerging risk patterns

Regulatory Documentation

- Screening HistoryComplete record of all monitoring activities

- Alert Resolution DocumentationDetailed records of case handling

- Decision RationaleEvidence supporting compliance determinations

- Systematic RecordsDocumentation of monitoring methodology

- Audit SupportReadily available evidence for regulatory examination

Technology Advantages

Performance and Intelligence at Scale

Advanced capabilities that grow with your business

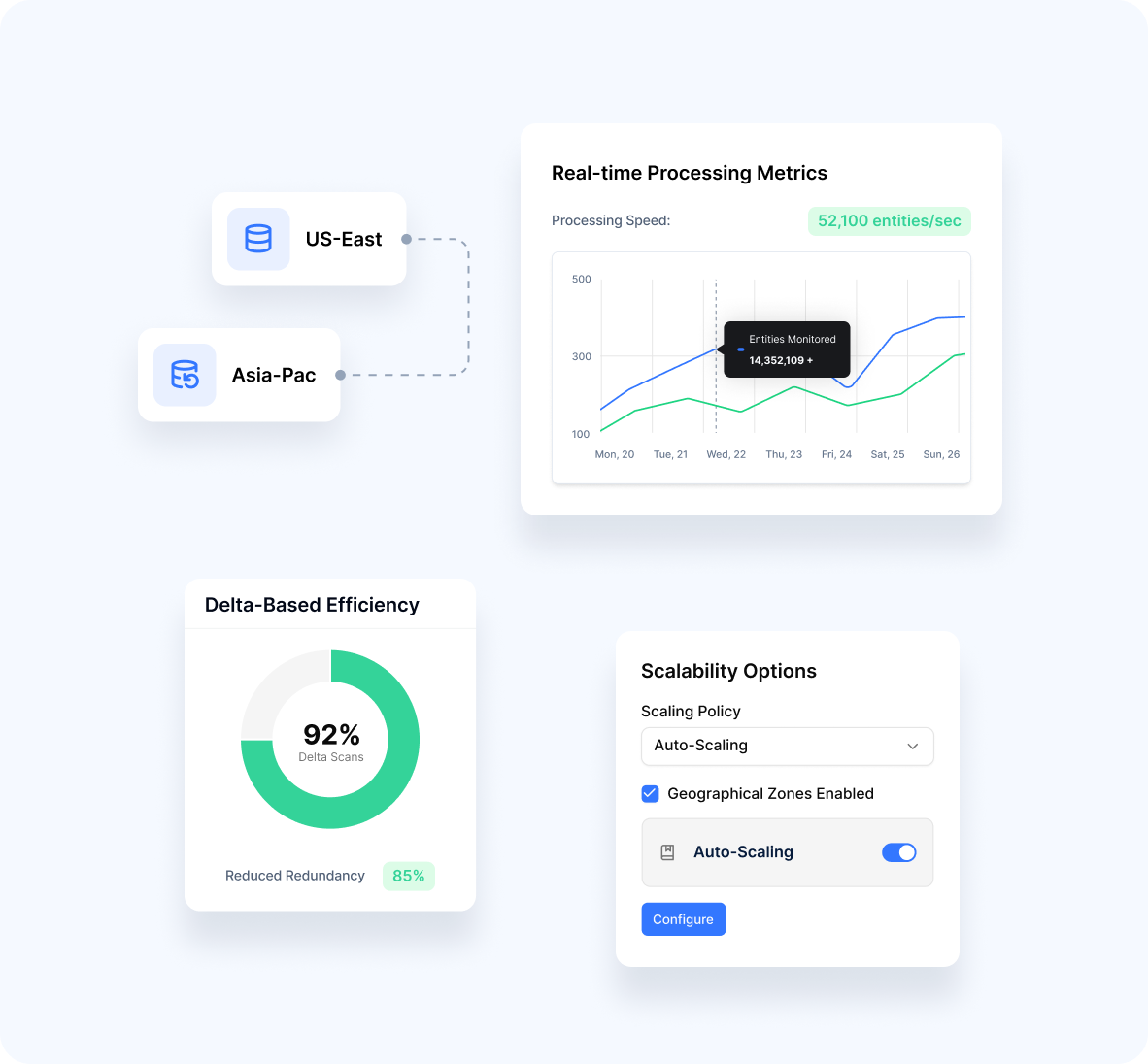

Performance at Scale

- High-Volume Processing Capability to monitor millions of entities

- Optimized Infrastructure Architecture designed for continuous operation

- Delta-Based Efficiency Focus on changes rather than redundant processing

- Load Distribution Intelligent management of processing capacity

- Scalable Expansion Ability to grow with your customer base

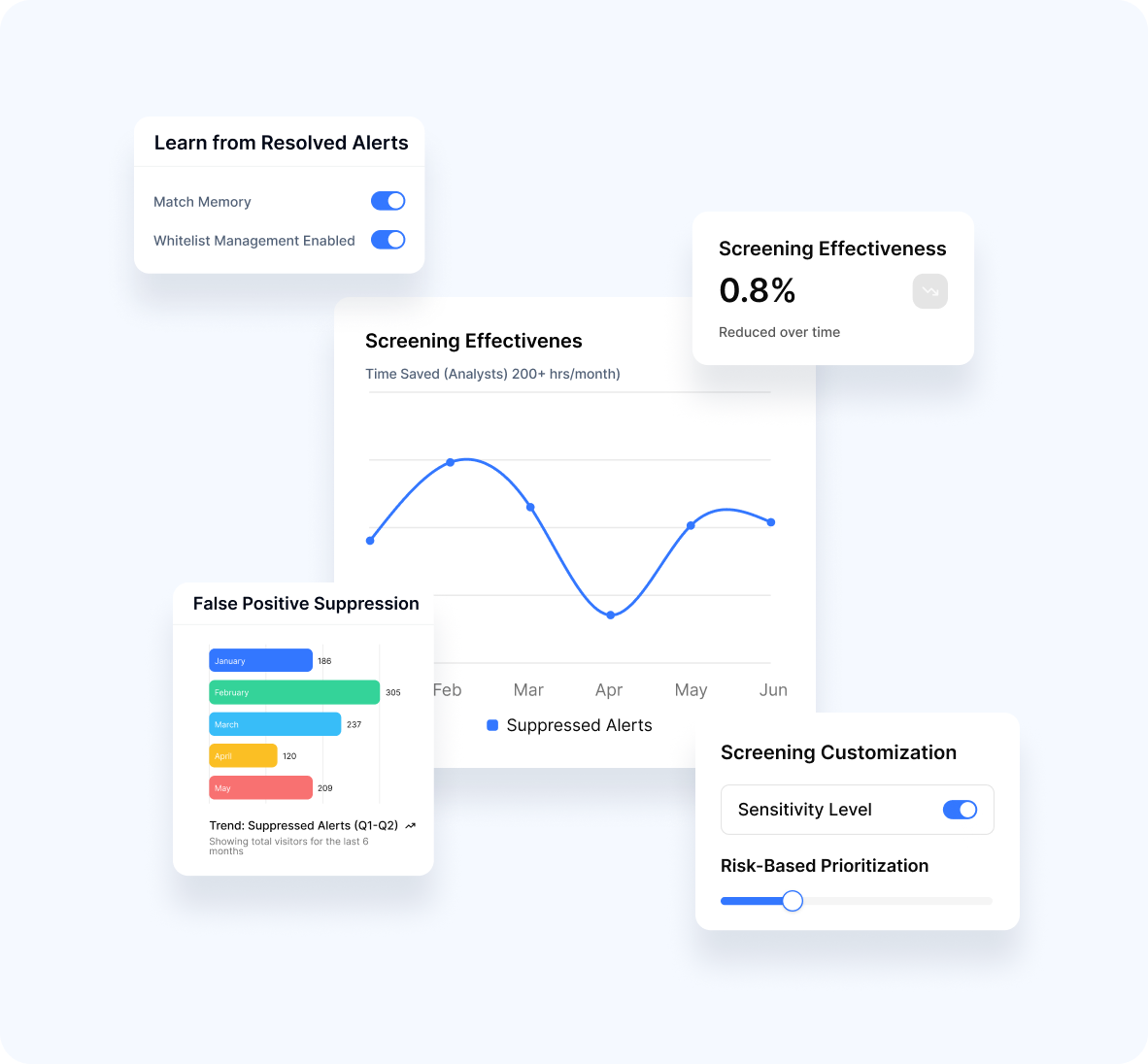

Intelligent Screening Control

- False Positive Suppression Avoidance of previously resolved alerts

- Match Memory Recognition of previously investigated scenarios

- Whitelist Management Appropriate exclusions for verified cases

- Tuning Capabilities Refinement of screening parameters based on results

- Risk-Based Intensity Screening depth aligned with entity risk profiles

Five-Stage Data Curation Process

Rigorous selection of reliable media sources, direct aggregation from governmental lists, development of political tracking frameworks, and targeted research for specialized categories

Application of ML classifiers and NLP for media processing, direct mapping of sanctions data, detailed PEP relationship research, and structured organization of specialized data

Fully tagged and sourced profiles with clear documentation, systematic comparison against existing databases, and regular profile enhancement with new information

Media quality programs with rigorous standards, sanctions reconciliation and verification, subject matter expert validation, and contextual relevance assessment

Continuous media scanning, automated tracking of sanctions updates, event-triggered PEP reassessments, and scheduled refresh cycles for all data sources

Advantage

Our AML monitoring capabilities deliver distinctive benefits:

True Continuity

Seamless protection from onboarding through the entire customer lifecycle

Business-Friendly Design

Minimal disruption with maximum compliance coverage

Integrated Experience

Perfect alignment with initial screening and verification

Resource Efficiency

Intelligent processing that optimizes compliance resources

Defensible Compliance

Comprehensive documentation supporting regulatory requirements

Transform your compliance approach to continuous protection with uqudo's sophisticated AML monitoring

To implement tailored options to your organization's ongoing compliance needs.

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-advertisement | 1 year | Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. These cookies track visitors across websites and collect information to provide customized ads. |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Please wait while you are redirected to the right page...