Facial Recognition & Liveness Detection

AI-Powered Biometric Verification Tailored for MEA

Uqudo’s facial recognition and liveness detection technology delivers best-in-class biometric verification built specifically for Middle Eastern and African markets.

Speed

Face capture with quality assessment in less than 100ms on modern devices

Accuracy

Exceptional face matching precision with minimal false positives

Security

Multi-layered protection against the latest spoofing technologies

User Experience

Frictionless verification process with real-time feedback

Key Capabilities

Advanced Facial Recognition

Our biometric system extracts and maps unique facial characteristics with exceptional accuracy:

- Facial Feature Extraction

Analyzes key facial landmarks to create unique biometric templates

- Periocular Recognition

Specialized technology focuses on the eye region for identification even when parts of the face are obscured - Template Matching & Scoring

Compares extracted templates against reference images with optimized machine learning algorithms

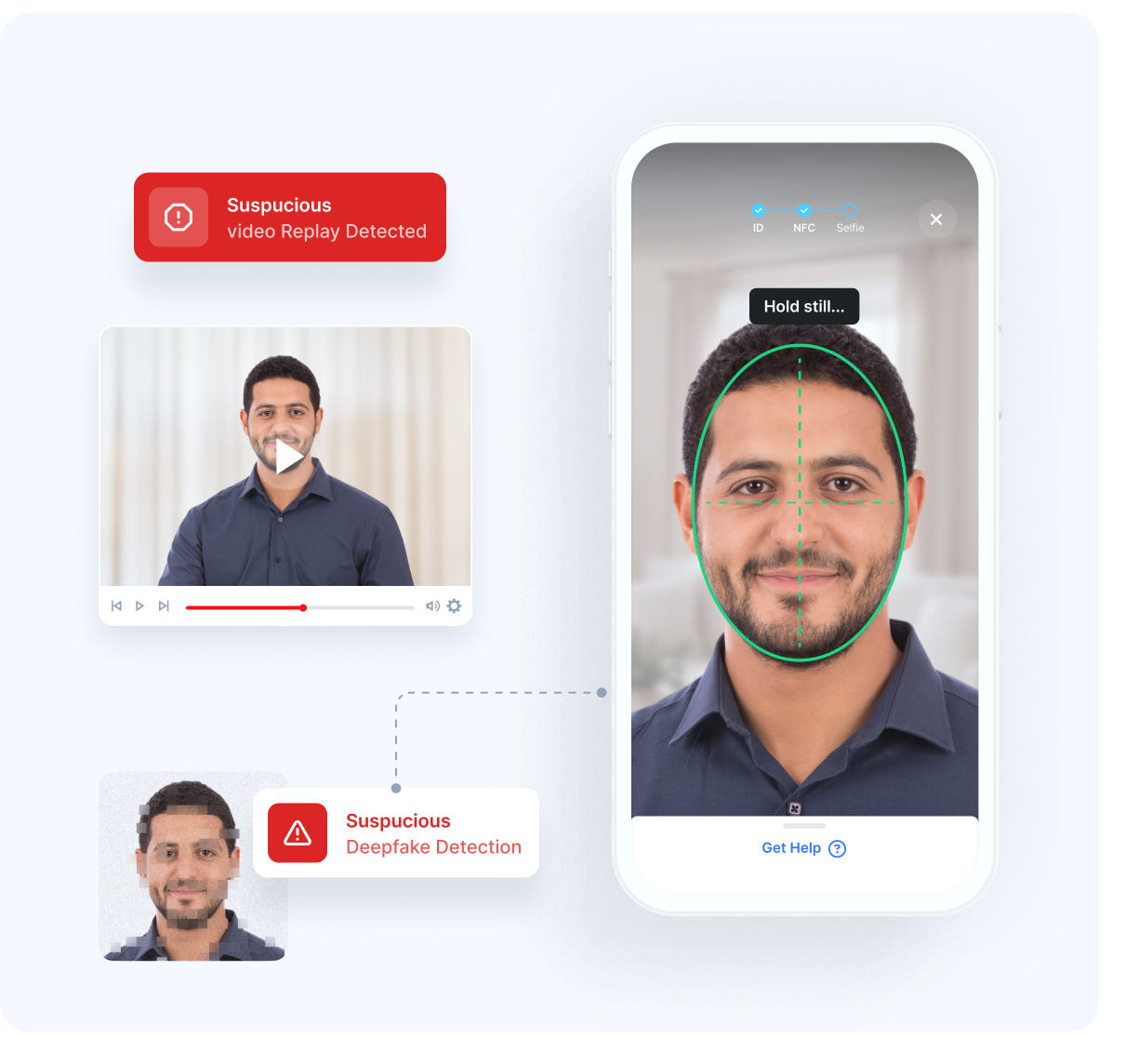

Comprehensive Liveness Detection

Our multi-layered approach ensures that only real, present individuals can verify their identity:

- Passive Liveness Mode

Verify identity without requesting any user action, reducing friction in the onboarding process

- Active Liveness Option

Request specific movements like head turns or blinks for enhanced security - Patented Presentation Attack Detection (PAD)

ISO 30107-3 compliant technology detects spoofing attempts

Anti-Spoofing Protection

Our system effectively counters sophisticated fraud attempts:

-

1

Presentation Attack Defense

Detects printed photos, lifelike masks, and video replays

-

2

Image Injection Protection

Prevents direct data injection and software exploitation through cryptographic validation

-

3

Deep Fake Detection

Identifies AI-generated faces through facial feature analysis, lighting consistency checks, and anomaly detection

Verification Modes

Support for both 1:1 matching (verification) and 1

matching (identification)

Multi-Accounting Prevention

1:N face search to prevent duplicate accounts and fraud

Authentication Applications

Supports passwordless login, transaction authorization, and account recovery

Flexible Deployment

Available via mobile SDK, web SDK, and API integration

MEA-Focused Innovation

Our facial identity recognition technology is specifically designed for Middle Eastern and African users:

- Unbiased Recognition

Algorithms designed to be invariant to race and geography

- Regional Testing

Extensively tested across diverse regional populations - Cultural Sensitivity

Designed with awareness of regional norms and preferences

Advantage

Advantage

uqudo’s technology is built from the ground up for the unique characteristics of MEA users. Our specialized approach delivers superior results ensuring inclusive and accurate verification for all your customers.

Transform your identity verification with technology that truly understands your market. Schedule a demonstration.

Frequently Asked Questions

Which industries can benefit from face verification and liveness detection?

Face verification and liveness detection are useful for any industry that needs secure digital onboarding and strong fraud protection. This includes banks, fintech and BNPL companies, telecom providers, crypto platforms, and money remittance services. With uqudo, these businesses can verify real users remotely while staying compliant with

KYC and AML regulations.

What are the key benefits of facial recognition for businesses?

Facial recognition helps businesses reduce identity fraud, onboard customers faster and deliver a smoother customer experience. uqudo’s solution provides quick and accurate verification, minimizes manual checks, supports KYC and AML compliance, and creates a secure digital journey that builds trust and supports long-term growth.

Who owns and controls the face verification data collected during verification?

uqudo acts only as a secure verification provider. The ownership and control of facial data remain with the client. uqudo processes the data strictly for verification purposes,

ensuring it is encrypted, securely handled, and compliant with all relevant data protection and privacy laws.

How does uqudo detect deepfakes and AI-generated identity fraud?

uqudo uses advanced liveness detection combined with AI-driven facial analysis to identify presentation attacks, spoofing attempts, and synthetic identities. The technology verifies that the face belongs to a real, live person and not a deepfake, video replay, or AI-generated image.

What industries commonly use liveness checks?

Liveness checks are widely used in industries such as banking, fintech, BNPL, telecom, crypto platforms, remittance services, and exchanges. These sectors depend on liveness detection to stop impersonation, account takeovers, and identity fraud during remote onboarding.

Does the face verification work in low-light or poor environmental conditions?

Yes. uqudo’s face verification works reliably even in low-light or difficult environments. The system checks image quality in real time and guides users to capture better images

when needed. This helps reduce errors while maintaining strong security and compliance standards.

How fast is the face verification and matching process?

uqudo’s face verification and matching process is near real-time, delivering results within seconds. This allows businesses to onboard customers quickly without compromising on security or accuracy.

How does uqudo ensure highly accurate face matching for users?

uqudo’s facial recognition services use advanced AI and deep learning to extract unique facial features and perform precise matching against reference images. When combined with liveness detection, this ensures that only real, live users are verified, reducing fraud and improving overall KYC accuracy.

Can facial verification be integrated into mobile apps or existing systems?

Yes. uqudo’s face verification and liveness detection can be easily integrated into mobile apps or existing digital systems using SDKs and APIs. This allows businesses to add secure biometric authentication directly into their current onboarding or login flows.