Adverse Media Screening

Screen your customers

against adverse media

and data sources

Obtain reliable and accurate information to find out if your customers or clients are involved in financial crime.

See it in action:

Why choose us?

Screen data from over 3 billion media articles that are fact-checked.

Follow a risk-based FATF approach to evaluate the credibility of news articles and publicly available information.

Identify those individuals who pose a reputational risk through a structured screening process.

How it works

Identify high-risk individuals and key company stakeholders.

Conduct thorough adverse media checks and background screenings.

Continuously rescreen to identify changes in customer risk profiles.

Adverse Media

Screening Features

Find out whether your clients have been involved in a non-convicted financial crime or have a history of legal non-compliance through media screening which includes

- Traditional news and media articles.

- International organisations database.

- Online news sites that cover financial crimes, money laundering and corruption.

- Social media forums.

More on Adverse Media Screening

Adverse media screening refers to checking third-party data sources for adverse news/information on customers and clients. This helps companies uncover their customer/client involvement in activities that relate to financial fraud.

After sanction and PEP screening, identifying a customer’s potential association with financial criminals and money launderers is an essential step in a firm’s AML screening process. This involves exploring global media news to search for potential involvement in activities like

- Financial crime

- Corruption

- Trafficking

- Terrorism

- Organised crime

A thorough adverse media screening procedure helps protect companies from penalties, financial fraud and negative publicity, keeping their reputation intact.

Secure, frictionless, & fully compliant digital onboarding. Integrated seamlessly within your app.

Latest Screening/AML updates

6 tips for a successful AML (Anti-Money Laundering) Compliance

Chandrika Mahapatra

KYC Content Specialist uqudo

Our clients

Easily integrate  with your tech stack.

with your tech stack.

Use our simple and secure Web SDK, Mobile SDK, or RESTful API to seamlessly integrate identity capabilities into your operations.

See documentationAn award-winning team

uqudo is proud to be recognised by some of the world’s most distinguished organisations.

Here’s what people say about us

-

Abdulmajeed Alsukhan

CEO & Co-Founder Tamara

uqudo, with its user-friendly interface, efficient processes, and responsive team, aligns seamlessly with our dedication to delivering fast, easy, and cost-effective customer authentication experiences. This collaboration fortifies our focus on putting our users first and upholding the highest standards of privacy and security.

-

Xu Chi

VP Ecosystem Cloud Middle East Huawei

Partnering with uqudo will enable Huawei Cloud to offer customers cutting-edge identity verification, contributing to the goal of building a more secure and inclusive digital world.

-

Joseph Dallago

CEO Rain Crypto

We are thrilled to partner with uqudo to leverage their innovative and secure identity technology into our customer’s onboarding process. By prioritising security and user-friendliness, we aim to make the benefits and opportunities provided by cryptocurrencies more accessible to individuals in the region.

-

Maqbool Al Wahaibi

CEO Oman Data Park

Oman Data Park is committed to providing our customers with the latest and most advanced technology solutions. Our partnership with uqudo will help us to further enhance our services and deliver fraud-proof digital identity solutions to our customers in Oman.

-

Jude Dike

CEO Get Equity

After our research, we found uqudo to be by far the best AML provider and we are confident that they will help us push our business forward as we grow.

-

Mehdi Fichtali

Founder & CEO FinaMaze

What made us choose Uqudo as our digital identity partner is their clear and fast integration process and the constant availability and efficiency of their support team. The client ID verification and video selfie is user-friendly and convenient making our onboarding process quasi-instant.

We price based on successful onboarding.

Say goodbye to request-based fees, repeat charges, and spiralling customer acquisition costs.

FAQ

What does your Screening process involve?

uqudo’s screening process involves running background checks by checking global lists for high-risk entities. In regulated industries, there is a requirement to ensure the individuals you are dealing with aren’t sanctioned to mitigate business risk.

- Anti Money Laundering (AML) is a set of policies, procedures, and technologies that prevents money laundering. Money laundering involves the execution of transactions to eventually convert illegally obtained money into legal money.

- A Politically Exposed Person (PEP) check, also known as PEP sanction screening, involves searching official politically exposed people lists to see if a prospective or current customer is on that list during client identification or transaction screening processes.

- Sanctions checks (sometimes known as watchlist checks) are specialised searches that include several international, government, or regulator sanctions databases that identify individuals prohibited from certain activities or industries.

How do you do AML/PEP’s/Sanctions screening?

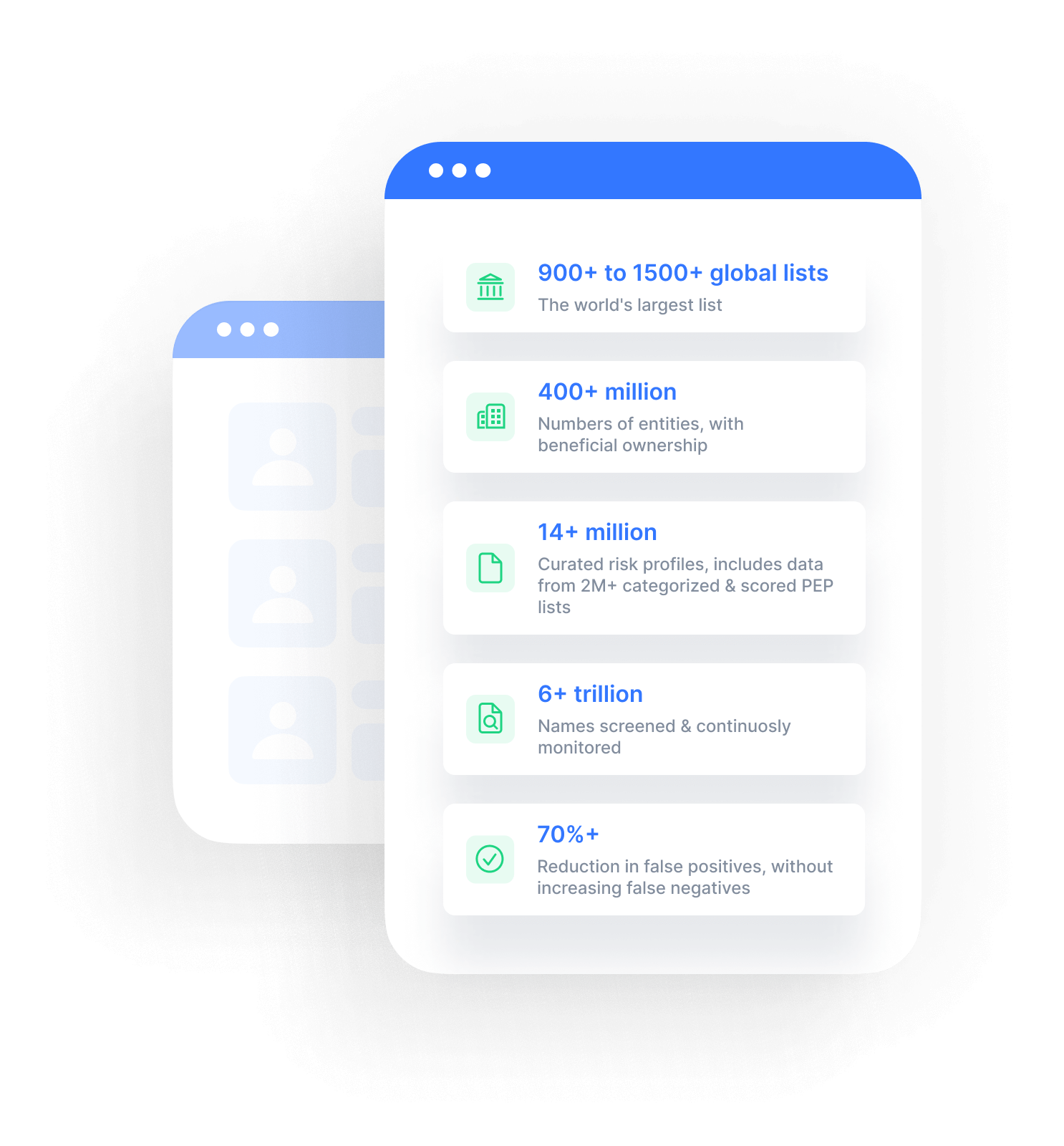

Our Screening lists include the following:

- Monitored Lists: 900+ monitored lists that include international sanctions, money laundering and other global lists.

- PEPs (Politically Exposed Person) lists: PEP list check against 1.7+ million high-risk individuals.

- Adverse Media Screening: Screening against 3 billion media articles.

We can screen and monitor in real-time, on an ongoing basis.

What is AML?

AML (Anti-Money Laundering) refers to the rules and regulations that combat money laundering and terrorist financing. AML screening helps detect and identify these suspicious activities.

What are monitored lists?

Monitored lists use data from numerous sources to evaluate a customer’s risk profile. Some examples of monitored lists include

- International sanction lists (FATF, OFAC, UNSC)

- Regional sanction lists (MENAFATF, EU, GIABA, ESAAMLG)

- Money laundering

- Terrorist financing

- Drug trafficking

- Narcotics trafficking

- Human rights violations

- International treaties violations

What is PEP screening?

PEPs (Politically Exposed Persons) are those individuals holding a prominent public position, which increases their susceptibility to fraud. PEP screening involves identifying PEPs and evaluating their risk profiles.

Our PEP screening involves evaluation against 4 PEPs risk levels, which are:

- High-risk PEPs

- Medium-risk PEPs

- Low-risk PEPs

- PEPs by association

Why is watchlist screening important?

A global watchlist screening helps companies identify suspicious money launderers and individuals associated with financial crimes. Along with this, screening helps firms comply with their region’s AML/CFT regulations.

Are uqudo’s Screening lists regularly updated?

Yes, our database undergoes real-time updates, so our Ongoing AML can easily track changes in a customer’s risk profile.

with your tech stack.

with your tech stack.