The Current Landscape: Securing Growth Amidst Evolving Regulations

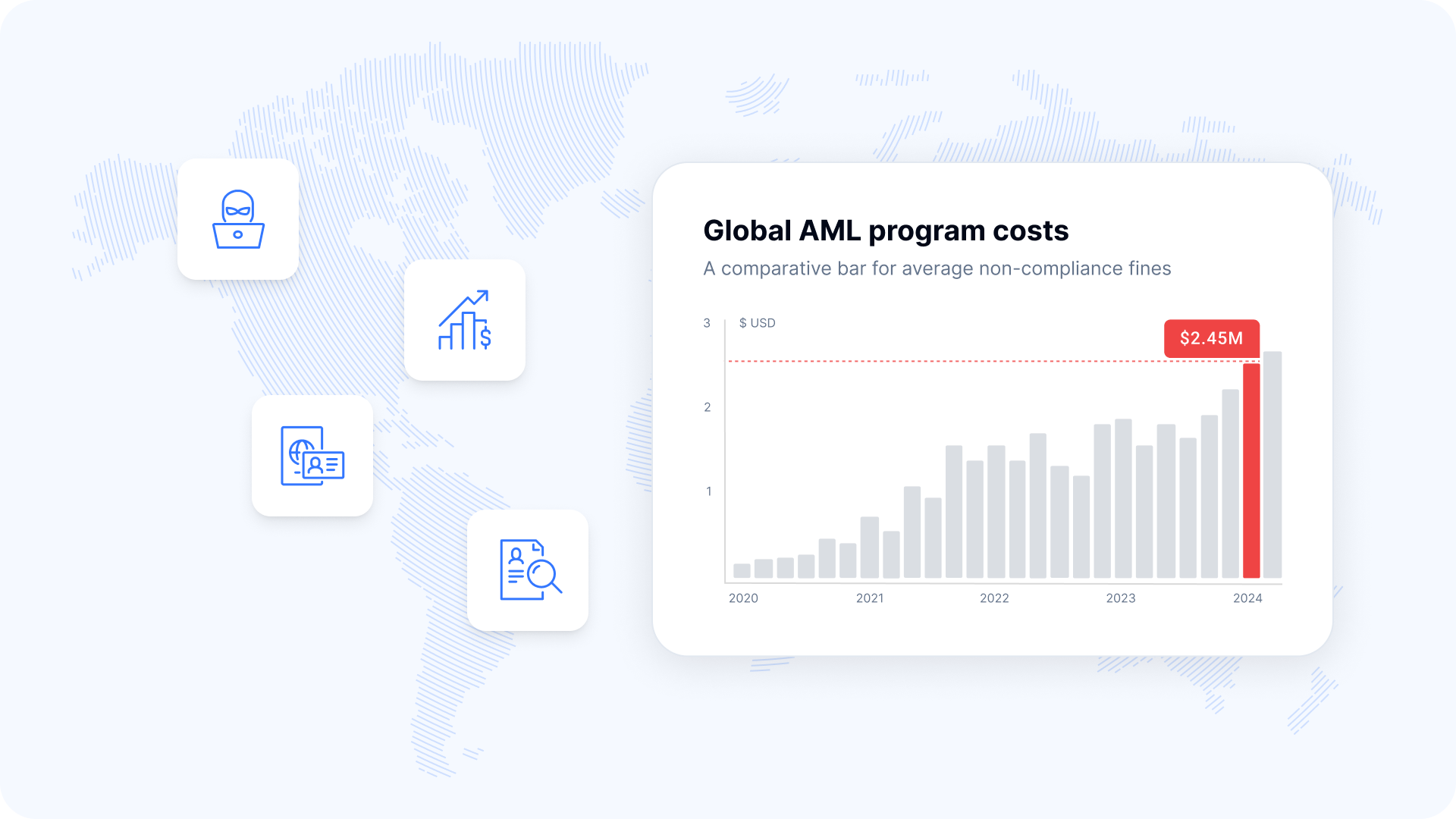

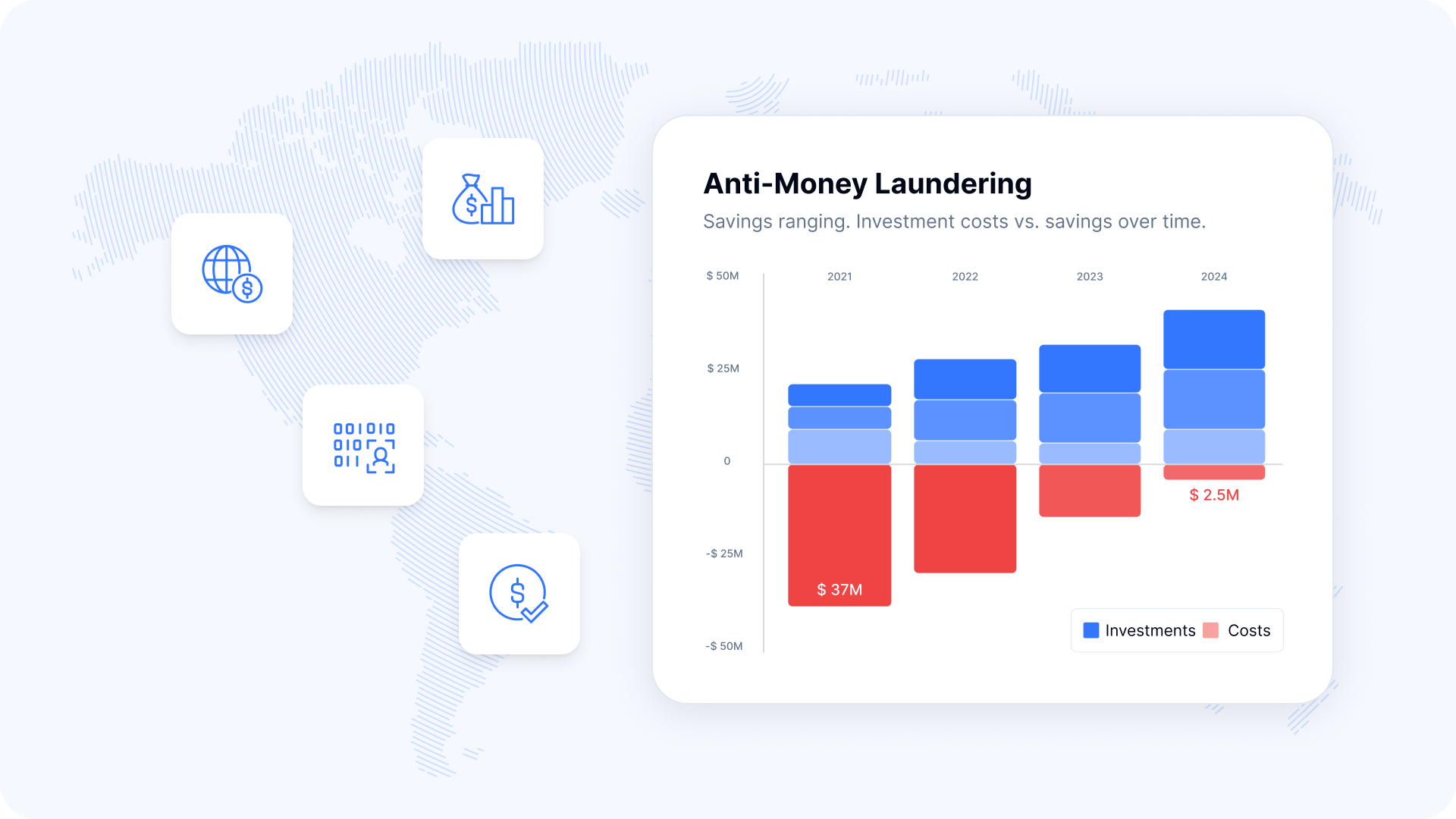

In today’s interconnected global economy, compliance with Anti-Money Laundering ( or AML) regulations is no longer optional; it is a critical element for sustainable business growth. AML compliance ensures businesses operate ethically while protecting themselves from severe penalties, reputational damage, and financial losses. Over the past two years, average expenditures on AML programs have surged by 23%, driven by the rising costs of manual reviews and compliance processes.

For businesses in the UAE, the government’s 2024–2027 AML strategy is a beacon of proactive governance. This national strategy emphasizes risk-based compliance, legal reforms, and international cooperation, reinforcing the UAE’s position as a regional financial hub. Beyond compliance, these efforts ensure trust among global investors, customers, and regulators.

The financial impact of failing to comply with AML regulations is significant. Non-compliance fines globally average $2.45 million per violation, with regulators imposing even higher penalties for repeated offenses. Businesses that fail to prioritize AML compliance risk operational disruptions, legal ramifications, and a tarnished reputation that could take years to repair.

The Challenges: Navigating Complex Risks

The landscape of AML compliance is fraught with challenges, ranging from regulatory complexities to operational inefficiencies. Understanding these challenges is the first step in building a resilient compliance strategy:

- Fragmented Regulatory Landscapes Across Jurisdictions: Businesses operating in multiple regions face a patchwork of regulatory requirements. For example, compliance with the EU’s AML Directives might differ from adhering to the US Bank Secrecy Act. Approximately 58% of financial institutions identify regulatory inconsistencies as a major obstacle, making establishing a unified compliance framework difficult.

- Resource-Intensive Processes: False positive alerts in traditional transaction monitoring systems average above 90%. This means compliance teams spend a significant portion of their time investigating non-suspicious activities. These inefficiencies inflate operational costs and divert resources away from genuine risks.

- Emerging Threats in Digital Finance: The rapid rise of digital currencies, fintech platforms, and neobanks introduces new vulnerabilities. These technologies, while revolutionary, often outpace regulatory frameworks, creating gaps that money launderers can exploit. For instance, nearly 300 million people globally now own cryptocurrency, adding another layer of complexity to AML compliance.

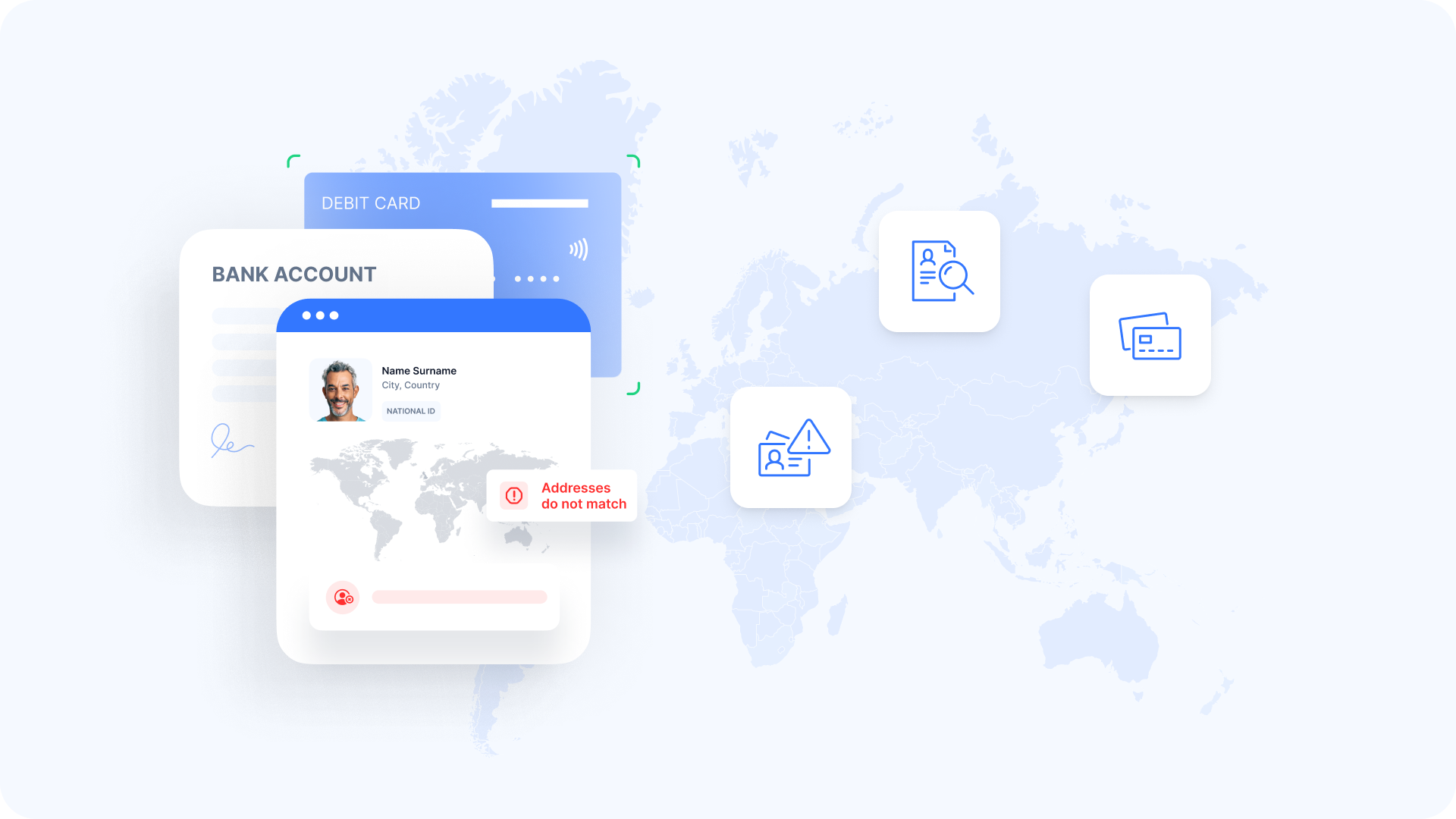

The growing sophistication of financial crimes further compounds these challenges. Fraudsters leverage advanced technologies, such as synthetic identities and complex layering techniques, making it increasingly difficult for businesses to detect and prevent money laundering activities effectively.

Without robust AML solutions, businesses risk falling behind. The financial implications of non-compliance extend beyond fines, leading to loss of investor confidence, reduced market competitiveness, and significant reputational harm. That’s why many businesses are turning to AML service companies to stay compliant and protect themselves from growing risks.

The Solutions: Embracing Technology-Driven AML Compliance

Despite these challenges, businesses can turn AML compliance into a competitive advantage by leveraging modern technologies and adopting strategic practices. Industries such as banking, money remittance, and crypto exchanges are at the forefront of implementing these advanced AML solutions.

Here’s how advanced AML solutions can address current pain points and unlock business growth:

- Leverage AI and Real-Time Monitoring Systems

Artificial intelligence (AI) and machine learning (ML) are revolutionizing AML processes. These technologies reduce false positives by up to 46%, allowing compliance teams to focus on genuine threats. Real-time monitoring systems powered by AI provide businesses with the tools to detect suspicious activities as they occur, significantly reducing response times. Automation also extends to drafting Suspicious Activity Reports (SARs). With leading solutions automating up to 48% of SAR filings, businesses save time, reduce human error, and improve compliance efficiency. AI’s self-learning capabilities enable these systems to adapt to evolving threats, ensuring robust protection against emerging risks.

- Unified Compliance Platforms

Comprehensive AML platforms that integrate KYC (Know Your Customer), CDD (Customer Due Diligence), and fraud detection capabilities provide businesses with end-to-end compliance coverage. These platforms streamline workflows, enabling businesses to monitor transactions, verify customer identities, and assess risks seamlessly. The UAE’s AML strategy offers a model for effective compliance. By emphasizing international cooperation and continuous upgrades, the strategy ensures businesses remain ahead of regulatory changes while fostering a secure financial environment.

- Enhancing Economic Stability Through AML

Effective AML measures are not just about regulatory compliance—they contribute to broader economic stability. By fostering investor confidence and supporting transparent business practices, robust AML systems create an environment where businesses can thrive. Investors are more likely to partner with organizations that demonstrate a commitment to ethical operations and compliance.

- Navigating Cross-Border Compliance

Global businesses must navigate varying regulatory requirements across jurisdictions. Adaptable AML solutions address this challenge by providing configurable rules and localized compliance features. This flexibility ensures businesses meet region-specific regulations without sacrificing operational efficiency.

Practical Steps for Implementing AML Solutions

If you’re looking to improve your Anti-money Laundering processes, here are a few actionable steps to consider:

- Conduct a Compliance Audit: Assess your existing AML practices to identify gaps and inefficiencies. This provides a clear roadmap for improvement.

- Choose the Right AML Provider: Look for providers that offer advanced technology, frequent updates, and comprehensive database coverage. Prioritize quality over cost to ensure robust compliance.

- Invest in Training: Equip your teams with the knowledge and skills needed to navigate complex AML processes effectively. This includes understanding emerging technologies like AI and blockchain.

- Focus on Integration: Ensure your AML solutions integrate seamlessly with existing systems, such as KYC and fraud detection tools. This creates a unified approach to compliance.

- Monitor and Adapt: Compliance is not static. Regularly review your AML processes to adapt to evolving threats and regulatory changes.

By taking these steps, businesses can safeguard themselves against financial crime while building a foundation for sustainable growth.

Conclusion: Secure Growth with Adaptable AML Solutions

In the face of evolving regulations and emerging financial threats, AML compliance is no longer a mere operational necessity—it’s a strategic imperative. Effective AML processes protect businesses from legal and financial repercussions while fostering trust among customers and stakeholders.

By embracing advanced technologies, such as AI-driven monitoring systems and unified compliance platforms, businesses can turn AML compliance into a competitive advantage. These solutions not only enhance operational efficiency but also position businesses as leaders in ethical and transparent operations.

Looking for reliable Anti-money Laundering services in the UAE? At uqudo, we specialize in delivering tailored AML solutions that empower businesses to navigate compliance complexities while unlocking new growth opportunities. As part of our broader suite of digital identity services, our AML tools ensure seamless onboarding, continuous risk monitoring, and compliance with evolving regulations. Contact us today to learn how our services can transform your compliance strategy.