The Quiet Evolution of Document Fraud

As digital onboarding becomes faster, more remote, and increasingly mobile-first, the trust we place in documents is being tested. IDs, passports, and licenses have long been used to anchor identity, but fraudsters are getting better at faking what looks real.

Fraudsters today aren’t just photoshopping faces; they’re crafting high-resolution synthetic IDs, using screen replays, AI-edited selfies, and multi-layered forgeries that easily pass basic visual checks. This isn’t just a fraud team issue, it’s a trust problem.

In markets like the UAE and the wider MENA region, where governments are driving digital transformation, regulatory bodies are simultaneously raising the bar for eKYC and AML compliance. Institutions are expected to not only verify identities but to ensure the integrity of every document presented.

According to Liminal, synthetic identities and deepfake-enabled fraud have become dominant threats in digital onboarding, with fraudsters increasingly relying on AI-driven techniques and document manipulation to bypass verification. Notably, deepfake-related identity fraud surged by 643% across the Middle East in 2024 alone, underscoring the critical role of advanced tamper detection in identifying altered documents before they compromise onboarding flows.

The impact isn’t just theoretical. In recent years, millions of dollars in fines have been issued across MENA and globally for insufficient identity checks linked to onboarding fraud and AML breaches.

Tampering is no longer rare. It’s subtle, fast, and often invisible to systems that weren’t designed to see beneath the surface. That’s where tamper detection solutions step in. These solutions meticulously examine document quality at a forensic level to identify any signs of alteration.

What Tamper Detection Really Does

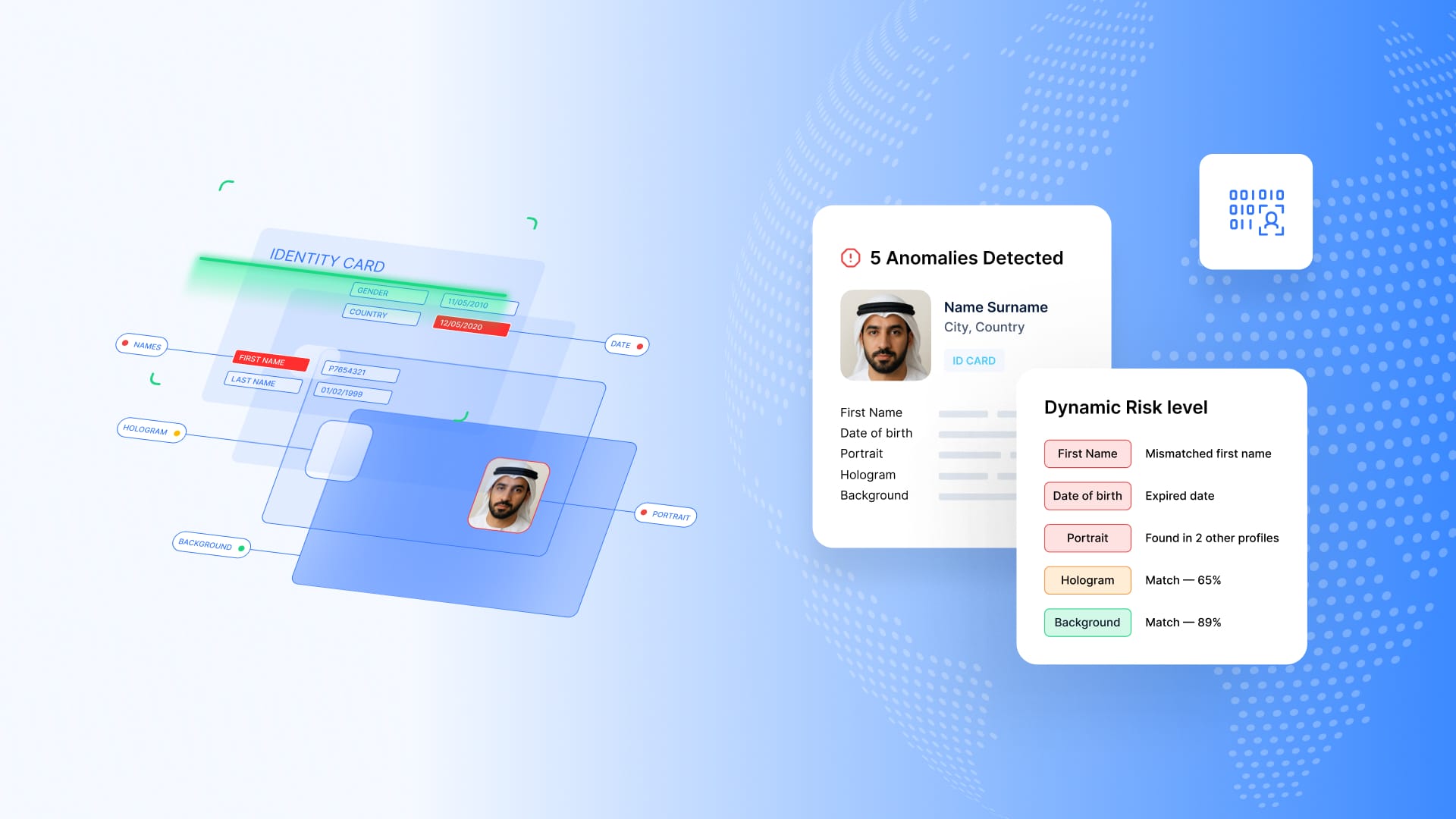

Unlike basic ID verification online, tamper detection focuses on identifying whether a document has been altered or manipulated, looking beyond data fields to detect signs of editing, layering, or misuse in how the document is presented.

Rather than relying on static rules or human eyes, tamper detection leverages AI and computer vision to answer critical questions:

- Is this a photo of a real document, or just a screen capture?

- Has the image been edited, cropped, or layered?

- Do fields like OCR, MRZ, and NFC chip data align?

- Is the document physically present, or is it being replayed?

- Does user behavior during submission raise red flags?

These are forensic-level checks, automated in real time.

For example, uqudo’sTampering Detection module analyzes visual inconsistencies, behavioral anomalies, and embedded chip integrity, fitting seamlessly into broader workflows alongside AI Document Scanning, NFC Verification, and KYC+. The goal? Faster, smarter verification without added friction.

Why It Matters in the MENA Region

Countries like the UAE, Saudi Arabia, and Egypt are actively updating digital onboarding regulations. Authorities such as the UAE Central Bank and SAMA now emphasize robust KYC practices, including document integrity and biometric verification.

Across the region:

- Mobile-first onboarding is accelerating, bringing more screenshots and PDF uploads.

- Fintech and BNPL platforms are scaling rapidly, often prioritizing speed.

- Crypto exchanges and remittance services are onboarding users in seconds.

This pace fuels growth, but also opens the door to synthetic IDs and altered documents.

At the same time, regulators across MENA and globally are shifting from guidance to enforcement. Initiatives like the UAE’s National Digital Identity program and Saudi Arabia’s digital economy vision expect businesses to adopt technologies that move beyond basic checks.

Inconsistent document verification has already led to multi-million dollar fines for KYC and AML lapses worldwide. Today, regulators demand detection of not only invalid data but also manipulated documents and synthetic identities.

By embedding tamper detection into onboarding flows, companies demonstrate proactive compliance, reducing exposure to audits, penalties, and reputational harm.

In this landscape, tamper detection isn’t just a fraud tool, it’s part of staying regulator-ready in a digital-first world.

Where It Makes a Difference

Tamper detection doesn’t belong to one industry; it belongs wherever documents are used to verify identity.

Whether you’re operating a lending platform, onboarding users for financial services, supporting telco SIM registrations, or simply issuing e-tickets or verifiable credentials, tamper detection helps ensure that the identity behind a document is real, present, and unaltered.

It’s especially useful when combined with other controls like Transaction Monitoring, Face Verification, and Liveness Detection, offering multiple perspectives on the same identity event.

But the broader value isn’t just fraud prevention, it’s confidence. With tamper detection in place, teams can automate more decisions, reduce manual escalations, and onboard real users faster, knowing they’re not letting in high-risk actors.

Behind the Scenes: How It Works

Modern automated document tampering detection solutions use a layered approach that combines AI, computer vision, and real-time data validation to detect document manipulation, far beyond what traditional checks can catch. The goal is not just to verify the visible content but to understand the authenticity and context of each submission.

At uqudo, this methodology is applied through intelligent orchestration, integrating tamper detection seamlessly with tools like AI Document Scanning, NFC Verification, and KYC+ to enhance identity verification without adding friction.

Typically, an effective tamper detection process includes:

- Image Source Analysis

Identifying whether a document was captured via camera, screen, or printout, flagging higher-risk methods commonly used in fraud attempts.

- Pixel-Level Forensics

Detecting subtle edits such as edge mismatches, shadow inconsistencies, or layered images that are invisible to manual review.

- Cross-Data Validation

Ensuring consistency between OCR-extracted data, MRZ codes, and embedded NFC chip information.

- Real-Time NFC Verification

Confirming the physical presence of a document to block static images or digital replays.

- Behavioral Analytics

Monitoring user interactions during submission, such as repeated attempts or irregular device handling, which often indicate tampering.

Each layer works quietly in the background, providing a deeper level of assurance by validating both the document and the conditions in which it’s presented. This approach, adopted by platforms like uqudo, ensures that identity verification remains fast, accurate, and resilient against evolving fraud tactics.

A Smarter Way to Build Trust

Effective tamper detection isn’t loud. It’s quiet, intelligent, and scalable. Continuous AI retraining, lightweight deployment, and orchestration across identity layers ensure it supports, not disrupts, your digital flow.

Forward-thinking teams in MENA and beyond now treat tamper detection as part of their digital hygiene, a silent guardian ensuring every verified identity is what it claims to be.

Final Thought: What You Can’t See Can Hurt You

Today’s fraud blends in. A clean-looking document. A decent selfie. A pass through outdated checks, and it’s in.

That’s why tamper detection matters. It’s not about rejecting users, it’s about making smarter decisions sooner.

As digital onboarding becomes faster and more automated, trust needs tools that can keep pace. Tamper detection is one of them.

Explore how KYC+, Tampering Detection, and AI Document Scanning quietly strengthen your identity workflows, keeping them fast, accurate, and secure.