NFC

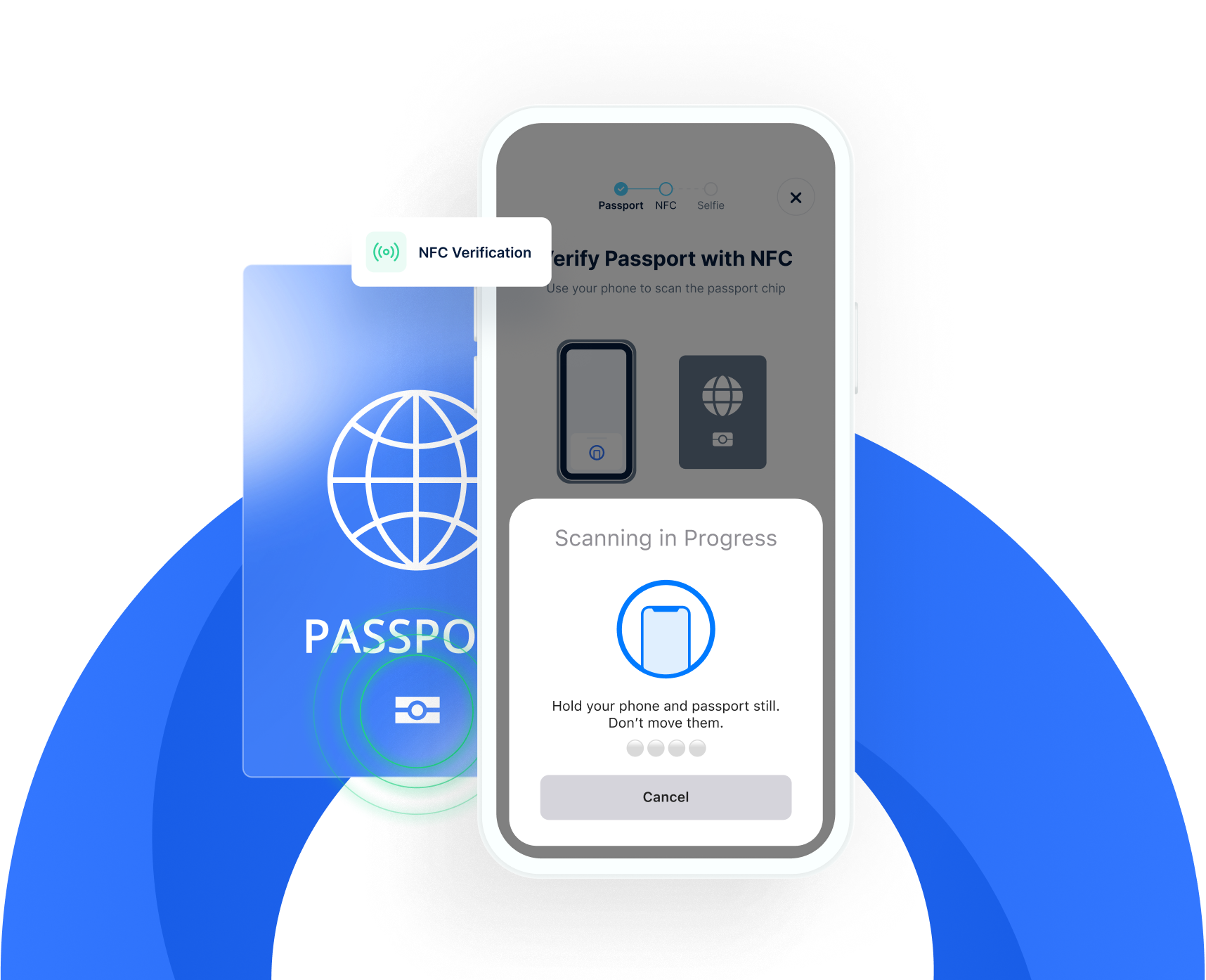

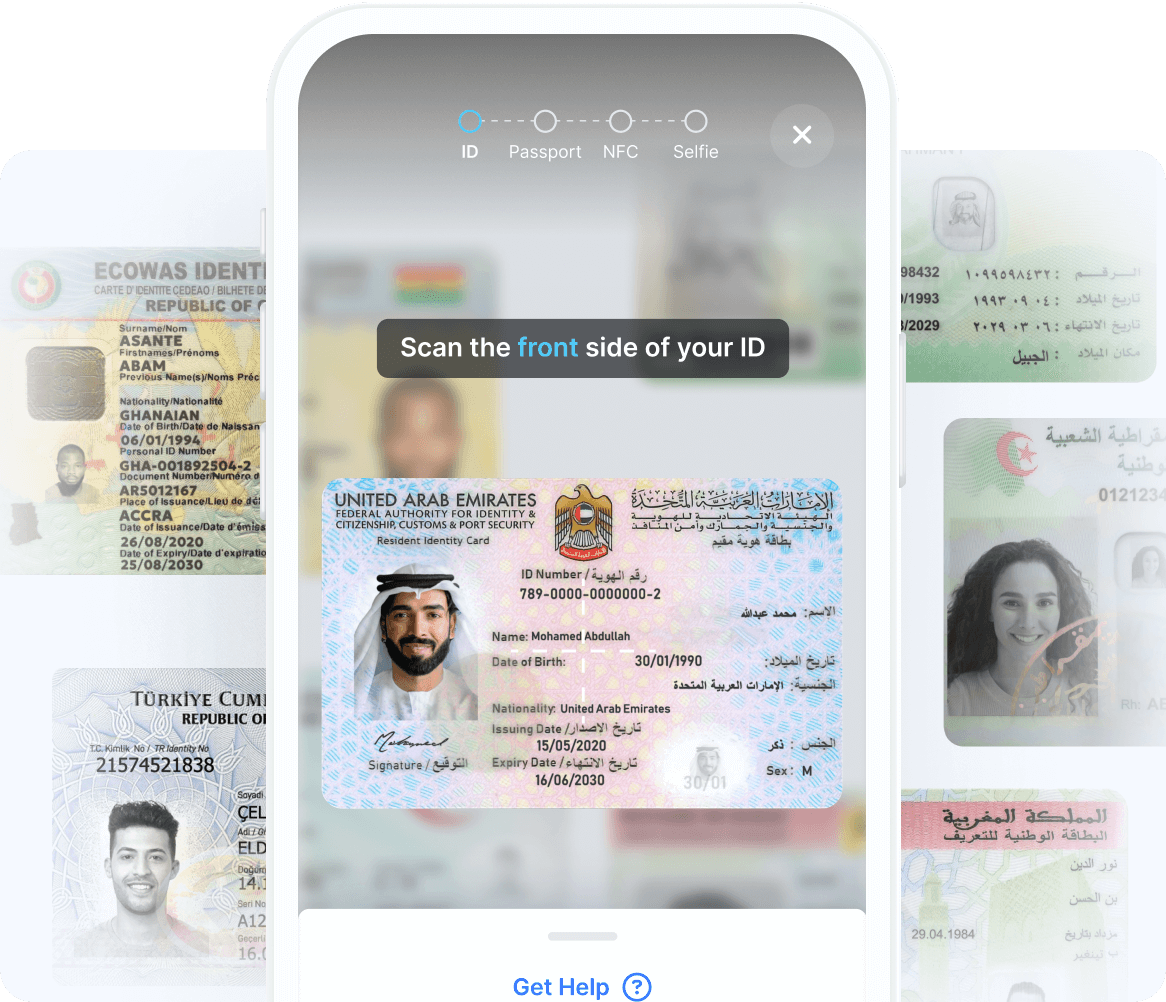

Ultimate Identity Verification Security for Digital Onboarding

Uqudo’s Near Field Communication (NFC) chip reading and verification technology provides the highest level of security and trust in document authentication.

Easy to Use

Just tap the document to an NFC-enabled smartphone

Quick Verification

Complete the process in seconds

Clear Guidance

User-friendly instructions throughout the process

Cross-Platform Support

Available on iOS and Android devices

Key Capabilities

Advanced NFC Reading

Our technology accesses secure document data with exceptional reliability:

- Comprehensive Coverage

Successfully reads and verifies 156+ passports with NFC chips

- Unique ID Card Capability

Reads national identity cards across 22 countries, including regions where competitors cannot. - ICAO and Non-ICAO Support

Handles both standard and non-standard NFC chip implementations

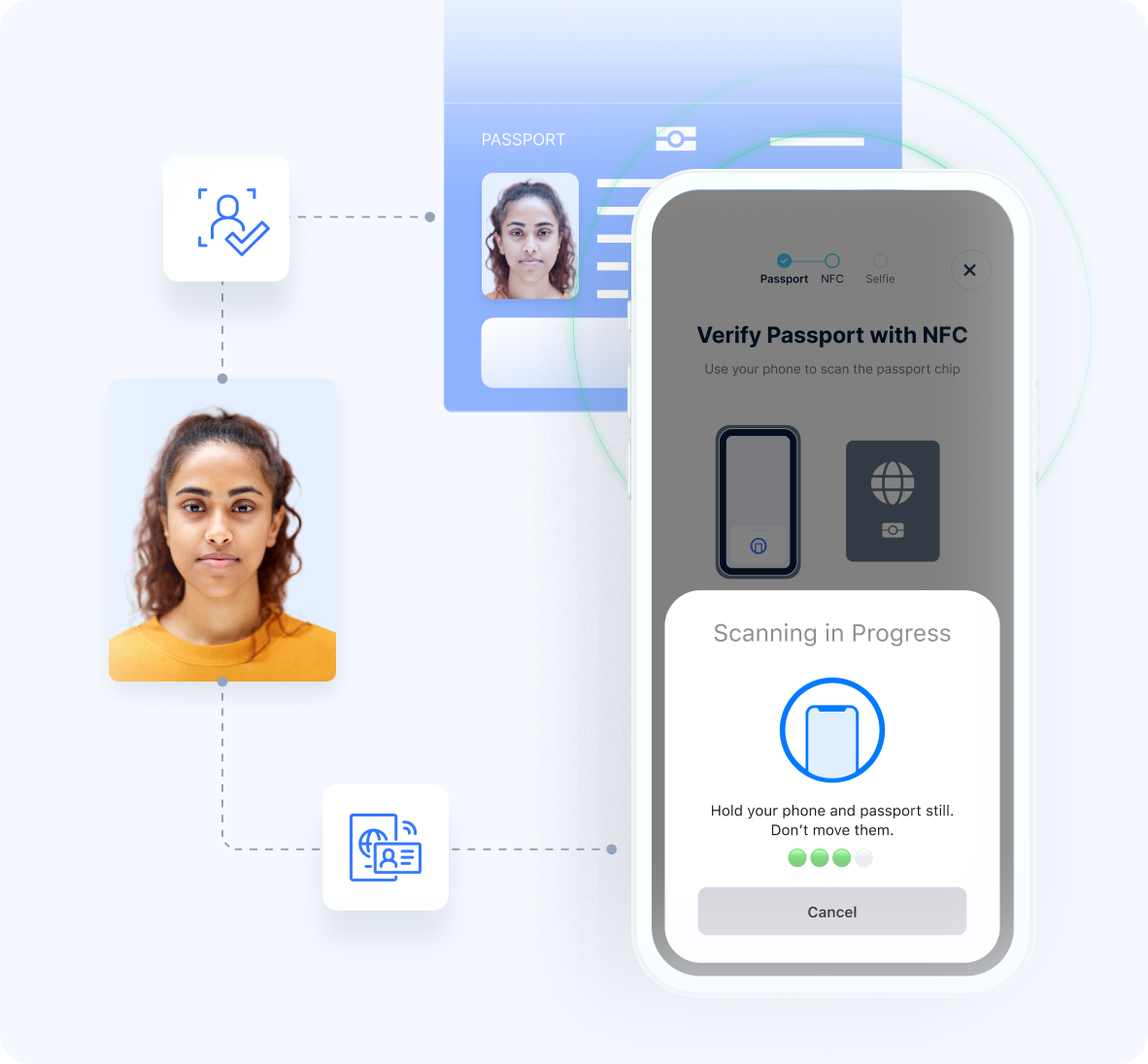

Multi-Layer Verification

Our system performs comprehensive checks to ensure document authenticity:

- Cryptographic Security

Verifies digital signatures to confirm data hasn’t been tampered with

- Biometric Comparison

Extracts the secure reference photo from the chip for high-security facial matching - Physical Presence Confirmation

Short-range NFC technology ensures the document is physically present

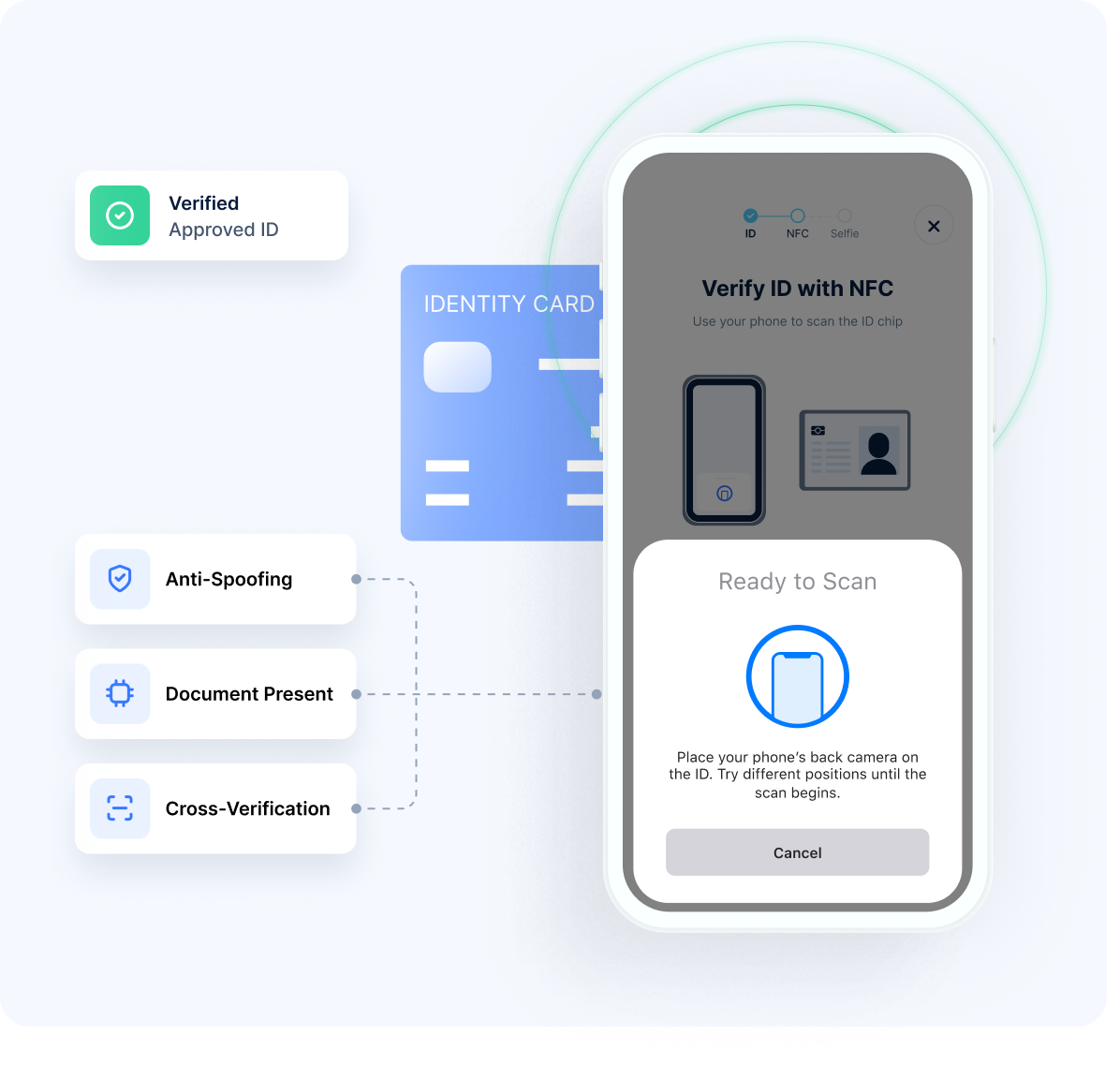

Fraud Prevention

NFC provides a crucial defense against sophisticated document fraud:

- Anti-Spoofing

Cryptographically secured data can’t be replicated by fraudsters

- Document Present Check

Confirms the physical presence of an authentic document - Cross-Verification

Compares NFC data with OCR and MRZ information for consistency

Highest Security Level

The most secure form of document verification available

Anti-Skimming Protection

Prevents unauthorized data interception

Tamper-Evident

Any attempt to modify chip data breaks cryptographic signatures

Regulatory Compliance

Meets the most stringent KYC/AML regulatory requirements

Integration Options

Mobile SDK Integration

Easily embed NFC capabilities in your applications

Comprehensive Documentation

Detailed implementation guides for developers

Technical Support

Expert assistance throughout the integration process

MEA Regional Leadership

Our NFC technology offers unmatched regional coverage:

- Unique Coverage: Verify identity documents via NFC in countries no competitors can access

- Regional Expertise: Deep understanding of varied regional implementations

- Government Partnerships: Built on uqudo’s heritage of working with government ID programs

Advantage

Advantage

While others offer basic scanning, uqudo anchors digital identity trust with NFC, combining it with advanced OCR and facial recognition to deliver the most comprehensive, secure verification solution across the MEA region.

Contact our team to discover how we can strengthen your ID verification process.

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-advertisement | 1 year | Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. These cookies track visitors across websites and collect information to provide customized ads. |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Please wait while you are redirected to the right page...