Secure & Compliant Banking: Identity Verification and Risk Management That Powers Digital Transformation

Deliver frictionless digital onboarding, prevent financial crime, and ensure regulatory compliance across retail, commercial, and private banking services.

Our clients

Flexible Implementation for Every Banking Journey

- Mobile SDK

- Web SDK

- API

- No-Code Solution

-

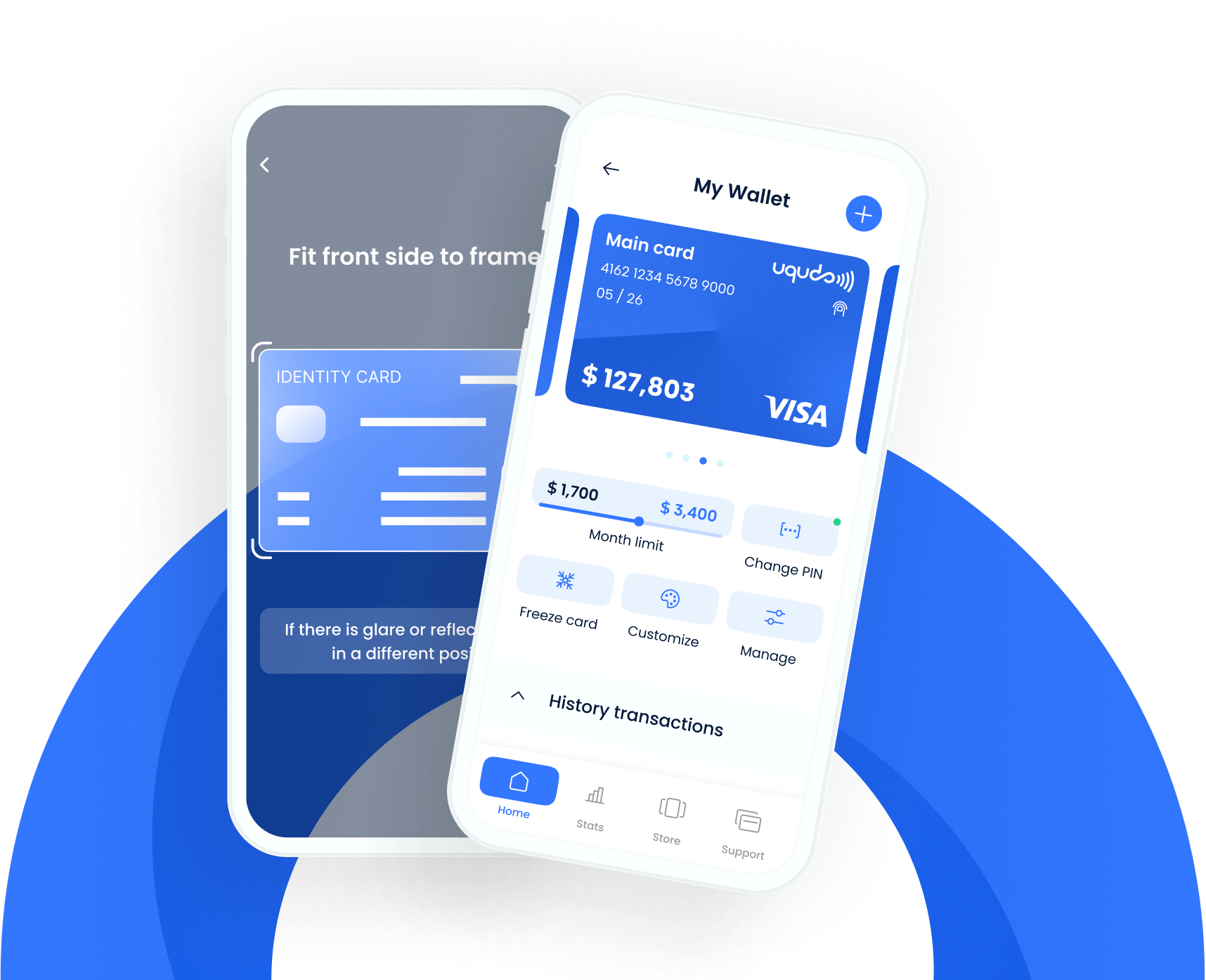

Mobile SDK (8MB)

Mobile Banking Apps

NFC verification, offline capabilities, millisecond document scanning.

-

Web SDK

Online Banking Platforms

Browser-friendly prompts, virtual camera detection, seamless integration.

-

API

Core Banking Integration

Tailored verification flows, high-volume transaction support, background checks

-

No-Code Solution

Branch Tablet Deployment

QR code access, fully hosted experience, zero development time.

Deployment Options

- Multi-tenant SaaS with regional hosting

- On-premise for stringent data residency requirements

- Hybrid approaches for specialized banking compliance needs

Identity Technology Made For Banking

- AI Document Scanning

- Face Verification & Liveness

- NFC Verification

- National Citizen Registry

- AML Screening

- Biometric Authentication

- Transaction Monitoring

- Know Your Business

-

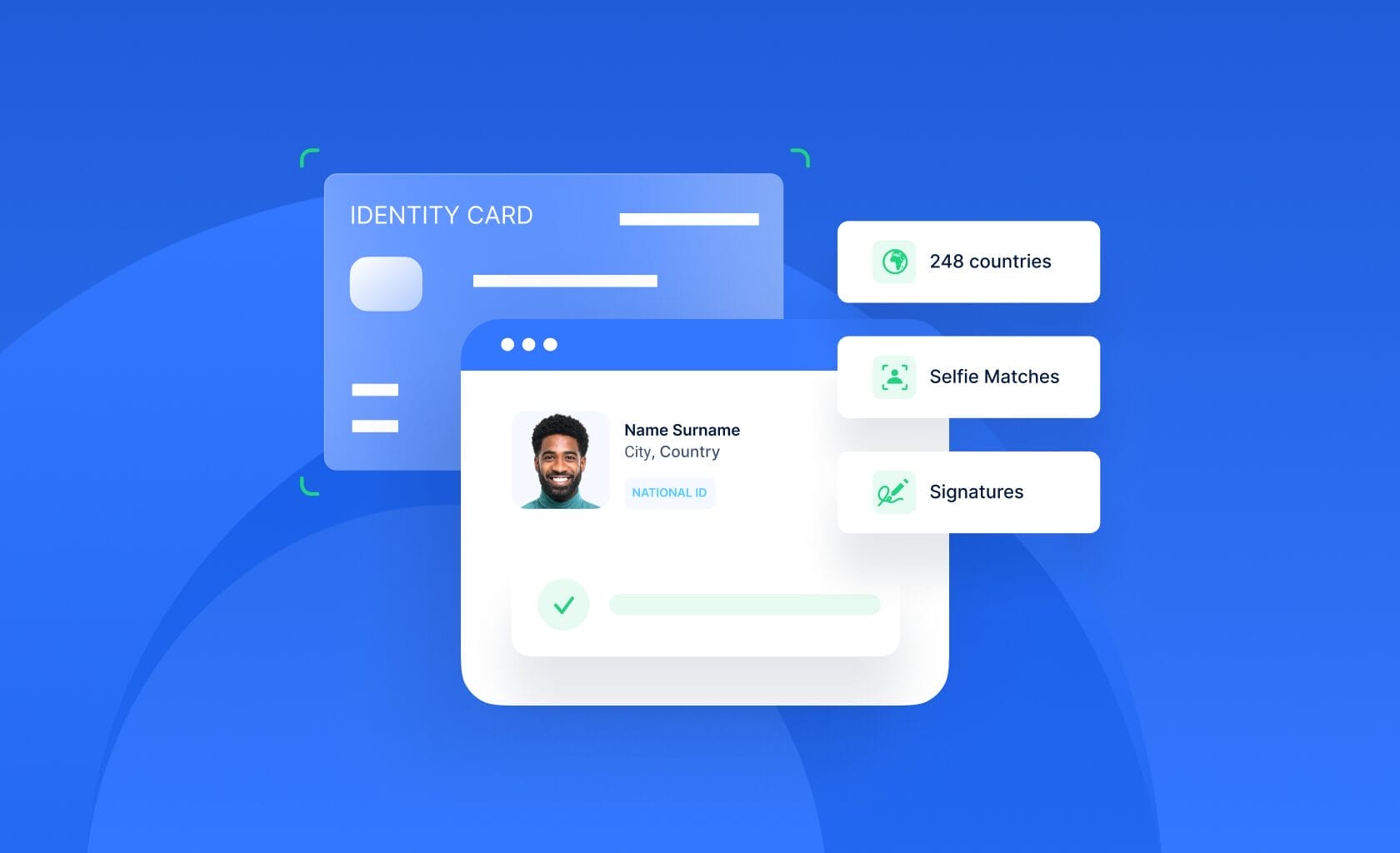

AI Document Scanning

Extract and verify customer data in milliseconds during account opening.

-

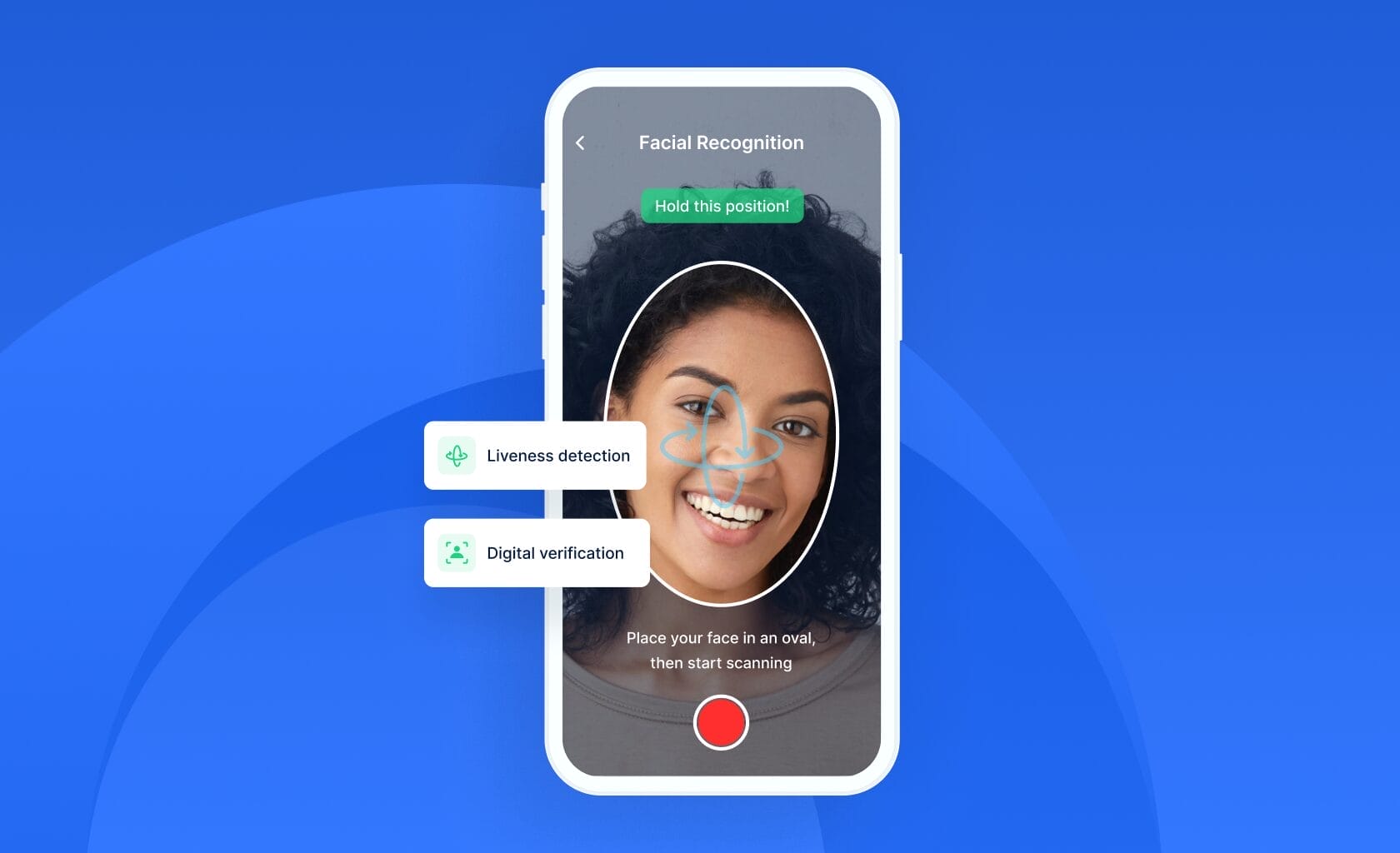

Face Verification & Liveness

Ensure genuine applicants and prevent account takeovers.

-

NFC Verification

Highest level of document authenticity for secure onboarding.

-

National Citizen Registry

Highest level identity assurance through government database verification.

-

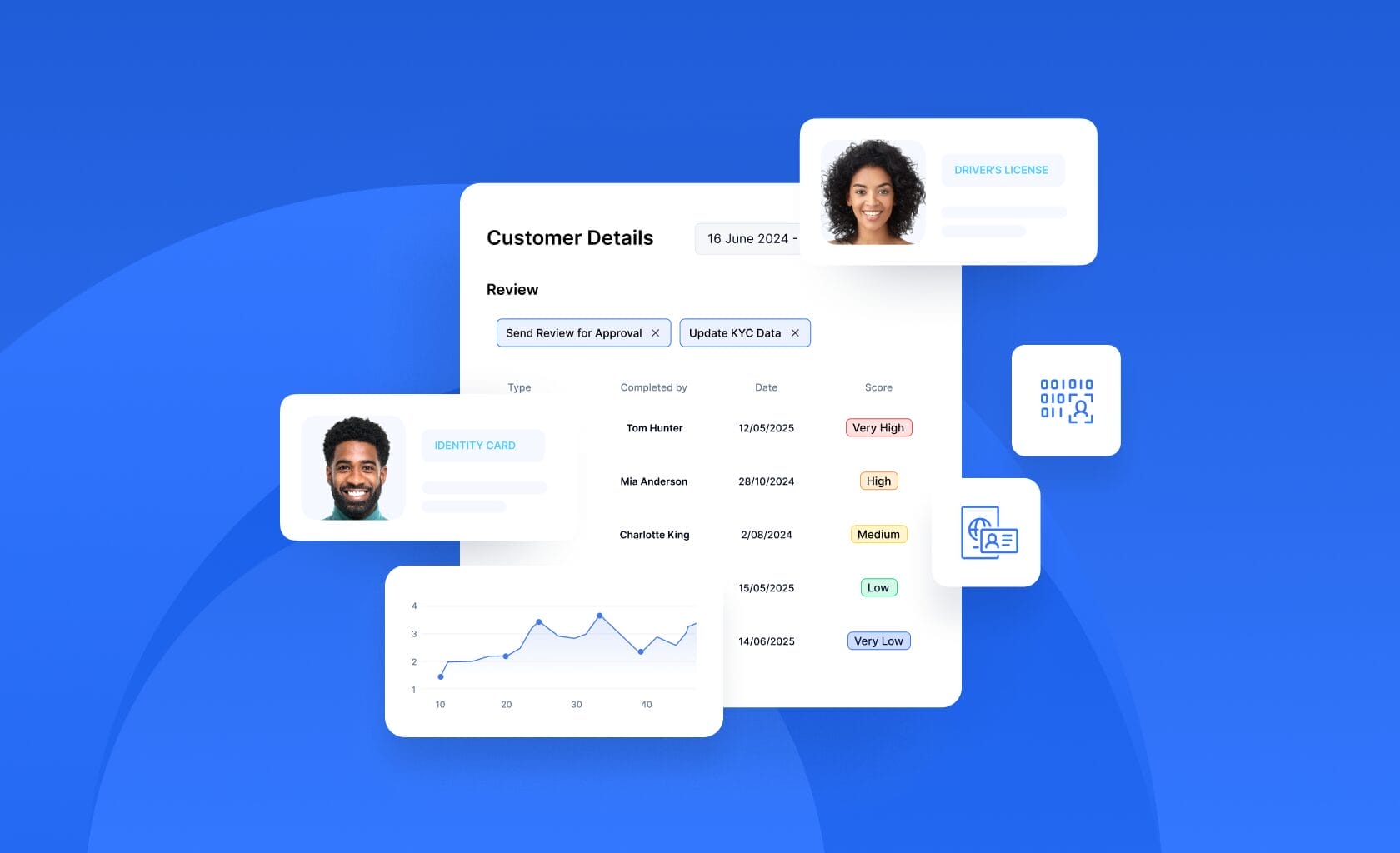

AML Screening

Comprehensive sanctions, PEPs and adverse media screening.

-

Biometric Authentication

Seamless and higher security password reset and transaction approval.

-

Transaction Monitoring

Flag suspicious payment patterns and detect potential money laundering

-

Know Your Business

Streamline business client onboarding with automated company verification covering 300+ million entities, UBO identification, and risk assessment.

Enterprise-Grade Security for Financial Services

- ISO 27001: Information security management [in progress, Completed stage-1 Assessment]

- Liveness Detection: ISO/IEC 30107-3

- Penetration Test: Available on request

Our solutions help banking service providers meet evolving regulatory requirements in the MEA region and beyond, with special emphasis on customer data protection, automated compliance checks and secure transaction processing.

Implementation Timeline

Our dedicated implementation team specializes in banking workflows and can accelerate your deployment with pre-built templates and configurations.

Your Streamlined Path to Go Live

Interactive Demo

See uqudo in Action

Experience our seamless banking customer journey:

- Digital account opening

- Secure customer authentication

- High-value transaction authorization

- Multi-channel experience

Unmatched MEA Coverage for Banking Providers

Our identity verification platform is specifically designed for the Middle East and Africa region with:

- 13,000+ AI document scanning support globally

- 156 Passports validated by NFC Chip

- National ID Card Verification across 22 countries

- Arabic OCR and specialized regional character support

- Local regulatory compliance expertise

Frequently Asked Questions

General Integration

How long does integration take for uqudo's identity verification solutions on banking platforms?

Implementation typically completes within 16 weeks for full deployment. Banks can pilot our solution immediately using our No-Code option via secure link. We provide comprehensive testing environments and dedicated implementation support to ensure seamless integration with your existing infrastructure while meeting all regulatory requirements.

What tools and resources are available to start integrating uqudo in banking environments?

We deliver enterprise-grade mobile SDKs (8MB), web integration tools, and robust API connections compatible with core banking systems. Your team receives secure testing environments, banking-optimized user interfaces, and comprehensive technical documentation. Our solution architects guide the entire implementation to align with your compliance framework.

What are the initial steps to deploy uqudo's solutions in a banking platform?

We begin with a requirements assessment to understand your operational needs. Following credential provisioning, you’ll select your deployment architecture (cloud-based or on-premise). Our team configures your preferred customer channels (mobile, web, or instant verification), then manages testing, compliance validation, and production deployment.

Industry-Specific Use Cases

How does uqudo prevent fraud during high-value banking transactions?

Our platform employs AI-powered identity verification with facial biometrics, document authentication via NFC technology, and real-time AML screening against global compliance databases. High-value transactions receive additional biometric authorization layers. Continuous transaction monitoring with pattern recognition identifies and prevents fraudulent activities before they impact operations.

Can uqudo handle complex corporate banking customer onboarding requirements?

Our comprehensive KYB platform verifies companies and corporate entities globally, processes business documentation automatically, maps complete ownership structures including UBOs, and performs Enhanced Due Diligence with thorough compliance screening against 1700+ international watchlists. The unified workflow management system efficiently handles multi-layered corporate structures while ensuring regulatory adherence.

How does uqudo improve customer experience while maintaining banking security standards?

We enable streamlined account opening in under 30 seconds through biometric verification and passwordless authentication, eliminating the need for traditional passwords. Customers access services seamlessly across all channels with enhanced security protocols. This approach reduces onboarding abandonment by 40% while maintaining institutional-grade security standards throughout the customer journey.

Security & Compliance

How does uqudo ensure data security for sensitive banking information?

Our infrastructure implements enterprise-level encryption protocols, multi-layered authentication frameworks, and advanced threat protection systems. Third-party security audits validate our controls regularly. Comprehensive monitoring with automated threat detection and detailed audit trails ensures data integrity and regulatory compliance across all operations.

Does uqudo meet banking-specific regulatory requirements in the MEA region?

We work closely with banking clients to help them meet local data residency and AML/CFT regulations across the MEA region. Uqudo’s unique blend of flexible deployment options, Arabic OCR capabilities, document tampering detection, and government and government database access helps you to navigate the complex regulatory landscape of the region, helping your institution maintain compliance with evolving regulatory landscapes and central bank mandates.

How does uqudo protect against sophisticated banking fraud schemes?

Our multi-layered defense system detects document tampering, prevents biometric spoofing through liveness verification, and identifies duplicate registrations via facial matching technology. Advanced behavioral analytics combined with real-time monitoring detect anomalous patterns, providing comprehensive protection against evolving fraud methodologies targeting financial institutions.

Scalability & Performance

Can uqudo scale to handle high volumes for digital banking platforms?

Our enterprise architecture processes thousands of concurrent verifications with automatic scaling capabilities for peak demand periods. We guarantee 99.99% service availability across cloud, private infrastructure, or on-premise deployments. The platform maintains consistent performance whether processing routine transactions or managing surge volumes.

How does uqudo optimize performance for digital banking onboarding?

Document processing completes within milliseconds at 99.5% accuracy rates. Biometric verification executes in under 100ms. Intelligent capture technology ensures first-attempt success, minimizing customer friction. Our efficient SDK integration preserves application performance while delivering rapid, accurate identity verification across all touchpoints.

What measures ensure uptime and reliability for mission-critical banking operations?

Redundant infrastructure with automated failover mechanisms maintains 99.9% operational availability. Enterprise-grade disaster recovery protocols and predictive system monitoring prevent service disruptions. Our architecture ensures continuous service delivery with data integrity protection, meeting the demanding requirements of 24/7 banking operations.

Support & Customization

What kind of support is available during banking integration?

We provide dedicated technical account management throughout implementation and beyond. Your organization receives priority incident response, scheduled performance reviews, and round-the-clock critical support. Our identity verification specialists work as an extension of your team, ensuring optimal system performance and rapid issue resolution.

Can uqudo customise solutions for specific banking compliance requirements?

uqudo’s white-label SDKs and API adapt to local regulatory needs, supporting 13,000+ documents and NFC for 156 passports. Our AML screening solution offers extensive customisation through configurable risk thresholds, the ability to upload non-standard sanction lists, fuzzy logic matching algorithms, and flexible screening levels (Basic, Advanced, and Level 3 with comprehensive adverse media). Our professional services team is also on hand to deliver highly bespoke customisations to meet the needs of your bank.

How does uqudo assist with ongoing optimization for banking platforms?

We deliver comprehensive performance analytics highlighting verification metrics and optimization opportunities. Regular business reviews identify enhancement areas for conversion improvement and fraud reduction. Our platform evolves continuously to address emerging document standards, fraud vectors, and regulatory changes affecting your operations.

What professional services are available for banking deployment?

Our specialized team provides end-to-end implementation services including workflow design, systems integration, and organizational training. We optimize operational processes to maximize efficiency while ensuring compliance. From strategic planning through continuous improvement, we deliver comprehensive support for successful identity verification deployment.

Secure, frictionless, & fully compliant digital onboarding. Integrated seamlessly within your app.

The Evolution of KYB in the Banking and Digital Platforms Revolution

Tom Green

COO uqudo

How Transaction Monitoring Enhances Compliance and Risk Management

Vlad Simakov

Solution Architect uqudo

OCR Technology in Identity Verification: How It Works and Why It Matters

Karim Tout

Head of AI uqudo

Our clients

Easily integrate  with your tech stack.

with your tech stack.

Use our simple and secure Web SDK, Mobile SDK, or RESTful API to seamlessly integrate identity capabilities into your operations.

See documentationAn award-winning team

uqudo is proud to be recognised by some of the world’s most distinguished organisations.

with your tech stack.

with your tech stack.