What is NFC?

NFC (Near Field Communication) is probably something you have used numerous times, but have no idea what it means. Those payments that you do by simply tapping your phone on the card reader at the supermarket, when you don’t want to use your physical credit card? That is an easy example of how NFC has made our lives easier (and increased our credit card purchases, definitely!)

Most smartphones today have NFC technology in them, and while it is often compared to Bluetooth and Wi-Fi, NFC is a proximity-based wireless technology, meaning that it only works in a very short range. NFC uses magnetic field induction to enable two devices to connect when they are at a very short distance (generally a few centimetres) from each other. Bluetooth on the other hand uses frequency hopping to exchange data between devices over short distances (generally up to 10 metres).

NFC has evolved from RFID (Radio Frequency Identification) technology and works at a standard frequency of 13.56 MHz. The first set of specifications for NFC tags was produced in 2006, and the first NFC-enabled smartphone was also introduced around the same time.

The major difference between NFC and RFID is that RFID is a contactless one-way method of communication that can occur at varying distances. In contrast, NFC is a two-way mode of communication where both devices have to be within a few centimetres of each other. This short-distance communication in fact makes NFC more secure.

What makes NFC easy to use is the fact that it does not require manual pairing or device discovery. When an NFC tag comes in close proximity to an NFC reader, the NFC connection is established and the devices can connect with each other.

How does NFC work?

NFC establishes a short-range network using electromagnetic radio fields, and this range is where the connection between the tags is established. NFC is a type of RFID, with a communication range of 10 cm, making it work for very small distances.

Like any other RFID tag, NFC works when the NFC tag and the NFC reader exchange information in the form of NFC data exchange. Since a wireless connection is established in seconds, data transfer using NFC is super fast, making it a very secure and convenient method of transferring information.

NFC also works without using Bluetooth or an internet connection, making it easy for consumers to use it regularly. An NFC reader connects only to one device at a time, minimizing the chances of any incorrect transactions when used for payments.

An NFC network consists of 2 devices, an initiator and a target device. These devices work either in an active mode or in a passive mode. Active mode refers to the device having its power supply or battery, whereas passive mode devices get their power from the active one. Devices using NFC can alternate between active and passive mode when being used as the transmitter or receiver, whereas NFC tags are always in a passive mode.

NFC devices in the active mode can send and receive data alternatively, and generally work in the following operating modes:

- Card emulation mode: In this, the NFC device (eg, the smartphone) acts like a contactless smart card. Here, the device does not generate its own RF field and data is transferred between the NFC device and the NFC reader.

- Peer-to-peer mode: In this, two-way communication between two devices takes place, where both devices can initiate communication.

- Reader/Writer mode: In this, the NFC-enabled device acts as a reader for the NFC tags containing smartcards or devices. This device can immediately detect the presence of a close target.

Was that a bit hard to understand? Well, let’s understand that using a common example. When you tap your phone wallet to a card machine for payments, you are actually using NFC for the process. In this, the card machine acts as the initiator (also called a reader), which sends out a signal searching for an NFC-enabled device. When you bring your NFC-enabled phone very close to the card machine, the payment information is communicated between the two devices, and then processed.

How can businesses use NFC?

NFC allows two devices in close proximity to communicate, which is an important method of data transmission for numerous applications. Since most smartphones nowadays are NFC enabled, it makes it very easy for businesses to use NFC in various applications.

1. Identity verification

Passive NFC tags are nowadays used to store an individual’s identification information on passports and other identity cards. This not only meets legal requirements for identity but also makes identity sharing and verification very easy. More on NFC in the world of digital identity in the sections below.

2. Payments

Probably the most common application of NFC technology, contactless NFC payment transactions are widely used today. Most debit and credit cards today come with a built-in NFC tag which can be emulated on smartphones’ wallet systems (Eg Google Pay, Apple Pay, Samsung Pay etc), which validates the cards with the individuals’ bank accounts. Once validated, the smartphone can be used for payments by bringing it in close proximity to the card readers. An important benefit here is that since NFC only works at close distances, the chances of you paying for someone else’s transaction are minimal.

3. Controlled access

Another usage of NFC (and RFID) is while providing access to controlled places like workplaces, institutions, hotel rooms and residential buildings. Since NFC is highly secure, it makes it easy to monitor every individual’s activity.

4. Public transportation

NFC tags loaded on an individual’s smartphone can provide easier and more convenient access to public transportation since it is much easier to simply tap your device to the ticketing system as compared to using paper tickets or a physical card.

5. Collecting information

You might have used QR codes at a museum or workshop to learn more about the event. Using NFC in this case makes it easier to store more information, since QR codes are quite limited by the amount of information they can hold, and devices need to have a particular QR code scanning app to use this feature well.

How does NFC facilitate digital identity?

With most people owning an NFC-enabled smartphone that has made in-store payments quicker, it is easy to believe that the financial sector has the greatest usage of near-field communication. But along with payments, NFC has now enabled a more secure and efficient method of identity verification.

Even though there are methods for identity verification using different technologies, identity industry experts believe that using NFC is advantageous because NFC-enabled smartphones are present with most people today and identity verification is a service which should be easily accessible to all. We wouldn’t want a new device simply for identity verification purposes, right?

Another important reason why NFC-enable identity verification is a great feature in digital identity is the security that NFC provides, which makes it very hard for identity theft to occur. With the International Civil Aviation Organization (ICAO) pushing governments across the world to use chip-based identity documents, it makes sense to use NFC-enabled identity verification.

With more than 150 countries today having NFC-enabled passports (called e-passports or biometric passports), authenticating the identity of individuals during border and access control has become faster and more efficient.

For identity verification, NFC readers can be used to verify the identity of an individual using information present in the RFID chip on an identity card. The NFC reader can access personal information such as name, date of birth, etc stored on the identity card and then use it for identity verification.

Using an NFC-enabled device for identity verification is not only secure and time-saving but since most smartphones are NFC-enabled today, it makes it easy for customers to simply use their devices for identity verification.

What are the benefits of NFC?

With the NFC technology having numerous applications like identity verification, transactions, and transportation, it is no surprise that the global NFC market is estimated to hit $54.52 billion by 2028, with a CAGR of 14.8% from 2021 to 2028.

Some key advantages of using NFC are;

1. Ease of accessibility

With most people owning a smartphone today, and most of them being NFC-enabled, it is very convenient for industries to design credit cards, identification documents and other NFC tags that can be easily used by people from the comfort of their personal devices.

2. Greater security

NFC is a proximity-based wireless technology, which means that only if the NFC chip containing card is brought close (< 10 cm) to the reader can any transaction/identification be approved. Being highly secure, it is very difficult for criminals to utilise someone’s personal details for their benefit. Since smartphones generally have numerous authentication methods, they are much safer to use in comparison to a physical card.

3. Saves time

The entire NFC process is rapid and this, in turn, speeds up transactions and customer identification, making the entire process seamless. Since NFC technology can be easily implemented, it helps save set-up time.

4. Does not require network connectivity

A major advantage of NFC is that it does not require any Bluetooth or internet connection. This makes it easier for people to conduct transactions and other NFC-related services without connecting their devices to the internet. This makes it feasible for small-scale businesses to use NFC-enabled devices for their services.

5. Enhanced user experience

An important factor for any consumer-driven industry, an enhanced user experience is a guarantee while using NFC tags. This is because the NFC process takes seconds to complete and doesn’t require any special software or application on a smartphone. And what’s the one thing most people have on them all the time? Their smartphones, of course! This quick and efficient process enables anyone with a smartphone to use NFC for different purposes.

6. Prevents fraud

NFC technologies can detect fraudulent documents in real time, making it easy to identify those with forged documents, thereby protecting an organisation from criminal activities.

7. Eco-friendly

Obviously using your smartphones instead of physical cards/paper documentation is better for the environment since it reduces the manufacturing costs of making physical cards and other documents.

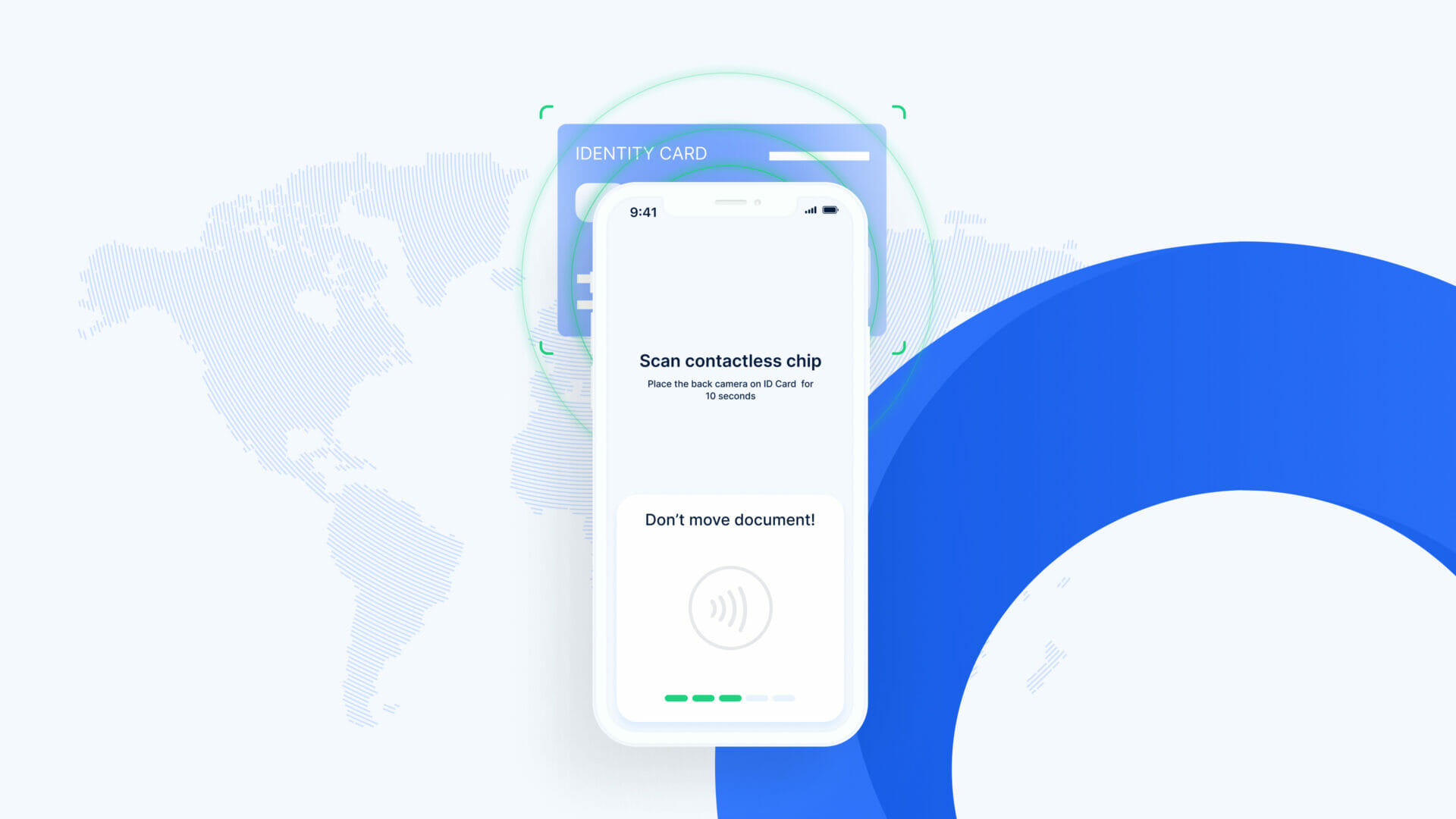

How does uqudo’s NFC-based identity verification work?

uqudo’s identity tech stack consists of an NFC reader and scanner that can verify your customer’s identity documents. For this, the customer has to first take a photo of the identity document. Next, the ID card has to be placed against the smartphone’s rear camera for the device to access its NFC chip.

The smartphone then reads the data from the contactless NFC chip that is embedded in the ID document. This digitally signed data includes a face image. Next, our SDK validates the certificates to ensure the data read is genuine.

uqudo’s NFC identity verification solutions can;

- Verify NFC chips using digital signatures in passports from 42 countries.

- Verify NFC chips using digital signatures from National IDs from countries that no other provider can including UAE, Oman and Bahrain.

After the NFC-enabled ID verification, our KYC and Screening process involves facial recognition, document verification and data validation for further verification.

To learn more about how you can use NFC verification in your business, get in touch with our team.