Secure & Compliant Money Remittance: Identity Verification and Risk Management That Powers Cross-Border Transfers

Deliver frictionless digital onboarding, prevent transfer fraud, and ensure regulatory compliance across remittance channels, creating trust in every transaction.

Flexible Implementation for Every Remittance Journey

- Mobile SDK

- Web SDK

- API

- No-Code Solution

-

Mobile SDK (8MB)

Remittance apps

NFC verification, offline capabilities, millisecond document scanning.

-

Web SDK

Online remittance platforms

Browser-friendly prompts, virtual camera detection, seamless integration.

-

API

Core platform integration

Tailored verification flows, high-volume transaction support, screening functionality.

-

No-Code Solution

Agent/kiosk deployment

QR code access, fully hosted experience, zero development time.

Deployment Options

- Multi-tenant SaaS with regional hosting

- On-premise for stringent data residency requirements

- Hybrid approaches for specialized remittance compliance needs

Identity Technology Made For Remittance Success

- AI Document Scanning

- Face Verification & Liveness

- NFC Verification

- National Citizen Registry

- AML Screening

- Biometric Authentication

- Transaction Monitoring

-

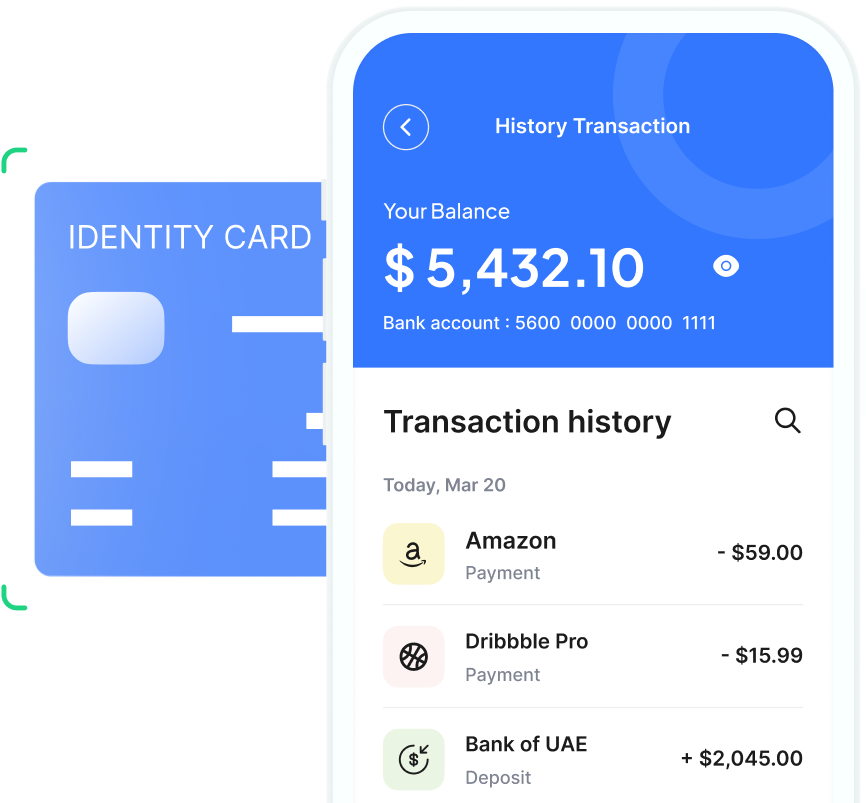

AI Document Scanning

Verify sender and recipient IDs in milliseconds with 99.5% accuracy across 13,000+ global document types, essential for cross-border compliance

-

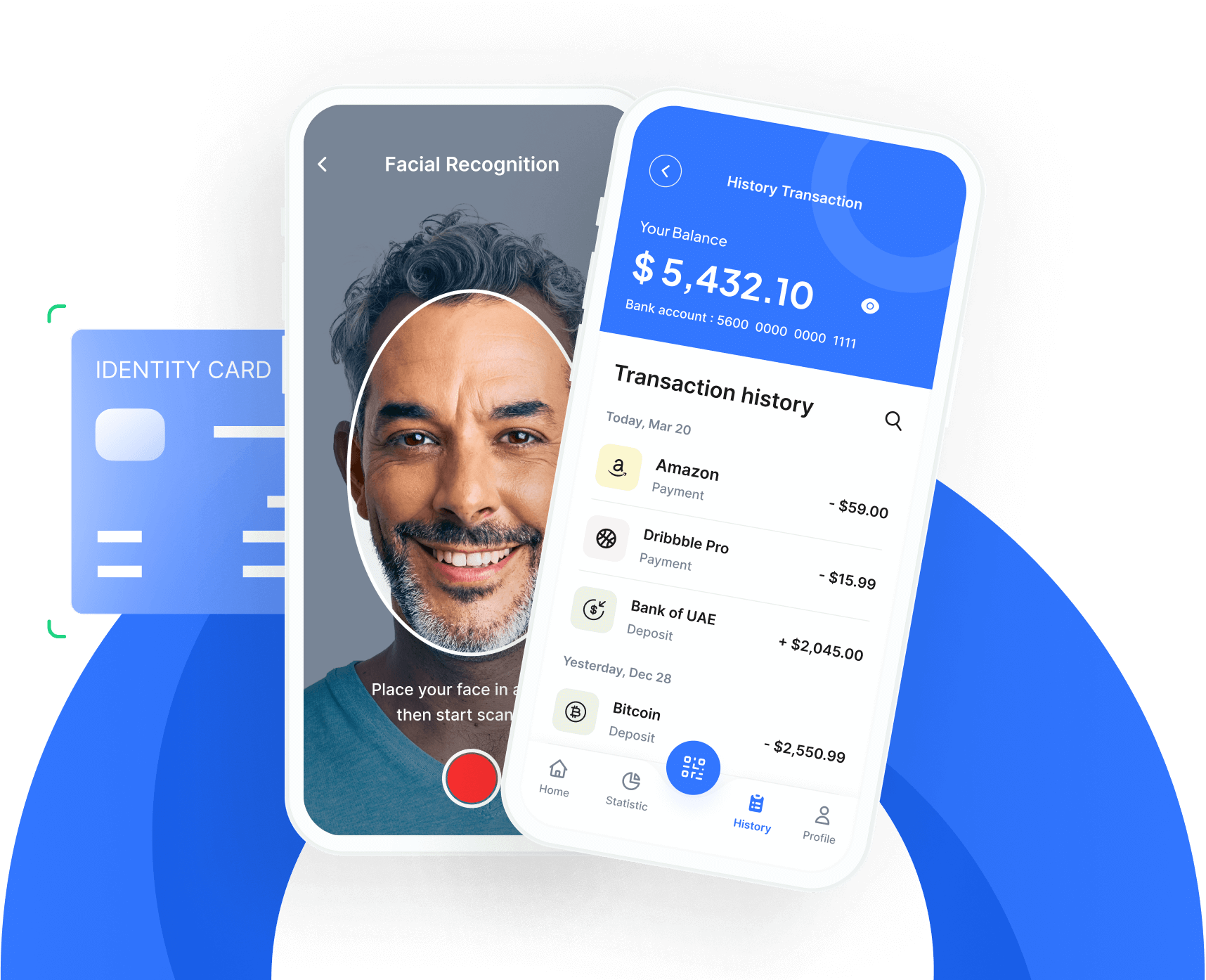

Face Verification & Liveness

Authenticate users in seconds with MEA-optimized algorithms that prevent impersonation, a critical risk in remittance fraud

-

NFC Verification

Achieve highest-level assurance for high-value transfers by cryptographically verifying chip-enabled IDs - a capability unique to uqudo in many MEA markets

-

National Citizen Registry

Connect directly to government databases in 9+ countries for real-time identity validation, reducing compliance risk in major remittance corridors

-

AML Screening

Screen against 1700+ global sanction lists and 1.7M+ PEPs in real-time to prevent illegal transfers and maintain regulatory compliance

-

Biometric Authentication

Secure recurring transfers with fast facial authentication that eliminates passwords while maintaining strong security

-

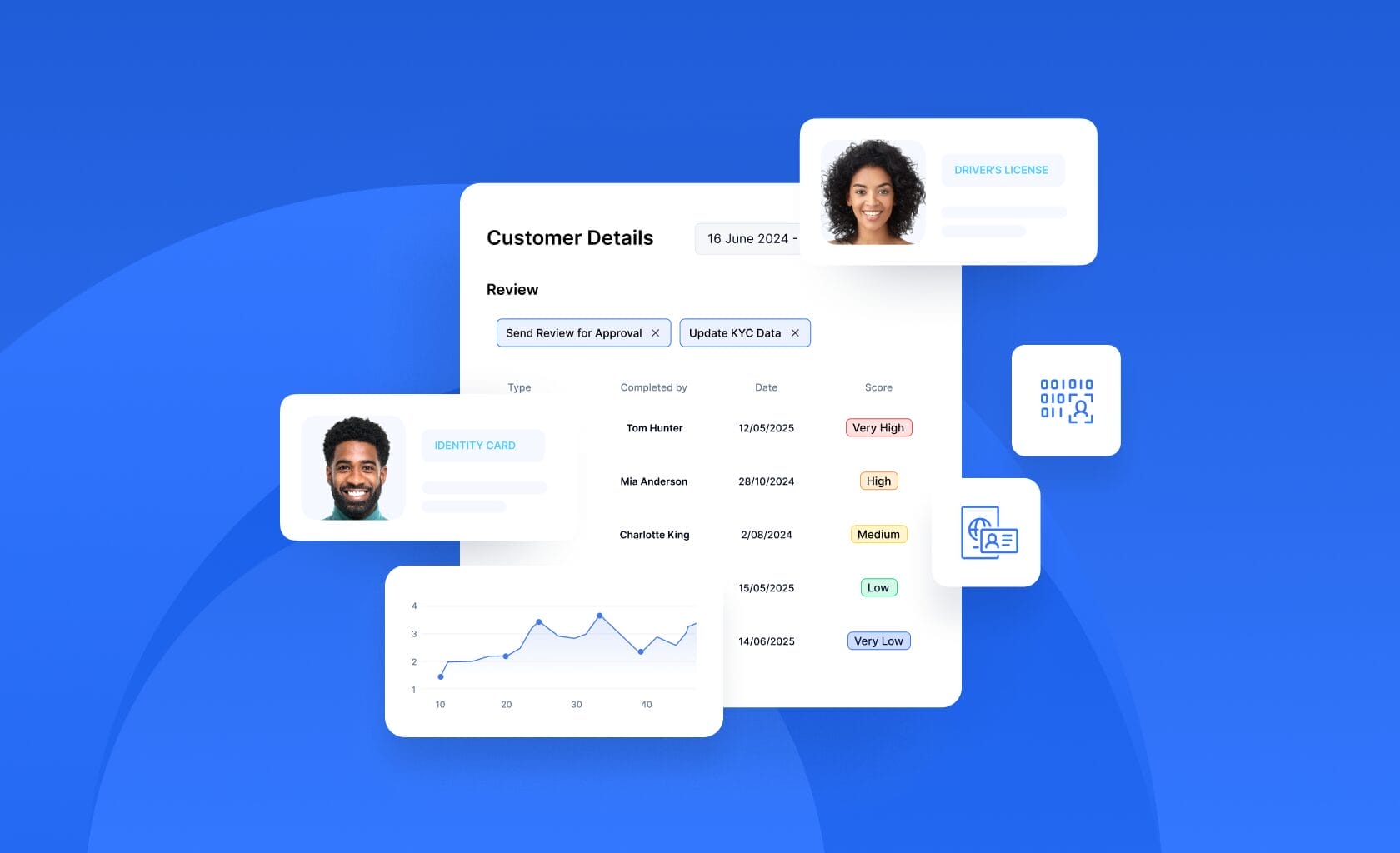

Transaction Monitoring

Flag suspicious patterns with AI-powered rules designed specifically for remittance risk scenarios and regulatory reporting requirements

Enterprise-Grade Security for Remittance Services

- ISO 27001: Information security management [in progress, Completed stage-1 Assessment]

- Livenss Detection: ISO/IEC 30107-3

- Penetration Test: Available on request

Our solutions help money transfer providers meet evolving regulatory requirements in the MEA region and beyond, with special emphasis on AML/CFT compliance, customer data protection, and secure cross-border transaction processing.

Implementation Timeline

Our dedicated implementation team specializes in remittance workflows and can accelerate your deployment with pre-built templates and configurations tailored for common remittance corridors.

Your Streamlined Path to Go Live

Interactive Demo

See uqudo in Action

Experience our seamless remittance customer journey:

- Digital customer onboarding

- Secure transaction authentication

- Recipient verification

- Multi-channel experience

Unmatched MEA Coverage for Remittance Providers

Our identity verification platform is specifically designed for the Middle East and Africa region with:

- 13,000+ AI document scanning support globally

- 156 Passports validated by NFC Chip

- National ID Card Verification across 22 countries

- Arabic OCR and specialized regional character support

- Local regulatory compliance expertise in major remittance corridors

Frequently Asked Questions

General Integration

How long does integration take for uqudo's identity verification solutions on money remittance platforms?

Implementation typically completes within 8 weeks for full deployment. Remittance providers can pilot our solution immediately using our No-Code option via secure link or QR code to scale across multiple markets. We provide comprehensive testing environments and dedicated implementation support to ensure seamless integration while meeting cross-border transaction regulations.

What tools and resources are available to start integrating uqudo in remittance services?

We deliver enterprise-grade mobile SDKs (8MB), web integration tools, and robust API connections compatible with remittance systems. Your team receives secure testing environments, multi-language interfaces, cross-border verification guidance, and comprehensive technical documentation. Our solution architects guide the entire implementation optimized for high-volume, low-latency operations.

What are the initial steps to deploy uqudo's solutions in a money remittance platform?

We begin with a requirements assessment to understand your corridor needs. Following credential provisioning, you’ll select your deployment architecture (cloud-based or on-premise with multi-country data residency). Our team configures sender and receiver verification flows across your channels, then manages testing, compliance validation, and production deployment across target markets.

Industry-Specific Use Cases

How does uqudo prevent fraud in cross-border money transfers?

Our platform employs AI-driven identity verification with NFC technology and real-time AML screening to combat remittance fraud. The 1:N Face Search prevents account takeovers and synthetic identities. Transaction Authentication with biometrics secures high-value transfers, while behavioral analytics identifies patterns indicating money laundering or structured transactions across corridors.

Can uqudo handle rapid verification across multiple remittance corridors?

Our global coverage supports 13,000+ identity documents and NFC verification for 156 passports, enabling rapid verification across diverse corridors. AI document scanning with multi-language OCR captures sender and receiver details in milliseconds. The scalable architecture handles peak volumes during holidays and month-end, while our KYB solution streamlines agent onboarding globally.

How does uqudo improve customer conversion rates for remittance services?

We enable streamlined onboarding in under 30 seconds through biometric authentication. Passwordless login reduces friction for repeat customers, while our lightweight SDK integrates seamlessly with remittance apps. No-Code KYC enables rapid agent deployment. This approach increases conversion rates significantly while reducing fraud losses through secure authentication.

Security & Compliance

How does uqudo ensure data security for cross-border remittance transactions?

Our infrastructure implements enterprise-level encryption protocols, multi-layered authentication frameworks, and advanced threat protection systems. Third-party security audits validate our controls regularly. Comprehensive monitoring with automated threat detection and detailed audit trails ensures transaction data integrity and regulatory compliance across multiple jurisdictions.

Does uqudo meet remittance-specific regulatory requirements in the MEA region?

We work closely with remittance providers to help them meet local data residency and AML/CFT regulations across the MEA region and beyond. Uqudo’s unique blend of flexible deployment options, multi-language OCR capabilities, document tampering detection, and government database access helps you navigate the complex regulatory landscape, ensuring compliance with financial authority mandates.

How does uqudo protect against emerging fraud schemes targeting remittance services?

Our multi-layered defense system detects document tampering across OCR, MRZ, and NFC channels. Presentation attack detection with infrared analysis prevents spoofing, while deepfake detection blocks AI-generated identity theft. Event analytics examines user behavior patterns across corridors, providing comprehensive protection against coordinated fraud schemes targeting money transfers.

Scalability & Performance

Can uqudo scale to handle peak volumes during high remittance seasons?

Our enterprise architecture processes thousands of concurrent verifications with automatic scaling for peak periods like holidays and month-end. We guarantee service availability across cloud, private infrastructure, or on-premise deployments. The platform adapts to changing geographic transaction patterns, maintaining consistent performance across all remittance corridors.

How does uqudo optimize performance for remittance verification processes?

Document processing completes within milliseconds at 99.5% accuracy rates. Facial recognition executes in under 100ms even in challenging agent environments. Our efficient 8MB SDK works seamlessly on limited bandwidth networks common in emerging markets. Quality detection ensures first-attempt success, minimizing customer wait times.

What measures ensure reliability for 24/7 remittance operations?

Redundant infrastructure with automated failover mechanisms maintains 99.9% operational availability for round-the-clock operations. Enterprise-grade disaster recovery protocols and predictive system monitoring prevent service disruptions. Regional data processing reduces latency for global networks, ensuring continuous service delivery for time-sensitive transfers with complete data integrity.

Support & Customization

What kind of support is available during remittance service integration?

We provide dedicated technical account management throughout implementation and beyond. Your organization receives priority incident response, scheduled performance reviews, and 24/7 emergency support for global operations. Our identity verification specialists work as an extension of your team, ensuring optimal performance across all corridors.

Can uqudo customize solutions for specific remittance compliance requirements?

uqudo’s white-label SDKs and API adapt to local regulatory needs, supporting 13,000+ documents and NFC for 156 passports. Our AML screening solution offers extensive customization through configurable risk thresholds, the ability to upload non-standard sanction lists, fuzzy logic matching algorithms, and flexible screening levels (Basic, Advanced, and Level 3 with comprehensive adverse media). Our professional services team delivers bespoke customizations for your remittance operations.

How does uqudo assist with ongoing optimization for remittance platforms?

We deliver comprehensive performance analytics highlighting corridor effectiveness, agent metrics, and verification patterns across regions. Regular business reviews identify enhancement areas for fraud reduction and customer experience improvement. Our platform evolves continuously to address emerging fraud vectors and regulatory changes affecting global remittance operations.

What professional services are available for remittance network deployment?

Our specialized team provides end-to-end implementation services including corridor workflow design, payment system integration, and agent network enablement. We optimize verification processes for both digital and agent-based channels while ensuring compliance. From strategic planning through continuous improvement, we deliver comprehensive support for successful identity verification deployment across your global footprint.

Secure, frictionless, & fully compliant digital onboarding. Integrated seamlessly within your app.

How Transaction Monitoring Enhances Compliance and Risk Management

Vlad Simakov

Solution Architect uqudo

The Advantages of Adopting Passwordless Authentication Services in the Digital Age

Tom Green

COO uqudo

Unveiling the Role of AI Document Scanning in Ensuring Fraud Protection

Tom Green

COO uqudo

Our clients

Easily integrate  with your tech stack.

with your tech stack.

Use our simple and secure Web SDK, Mobile SDK, or RESTful API to seamlessly integrate identity capabilities into your operations.

See documentationAn award-winning team

uqudo is proud to be recognised by some of the world’s most distinguished organisations.

with your tech stack.

with your tech stack.