Trusted Digital Identity Solutions in Tanzania

MEA’s leading identity platform delivering secure, frictionless verification for Tanzania’s growing digital economy

Transform Identity Verification for Tanzania’s Evolving Digital Economy

Empowering Tanzania’s Digital Identity Landscape

Tanzania is making significant advances in its digital transformation journey, with ambitious initiatives through the National ICT Policy and Tanzania Development Vision 2025. As financial inclusion expands and digital services grow across banking, mobile money, and e-government, robust identity verification has become essential for businesses operating in Tanzania’s developing digital ecosystem.

Solving key challenges

-

Regulatory Compliance

Meeting the requirements established by the Bank of Tanzania (BOT) and Financial Intelligence Unit (FIU-TZ)

-

Document Authenticity

Verifying the authenticity of Tanzanian identity documents including national ID cards and passports with precision

-

Multi-Language Support

Supporting English and Swahili character recognition and document processing with high accuracy

-

Mobile-First Security

Balancing security with frictionless user experiences for digital identity verification

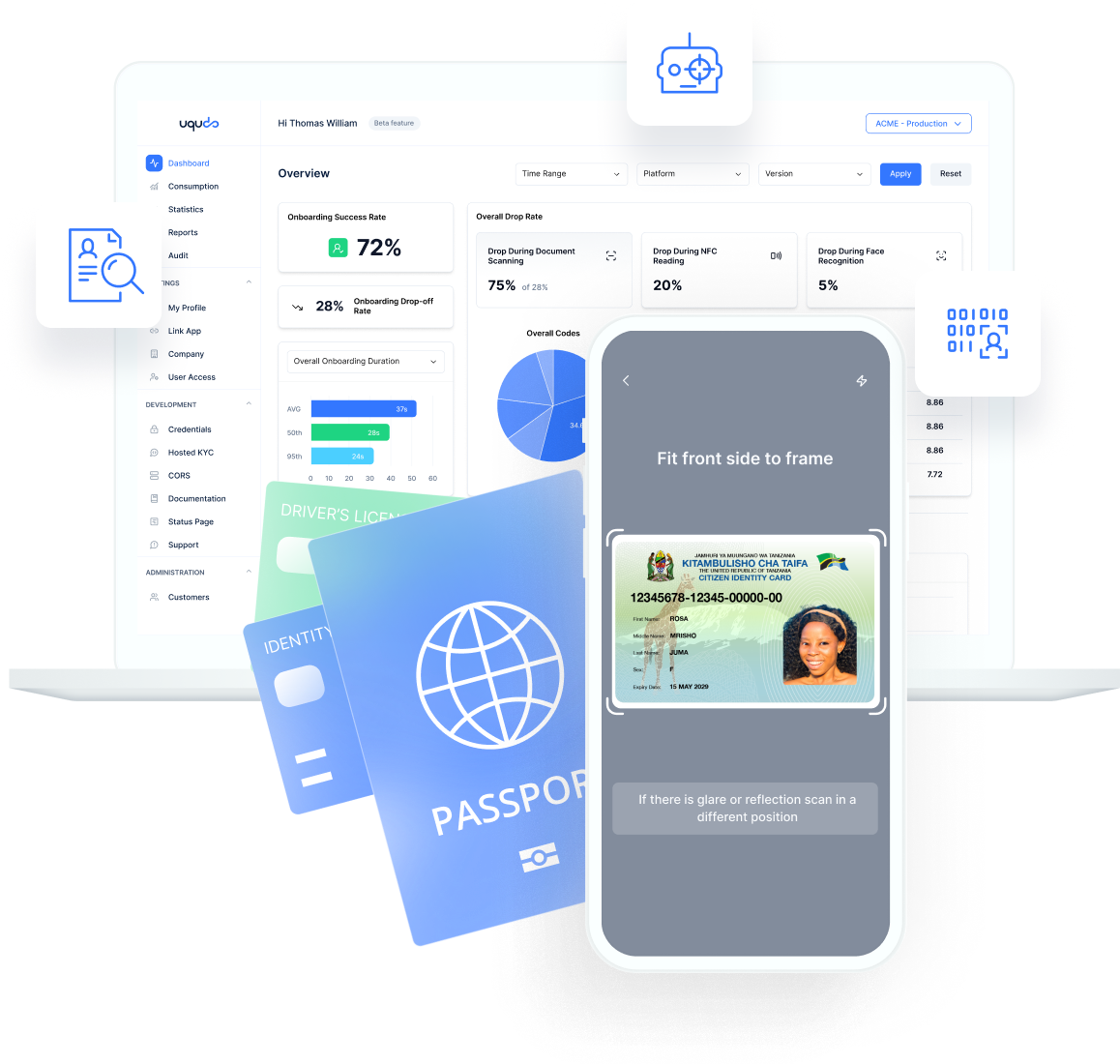

uqudo’s Tanzania-Focused Solution

uqudo delivers a comprehensive digital identity platform optimized for Tanzania’s unique needs, supporting local identity documents with advanced verification technologies including NFC chip reading and verification that help businesses achieve regulatory compliance while creating seamless user experiences.

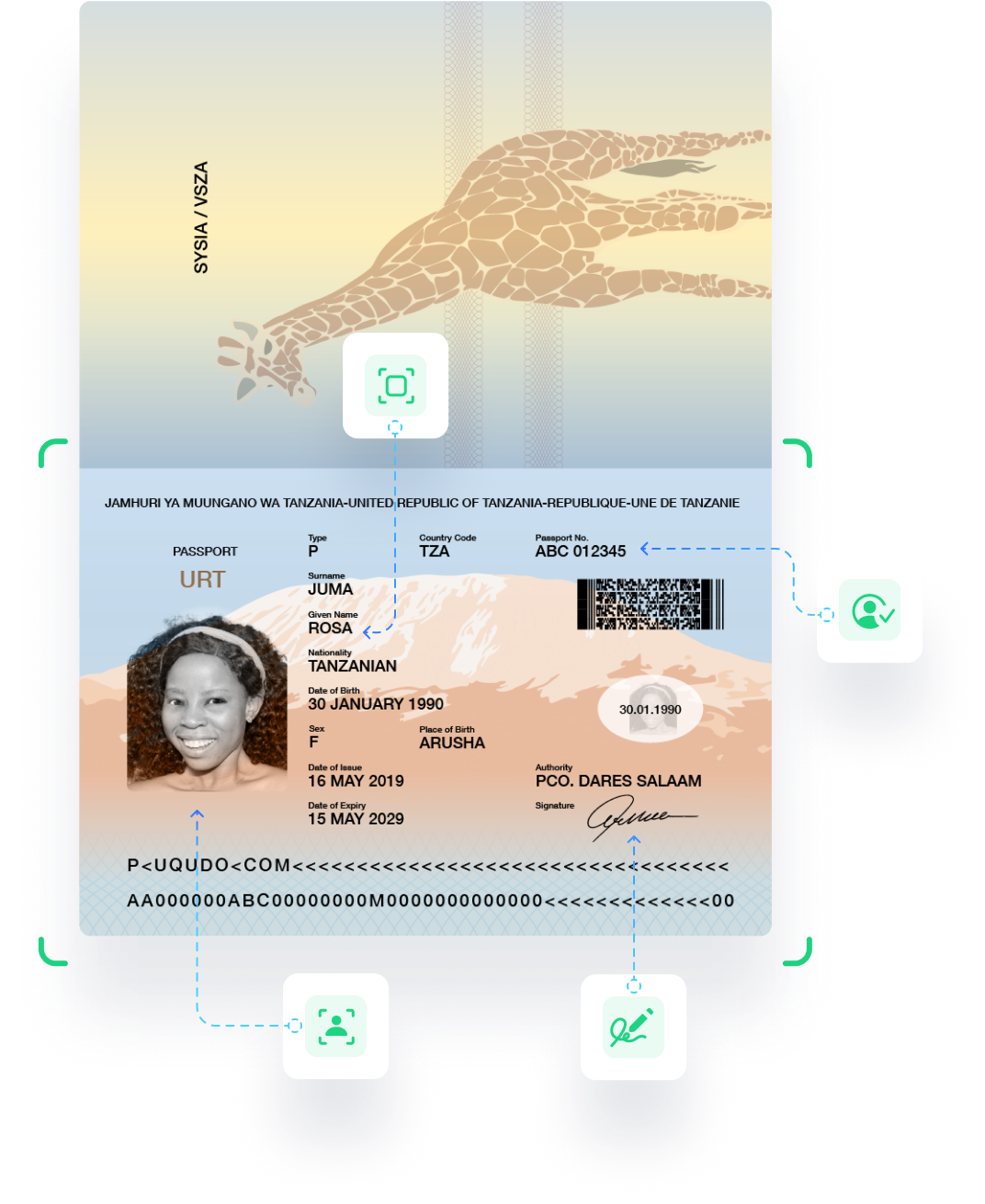

Verify Tanzanian Identity Documents with Precision

The Tanzanian National Identity Card, issued by the National Identification Authority (NIDA), is fully supported by uqudo’s advanced verification technology with multiple validation layers.

uqudo verifies Tanzanian passports issued by the Immigration Services Department, extracting and validating all critical personal information through multiple verification layers.

As a leading identity verification provider, uqudo supports comprehensive verification of driving licenses issued by the Tanzania Revenue Authority.

- National Identity Card

- Passport

- Driving License

AI Document Scanning

-

Quality Detection

-

Advanced Tampering Detection

-

Superior OCR Capabilities

NFC Reading & Verification

-

Enhanced Security

-

Data Verification

-

Stronger Assurance

AI Document Scanning

-

Millisecond Processing

-

MRZ Validation

-

Comprehensive Tampering Detection

NFC Chip Reading

-

Enhanced Security

-

Stronger Assurance

-

Streamlined Experience

AI Document Scanning

-

Precision Document Isolation

-

Quality Assessment

-

Tampering Detection

-

Enhanced Data Extraction

Experience Advanced Document Verification for Tanzanian Identity Documents

See how uqudo verifies Tanzanian ID cards, passports, and driving license checks with millisecond processing, NFC verification, and multi-layered tampering detection.

Navigate Tanzania’s Evolving Compliance Requirements

- Regulators

- Data Protection

- Data Residency

- Data Subject Consent

- AML / CFT

Regulatory Authority

• Bank of Tanzania (BOT)

• Tanzania Communications Regulatory Authority (TCRA)

• Financial Intelligence Unit (FIU)

• National Identification Authority (NIDA)

Key Legislation

• Data Protection Act, 2022

• Cybercrimes Act, 2015

Regulatory Authority

• Ministry of Information, Communication and Information Technology

Key Legislation

• Electronic Transactions Act, 2015

• Bank of Tanzania Circular on Financial Data Localization

Regulatory Authority

• Bank of Tanzania (BOT)

• Tanzania Communications Regulatory Authority (TCRA)

Key Legislation

• Data Protection Act, 2022

Regulatory Authority

• Ministry of Information, Communication and Information Technology

Key Legislation

• Anti-Money Laundering Act, 2006 (as amended)

• Anti-Money Laundering Regulations, 2012

• Bank of Tanzania AML/CFT Guidelines

Regulatory Authority

• Financial Intelligence Unit (FIU)

• Bank of Tanzania (BOT)

Deploy Identity solutions that meet your specific requirements

Flexible Implementation to meet local requirements

-

Private Cloud Hosting

-

In-Country Hosting

-

On-Premise Deployment

Security and Compliance

-

Strong Encryption

-

Local Compliance

-

Security Audits

Build Trust Across

the Customer Lifecycle

Complete KYC Solutions

Deliver end-to-end digital ID verification optimized for Tanzanian requirements with advanced document validation, NFC verification, biometric matching, and customizable workflows that balance security with user experience.

KYB (Know Your Business)

Automate Tanzanian business verification with comprehensive company data, ownership structure mapping, and document validation that streamlines due diligence while enhancing risk assessment accuracy.

AML Screening solutions

Screen against global sanctions, identify politically exposed persons, and monitor adverse media with continuous screening that helps clients identify emerging risks across Tanzania’s business landscape.

Advanced Authentication

Secure user accounts with biometric login, transaction authorization, and multi-factor authentication that prevents fraud while delivering seamless experiences across digital touchpoints.

Transaction Monitoring

Detect suspicious patterns with real-time analysis, configurable rules, and AI-assisted insights that streamline alert investigation and strengthen fraud prevention capabilities.

Professional Services

Deploy identity expertise through solution design, integration support, and ongoing optimization delivered by specialists who understand Tanzania’s unique verification challenges and regulatory landscape.

Leverage Purpose-Built Technology for Tanzania's Unique Requirements

Multi-Language Support

Enable verification interfaces in both English and Swahili, ensuring accessibility and ease of use for all Tanzanian users.

NFC Verification Excellence

Provide the highest level of identity assurance with NFC chip reading for both national ID cards and passports, extracting and verifying cryptographically secured data for superior verification certainty.

Advanced Biometrics

Prevent identity fraud with facial recognition technology optimized for diverse populations, multi-layered spoofing protection, and passive liveness detection that delivers security without compromising user experience.

Seamless Integration

Detect sophisticated fraud with five-pillar tampering detection, event analytics, source validation, and advanced verification that provides unparalleled protection against document manipulation.

AI-Powered Security

Detect sophisticated fraud with five-pillar tampering detection, event analytics, source validation, and advanced verification that provides unparalleled protection against document manipulation.

Offline Capabilities

Maintain verification functionality even with intermittent connectivity, addressing the infrastructure challenges in rural regions of Tanzania.

Frequently Asked Questions

What Tanzanian identity documents does uqudo support?

uqudo supports comprehensive verification of Tanzanian National ID cards, passports, and driving licenses with AI document scanning technology. Additionally, we offer NFC reading and verification for national ID cards and NFC reading for passports.

Does uqudo support verification of the NFC chip in Tanzanian ID cards?

Yes, uqudo has advanced capabilities to both read and verify data from the NFC chips embedded in Tanzanian national ID cards, providing the highest level of verification assurance.

Does uqudo support Swahili language recognition for Tanzanian documents?

Yes, uqudo’s OCR technology supports both English and Swahili languages, ensuring accurate data extraction from Tanzanian identity documents regardless of the language used.

How does uqudo ensure the authenticity of Tanzanian identity documents?

uqudo employs advanced AI document scanning with MRZ code verification for passports, NFC chip reading for ID cards and passports, and our five-pillar tampering detection system to ensure document authenticity.

What deployment options are available for Tanzanian businesses?

uqudo offers flexible deployment including SaaS cloud solutions, in-country hosting options to address data residency requirements, and on-premise deployment for specific security needs.

How does uqudo support data residency requirements in Tanzania?

uqudo provides in-country hosting that meets data residency requirements in Tanzania, helping clients comply with the Electronic Transactions Act and Bank of Tanzania circulars on financial data localization.

What integration options does uqudo offer for Tanzanian businesses?

uqudo provides multiple integration paths including lightweight mobile SDKs (8MB), web SDKs, comprehensive APIs, and no-code solutions to suit different technical requirements.

How does uqudo help with Tanzania's data protection requirements?

uqudo’s flexible solution helps clients navigate Tanzania’s regulatory landscape including the Data Protection Act, 2022, providing features that support compliance with data subject consent requirements and privacy best practices.

Can uqudo help with Bank of Tanzania's KYC/AML requirements?

Yes, uqudo works with financial institutions to help them achieve compliance with Bank of Tanzania regulations on KYC/AML, including the Anti-Money Laundering Act, 2006 (as amended) and related guidelines.

How does uqudo address telecom subscriber verification requirements?

uqudo provides solutions that help telecom providers address subscriber verification requirements outlined by the Tanzania Communications Regulatory Authority (TCRA), supporting SIM registration compliance.

What are the main identity fraud challenges in Tanzania?

Common challenges include document forgery and tampering, synthetic identity fraud, and account takeover attempts. Tanzania’s growing digital economy has created opportunities but also new fraud vectors that require advanced detection capabilities.

How does uqudo address document tampering specific to Tanzanian IDs?

uqudo’s five-pillar tampering detection system is tuned for Tanzanian documents, including source detection, ID photo integrity checks, consistency verification, and event analytics to identify both physical and digital tampering.

What are the best practices for identity verification in Tanzania's financial sector?

Best practices include implementing multi-layered verification (document + NFC + biometrics), continuous monitoring, and comprehensive OCR for accurate data extraction while maintaining a frictionless user experience that supports Bank of Tanzania guidelines.

Manual to Automated: Understanding the Changing Landscape of KYB

Tom Green

COO uqudo

AML Compliance: Navigating the Challenges of Cryptocurrency and Digital Payments

Tom Green

COO uqudo

Unveiling the Role of AI Document Scanning in Ensuring Fraud Protection

Tom Green

COO uqudo

Our clients

Easily integrate  with your tech stack.

with your tech stack.

Use our simple and secure Web SDK, Mobile SDK, or RESTful API to seamlessly integrate identity capabilities into your operations.

See documentationAn award-winning team

uqudo is proud to be recognised by some of the world’s most distinguished organisations.

with your tech stack.

with your tech stack.