Transaction Authorization

Secure Verification for High-Value Actions

uqudo’s Transaction Authorization solution provides robust verification for sensitive operations while maintaining a seamless user experience.

Key Capabilities

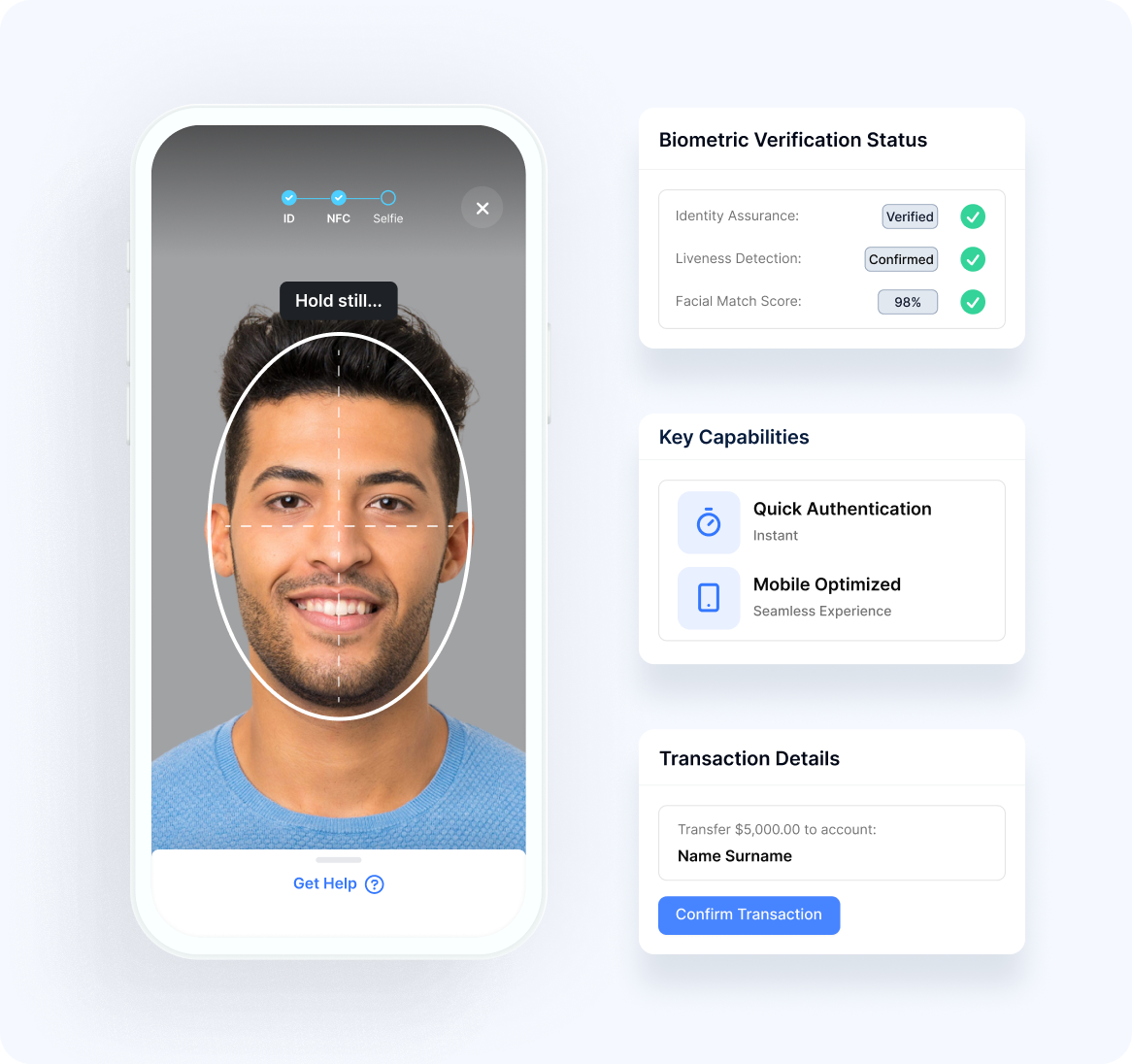

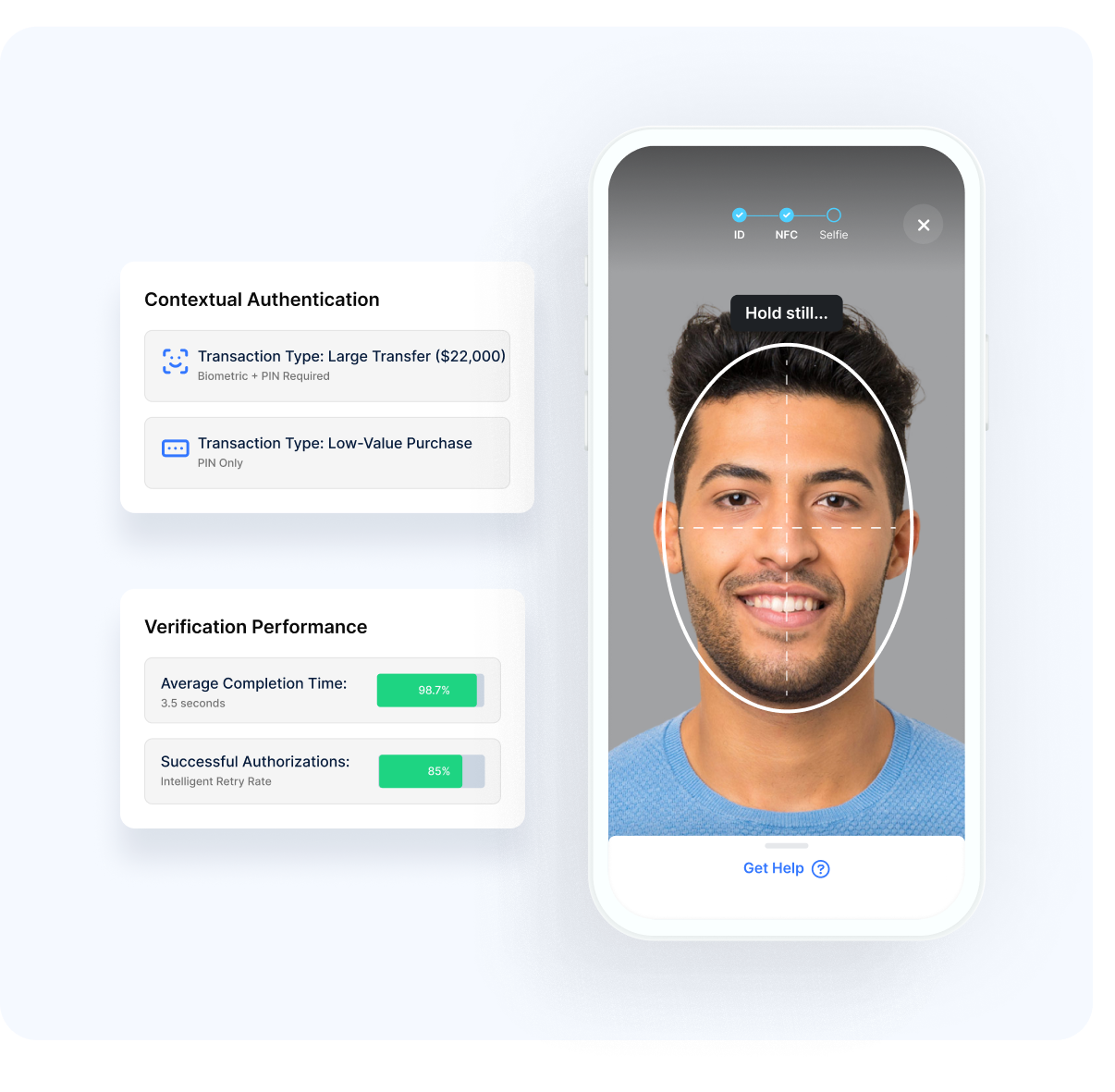

Biometric Transaction Verification

Our platform employs facial recognition for secure action confirmation:

Biometric Authorization

- Identity AssuranceVerification of the user’s identity for critical transactions

- Liveness DetectionConfirmation of genuine user presence during authorization

- Intent ConfirmationExplicit verification of the user’s desire to proceed

- Quick AuthenticationRapid verification to maintain transaction flow

- Mobile OptimizationStreamlined experience on smartphones and tablets

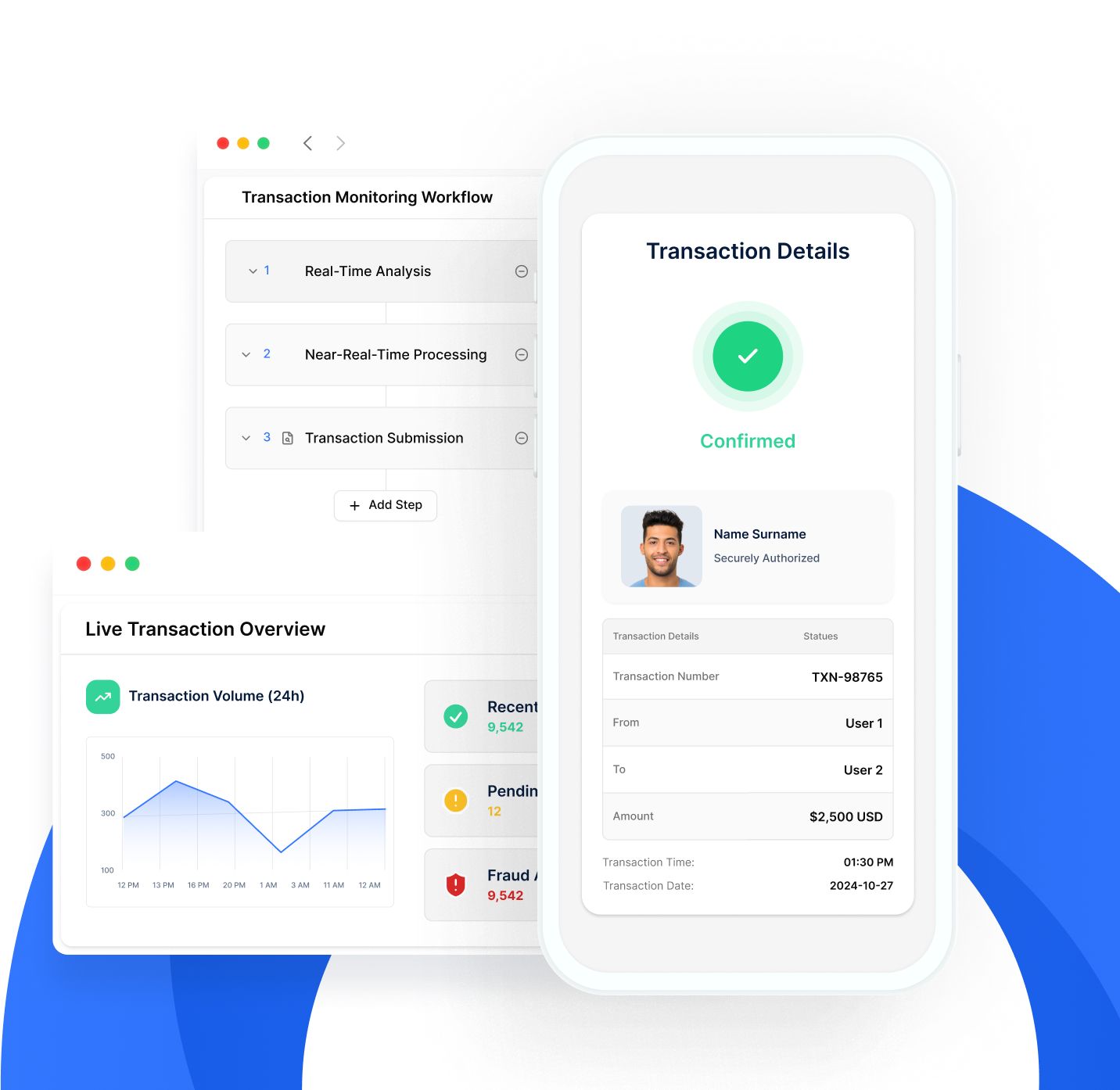

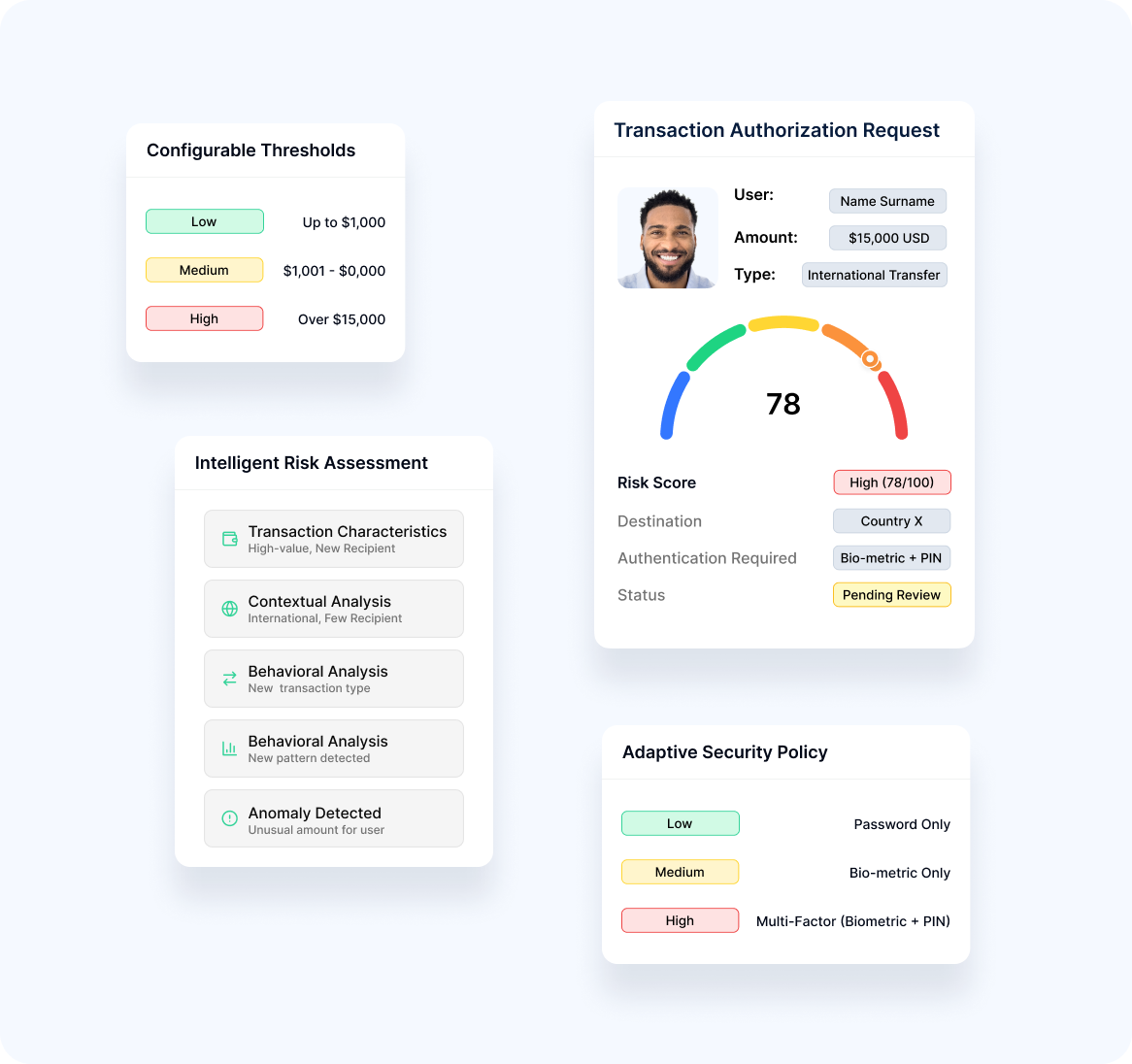

Risk-Based Authorization

Our solution applies appropriate security based on transaction risk:

Dynamic Protection

- Intelligent Risk AnalysisAnalysis of transaction characteristics and context

- Adaptive SecurityAuthentication strength proportional to risk level

- Configurable Risk ThresholdsCustomizable settings based on organization risk appetite

- Behavioral AnalysisConsideration of user patterns in risk evaluation

- Anomaly DetectionIdentification of transactions that deviate from normal patterns

Application Scenarios

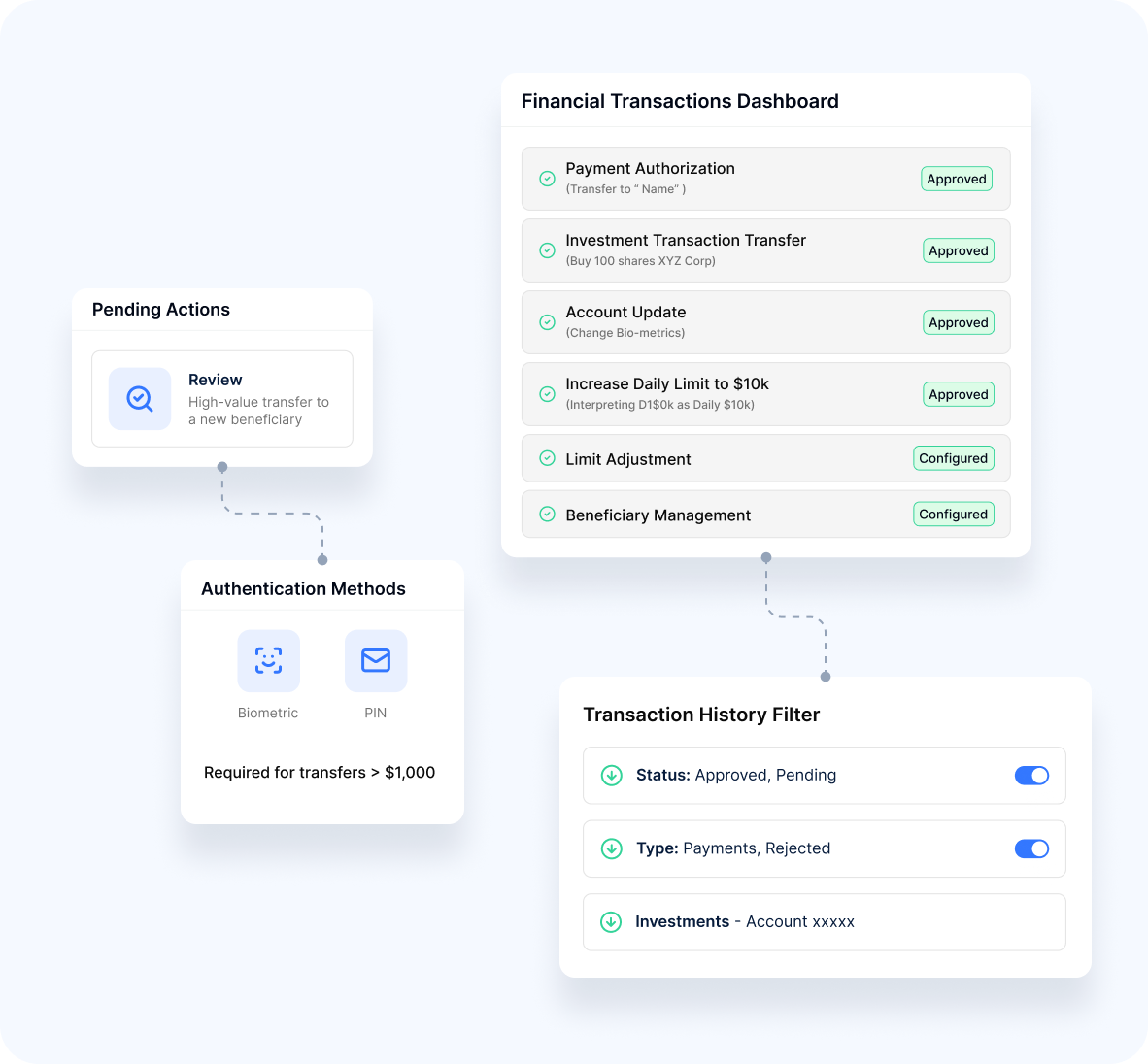

Financial Transactions

Our platform secures monetary operations:

Safe Transactions

- Payment AuthorizationPayment verification for funds transfers and purchases

- Investment TransactionsProtection for securities trading and wealth management

- Account UpdatesSecure modification of payment methods and account details

- Limit AdjustmentsSafe changes to transaction thresholds and restrictions

- Beneficiary ManagementProtected addition and modification of payment recipients

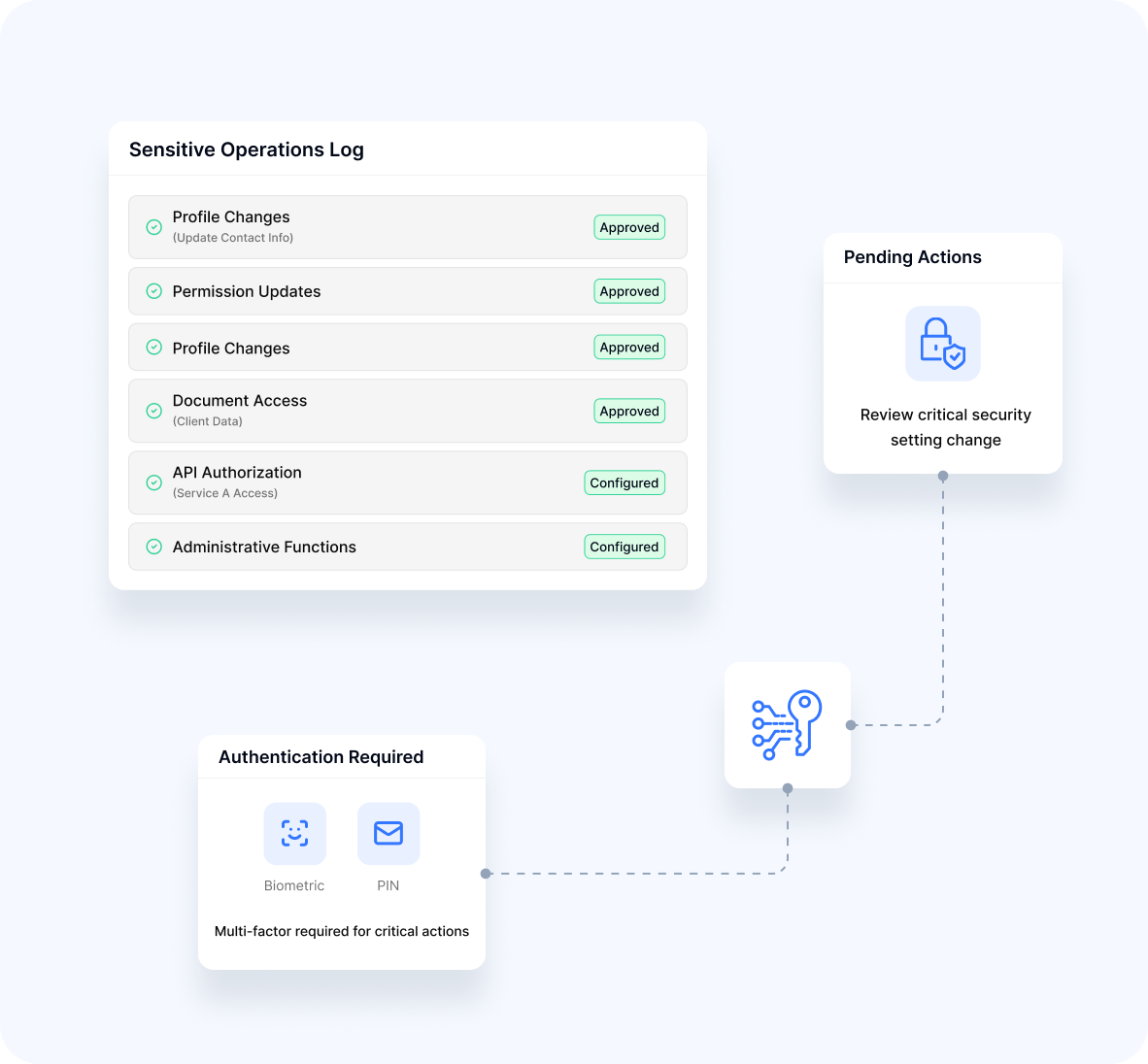

Sensitive Operations

- Profile ChangesVerification for modification of important account information

- Permission UpdatesProtection for security setting changes

- Document AccessControlled retrieval of sensitive information

- API AuthorizationSecured access to critical system interfaces

- Administrative FunctionsProtected high-impact operations

User Experience Excellence

Frictionless Security

Our approach balances protection with usability:

Effortless Protection

- Contextual AuthenticationSecurity appropriate to the specific transaction

- Streamlined VerificationMinimal steps for transaction completion

- Clear Security CommunicationTransparent explanation of verification requirements

- Consistent ExperienceUniform process across channels and transaction types

- Intelligent Retry HandlingGraceful management of verification challenges

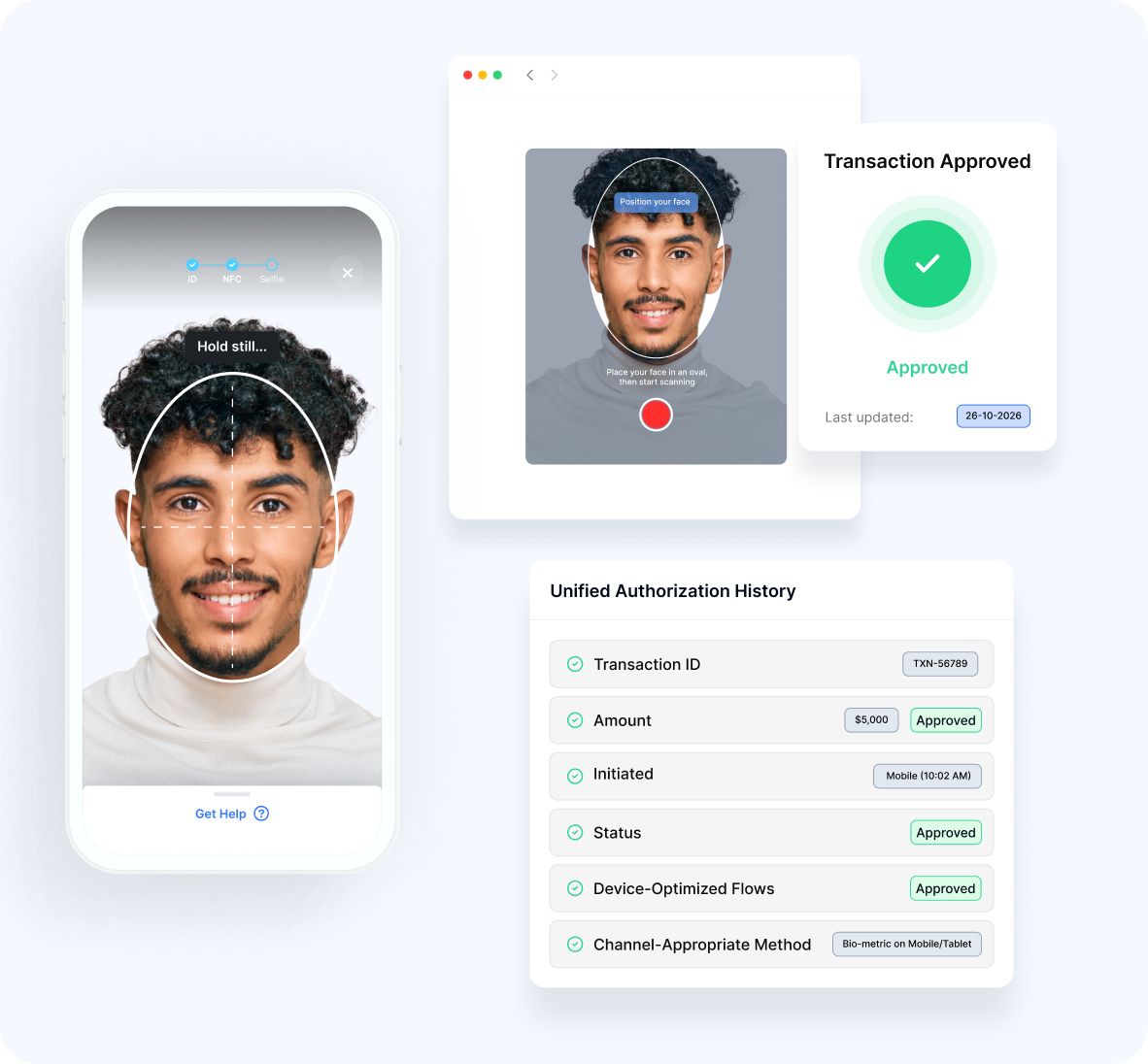

Cross-Channel Consistency

- Omnichannel SupportConsistent verification across web, mobile, and other channels

- Device-Optimized FlowsExperiences tailored to specific form factors

- Continuous SessionsSeamless transitions between devices during transactions

- Unified HistoryConsolidated view of authorized transactions

- Channel-Appropriate MethodsVerification techniques suited to each environment

Security Features

- Advanced Protection

- Fraud Detection

Our platform implements comprehensive transaction safeguards:

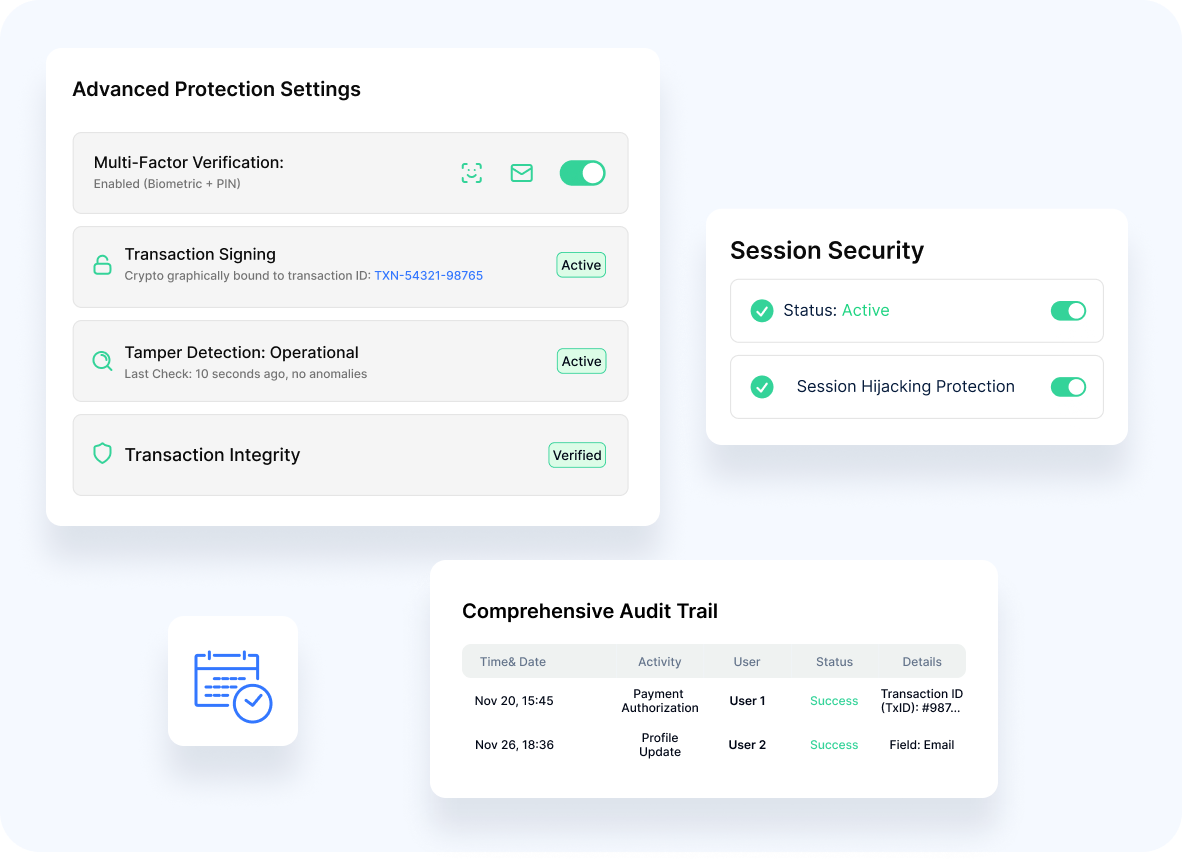

Multi-Factor Verification

A Combination of multiple authentication elements

Transaction Signing

Cryptographic binding of authentication to specific transactions

Tamper Detection

Identification of manipulation attempts

Session Security

Protection against session hijacking and injection

Comprehensive Audit Trail

Detailed logging of all authorization activities

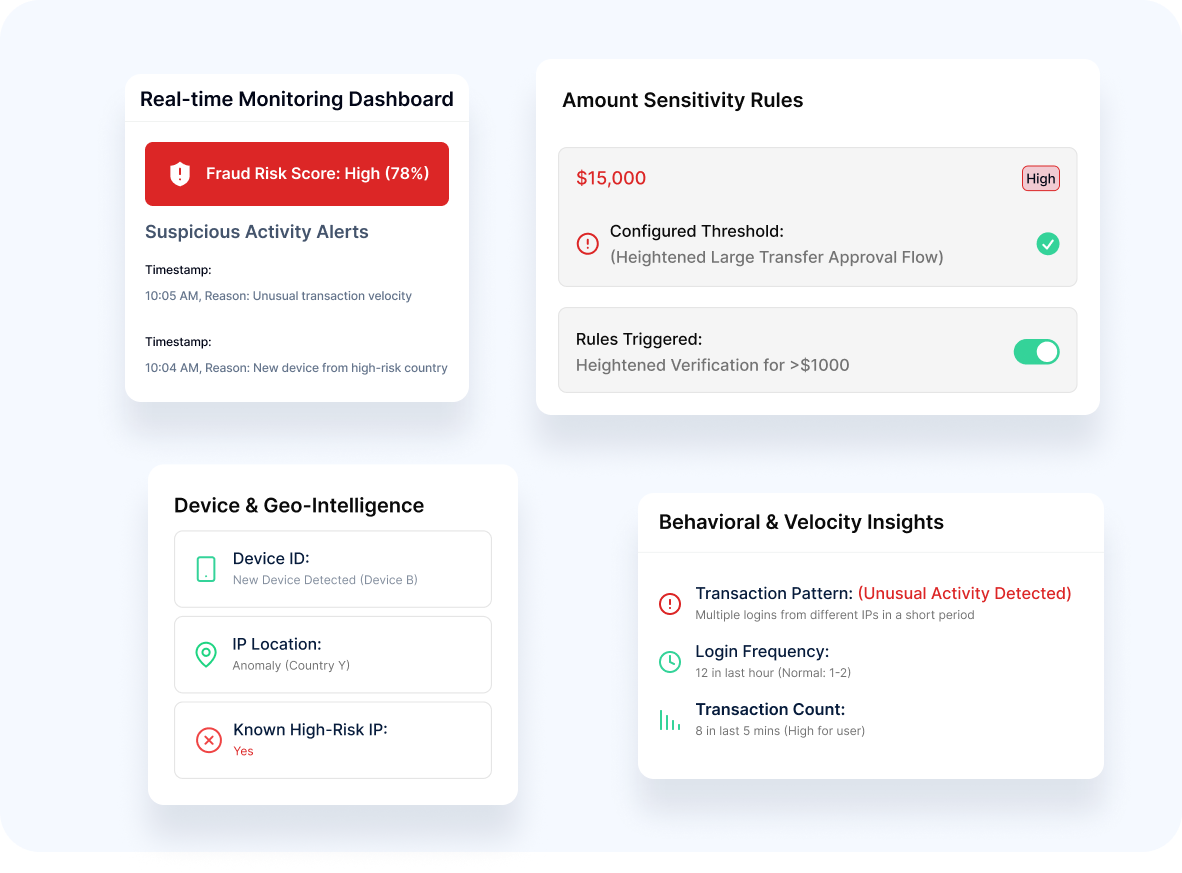

Our technology offers sophisticated defense against deception:

- Pattern Analysis Detection of unusual transaction behavior

- Velocity Monitoring Identification of suspicious transaction frequency

- Device Intelligence Consideration of device characteristics and history

- Location Awareness Geographic risk factor assessment

- Amount Sensitivity Heightened verification for larger transactions

Implementation Options

Flexible Integration

Our platform supports diverse deployment approaches:

Mobile SDK

- Native libraries for iOS and Android applications

Web Components

- Pre-built UI elements for web authorization flows

API Integration

- Headless implementation for custom interfaces

Authentication Orchestration

- Incorporation into broader security frameworks

Backend Verification

- Server-side validation options

Enterprise Readiness

Our solution meets the needs of complex organizations:

Customizable Policies

- Tailored rules for different transaction types

Regulatory Alignment

- Compliance with PSD2, SCA, and other frameworks

Performance Optimization

- Minimal latency for time-sensitive transactions

High Availability Design

- Reliable operation for critical business functions

Analytics Dashboard

- Visibility into authorization patterns and security incidents

Advantage

Our transaction authorization capabilities deliver distinctive benefits:

Biometric Precision

Superior facial recognition for confident verification

Balanced Security Model

Strong protection without excessive friction

Mobile-First Design

Optimized for smartphone authorization experiences

Integration with Identity Platform

Seamless connection with broader verification ecosystem

Regional Expertise

Understanding of MEA-specific transaction security requirements

Protect high-value transactions while maintaining exceptional user experiences.

To discuss implementation options tailored to your organization's needs.

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-advertisement | 1 year | Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. These cookies track visitors across websites and collect information to provide customized ads. |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Please wait while you are redirected to the right page...