Table Of Contents

What is AML?

Anti-money laundering refers to the laws and regulations in place that aim at detecting the efforts of financial criminals to disguise illicit money as legal income. Money launderers obtain money from numerous illicit sources like drug trafficking, gambling, corruption, and embezzlement and hide them through various methods in order to disguise them as legitimate income. A criminal offence in various countries, money laundering is a major source of concern for governments across the globe. Money laundering initially referred to illegal financial transactions, but nowadays also involves any illegal financial activity including hidden transactions, tax evasions, and illegal accounting.

With the growth and ease of accessibility to technology, financial criminals have found it quite easy to trick banks and financial institutions into accepting illicit funds. By using techniques like disguising their identities and investing money in hard-to-detect markets, financial criminals have been using modern technology to trick systems. These illegal transactions often make it difficult for financial bodies to combat money laundering, which is why numerous AML laws have been enforced.

The Financial Action Task Force (FATF) which was formed by the G7 countries in 1989 has played an important role in making laws and regulations to combat money laundering across the world. The FATF studies and develops international measures to combat money laundering and terrorism financing. Along with the FATF, the International Monetary Fund (IMF) is another international regulatory body that makes regulations to prevent terrorist financing.

What are the ways money can be laundered?

In order to fully understand AML and Anti-Money Laundering Compliance, it is necessary to first understand the ways money can be laundered. There are various techniques financial criminals use to launder money, and some of them are given below:

- Smurfing: Smurfing, also called structuring, refers to the method of dividing a large sum of money into smaller transactions, in order to bypass law enforcement. This small division of money is deposited in different accounts, under various identities. The major reason why structuring works is that because the money is deposited into different accounts, it is hard for regulatory authorities to link them to a single person.

- Shell companies: Shell companies are those which do not have actual operation or business assets and simply exist on paper. They are generally not illegal, but when used for financial crimes like tax evasion and money laundering, they are considered illegal bodies. Financial criminals tend to hide their identity as owners of shell companies to organize and commit frauds.

- Bulk cash smuggling: This involves smuggling large amounts of money to a different country to evade taxes, and then used for other illegal activities in the destination country.

- Cash-intensive businesses: Cash-intensive businesses are those which get a majority of their revenue in cash, eg, restaurants, convenience stores, and parking garages. Money launderers use these legitimate businesses as a cover-up for their illegal criminal activities. Since these businesses deal with large amounts of cash on a regular basis, it is often hard to identify criminal activities.

- Round tripping: Round tripping is a method of transferring money from one country to another where the tax rules are lenient. This money is then sent back to the original country via foreign investment, which generally is exempt from taxes for money laundering.

- Trade-based money laundering: Trade-based money laundering is a method of exploiting the vulnerabilities of cross-border trade by over or under-invoicing, which refers to submitting an inflated or deflated invoice, thereby disguising the movement of money.

- Bank capturing: In this, financial criminals either own a bank themselves or have large shares in the bank, and can freely move funds throughout the bank. This generally occurs in regions where the AML laws are not stringent.

- Casino laundering: One of the most common methods of money laundering, in this, financial criminals buy gambling chips using illicit funds, gamble for a small amount, and then claim back all the money for the gambling chips. This turns out to be legal since the gambling win in a casino is received in cash.

- Virtual currencies: Dealing with cryptocurrencies is another tactic used by financial criminals to launder money, due to the ease of hiding identity in cryptocurrency transactions. Since some digital currency platforms don’t perform background checks while onboarding customers, it makes it easy for criminals to remain anonymous.

What are the stages of money laundering?

The main aim of financial criminals while laundering money is to convert illicit income into legal funds. There are three main stages in this process, which include placement, layering, and integration.

- Placement stage: The placement stage refers to placing illicit funds into the financial system, to make them look like legitimate income. Often financial criminals will take in large amounts of money and store them in smaller quantities in various banks and financial institutions. This method of placing their illicit money in legal bodies helps in covering up their tracks and disguising the funds as legit money. Another way of placing illegal money is sending it offshore. The placement stage is the most vulnerable stage of the money laundering process as it is relatively easy for legal institutions to catch these transactions since a large amount of money would be moving in a short amount of time.

- Layering stage: The most complex stage of money laundering, layering refers to moving the illicit money away from its source so that it cannot be tracked to the original launderer. It generally involves layering the transactions in a manner that makes them look legal. For layering the funds, money launderers generally move the cash between multiple banks and financial institutions or convert it into money orders, stocks, or wire transfers. The layering method sometimes involves nesting the money within each other, for example investing in a business that would then invest the same in another business or stocks. The main purpose of this would be to layer in the funds in a manner that would make it very hard for investigators to differentiate between legal and illegal money.

- Integration stage: Also known as the extraction stage, the integration stage of money laundering refers to the reentering of the funds to the legitimate economy as clean money. These criminal proceeds can now be used to buy or invest in luxury assets like jewellery, real estate, or long-term business ventures, giving the appearance of legal income. At this stage, the money is very hard to distinguish as illegal funds, since it has a trail of legitimately sourced funds. The money launderers at this stage are very careful and tend to do everything to prevent attracting attention.

What is the impact of money laundering?

Money laundering causes long-term damages to a country’s economy because despite the amount of money laundered being very large, it tends to go unnoticed by financial and legal authorities. When this laundered money is used for drug trafficking, smuggling, terrorist funding, and other crimes, it has a deeply negative impact on society. A few other impacts of money laundering are:

- Makes foreign investors hesitant in investing in a high-risk money laundering country, impacting economic growth.

- Money laundering affects a country’s banks and financial institutions consequently affecting exchange rates and capital flow.

- Tax evasion is another form of money laundering, and this, in turn, reduces a country’s tax revenue.

- An increase in money laundering activities in a country may make it a haven for criminals, making it easy for criminal activities.

- Money laundering in worst cases may lead to the overall weakening of a country’s finances.

What can financial institutions do to prevent money laundering?

According to UNODC roughly, only 1% of laundered money is seized and frozen. These statistics are very concerning for banks and financial institutions that spend large amounts of money on AML transaction monitoring, with the expenditure set to increase even more in the next few years.

Though the growth of technology has aided in the rise of money laundering cases across the world, similar technology can actually help bring these numbers down. With banks and financial institutions rightfully aware of the impact of illicit money laundering, these organizations have been taking numerous steps to prevent money laundering. For this, it is necessary to develop a strong Anti-Money Laundering compliance program.

The AML solutions program should be designed in a way that it can detect different types of money laundering activities, including tax evasion, illegal fund transfers, and terrorist financing. A risk-based AML verification procedure that depends on factors like geographic location, laws of the country along with the type of business conducted by a firm has to be developed. A few factors to keep in mind while developing an AML compliance program are

- Written policies on AML: For tackling money laundering, it is necessary for an organization to have effective anti-money laundering rules and regulations (these vary from country to country) in place. Keeping an updated AML checklist will help employees understand the AML verification process while onboarding new customers and flag suspicious activity. This way a firm can be protected from indirectly assisting in financial crimes.

- Monitoring transactions on a real-time basis: Real-time monitoring of transactions in order to ensure any suspicious activity is caught at the earliest is an important feature of an AML solutions program. It is necessary to regulate the system in a manner that if any high-risk transaction takes place, it can be flagged immediately.

- KYC/CDD: An effective KYC procedure is a prerequisite for successful AML compliance. Verifying a customer’s identity and evaluating their risk profiles, along with ongoing monitoring are key factors in this. Appropriate due diligence should be ensured so that the transactional behaviour of customers can be monitored and major deflection from usual behaviour can be flagged.

- Using powerful AML technologies: With numerous software available for checking and evaluating transaction data, it is necessary that financial institutions utilize efficient software for their AML transaction monitoring. This may include regular screening, and keeping an eye on databases that include money launderers, and this can be effectively done using AI (Artificial Intelligence) and Machine Learning.

- Keeping an eye for Money Laundering red flags: Sometimes money launderers make a mistake while disguising their illicit funds, and keeping a list of red flags can help financial institutions spot them easily. Some red flags to consider include

- Large unaccountable transactions

- Suspicious data identification

- Large spends on gambling

- Transactions with suspicious money launderers

- Sanction Screening Lists: A sanction list, generally created by a legal authority consists of individuals and organizations that are considered high risk for financial bodies. An important part of CDD, it is necessary that companies apply stringent sanction control during their onboarding process.

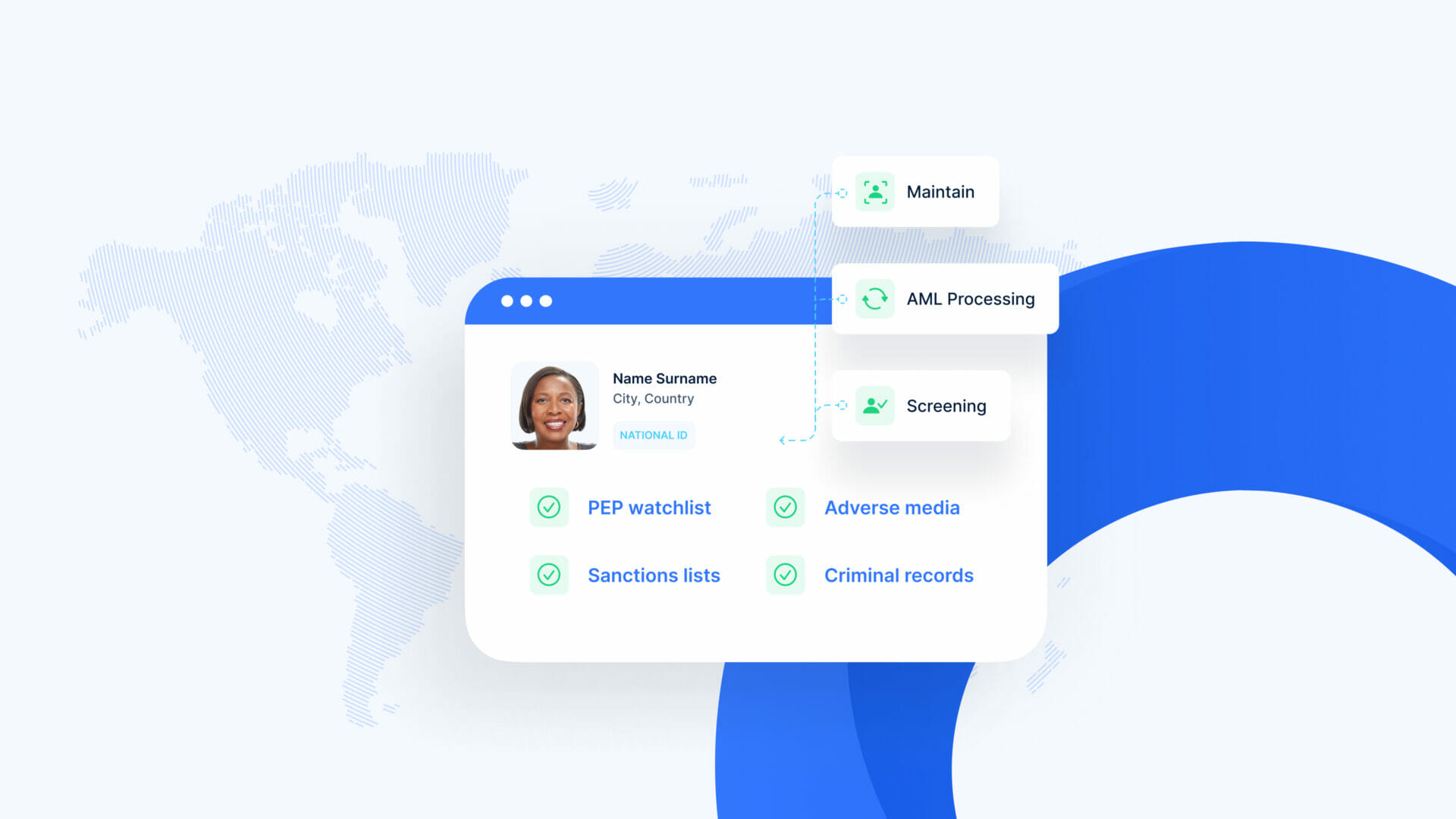

uqudo’s full-fledged Screening process

Our screening process can uncover all potential risks before they harm your organization. Our database has access to the world’s largest PEPs, sanctions, AML and adverse media lists, making it easy for us to identify high-risk customers. uqudo’s database undergoes ongoing updates which make our screening and verification process meet legal and regulatory obligations.

Our comprehensive screening process includes:

- Monitored lists which have access to 1500+ global sanction lists including international sanctions, terrorism-related lists, drug trafficking lists, and many more.

- An advanced AML PEP screening procedure checks against 1.7+ million Politically Exposed Persons that feature government officials, military figures, and state-owned enterprises

- Adverse Media screening against a library of over 3 billion media articles

- Fully automated Continous Screening process eliminating the need to rescreen customers

How can uqudo transition your AML compliance program?

With the growing need for AML verification procedures for businesses in various industries, it is necessary for firms to strictly adhere to AML compliance checks to ensure they are not indirectly being a part of money laundering activities. Though banks and financial institutions take large steps to counter financial crimes, it is sometimes time-consuming to keep track of the continuously changing AML regulations. As a leading AML service provider, uqudo’s AML compliance program increases your organization’s security against money laundering. Powered by AI and ML, our AML platform provides KYC/CDD checks, screening, and analytics to protect you from financial crimes. For detailed information, get in touch with us.