Do you remember the last time you stayed away from your digital devices for more than a few days? With most people glued to technology, I bet you don’t!

The COVID-19 pandemic has shown that we as humans can probably survive for quite some time with minimal interaction with the outer world, by simply having our phones and laptops with us at all times.

Not the best thing, definitely, but human dependency on technology has pushed companies to be more digital. From opening a bank account digitally to submitting documents online for a visa application, there’s little that cannot be done through technology.

This growth of technology has helped accelerate the fintech industry, but technology has also made it easy for financial criminals to misuse data. Due to this, it is necessary for companies to have a secure digital identity system in place to protect their and their users’ critical information.

A well-built digital identity system provider can help both financial institutions as well as their customers since technology is more available and affordable today. Providing a simpler option to those who have been excluded from financial services due to their inability to identify themselves has also made the financial industry more inclusive.

Studies show that global identity solutions are expected to grow to $ 70.7 billion by 2027, with a CAGR (Compound Annual Growth Rate) of 20.4% from 2022 to 2027. Digital identity is rapidly being accepted in the world of traditional banking, with banks finding it easier to identify and keep track of customer transactions digitally. Not only financial services, but other industries like telecommunications, insurance and even public sector firms are also moving towards a more digital method of operations.

What is digital identity?

To understand the impact digital identity has on key industries today, we need to first understand what exactly is meant by digital identity. As the term states, digital identity refers to the identity of an individual, organisation or electronic device that exists online. this includes usernames, passwords, search history and numerous other aspects that enable users to communicate online.

The digital identity of an individual arises organically from the information provided to websites and the shadow data that is created by the person’s online actions. Since the information provided varies from website to website, digital identities are largely contextual in nature. Essentially, your digital identity is the online data that can be traced back to you.

There are many pieces of information that comprise an individual’s digital identity, some of which are

- Name

- Date of birth

- Email address

- Usernames

- Passwords

- Government-issued ID cards

- Biometrics (face, voice etc)

- Online search history

- Purchasing history

A combination of these pieces of information helps identify an individual’s digital identity.

What is digital identity verification?

Now that we have understood what comprises digital identity, let’s establish what digital identity verification stands for. Verifying an individual’s identity refers to checking if their details are correct and if they truly exist. Verifying someone’s digital identity is the same thing, just done digitally.

In the past, while opening a bank account, people used to validate their identity face-to-face. While this ensured great security, it was a largely time-consuming process. From submitting documents to finally being able to conduct transactions, the banking process was a truly hectic one.

Companies today are rapidly moving to a more digitised method of operations. This has not only made operational processes quick and more efficient, but it has also increased cybersecurity risk. Validating a person’s identity online in the right manner is one of the first steps in ensuring that our digital-first way of life remains risk-free.

With data breaches quite prevalent today, companies often have to take numerous steps to protect their user information. And this data doesn’t simply include names and addresses, but also other critical information like government ID card numbers and bank account details. Since consumers today are largely dependent on the internet for various tasks, from shopping online to paying credit card bills, the amount of information out there for cybercriminals to misuse is huge.

The more data available for fraudsters to use, the more data breach cases we hear of. Haven’t you heard of cases of large amounts of credit card fraud and identity theft? These have become so common today that many have accepted them as a side effect of digital transformation. Statistics show that there a cyber attack occurs every 39 seconds. Imagine the amount of data that gets stolen in a year then!

But what can be done to protect sensitive online information? Having an efficient and stringent digital identity verification solution is the only way to keep customer data safe. An online system that can truly establish a user’s real identity is the key to a safer digital world.

Digital identity verification refers to validating an individual’s identity using identity verification software. Digital identity verification uses numerous methods like biometric authentication, facial recognition and digital ID verification to validate the identity of a user.

A key step in customer onboarding and account opening, digital identity verification helps validate a consumer’s identity digitally and protects companies from fraudsters.

Why is digital identity verification important?

Organizations today pay hefty fines for non-compliance which often lead to data breaches. Building a strong identity verification system helps companies identify risks and take measures to prevent fraud. Here are a few benefits of digital identity verification:

1. Easy to implement

Implementing identity verification software is very easy for a company today, with numerous identity verification solutions available. Firms simply have to integrate them into their existing system and they are ready for use.

2. Better user experience

Would you prefer going to a bank for opening a bank account over opening one on your phone? Obviously, you would choose the comfort of your own home! Implementing an identity verification software not only makes data safe but also makes it easier for customers to join a new platform.

3. Greater security

Digital identity verification provides an added layer of security to sensitive information by preventing data to be accessed by cybercriminals. Using biometrics and facial authentication (or a combination of both!), critical data is protected from misuse.

4. Reduces manual intervention

Prior to a full-fledged digital authentication system, people had to physically visit banks and government institutions to validate their identities. An identity verification software provider not only reduces the need for in-person verification but also lessens the number of individuals needed for the verification process.

5. Provides selective access to information

Another key advantage of a digital system is that it provides only necessary people access to data (this is always asked to customers), making it easier to track fraud and misuse. With numerous authentication methods, users can prevent unauthenticated individuals from accessing their data.

6. Decreases the risk associated with human verification

It is easy for fraudsters to create duplicate documents and get them verified by unsuspecting officials. Comparing this with a digital process, bypassing software is much harder since the system can access a large amount of information at a given point in time, reducing the chances of duplicates.

7. Faster turnaround time

Identity verification prior to being digital used to take days or sometimes even months to complete. Using identity software providers reduces the amount of processing time making it easier for companies to onboard new customers quicker. This is an important benefit since users today drop off verification processes midway if they are too lengthy.

What are some examples of digital identity verification methods?

Implementing a digital identity verification platform makes customer onboarding easier and faster for industries. Some methods generally used in combinations by companies to verify identity digitally are:

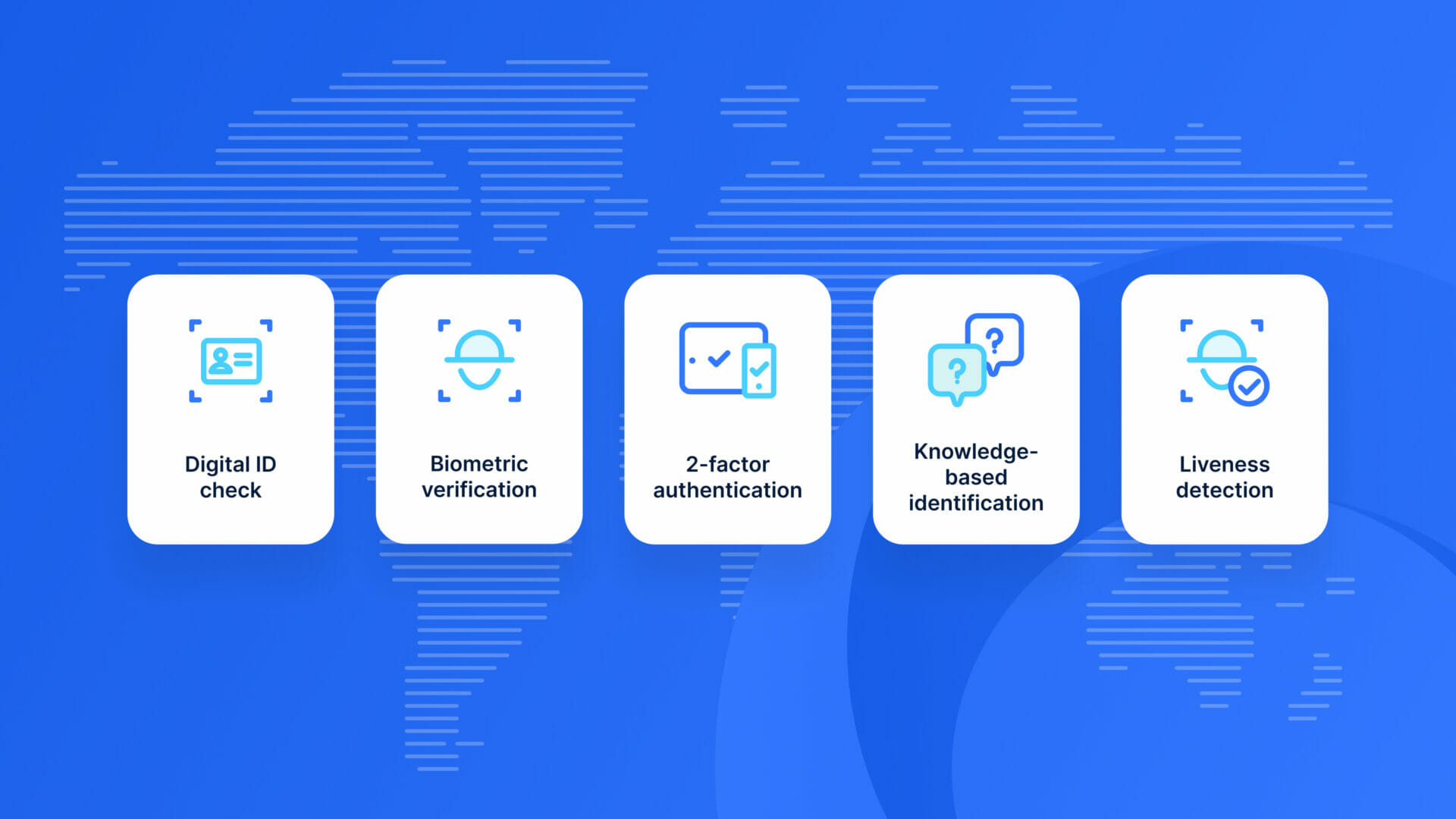

1. Digital ID check

Numerous countries today have adopted digital versions of national IDs. Verifying these national IDs against a database helps companies validate the identity of their customers.

To verify an ID card digitally, a user scans/uploads their identity documents, the data from which is then extracted via software. The extracted data is then compared with the existing database. Since artificial intelligence can easily identify document tampering, it helps authenticate a user.

2. Biometric verification

Verifying identities using an individual’s biometric characteristics like face, voice or fingerprints is another secure method of digital identification. Since biometrics are unique to each individual biometric verification is reliable and secure. Biometric authentication also enhances user experience by removing the hassle of remembering multiple passwords.

3. Two-factor authentication

A dual authentication method is widely used because of the greater security it provides. In this, a user is first asked to enter their login credentials to access a platform. Next, they are either asked to log in via a link sent to their email addresses or to enter an OTP (One-Time Password) sent to their phones. This dual authentication method ensures that even if a password is compromised, the user data remains safe from fraudsters.

4. Knowledge-based identification

Knowledge-based identification is the method of verifying users by asking them to enter information only they are aware of. These questions are answered by the user while signing up for a platform and then later used as security questions. Used along with passwords/biometric authentication, knowledge-based security questions provide an extra layer of security.

5. Liveness detection

Liveness detection refers to verifying if the person in front of the camera is alive and real, and not a video or mask, using computer vision technology. Facial recognition along with liveness detection helps prevent spoofing, thereby reducing the occurrence of identity theft and fraud.

Digital identity in Fintech

A combination of technology growth and easier access to digital platforms have enabled companies to perform remote identity verification, which not only is faster than traditional verification methods but much cheaper.

Using a digital platform for verification does not simply mean validating a user’s identity digitally. Companies have to ensure that they are complying with legal requirements, keeping a check on online fraud and maintaining user privacy, all while enhancing the user experience.

With customers expecting a seamless digital experience and moving away from traditional verification methods, companies have to keep up by providing easily accessible online systems. Utilising a digital identity platform helps fintech companies stay compliant with regulations and streamline user authentication.

Along with the benefits mentioned earlier, using digital identity verification reduces operational and customer onboarding costs for fintech making them more viable than paper-based verification methods.

An important factor regulated industries have to consider while onboarding users are staying compliant with their region’s KYC and AML regulations. With digital platforms being constantly updated according to new laws, eKYC platforms make it easier for fintech to follow regulatory guidelines.

Digital identity verification takes place in seconds, and this time efficiency enables firms to onboard customers and process transactions faster. Not only this but by using digital methods, companies can onboard clients and customers from any part of the world (obviously by following that region’s regulatory requirements!)

Lastly, one of the most important advantages of using fintech AML compliance services on digital verification platforms is that it provides greater security to their customers’ sensitive information.

How can uqudo support your identity verification process?

Going beyond the traditional identity verification process, uqudo will help you uplift your onboarding process by making it faster, more compliant and cheaper. Our frictionless and compliant KYC (Know Your Customer), Screening, KYB (Know Your Business) and Authentication processes can fit seamlessly into your onboarding journey, enhancing your users’ experience.

As KYC service providers, uqudo’s AI document scanning and OCR technologies can read and extract data within milliseconds, reducing your KYC workload and keeping fraudsters out. Our AML and Sanctions screenings have access to one of the world’s largest databases of sanctioned individuals, making it easy to protect your user data.

We’ve already discussed how our KYC fintech solutions using biometric authentication and passwordless logins can in fact help eliminate fraud due to weak, stolen or misused passwords.

Our state-of-the-art KYB fintech solutions can help your company screen and verify potential clients, protecting your firm from fraudsters, and enhancing your overall reputation.

Not only is uqudo a highly reliable and compliant digital identity platform but as leading digital identity fintech service providers, our advanced tech stack can be seamlessly integrated and fully customised according to your requirements.

Interesting, isn’t it? Get in touch with us to learn more.