KYC

Boost Conversion While Meeting MEA Compliance Requirements

Transform your onboarding experience with uqudo’s advanced KYC solution that enables frictionless verification while ensuring full regulatory compliance, helping you drive growth while reducing fraud.

Why Leading Companies Choose uqudo KYC

Accelerate Onboarding

Complete customer verification in under 30 seconds

Maximize Coverage

Extensive document support types across EMEA

Eliminate Language Barriers

Arabic OCR, regional compliance expertise, and optimized algorithms

Protect Your Business

Advanced fraud prevention with military-grade security

Implement Effortlessly

Multiple deployment options that integrate with your existing systems

Capture Documents Instantly with AI-Powered Scanning

Our proprietary AI technology delivers millisecond document scanning with industry-leading accuracy, eliminating manual review for automated KYC verification.

- Process Extensive identity documents with precision

- Extract data from Arabic, Latin and Kurdish scripts automatically

- Ensure perfect image capture with Quality Detection

- Stop fraud before it starts with Tampering Detection

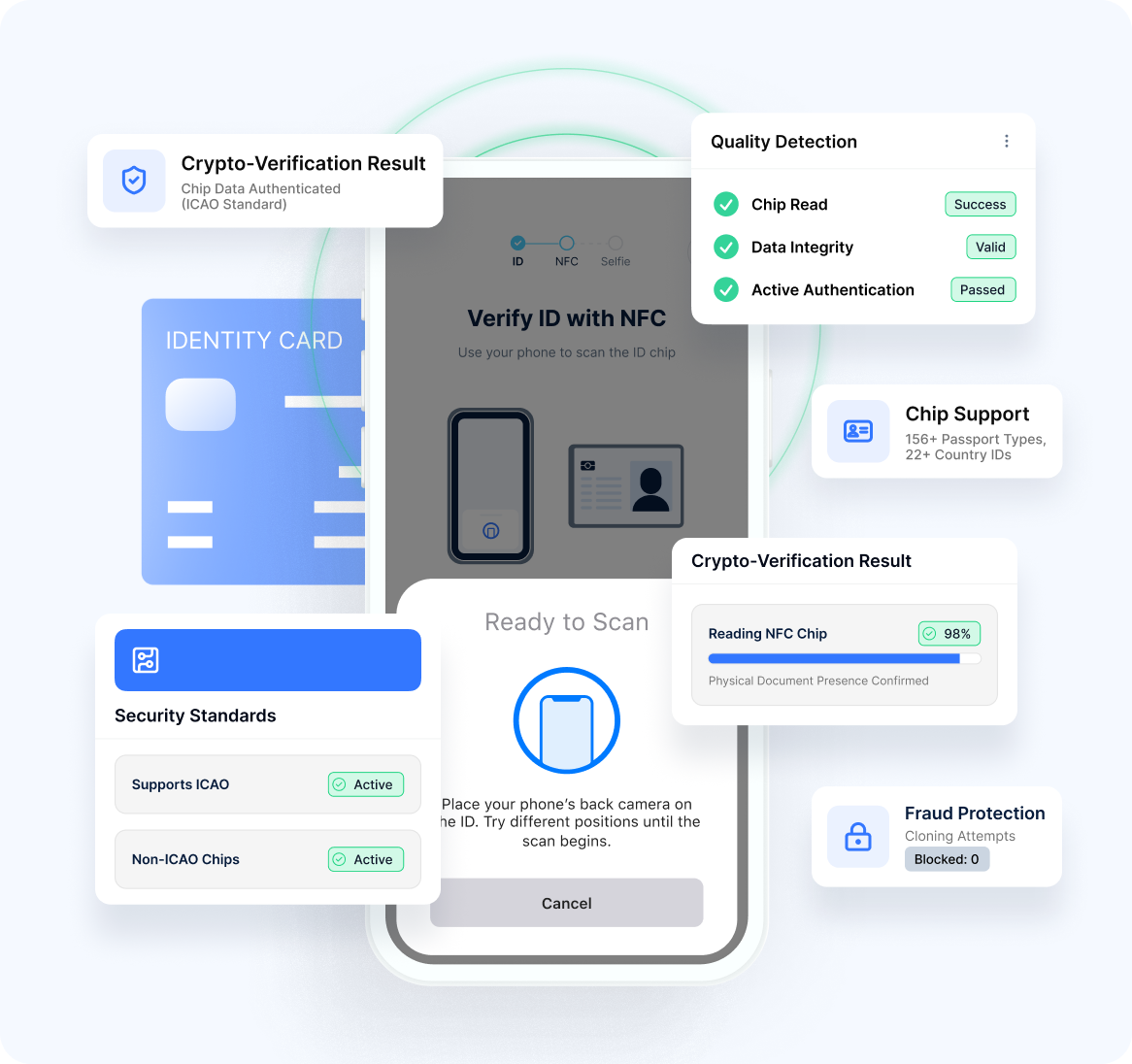

Validate Documents Cryptographically with NFC Technology

Achieve the highest level of identity assurance by reading and validating electronic document chips that are nearly impossible to forge.

- Authenticate 156+ passport types with chip verification

- Verify national ID cards across 22 countries securely

- Support both ICAO and non-ICAO standard chips

- Guarantee physical document presence with short-range NFC

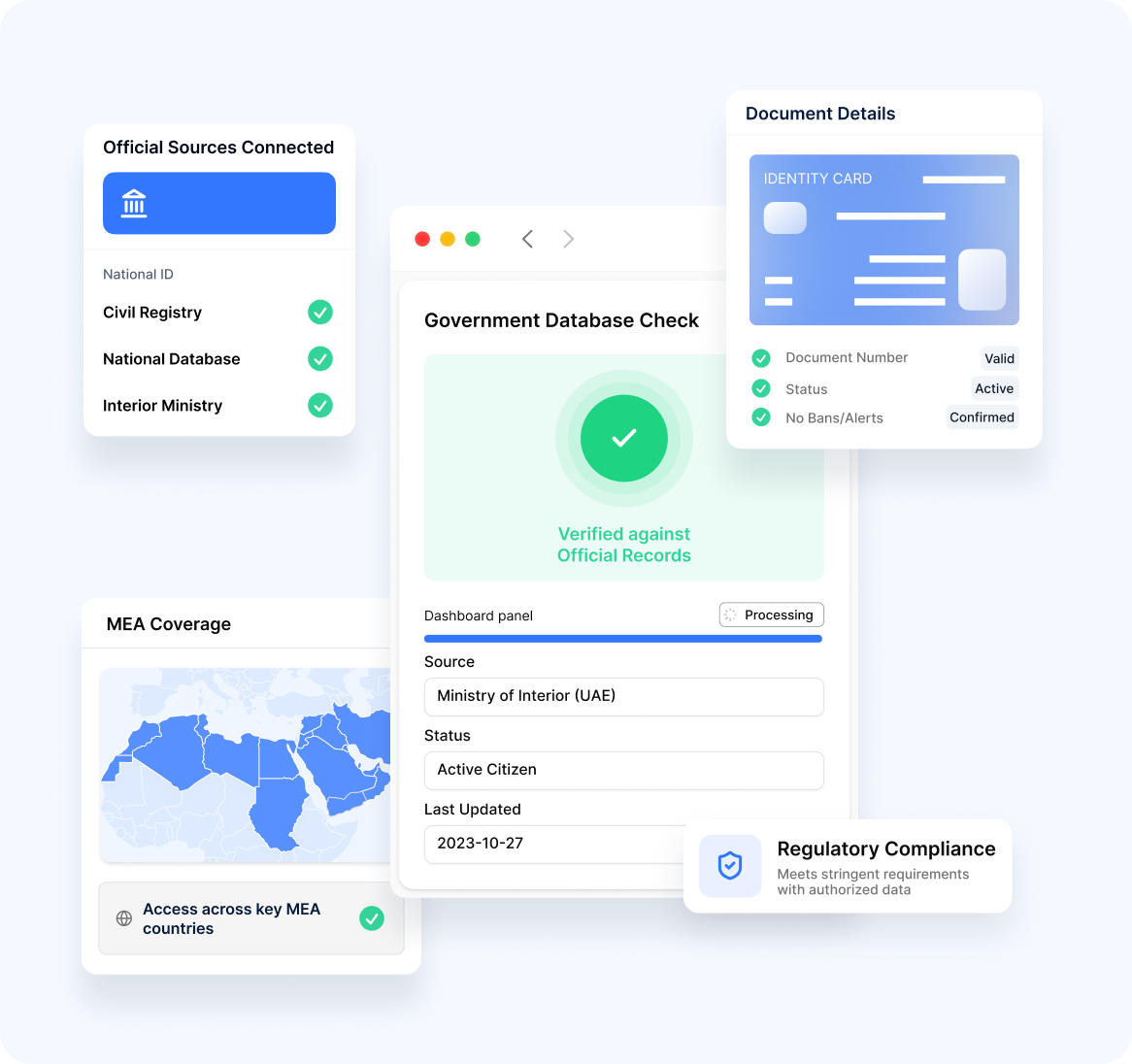

Verify Against Official Records via Government Databases

Eliminate identity uncertainty by validating directly against authoritative government sources for identity verification.

-

- Connect seamlessly to official identity records

- Instantly confirm document validity and active status

- Access verification across key MEA countries

- Meet stringent regulatory requirements with authorized data

Confirm Real Presence with Advanced Biometric Verification

Ensure the person is genuinely present and matches their ID with sophisticated facial recognition that stops spoofing attempts.

- Match faces to ID photos with precision

- Block sophisticated presentation attacks and Deepfake attempts

- Customize security levels with Active Liveness or Passive Liveness

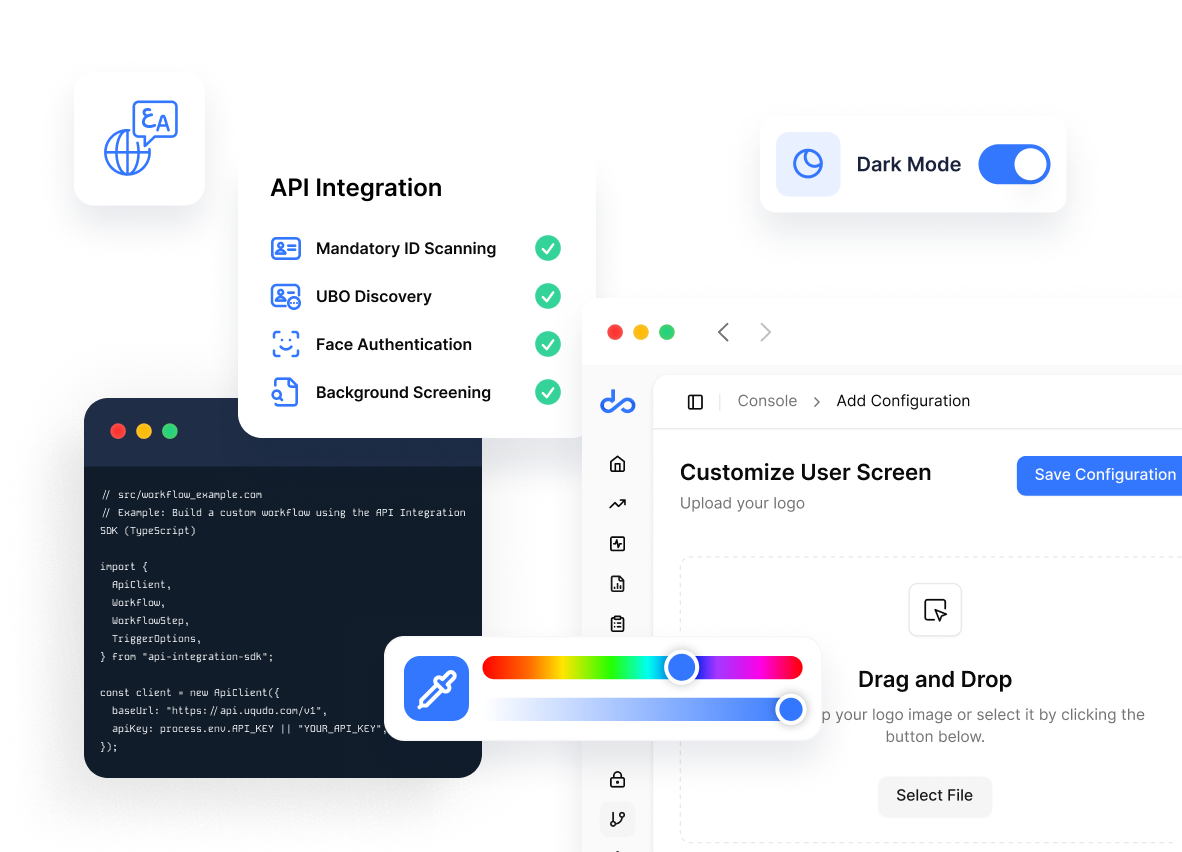

Flexible deployment models for any business need

Choose the integration method that works best for your organization:

-

API IntegrationBuild custom workflows through our comprehensive REST API

-

Custom ApplicationWe design the workflow and the UI to meet your requirements

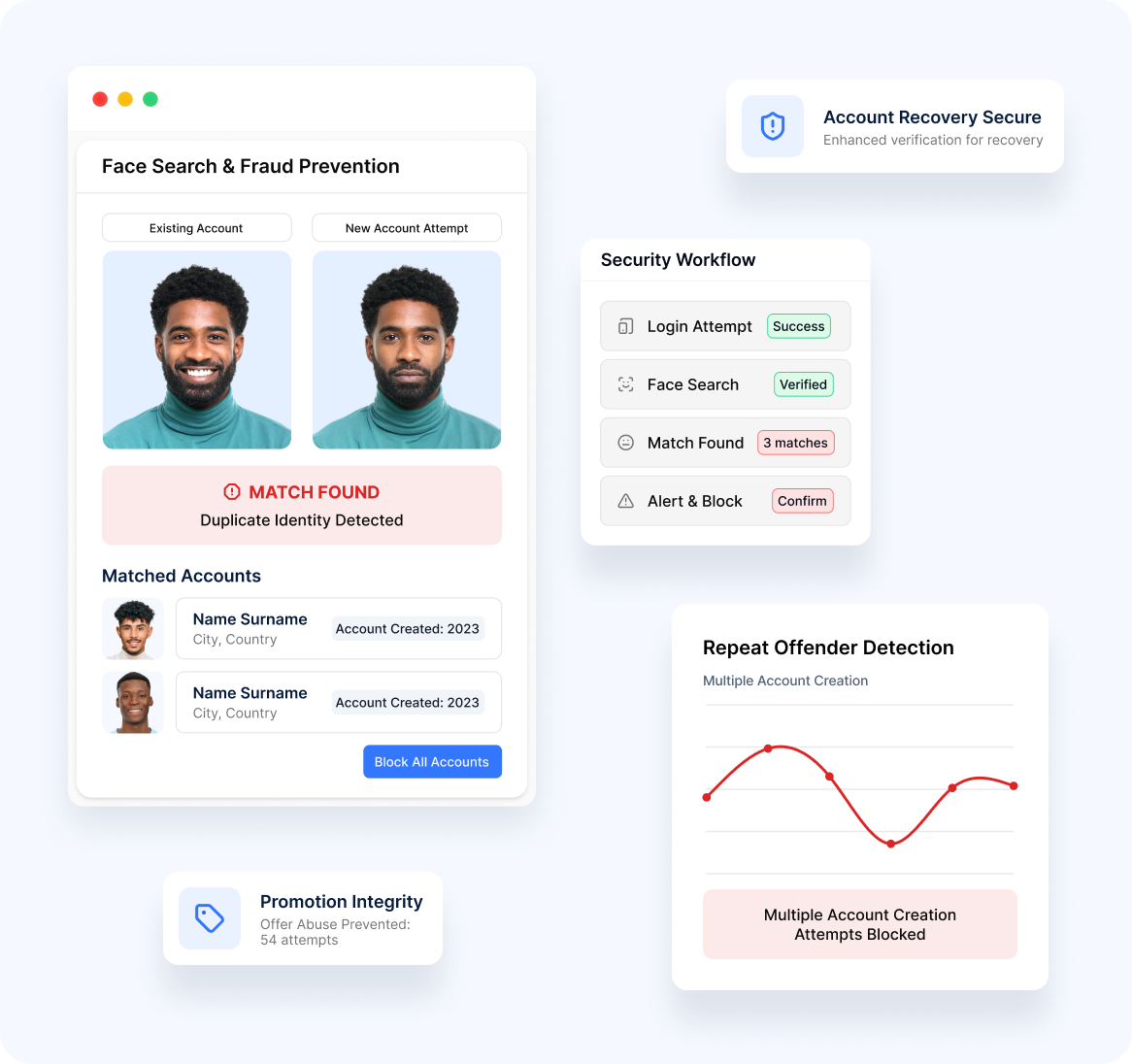

Prevent Fraud with Powerful Face Search Capabilities

Protect your platform from multiple account fraud and abuse with advanced facial recognition matching.

- Identify repeat users attempting to create multiple accounts

- Stop fraudsters before they can exploit your system

- Enhance security for account recovery workflows

- Maintain promotion integrity by preventing offer abuse

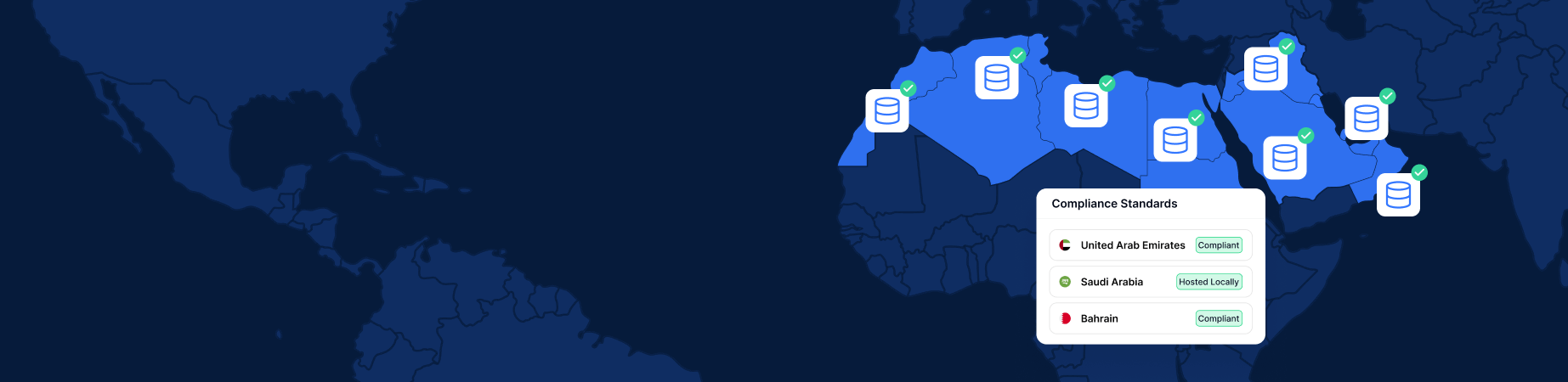

Meet stringent data residency

requirements across MENA

Frequently Asked Questions

What is KYC (Know Your Customer) software?

KYC (Know Your Customer) software is a tool that automates client identity verification with the help of solutions like uqudo. It authenticates users in real time through document scanning, facial recognition, and NFC chip reading. This software enables businesses across multiple sectors to detect fraud, assess risk, and ensure efficient compliance with KYC and AML regulations. As one of the leading ekyc solution providers, uqudo enables secure and real-time verification for a range of industries.

How can KYC software improve onboarding efficiency?

uqudo’s KYC system speeds up onboarding by automating checks that would otherwise require manual review. With verification completed in under 10 seconds, businesses can reduce operational effort and improve customer conversion. This streamlined process is supported by automated KYC verification solutions designed to deliver accuracy and regulatory compliance.

How does KYC work in banking?

In banking, KYC involves verifying customer identities, conducting due diligence, and continuously monitoring transactions to detect suspicious activity. uqudo enables banks to automate the entire KYC process through advanced document verification, biometric face matching, and AI-driven fraud prevention to ensure compliance with strict financial regulations.

Why should I choose uqudo as my KYC and identity verification provider?

uqudo delivers advanced KYC and identity verification solutions that combine biometric authentication, AI-powered fraud detection, and seamless document verification. With frictionless integration options, uqudo enables smooth customer onboarding while ensuring compliance with regional and international AML regulations. Its scalable and customizable solutions make it the ideal choice for banks and financial institutions looking to enhance efficiency and meet strict regulatory requirements.

Which KYC verification services does uqudo provide?

uqudo offers a complete suite of KYC verification online services, including document verification, face matching, liveness detection, and NFC chip reading. The platform also

supports enhanced due diligence and address verification, making it ideal for industries with strict compliance needs.

How to choose the best KYC provider in your country?

When selecting a KYC provider, start by assessing your company’s specific needs and compliance requirements. Compare providers based on their coverage of relevant countries, supported document types, and verification methods. Ensure the solution includes strong liveness detection, robust AML and KYB capabilities, and transparent pricing. It’s also important to evaluate ease of integration, data security, platform reliability, and customer support to confirm the provider aligns with your operational, security, and compliance objectives.

What are all the documents required to update my KYC online?

To update your KYC online, users typically provide a valid government-issued ID such as a passport, driver’s license, or national ID. uqudo verifies these documents using AI-powered scanning, biometric checks, and secure database validation to ensure authenticity.

How does an automated KYC process work?

uqudo’s automated KYC process verifies documents, performs biometric liveness checks, and validates identity data against trusted databases in real time. This end-to end automation minimizes manual effort, prevents fraud, and enables instant digital onboarding.

What are the types of Due dilligence that uqudo KYC apply based on Risk level?

uqudo’s KYC approach focuses on four levels

- Customer Identification Program (CIP)

- Customer Due Diligence (CDD)

- Enhanced Due Diligence (EDD)

- Ongoing Monitoring.

These elements work together to ensure full compliance and reduce the risk of financial crime.

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-advertisement | 1 year | Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. These cookies track visitors across websites and collect information to provide customized ads. |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Please wait while you are redirected to the right page...