Compliant identity and KYC solutions for banks and financial institutions.

Empowering banks and financial institutions to fulfil their regulatory obligations and eliminate fraud without adding friction to the customer experience.

See it in action:

Accelerate digital transformation with streamlined instant user onboarding and identity verification

Make the shift to a fully digital customer experience with our frictionless and formless identity layer.

Stay compliant with a robust onboarding and user identity verification system

Keep up with evolving regulations in your region.

Automated authentication for banking to achieve efficiency at scale

Say goodbye to inefficient manual processes and reduce costs with our fully automated solution.

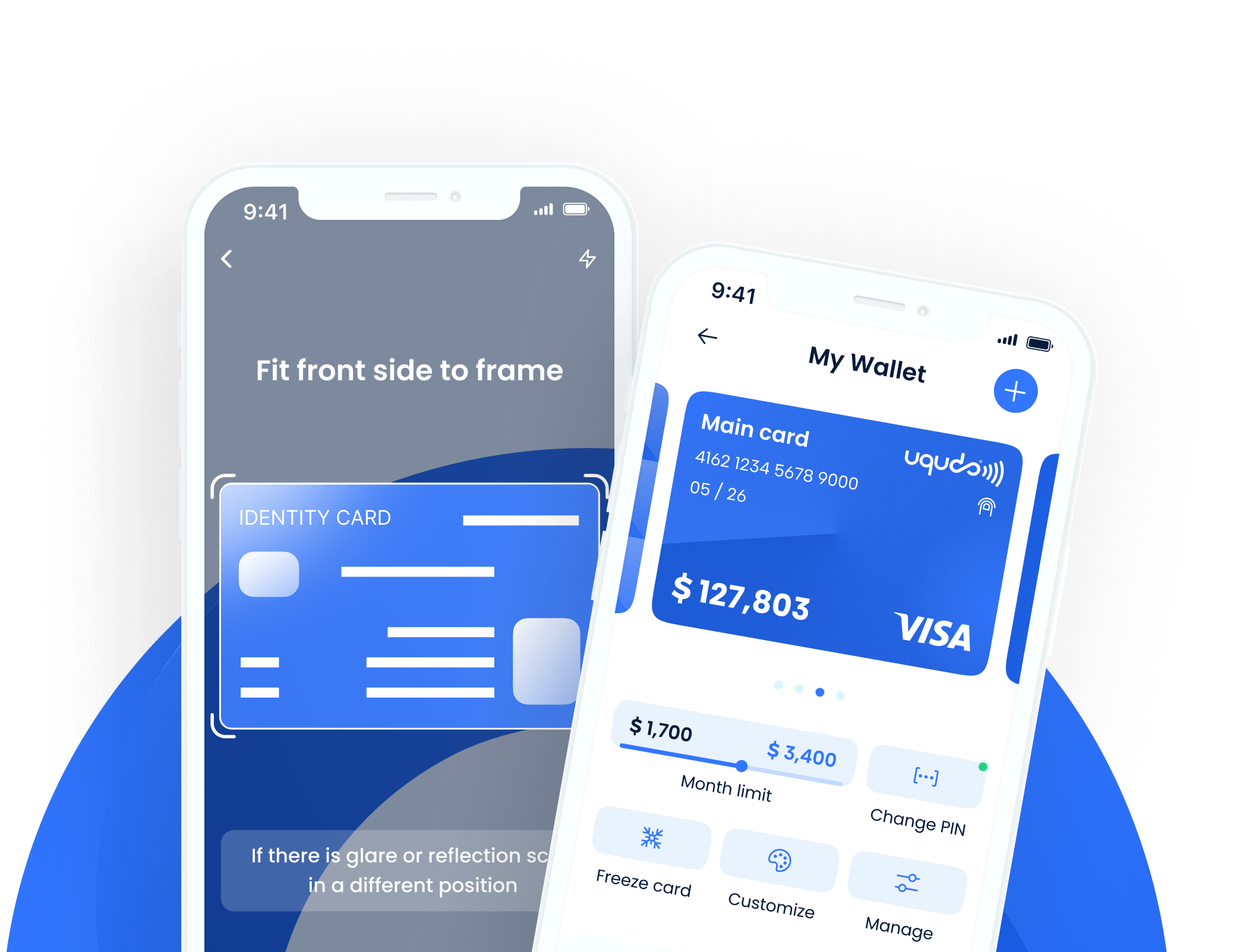

Empower users to open a quick & secure account digitally in 30 seconds

Allow new users to access your service quickly to increase conversion rates.

Unrivalled user screening for KYC, two-factor authentication, PEPs, sanctions and adverse media

Screen for suitability and risk with access to the world’s largest PEPs, sanctions, AML and adverse media lists.

A fully customizable onboarding journey embedded in your app or website

Our clients

Pushing boundaries in the identity space in MEA and beyond

Licenses sold

EMEA Document Scanning Coverage

EMEA Passport NFC Reading

Awards & Recognitions

Here’s how banks & financial institutions leverage our digital identity solution

Opening a digital bank account

Recertification

of KYC

Additional

checks

Wallets

Secure, frictionless, & fully compliant digital onboarding. Integrated seamlessly within your app.

An award-winning team

uqudo is proud to be recognised by some of the world’s most distinguished organisations.

We price based on successful onboarding.

Say goodbye to request-based fees, repeat charges, and spiralling customer acquisition costs.